Yelizaveta Tomashevska

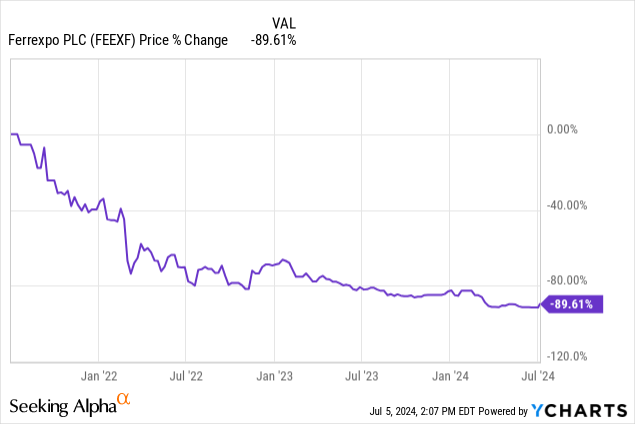

In our last coverage of Ferrexpo (OTCPK:FEEXF) (OTCPK:FEEXY) we highlighted that it is only interesting as a vehicle with which to speculate on the outcome of the US presidential election. Otherwise, it is of course an extremely risky and binary play whose price is almost entirely subject to highly idiosyncratic speculation around the Ukrainian battle lines and momentum in the war which has already had severe consequences for Ferrexpo’s produced pellet volumes and poses a risk of total capital impairment for investors. Its political risks and possibility of total capital impairment make it quite uninvestable.

The presidential debate performance, according to the betting odds, seems to have done a lot in Trump’s favour whose platform includes efforts to negotiate an end to the Ukraine war and even claims that it can be done overnight which are likely exaggerated. Nonetheless, markets have made the speculative connection with Ferrexpo, and it has risen almost 20% without any other news in the last 5 days, having traded before that on a base of around 45 GBX since March 2024. With prices still significantly below the levels when we last covered to the stock, Ferrexpo could deserve to trade higher as a possible timeline to the end of the war becomes more defined with respect to administration change in the US, allowing for resumed production, dissipated capital impairment risk and a possible resumption in institutional stock support.

However, we highlight that a new administration is by no means a guarantee to some end of the war, despite the leverage the US has over geopolitics and the Ukraine conflict in particular. Ferrexpo remains highly speculative and very risky.

The Ferrexpo Case

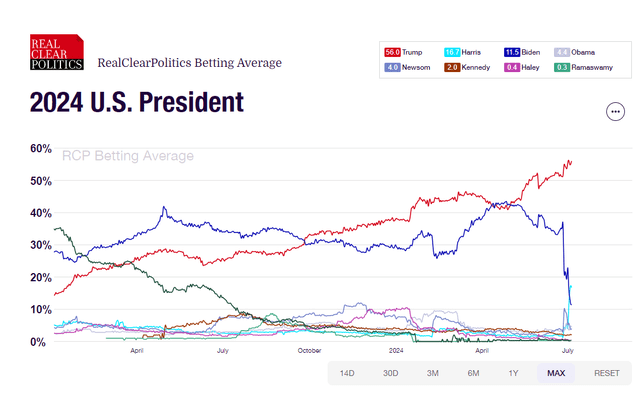

Betting odds election (Realclearpolitics.com (see also Bet365 linked in text))

The logic is quite simple: Ferrexpo share prices have been smashed into the ground by the very significant risk that its iron pellet operations and iron ore mines, all just east of the Dnieper River in Central Ukraine, get blown up or otherwise requisitioned by the Russians, or other adverse situations you might imagine. This has made it uninvestable for most institutions.

Currently, the war is having an actual impact on operations in curbing logistical capacity and therefore production to a fraction of previous levels. It is still able to operate profitably however at current scale, which means that the only existential threat is the war. The risks are severe, and all investors should be fully aware of that.

More Republican than Democrat politicians have been belligerent in the matter of providing military aid to Ukraine. Markets have already started taking into account the sea change Trump’s winning prospects after the Biden debate performance, with Ferrexpo rising over 20% in the last week without any other relevant news.

Indeed, as far as realclearpolling.com is concerned, the betting odds are even putting Biden at being a less likely president than current Vice President Kamala Harris, let alone Trump. This is reflected in Bet365 betting odds as well.

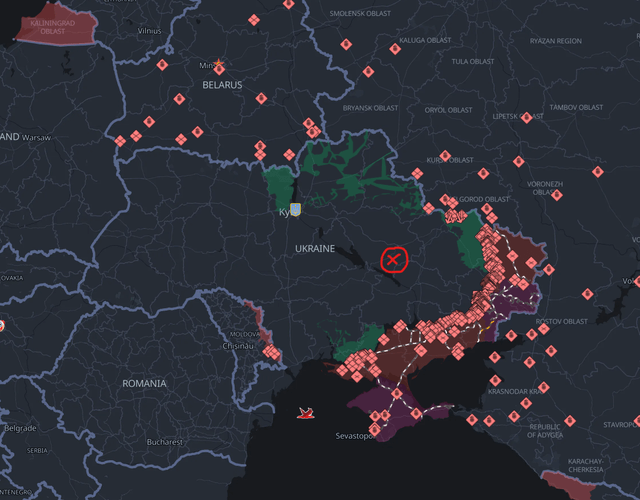

Ukraine Battle Lines (deepstatemap.live)

Ferrexpo’s iron ore mines and pellet production facilities are still located quite far from the battle lines as marked with the red X, but it’s not inconceivable that it could be within reach at some point of artillery or other military resources, and it might be a relevant strategic target to hurt the Ukrainian economy, or more unlikely for Russian appropriation if the battle lines move far enough. Even in the event of a peace deal, we don’t know if and how Ukraine gets divided. Zelensky’s position is that no territory will be ceded. The Russian position is that any peace deal must reflect the reality of the battle lines and momentum in the war. Who knows what the endpoint is if and how the US, which does have leverage over Ukraine at least but not Russia, bridges the substantial gap. It’s not clear that the Russian position would be any more acceptable to the US than to Ukraine.

Regardless, it is clear that the market is going to assert some substantial discount on the shares on account of the risks associated with being in a war-torn country. That discount seems to be around 80% just looking at the change in share prices since the invasion, comprising both the current volume impact on cash flows as well as the risk of damage to Ferrexpo assets. Any end in sight for the war is a major catalyst for the stock.

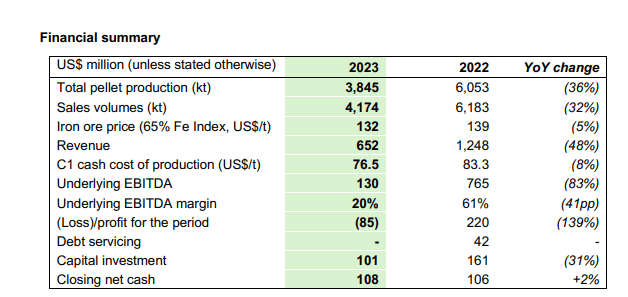

FY 2023 Financials

Part of the war discount is on account of the reduced pellet volumes able to come out of the Ferrexpo facilities due to the war disrupting Ferrexpo’s ocean exports and other logistical capacity. This has limited the company production substantially and impacted run-rate financials. Iron ore prices are quite fine, around levels from before the war when they’d have been operating normally, only down around 5% this year compared to average 2022 levels. Logistics capacity has been impacted as they’ve had to change the ports they use on the Black Sea for export and had to rely on other lower volume means like river barges.

Ferrexpo Financial Highlights (FY 2023)

Otherwise, the company is still operating sustainably, even if at reduced utilisation levels. Production has clearly declined by 36%, reflecting even further declines from last year that passed mostly under the war. Ferrexpo is nonetheless profitable at an EBITDA level, with decent industrial margins of 20%. Net cash is positive and same as last year. It has even salvaged some margin by driving down cash costs per tonne. There aren’t any other existential risks than the war, which is why news around the war matters as much as it does for the stock.

Iron Ore Price (Tradingeconomics.com)

Bottom Line

The iron ore outlook isn’t that great. The construction activity in China continues to decline, with the outsized exposure to construction within China, and the world in turn to China, impacting global iron ore prospects. Other shoes may drop, with lingering uncertainty around macro in Europe and the US. However, much has been priced in, and iron ore remains around the same levels as last year. Also, these considerations likely have a negligible effect on Ferrexpo’s price, since there are bigger fish to fry.

As far as Ferrexpo’s idiosyncratic risk is concerned, we point to the market, which has already reacted positively to the possibility of a Trump presidency rising. It’s a proven and longstanding industrial business trading in the most stalwart and established commodity other than gold, and we can be fairly certain that the market’s discount of the stock into penny stock territory comes down to the sole, and very valid reason, that the operations are located east of the Dnieper in Ukraine and are at risk of catastrophic damage or even permanent appropriation. There are no other meaningful factors for the stock price other than those related to the war.

The risks are specific and observable, which lets us at least think directionally and comment on how they articulate with changes like those in the election prospects of candidates more amenable to brokering or even forcing peace. The change in election odds should be taken on board by speculators. There is huge space for revaluation if the conflict were to become settled, possibly as much as 5x just based on where prices were on average for a few months before the February 2022 invasion. Current multiples are only a little above 2x EV/EBITDA, which absent idiosyncratic risks would be far too low for a business of Ferrexpo’s profile.

However, even if Trump does win, it’s not at all certain that his administration could secure peace in Ukraine, although the US clearly has leverage over the Ukrainian war effort as a major supplier. It’s not enough to take an expected value approach with the election odds, since there are second order uncertainties to take into account around how even a willing US would be able to broker peace. It is highly speculative, although with the big discounts being isolated to the war, we think that just working with the betting odds data the case has become better for Ferrexpo and upward price action is justified.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.