Roman Vyshnikov/iStock Editorial via Getty Images

Introduction

Pirelli (OTCPK:PLLIF) is a large Italian tire manufacturer and recently enjoyed increased brand recognition as it is the sole tire supplier to the Formula 1 teams. Although the company’s revenue has remained relatively flattish in 2023, and although we shouldn’t expect any revenue growth in 2024 either, the lower operating costs still result in increasing profits and free cash flows. The company also recently published its guidance for 2025, and that’s a good reason to have another look under the hood to see if I need to fine-tune my expectations.

This article is meant as an update on previous coverage given the recent changes and fresh guidance for 2025, and I would like to recommend you to read the older article on Pirelli here.

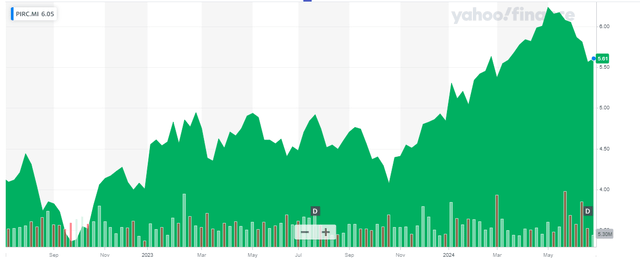

Pirelli has its main listing in Italy, where it is trading with PIRC as its ticker symbol. The average daily volume is 2.2 million shares. The current market capitalization is approximately 5.6B EUR.

A quick look back at 2023 and the first quarter of this year

As Pirelli has provided a roadmap for 2024 and 2025, it has provided some tangible elements we can hold the management accountable for. However, I think it would be a good idea to look back at FY 2023 to provide some more context on the anticipated 2024 and 2025 performance.

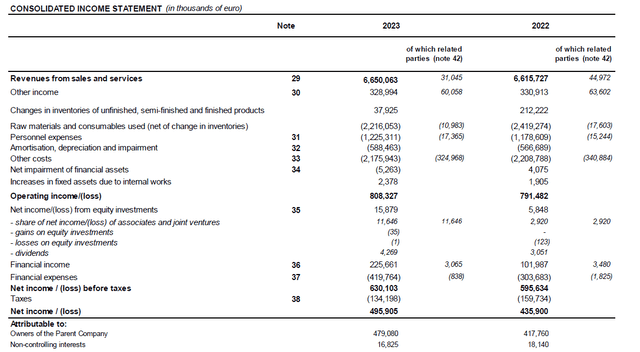

In 2023, Pirelli reported a total revenue of 6.65B EUR, which represents an increase of approximately 0.5% compared to the preceding year. While the revenue increase was pretty unimpressive, it’s important to note Pirelli’s operating expenses decreased quite substantially. Its COGS decreased by just over 200M EUR and although the staff expenses and depreciation and amortization expenses increased, the small revenue increase and lower COGS helped to boost the operating income by in excess of 2% to 808.3M EUR.

On top of that, as the income statement above indicates, Pirelli saw the net income from its equity investments increase to almost 16M EUR while the net finance expenses of 194M EUR were lower than the 201M EUR it spent in 202. Taking all these elements into consideration, the pre-tax profit increased by in excess of 5% to 630M EUR while the net profit was approximately 496M EUR of which 479M EUR was attributable to the shareholders of Pirelli. This represented an EPS of 0.479 EUR.

So although the revenue increase wasn’t very impressive, thanks to excellent cost management, Pirelli’s bottom line still increased and that’s ultimately what matters.

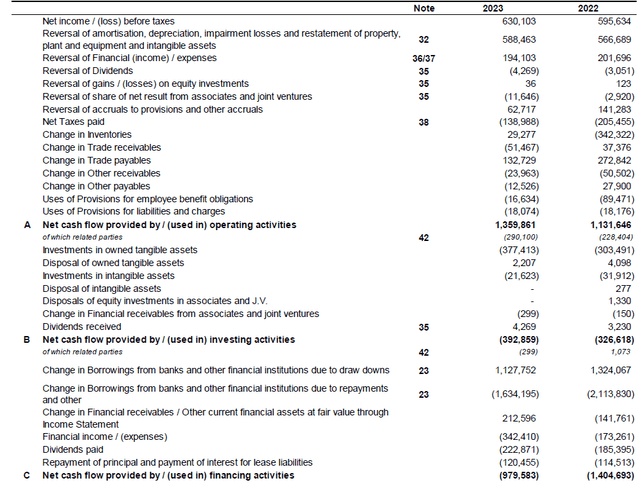

I originally argued Pirelli is an interesting company from a free cash flow perspective as well, so it goes without saying I always give the company’s cash flow statement some special attention. And as the FY 2023 results below indicate, the reported operating cash flow was 1.36B EUR, including a 40M EUR contribution from working capital changes. This still excludes the 120M EUR in lease payments, resulting in an underlying adjusted operating cash flow of 1.2B EUR and 0.9B EUR after taking all finance expenses into account

The cash flow statement also indicates the total capex was approximately 399M EUR (including the investment in intangible assets). This means the underlying free cash flow generated by Pirelli was approximately 500M EUR, representing 0.50 EUR per share after also taking the income attributable to the non-controlling shareholders into account. That’s higher than the net income due to a total capex plus lease payments that was lower than the depreciation expenses, while the income statement also included some provisions and accrual to provisions that have not yet materialized into a cash outflow.

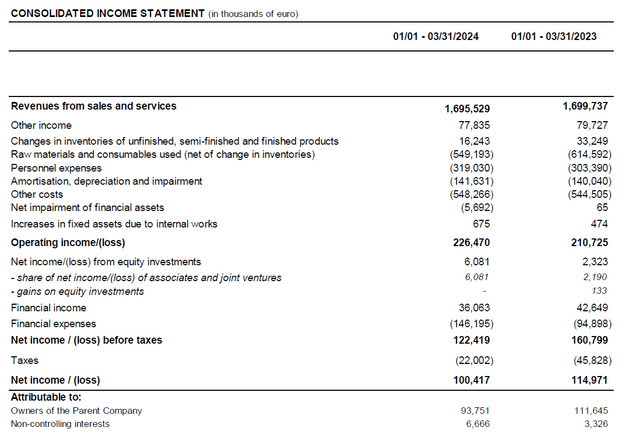

A good result, without any doubt. And 2024 has also already started quite strong for Pirelli. As the Q1 income statement below shows, the revenue decreased by 0.25% but thanks to lower operating expenses and COGS, we once again see an increase in the operating income which jumped to 226M EUR. Unfortunately, this did not translate into a higher net income as the increasing financial expenses definitely had a negative impact on the bottom line. That being said, a substantial portion of those higher finance expenses is related to the hyperinflation and currency devaluation and that 49M EUR impact on the net profit has no impact on the company’s cash flow performance.

The net profit was just 100.4M EUR, of which 93.8M EUR was attributable to the shareholders of Pirelli. But fortunately, the net free cash flow was approximately 125M EUR, or 12.5 cents per share.

The plans for 2024 and 2025 are encouraging

As you notice, it’s important to keep an eye on the fine print when you are looking at Pirelli, as there are several non-recurring and/or non-cash elements that have an impact on the income statement but may not necessarily have an impact on Pirelli’s cash flow profile.

Fortunately, the company is usually pretty good at providing guidance and the Italian tire manufacturer recently issued its guidance for 2024 and 2025.

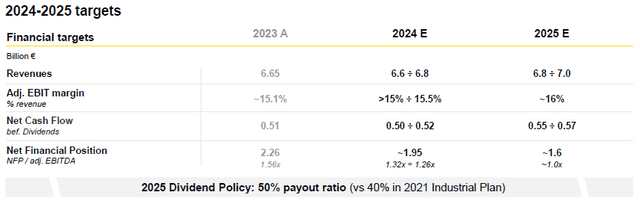

As you can see below, the total revenue will likely remain flat this year as the midpoint of the 6.6-6.8B EUR guidance is almost exactly the 6.65B EUR revenue generated in 2023. More importantly, the EBIT margin should increase slightly and the midpoint of the EBIT margin guidance is 15.25% compared to the 15.1% margin generated in FY 2023.

This should result in Pirelli reporting a total net cash flow of 0.5-0.52B EUR, and this will go a long way to further reduce the net debt to 1.95B EUR. Note: Pirelli uses the term ‘net financial position’ as the company doesn’t just take the cash and financial debt into account, but also includes some receivables and payables.

So while 2024 will likely be a year of consolidation, I am looking forward to seeing if Pirelli is able to meet its 2025 targets. The midpoint of the revenue guidance calls for a 6.9B EUR revenue and an adjusted EBIT margin of approximately 16%. This means the EBIT should increase from 1.01B EUR in FY 2024 to 1.1B EUR in FY 2025, an 8% increase thanks to the combination of a higher revenue and a higher margin.

This should result in a net free cash flow of 0.55-0.57B EUR, representing 0.55-0.57 EUR per share. And as the company will apply a 50% payout ratio from 2025 on, about half of its net profit (and likely a slightly higher dollar amount in free cash flow) will be retained on the balance sheet, resulting in a decrease in the net financial debt/position to 1.6B EUR, which would represent just 1x the adjusted EBITDA.

Investment thesis

I don’t think we should expect any fireworks from Pirelli this year, but it looks like the company will put another important step forward in 2025 as it is guiding for a combination of a revenue increase with a margin expansion. The 2025 guidance implies a free cash flow result of 0.55 EUR per share (at the lower end of the range), which makes the current share price of 5.6 EUR pretty attractive as it represents a free cash flow yield of approximately 10%.

Additionally, at the current share price of 5.6 EUR, the anticipated enterprise value (using Pirelli’s interpretation of ‘net debt’) would be 7.2B EUR, representing just 4.5 times the adjusted EBITDA in 2025.

This means the stock is pretty attractively priced.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.