da-kuk/E+ via Getty Images

Investment Thesis

Nutanix, Inc. (NASDAQ:NTNX) has a lot going for it. Simply put, it’s perceived as a safe investment due to its mid-teens growth rate and substantial scale.

The company is growing steadily without needing exceptional performance each quarter. With approximately $2.5 billion in forward run-rate revenues, Nutanix is seen as stable yet still growing enough to remain attractive to investors.

Its valuation of 31x next year’s non-GAAP operating profits remains attractive, too, particularly given the recent pullback on its stock.

Altogether, there’s a lot to like here.

Rapid Recap

Back in March, I said,

[…] my bullish stance on Nutanix remains strong, fueled by its adept handling of workload management and attractive valuation.

Its fiscal Q2 2024 results, boasting a robust free cash flow margin of 29%, underscore its financial strength. Despite sustaining mid-10s% CAGR growth, Nutanix is attractively priced at 21x forward free cash flows.

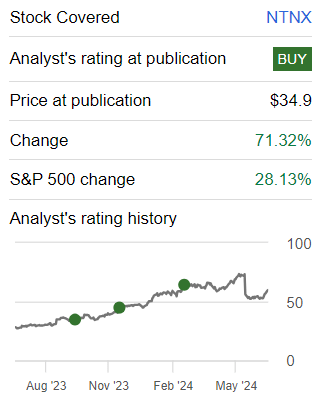

Author’s work on NTNX

Nutanix is a stock that I’ve been bullish on for a while, and its stock has outperformed the S&P 500 (SP500) by more than 40% while I’ve been bullish about this name. And despite investors opting to take profits now, I remain bullish. Here’s why.

Nutanix’s Near-Term Prospects

Nutanix provides cloud computing solutions that help businesses modernize and optimize their IT infrastructure. Their platform integrates computing, storage, and networking into a single, scalable system, allowing companies to simplify the management of their data centers and reduce costs.

Nutanix cloud platform is gaining traction, particularly with large organizations focused on digital transformation and infrastructure modernization. Significant deals, such as those with Fortune 50 and Fortune 500 companies, highlight Nutanix’s ability to attract and expand within major enterprises.

Additionally, Nutanix’s near-term prospects are bolstered by its strategic focus on cloud-native and AI-driven solutions.

Plus, Nutanix notes significant enhancements to its cloud platform, including expanded support for modern applications and enterprise AI. Innovations like GPT-in-a-box 2.0, which offers advanced GPU and large language model support, and the Nutanix Kubernetes Platform for containerized applications, strongly positions Nutanix.

Yet, Nutanix also faces challenges with the lengthening sales cycles of larger deals, which introduce variability in the timing and outcomes of transactions, which impacted its fiscal Q4 outlook (expanded upon soon).

The competitive landscape, especially with Broadcom’s (AVGO) aggressive pricing strategies post-acquisition, adds further pressure here.

Given this balanced background, let’s now discuss its fundamentals.

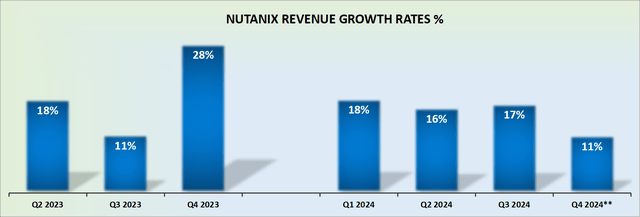

Revenue Growth Rates Will Improve

There’s good news and bad news when it comes to Nutanix’s growth rates. The bad news is that Nutanix’s guidance pulled in its revenue growth rates for fiscal Q4 2024. Naturally, investors didn’t view this positively and the stock took a breather as investors sought to take profits now.

However, I believe that we should take its fiscal Q4 2024 guided revenue growth rates into context. After all, fiscal Q4 of last year was always going to be a very challenging comparison quarter.

What’s more, as we move into the next fiscal year, starting next month, its comparisons ease up, which will allow Nutanix to continue delivering mid-10s% revenue growth rates.

With this framework in mind, let’s now discuss its valuation.

NTNX Stock Valuation — 31x Next Year’s Non-GAAP Operating Profits

Nutanix holds a slight net cash position. More specifically, Nutanix holds approximately $200 million of net cash, once its marketable securities are factored in. This leaves Nutanix in a stable position.

What’s more, presently, Nutanix guides for about 15% non-GAAP operating margins. But we must keep in mind that from fiscal 2022 into fiscal 2023, Nutanix’s non-GAAP operating margins went from negative 5.5% to 8.6%, a dramatic improvement in profitability of 14.1 percentage points.

Then, from fiscal 2023 into fiscal 2024, its non-GAAP operating profits are expected to increase by a further 10 percentage points.

Consequently, how much more improvement in profitability can we truly expect to see in fiscal 2025? Perhaps Nutanix’s non-GAAP operating margins expand by a further 300 to 400 basis points?

Let’s make the case that Nutanix delivers around 19% non-GAAP operating margins next fiscal year. This would put Nutanix on a path to deliver $480 million in fiscal 2025. That’s a 45% increase from the $330 million expected this year.

Hence, investors are asked to pay around 31x next year’s non-GAAP operating profits. A reasonable figure, considering its multi-billion dollar revenue line, that’s growing at mid-teens growth rates.

The Bottom Line

In conclusion, Nutanix, Inc. presents an appealing investment opportunity with its stable growth trajectory and strategic positioning in cloud computing solutions.

Given NTNX’s recent pull, its valuation of 31x next year’s non-GAAP operating profits is attractive.

This figure reflects a reasonable pricing given Nutanix’s robust revenue base and anticipated margin improvements, signaling the potential for an increase in shareholder value.

In summary, Nutanix’s trajectory toward profitability and its 31x valuation for next year’s earnings make it an appealing choice for investors looking to “compute” their returns wisely.