Dimitrios Kambouris/Getty Images Entertainment

Company Presentation

Founded in 1994, SharkNinja, Inc. (NYSE:SN) is a global product design and technology company. The firm has one goal: to create 5-star innovative lifestyle products and solutions for consumers around the world. As its name suggests, SN is made of two different brands, namely: Shark & Ninja.

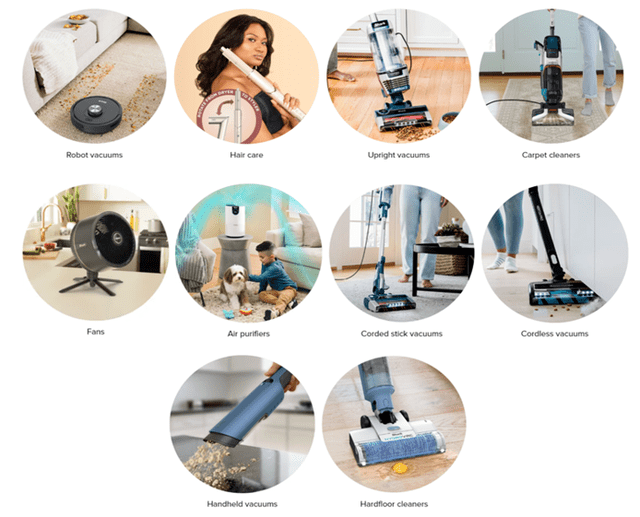

SN portfolio is divided into 31 sub-categories.

The Shark brand creates products related to hair care, floor care (vacuums, floor & carpet cleaners), air purifiers, and fans.

Shark’s portfolio is made of 10 products:

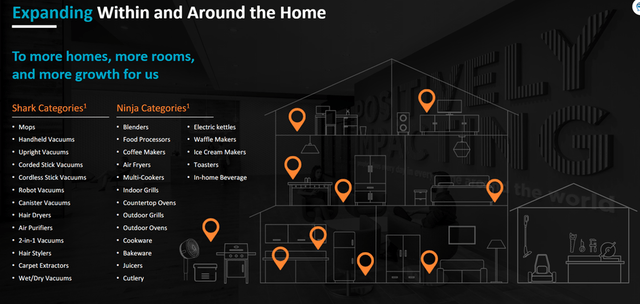

The Ninja brand specializes in kitchen products such as drink systems, countertop appliances (air fryers, ovens, blenders, ice cream makers, Toasters…), kitchenware and outdoor (coolers, grills…)

Ninja’s portfolio is made of 20 products:

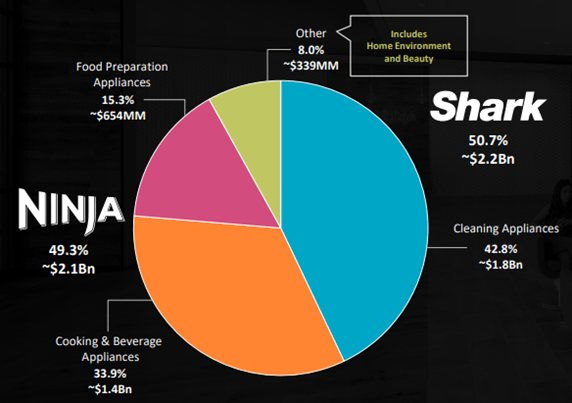

Here’s how the firm revenues are segmented:

Company Presentation

Shark revenues represent 50.7% of the firm’s revenue, while Ninja represents 49.3%. The mix is well-balanced.

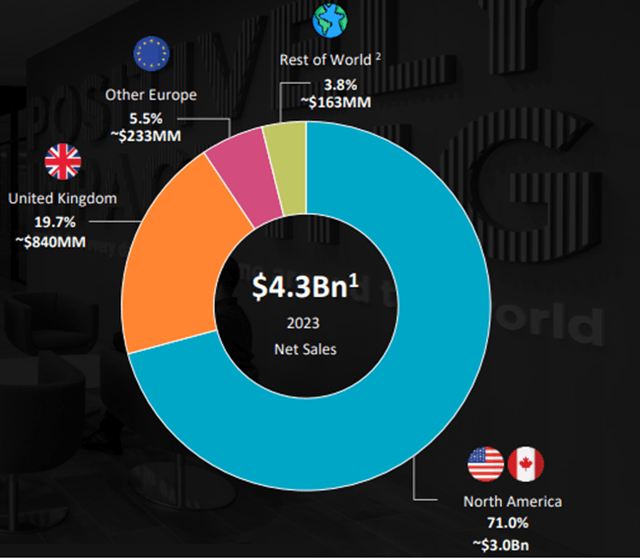

Here’s how SN’s revenues are segmented geographically:

SN is mainly present in North America, which represents 71% of the revenues. The U.K. is the second-largest market and represents 19.7% of revenues, while Europe represents 5.5% and the rest of the world 3.8%.

A Total Addressable Market With A Lot Of Potential

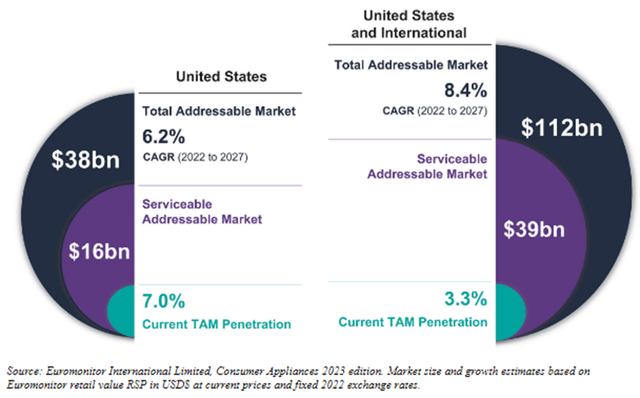

SN operates within a vast and lucrative market landscape underscoring the magnitude of this industry, with a Total Addressable Market (“TAM”) presenting significant opportunities for growth and expansion.

According to a study made by Euromonitor International and shared by SN within its Form- S1, the TAM in the United States alone, is estimated at an impressive $38 billion. This figure not only reflects the current market potential but could also imply, according to the study, a robust compound annual growth rate (“CAGR”) of 6.2% from 2022 to 2027.

Such growth is indicative of a vibrant industry where innovation and consumer demand drive continuous market expansion. However, the potential for SN extends beyond the American frontier.

When considering the combined data for the U.S. and international markets, the TAM could soar to $112 billion. We believe that this global perspective is critical, as it illustrates a wider stage with plenty of opportunities. The international market’s CAGR is projected at 8.4%, slightly higher than the U.S. market, suggesting that international territories might offer more aggressive growth opportunities for the firm.

Overall, the U.S. and the international markets appear to be underpenetrated with a current TAM penetration of only 7% in the U.S., and 3.3% internationally.

Euromonitor International Limited

Although SN business might not appear pretty attractive at first glance, we have identified several elements that lead us to believe that this name has a lot of potential. SN operates within the highly fragmented lifestyle solutions segment, where few players truly distinguish themselves.

At Growth Arcane, we are confident that there is an opportunity for a standout player in this space, and we firmly believe that SN is exceptionally well-positioned to be that leader.

Let’s dive into what makes SN so unique.

From Sharks in the Shower to Ninjas in the Kitchen – SN Products Can Dominate Every Corner of Your Home

Given the important size of SN’s portfolio, it is interesting to realize that SN products could be in almost any room of a house. For almost every room, there’s an SN product that fits. We see this first element as positive. It is, in our view, a strong support for cross-selling techniques. Indeed, satisfied clients who bought one SN product are more likely to buy some other to fulfill their needs. As SN’s portfolio is broad, we identify this element as key. Also, we expect it to strengthen and become more and more important as the firm continues to expand its portfolio.

Innovate, Engage, Dominate… Start Again! – Disruptive Innovation and Dynamic Marketing Strategy to Lead the Way

To stand out from the competition, SN has a well-established strategy that relies on two major pillars:

Disruptive Innovation & Marketing

Disruptive Innovation – A Unique Approach to Engineering Revolutionary Products

SN’s innovation strategy is clear. First, it identifies a market it wants to disrupt, it innovates, and then enters this market. The firm would like to recognize customers’ needs and answer them as quickly and as well as possible. However, that’s not all. What is striking to us, is the firm’s capability to go the extra mile as it tests its products to the extreme. SN’s goal is not only to answer customers’ needs, it is to create needs they never suspected.

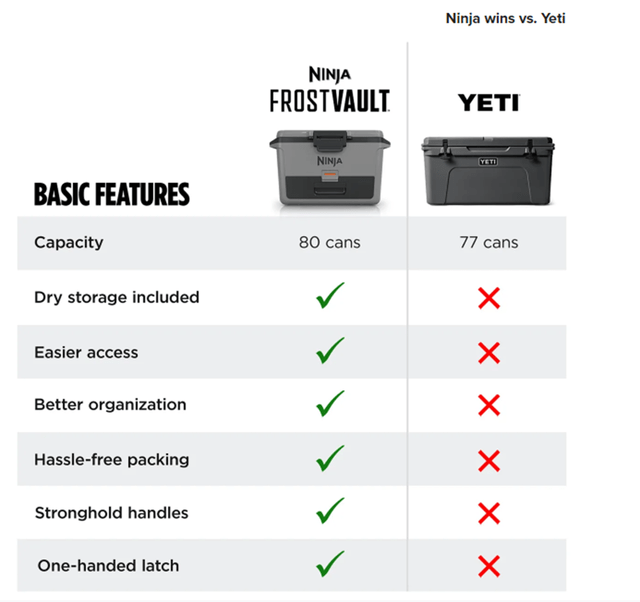

Here’s an example with the Frost Vault Cooler that you can see down here:

Company Website

With capacities of up to 50 quarts holding 80 cans, this cooler is designed for diverse group activities. The easy-carry handles, lockable lid and drawer for secure transport, and a quick latch that allows one-handed operation enhance convenience and security, transforming a simple cooler into a versatile, essential tool for outdoor adventures. What surprised us the most, was the addition that appears simple but very convenient of two drawers to store food and protect it.

These thoughtful additions redefine expectations and show how SN can showcase innovative features that anticipate and create consumer needs.

To fulfill its mission and to dominate the market it wants to enter, SN focuses also both on engineering and design, which are key for home products.

This translates into the numbers.

For example, the firm commitment to innovation can be shown by the size of its cross-functional engineering and design teams, made of 700 employees. This represents almost 25% of SN’s workforce.

The firm also owns more than 4500 patents in many segments. However, this number should be contextualized in our view. They could concern technologies but also designs, which can be a synonym of disruptive innovation but not necessarily.

Marketing – An Aggressive Omni-Channel Model

SN also invests a lot in marketing. It is not enough to be the best; people have to know that you are. Marketing is truly a crucial element of the firm strategy. SN chose to use a multichannel method to promote its products. We have the conviction that is the right choice. We see SN’s marketing strategy as the most differentiating within the industry.

We identify two major axes of this approach:

– TV ads

– Social Networks

To reach the largest number of clients, these channels are key. SN understood that. Thus, the group doesn’t skimp on resources when it comes to TV advertising.

As an example, the company made a TV ad for its Ninja coffee machine with one of the most famous actresses in the world: Sophia Vergara

Social networks are also a key marketing channel, especially given the importance media like TikTok and Meta took in people’s lives. These channels are now essential to a brand marketing strategy.

Using social networks for marketing is in our view the most efficient marketing technique as it can be considered as almost costless. With social networks, brands can let the “word of mouth” do the job. Thus, with this technique, if a company has a good product, it is likely to succeed. That’s why SN is putting more and more effort into this type of strategy.

SN, particularly through its Ninja brand, excels in “storytelling” marketing, appealing to creativity and the joy of shared experiences. Products like the ice cream and waffle machines aren’t just appliances; they’re gateways to creating memories, whether it’s crafting homemade juices for children, enjoying a barbecue, or indulging in a picnic. These moments of happiness and creativity are not only central to the customer experience, but also highly shareable online, enhancing SN’s marketability. In a society that values personal expression and shared experiences, we have the conviction that SN’s ability to connect products with pleasure and creativity gives it a distinctive edge in the market.

Another element we like about SN’s marketing strategy is its aggressiveness.

This kind of marketing strategy is particularly effective, in my view.

Ninja doesn’t just claim to be the best, it wants to show why others are losing against them. It might appear as a bold strategy, but it is catchy and has proven its efficiency!

Here’s a concrete example with the Ninja Forst Vault Cooler :

Strategic Marketing Efficiency Reflected In Robust Numbers

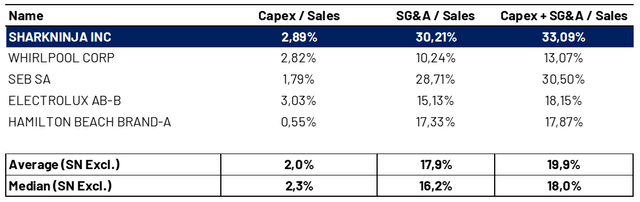

The importance placed on the marketing budget is clearly reflected in the numbers. We identified 4 pure peers that directly compete with SN.

It is interesting to see that SN’s SG&A / Sales ratio is two times higher than the industry average and median, highlighting important marketing expenses. On the other hand, capex is in line, which we find impressive. It suggests that the group manages to innovate way more than its peers with the same amount of money.

Over the long term, the firm marketing strategy is also paying off. SN is gaining more and more notoriety and momentum.

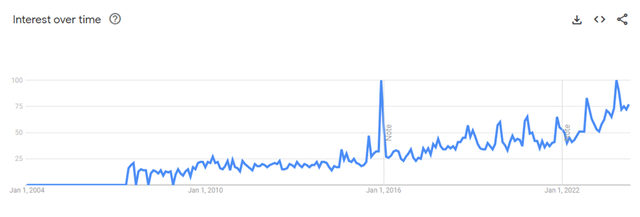

As proof of this strong momentum, we wanted to share with you the Google Trends score for SN since 2004. The closer the score is to 100, the higher the interest.

Here you can see that SN is gaining popularity in a rather consistent and linear way which is, in our view, particularly positive and healthy.

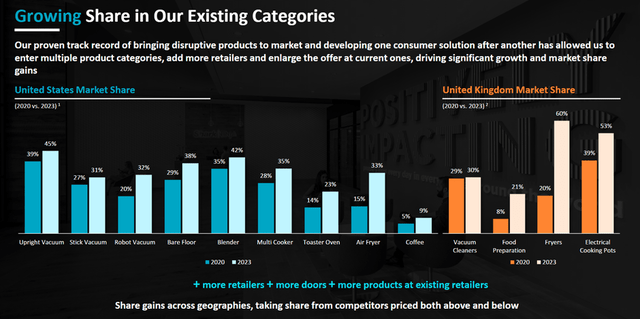

This strong momentum is also characterized by impressive market share gains:

It is truly appreciable to see that SN has gained substantial market shares on all its product segments over the last 3 years. The categories in which the gains are the most important are the Air Fryers category in both the U.S. and the U.K., the Robot Vacuum category in the U.S., the Food Preparation Category in the U.K., and the Coffee Category in the U.S.

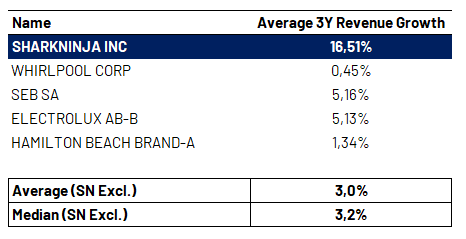

Finally, in the last three years, SN has significantly outperformed its competitors in terms of top-line growth, demonstrating the group’s strong ability to capture additional market shares.

Bloomberg

Omnichannel Distribution to Maximize Accessibility

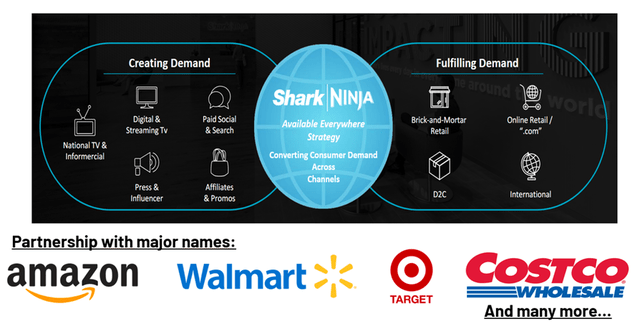

Distribution might be a challenge for companies belonging to this industry. Depending on who you target, you might want to be selective and create a sentiment of scarcity, or you might want to reach as many customers as possible. SN chose the 2nd option. As it wants to deliver 5-star products and make them accessible to everybody, it is targeting the masses. In this logic, the goal is to be everywhere. As of today, you can buy SN products almost on every channel that exists whether on SN websites, leading e-commerce platforms and marketplaces, through home shopping networks … The firm doesn’t rely on exclusive partnerships. It has deep relations with various world-leading retailers such as Amazon.com, Inc. (AMZN), Walmart Inc. (WMT), Target Corporation (TGT), Costco Wholesale Corporation (COST), Best Buy Co., Inc. (BBY)… and many more.

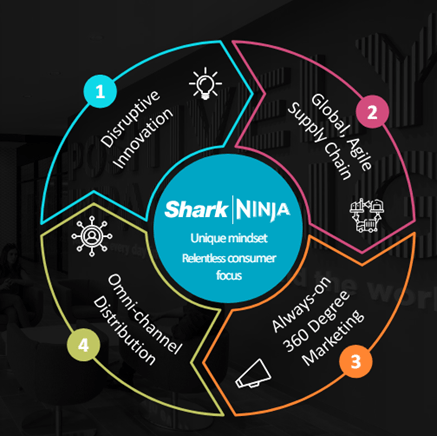

This graph is, in our view, the best representation of SN’s marketing and distribution strategy:

Finally, this graph is, in our view, the best to represent and sum up SN’s global strategy:

Company Presentation

Where Strategy Meets Success

This combination of innovation and marketing led the firm to have a particularly strong reputation and many best-selling products, especially in the U.S. Both brands, Shark and Ninja have been awarded many times for being the best-selling and most appreciated brands in many of their sub-categories.

International Expansion Strategy

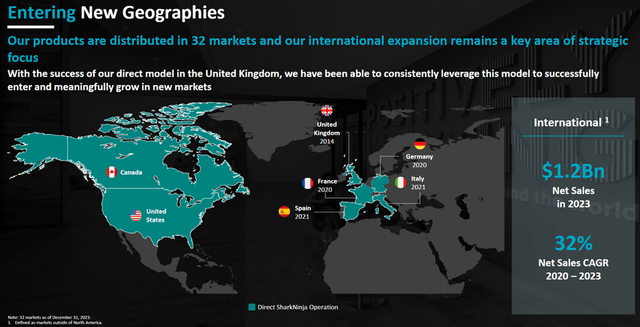

SN wants to reach as many clients as possible. As such, the group doesn’t rely on the success it has in North America. It started to expand its operation in the U.K. in 2014. It has been a huge success.

Thus, the firm plans to leverage its model successfully to reach even more locations. SN has also expanded its geographical reach to France and Germany in 2020, Spain and Italy in 2021 and plans to expand even more. We have the conviction that SN has all the cards in its hands to succeed. The company already used the U.K. as a “lab” since 2014, and it has become in only 10 years one of its largest revenue contributors.

We believe that SN has now the knowledge and the experience to enter and dominate many more markets.

The Trade-offs in Shark Ninja’s Supply Chain

SN supply chain is fully externalized.

Unfortunately, the firm doesn’t communicate the names of its partners. However, it is known that the firm’s supply chain extends across countries with close to 70 tier-one suppliers, with 25 considered to be critical suppliers. Critical components mainly come from China, Thailand, Vietnam, Indonesia, Singapore, and Malaysia.

This approach is interesting as it reduces operational costs and investments while increasing profitability. But on the other hand, it also implies some risks especially regarding information leaks, technological transfer, working conditions, tariff changes …

Financial Analysis & Valuation

Our financial analysis concentrates on examining debt levels, profitability metrics, and valuation.

The industry in which SN operates is particularly fragmented and some peers that are more mature like Bosch, Brandt … are not listed. Still, we identified 4 pure-listed peers and compared them to SN.

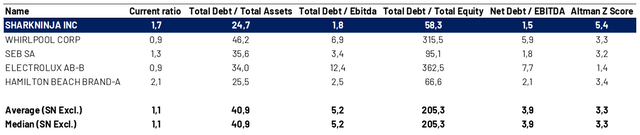

Debt Analysis

SN is way younger than its peers. It was founded in 1994. To give you an order of magnitude, peers like AB Electrolux (publ) (OTCPK:ELUXY) were founded at the beginning of the 20th century and SEB SA (OTCPK:SEBYF) was founded in 1857!

Thus, we would have expected that SN, given its strategy to penetrate many markets and win market shares quickly, would be the most indebted player.

It is not at all the case. SN is the company with the most robust and compelling balance sheet. It has one of the best short-term liquidity ratios, and the lowest debt level when compared to Total Assets, EBITDA, and Total Equity. It also has the highest Altman Z-Score. All these elements are crucial. It means that SN’s innovation and marketing strategies are sustainable. Even better, they will have the flexibility to use debt and leverage to expand in other markets and develop more products if needed.

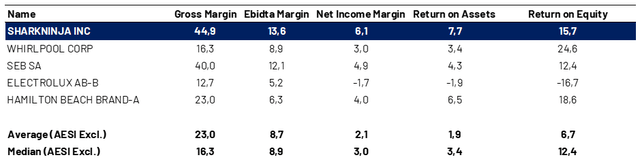

Profitability Analysis

We’ve been insisting on the company’s strong commitment to innovation and marketing, but is it paying off financially speaking? Is this strategy characterized by strong profitability?

Yes, it is. SN has the highest margins within its peer group. With the highest Gross, EBITDA, Net Income margins, Return on Assets, and Return on Equity above the peer group average, SN clearly stands out.

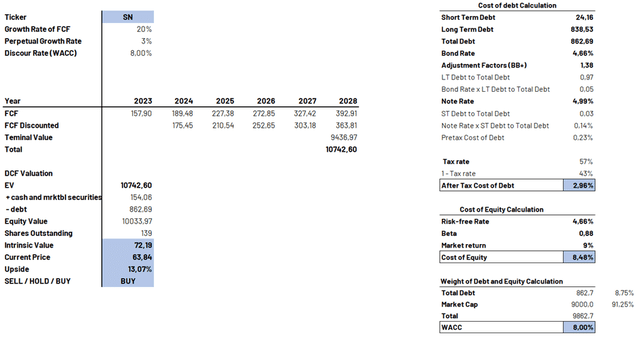

Valuation

Given this potential for sustained growth and margin improvements, we expect the company to grow its FCF in the high teens for the 5 upcoming years. We have the conviction that SN will be able to keep robust growth while improving at the same time its profitability. As the company is growing and focusing increasingly on digital marketing, which is less expensive, we expect margins to improve. Also, the firms plan to enter new markets. It could appear costly. However, we have the conviction that SN has enough experience and a solid track record to proceed efficiently without spending too much. On the other hand, the adaptability of its supply chain, coupled with potential A.I.-enhanced marketing and client management, suggests promising growth prospects. This growth is likely to be accompanied by increased margins due to robust revenue expansion, cost reductions from more effective marketing strategies, and stabilized capital expenditures.

Taking all these elements into account, we used a 20% FCF Growth Rate, a WACC of 8%, and a 3% perpetual growth rate. This leads us to a target price of $72 representing a 13% upside.

Risks

We identify several risks that must be considered:

SN’s strategy relies heavily on innovative marketing and disruptive products to stay competitive. While this approach has been beneficial, it also carries risks. Future innovations may not disrupt the market or resonate with consumers as previous ones did. Additionally, in a market crowded with established competitors, SN’s ability to expand its market share depends on continual innovation and effective brand engagement strategies. It’s critical to acknowledge this uncertainty.

SN’s success also hinges on aligning with consumer trends and robust marketing. However, shifts in consumer behavior could have a negative impact on SN’s products.

Another area of risk that we mentioned above is related to SN’s completely outsourced supply chain. This exposes SN to many risks and especially operational ones which could cause supply disruptions, increase costs, and squeeze margins. The sourcing of critical components predominantly from Asia further heightens this vulnerability in our view.

Lastly, economic downturns pose a significant risk as they may lead to decreased consumer spending on non-essential goods, potentially impacting SN’s sales.

Conclusion

We believe that SN stands out as a robust contender in the consumer goods industry. We particularly like its profile, characterized by innovation and a forward-thinking approach to market engagement. These two pillars, have become synonymous with SN’s brand, fostering a competitive edge that continues to drive its market share upward. We have the conviction that SN’s aggressive investment in marketing, coupled with a robust and rapidly expanding patent portfolio and its commitment to not just meet but create consumer demand will make it the future leader of this fragmented industry. Moreover, the firm’s omnichannel distribution strategy ensures that its products are as accessible as they are desirable.

Given the company’s robust growth prospects, expanding market penetration, and strategic agility, along with the potential for margin improvements, we initiate on SN with a Buy Rating and a TP of $72, representing a 13% upside.f