maybefalse

My Thesis

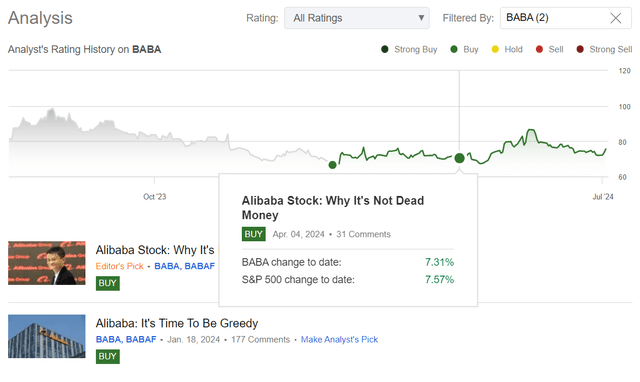

In a way, I was fortunate to initiate my coverage of Alibaba Group (NYSE:BABA) stock at the end of January 2024, during its lowest local price point, so I luckily managed to catch the local bottom for Alibaba stock at the time. Since then, the stock has only grown by 13.5%, whereas the S&P 500 index (SPX) has increased by almost 16%, highlighting the strength of the American stock market we’ve seen in recent weeks.

Seeking Alpha, Oakoff’s coverage of BABA stock

It’s been three months since my last update, and today, I’ve decided to revisit the growth prospects of BABA. In my opinion, the market is still not fully recognizing their potential. Alibaba remains one of the most undervalued yet highly attractive opportunities available today.

I believe that the main reason why Alibaba’s shares have not made any significant gains recently, even though the quotes of its Western counterparts have more than doubled in just a few months, is the weakness of the Chinese economy. However, there’s a promising catalyst on the horizon that could represent a turning point for Alibaba and the entire Chinese stock market. I therefore reiterate my buy recommendation today and encourage investors to consider becoming “greedy” right now and take this opportunity.

My Reasoning

Let’s first take a look at how the company performed in its last reporting quarter.

For fiscal Q4 2024 (calendar Q1), Alibaba reported an increase in revenue of around 7% YoY, generating almost $31 billion. There was a major FX change during calendar Q1: The USD/CNY exchange rate climbed to ~7.22 from ~6.85 last year, without which the company’s revenue would be significantly higher in US dollar terms. Despite these headwinds, the company’s sales have been by ~$250 million stronger than analysts expected – Alibaba is clearly doing a good job of protecting its market share in the face of growing competition in the industry (something many feared and still fear).

As for the bottom line, Alibaba didn’t manage to surprise analysts, even on an adjusted basis. The weak net income growth can be attributed to a 3% year-over-year decline in operating profit (in RMB currency), which amounted to only $2 billion. Adjusted EBITA fell by 5% YoY to $3.31 billion, largely due to the company’s investments in its e-commerce business and “the retention incentives granted to Cainiao employees”, according to the press release. It’s difficult to determine whether these costs were one-time; regardless, the negative surprise in terms of EPS led most Wall Street analysts to lower their forecasts for the upcoming quarters, which undoubtedly put pressure on Alibaba’s stock prices.

Seeking Alpha, BABA, Oakoff’s notes added

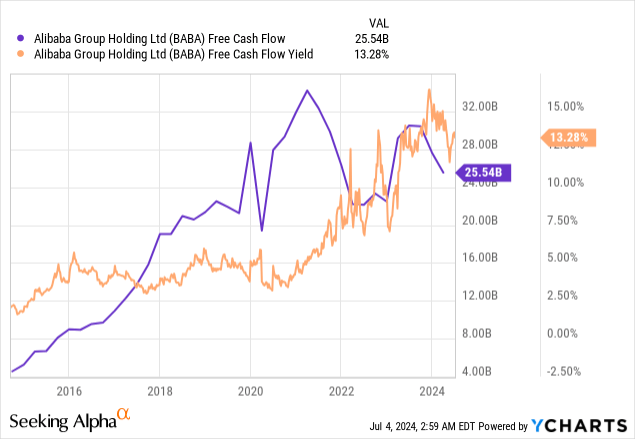

From the point of view of cash generation, Alibaba also faced some difficulties in Q4 FY2024 as its net cash provided by operating activities decreased by 26% to ~$3,233 million, and FCF fell by 52% to just $2,127 million. As a result, the FCF margin, as a ratio to revenue, dropped to 11%. On the other hand, the company still generates ~13.3% in FCF yield (FCF to its market cap) on a trailing twelve-month basis, which is impressive for such a large and well-diversified company, in my opinion.

On a positive note, BABA recorded double-digit growth in GMV in China and in the international segment compared to the previous year. From my past coverage, I recall that Alibaba has shifted its focus from merchants to customers exactly for the sake of boosting sales and GMV, so the plan seems to be working, judging by the latest data. This approach usually results in temporary margin headwinds as price competition and customer-first focus take center stage. However, I agree with the analysts at Argus Research (proprietary source, dated May 2024), who stated that this strategy should contribute to sales growth and higher margins over time.

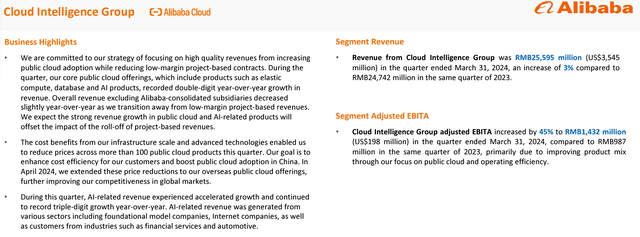

Additionally, in fiscal Q4 FY2024, we could see accelerated growth in customers and cloud computing revenues related to its AI products. Yes, the Cloud’s revenue in general increased by just 3% YoY – incomparably lower than the figures we see in Amazon’s (AMZN) AWS or Microsoft’s (MSFT) Azure, but Alibaba’s cloud business is rapidly reviving its profitability with adjusted EBITA rising in Q4 FY2024 by 45% YoY “due to improving product mix through the focus on public cloud and operating efficiency”.

I believe that Alibaba has sufficient resources and expertise to sustain and continue this trend moving forward amid the addressable market (The Asia Pacific Cloud Infrastructure Market) projected to hit $593.7 billion in market valuation by 2032 based on Astute Analytica’s research paper – that’s a CAGR of 25.93% during the forecast period 2024-2032.

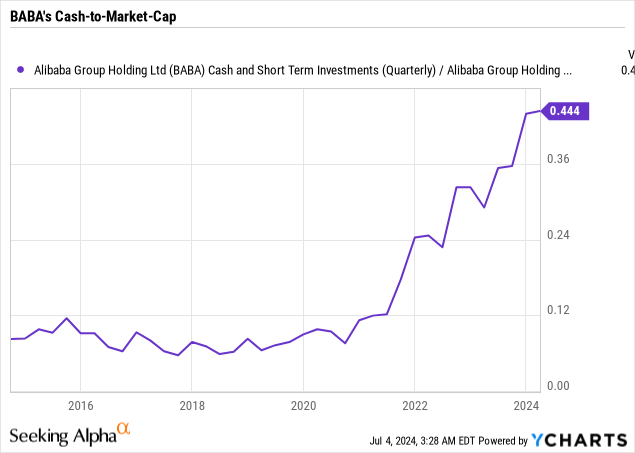

It’s hard to believe, but with approximately half a trillion yuan in cash and equivalents on the balance sheet (as of March 2024) and a debt of only RMB 170 billion, Alibaba’s current cash ratio is already 44%. This suggests that the company is significantly undervalued by the market, potentially by 2-3x, especially when compared to other technology giants with similar operational activities but different geographical focuses (i.e. Western peers).

Alibaba didn’t provide guidance for FY2025, but I believe while the cash cushion is still there and the FCF keeps flowing in, the substantial share repurchases program BABA currently has (and the approval of a $4.0 billion dividend for fiscal year 2024) reflects the company’s ability to return massive value to its shareholders.

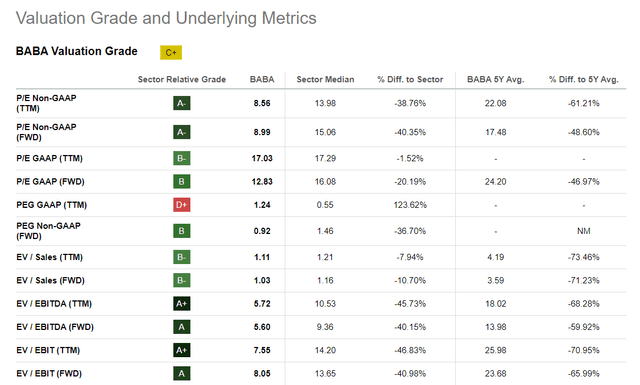

Despite the value Alibaba stock currently represents to investors (my opinion), the stock price is basically flat YTD (even slightly down), while the non-GAAP P/E multiple for the next year is estimated at ~9x – that’s a 40% discount to the sector’s median, according to Seeking Alpha data. Most other multiples are also saying that BABA is quite undervalued.

Undervaluation alone is not a sufficient reason to buy any stock, as serious internal and business problems can cause the valuation to fall further – this is often the reason why many stocks remain undervalued (investors call them “value traps”). In recent years, the difficult economic climate in China, combined with regulatory and real estate risks, has kept stocks low.

We know that the Chinese economy has been heavily reliant on real estate and the current mortgage crisis, combined with slow consumer demand growth, presented significant hurdles. For a recovery, we need a major change in the Chinese economy – a catalyst that would initiate the recovery process and have a positive impact on the stock market as a leading indicator.

Stocks have usually bottomed about six months before the economy but have bottomed as much as ten months before the economic decline is over.

[Forbes]

I’m hopeful that the upcoming events, particularly the July meeting of the Politburo of the Communist Party of China (the Third Plenum of the 20th Party Congress) will serve as catalysts for positive change.

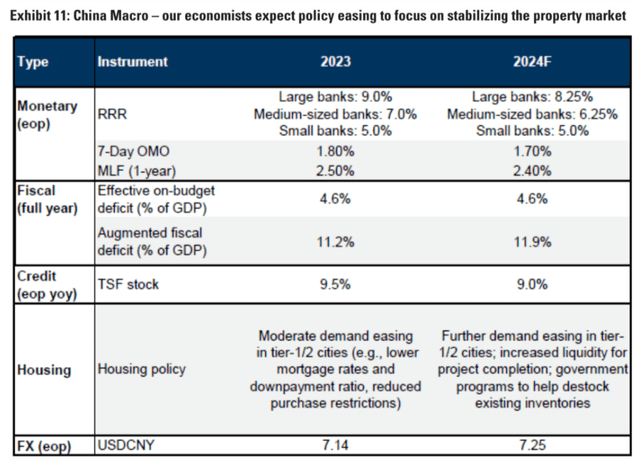

As analysts at Goldman Sachs recently noted (proprietary source, dated July 2024), the Politburo meeting will outline policy arrangements for the rest of 2024, and while no major stimulus is expected, there may be increased support for the property market. This step would be crucial in stabilizing the property sector and mitigating downside risks to maintain about 5% real GDP growth by year-end.

Goldman’s calculations (proprietary source)

I estimate that these incentives will have a very strong positive impact on China’s real estate market, which will, in turn, boost economic growth – this should restore investor confidence in individual stocks, making BABA a primary focus for portfolio managers thanks to the moat it holds and the above-mentioned undervaluation discount.

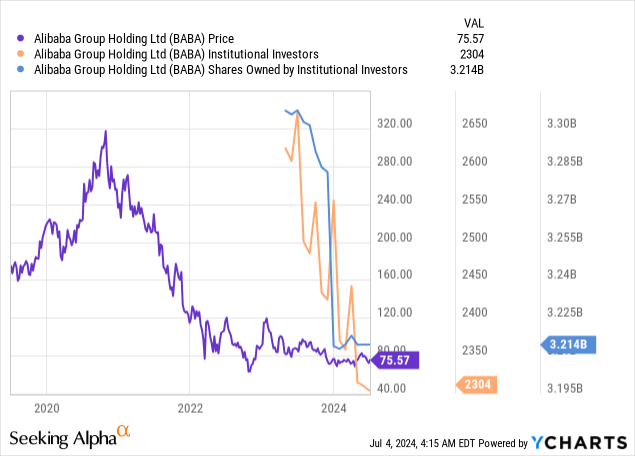

The return of institutional investors to Alibaba shares has not yet begun, as YCharts data shows. The number of shares held by investors has declined significantly, as has the presence of well-known investors in the company’s capital structure. However, I believe that their comeback is inevitable given the factors mentioned above – once this process begins, it could have a massive positive impact on Alibaba.

From a technical analysis perspective, the stock is near its local lows, around $75-$76 per share. The relative strength index indicates a gradual recovery, painting a divergence in the weekly timeframe. The nearest strong resistance is 56-57% above current levels, which aligns with the significant discount the company’s shares are currently trading at.

TrendSpider Software, Oakoff’s notes added

Based on all of the above, I remain “greedy” so to speak, and intend to buy back any major dips from the current price levels. I hope that the catalyst discussed in today’s article will reignite positive sentiment towards Chinese assets, particularly Alibaba Group.

Risks To My Thesis

A significant risk to my bullish stance on Alibaba is the possibility of persistent macroeconomic headwinds. If the current issues with the Chinese economy – low demand growth, tech firms being heavily regulated, and a prolonged real estate crisis – are, in fact, long-term in nature, they will surely affect Alibaba’s recovery and growth prospects. Also, unexpected geopolitical tensions or trade disputes could also negatively impact investors’ sentiments. I therefore advise everyone to do their own due diligence and check the reasoning of any bull before getting involved.

Additionally, my thesis relies on the emergence of a catalyst, which may ultimately not materialize – one must consider what has prevented the Chinese government from addressing the current issues sooner.

Moreover, the undervaluation of the company could continue indefinitely, as we have seen in recent years. If China’s officials decide to devalue their local currency, as has been speculated for some time, this would significantly impact Alibaba’s and other domestically oriented retailers’ revenues translated into USD. This could render BABA’s current low valuation multiples essentially irrelevant.

Concluding Thoughts

Despite the many risks associated with my thesis, I still believe that the potential reward of buying Alibaba stock today significantly outweighs the potential risks. The company is currently trading at a significant discount to its intrinsic value. The growth prospects for the individual segments appear impressive. Of course, Alibaba’s further performance will likely depend on how quickly the bullish sentiment for Chinese assets returns and what measures the CCP takes to stabilize the economy, especially the real estate sector. While the timing of the first step is uncertain, I believe that the second step will soon be the long-awaited catalyst that breathes new life into Alibaba stock.

I reiterate my previous “Buy” rating.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.