Sundry Photography

Amid more challenging macro straits this year, many companies have adopted a tried and true playbook to drive revenue growth: increasing pricing by a variety of means. For Eventbrite (NYSE:EB), the online ticketing company that competes with the likes of StubHub and Ticketmaster, this meant introducing new creator fees, wherein event organizers now have to pay Eventbrite a fee for hosting an event and accessing its audience reach.

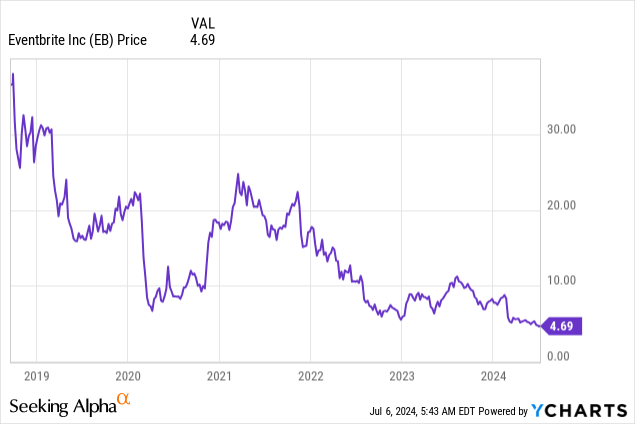

The change has produced a very predictable effect: net revenue per ticket has soared due to the new fees, but more creators have dropped out and paid ticket volumes have continued to decline. So far, Wall Street has very little confidence in Eventbrite’s trajectory looking ahead, as the stock is down more than 40% year to date.

Compelling valuation, but risks from pricing moves still remain

I last wrote a neutral opinion on Eventbrite in April, when the stock was still trading in the low $5 range. Since then, we’ve been able to see the initial impacts of the company’s fee structure change on Q1 results.

Eventbrite is plowing ahead with the change, noting as well that it continues on expanding its diversity of events that it covers. It recently commissioned a study, “Niche to Meet You,” on younger generations’ fatigue over online dating and the rise of offline dating events, like speed-dating rounds. The company is attempting to bring in more of these types of events and creators to offset potential churn from its recent pricing decisions.

I remain neutral on this stock. We have seen positive benefits from these price increases in Eventbrite’s Q1 results: revenue growth exceeded expectations, and its adjusted EBITDA margins soared to new heights. We note now that one of the biggest draws to Eventbrite is that we can properly value the stock from an EBITDA basis.

At current share prices under $5, Eventbrite trades at a market cap of $455.5 million. After we net off the $693.6 million of cash and $358.2 million of debt on the company’s most recent balance sheet, the company’s resulting enterprise value is just $120.1 million. That’s another big draw for Eventbrite: the majority of its market cash is simply sitting in its net cash position.

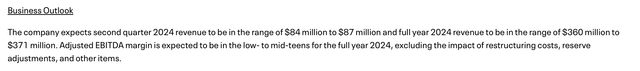

Meanwhile, for the current fiscal year FY24, the company is expecting to generate revenue of $360-$371 million, which represents 10-14% y/y growth, and a “low to mid teens” adjusted EBITDA margin on that revenue profile.

Eventbrite outlook (Eventbrite Q1 shareholder letter)

If we conservatively assume a 12% adjusted EBITDA margin (in line with Q1 margins) on the midpoint of the company’s revenue range, adjusted EBITDA for the year would be $43.9 million (+53% y/y). This puts Eventbrite’s valuation at just 2.7x EV/FY24 adjusted EBITDA.

The stock is cheap: but that’s because its path forward is laden with risks, including:

- Churn impacts from fee decisions. Eventbrite’s decision to start charging event organizer fees, arguing that creators should pay for access to Eventbrite’s audience reach, is currently driving double-digit revenue growth. But we’ve already seen paid creator counts decline, and over the long run, it could steer more creators away from Eventbrite and toward competing platforms.

- Volume decline. To that extent, paid ticket volumes are also declining – a reflection of fewer events, fewer creators, and ultimately fewer buyers on the Eventbrite platform.

- Numerous competitors. We can’t forget as well that Eventbrite is one of a number of online ticketing platforms, including evite, Ticketmaster, Meetup, and other names.

All in all, despite the fact that I’m looking to rotate more of my portfolio toward deep-value names amid a very expensive stock market, I continue to prefer sitting on the sidelines for Eventbrite. In my view, there are too many unknowns surrounding paid ticket declines to make a long-term bet here.

Q1 download

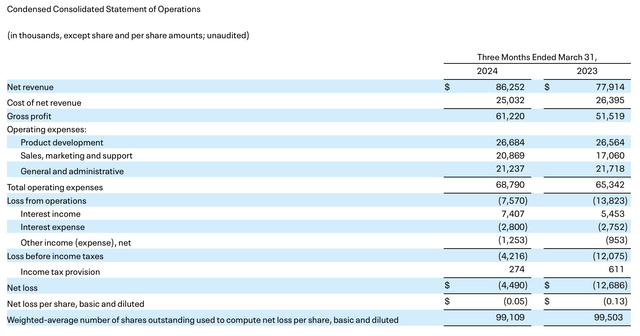

Let’s now go through Eventbrite’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Eventbrite Q1 results (Eventbrite Q1 shareholder letter)

Eventbrite’s revenue grew 11% y/y to $86.3 million, slightly beating Wall Street’s expectations of $85.3 million (+9% y/y). We do note, however, that revenue growth decelerated sharply from 22% y/y growth in Q4. We also note that Eventbrite’s full-year guidance, which calls for a 10-14% y/y growth range, implies that to hit the midpoint, Eventbrite’s performance will have to sequentially accelerate and improve as we move throughout the year.

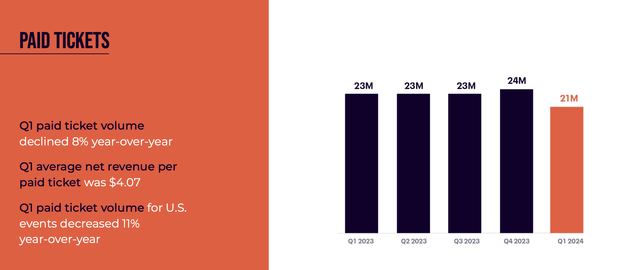

As expected, paid ticket volumes declined -8% y/y to 21 million tickets: a deeper decline than -4% in Q4. The company offset this with a net revenue per ticket of $4.07, which was up 21% y/y.

Eventbrite paid ticket trends (Eventbrite Q1 shareholder letter)

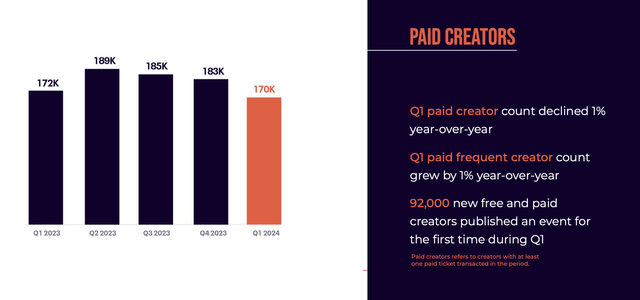

Perhaps more worrisome than the decline in paid tickets, however, was the sharp drop-off in paid creators: which has already been a trend over the preceding few quarters. Eventbrite’s count of paid creators declined 13k sequentially to 170k, the third straight quarter of decline.

Eventbrite paid creator trends (Eventbrite Q1 shareholder letter)

The company still argues that it’s building a long-term foundation for creator investment and success. Management says that more creators are opting to sign up for monthly subscriptions rather than pay per event, which suggests that these creators may be higher-volume, higher-frequency customers for Eventbrite. Per CEO Julie Hartz’s remarks on the Q1 earnings call:

Second, on pricing and packaging. Creators have adopted the monthly subscription plan at a faster rate than pay per event pricing, which combined with their direct feedback has given us a strong signal on how we can simplify the choice set and lean more into the subscription pathway by offering free trialing, annual discounts and promotional benefits for things like Eventbrite Ads. In response to these changes and clear communication around the plans, subscribing creators increased by 40% across the first quarter […]

In addition to these transitions, we’re focusing on creator satisfaction and listening carefully to their feedback. For instance, we introduced instant payouts and tap to pay in Q1 to give creators faster access to their money and greater convenience to support at the door ticket sales. We also delivered a new creator dashboard that provides the reporting clarity they want. Creators have also asked for greater support and expert guidance and we responded by expanding customer support and account management.

These action plans are the primary levers that position us to reaccelerate paid ticket volume, as we move through 2024. But we haven’t taken our eye off the longer-term strategy of how we build our marketplace at scale. Our creators tell us their top need is to connect with their community and convert that community into a growing number of event goers.”

As we move into Eventbrite’s Q2 earnings release (expected in early August) and beyond, it’ll be key to see that paid ticket volumes and creator counts don’t meaningfully deteriorate further from here.

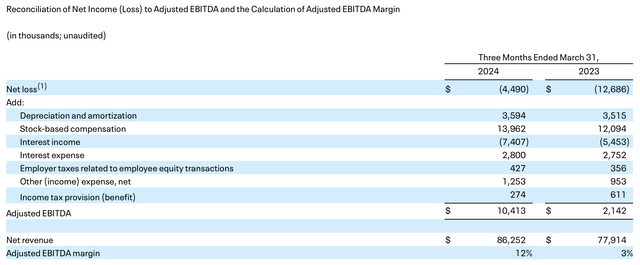

From a profitability perspective, it’s no surprise that Eventbrite’s pricing moves have produced a substantial boost to adjusted EBITDA, which grew nearly 5x y/y in the quarter to $10.4 million, representing a 12% adjusted EBITDA margin: nine points higher than 3% in the year-ago quarter.

Eventbrite adjusted EBITDA margins (Eventbrite Q1 shareholder letter)

Key takeaways

I wish Eventbrite was a slam-dunk value play that I was confident on, because a ~3x adjusted EBITDA multiple is almost impossible to find in today’s market: but unfortunately that cheap valuation comes with a plethora of risks as Eventbrite undergoes a major business model change and has continued to shed creator counts and paid ticket volumes. I continue to prefer watching this stock from the sidelines and waiting on further clarity before diving in.