Editor’s note: Seeking Alpha is proud to welcome Investing Differently as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Rafmaster

Investment Thesis

To begin with, Jumia (NYSE:JMIA), a company I regard as a juggernaut in its own space, is not currently in its best position. I believe the problems it is going through could be temporarily provided it makes all the right decisions. Macroeconomic headwinds are the company’s biggest problems and in my opinion, are beyond its control. Based on my analysis, if the company can take major steps towards spreading beyond overreliance on a particular segment and market, its struggles can be a thing of the past. Therefore, Jumia has a hold rating from me.

Introduction

Jumia is Africa’s leading e-commerce platform with $244 million in revenue in 2023, and ~24 million active customers; it operates in the following segments; online marketplace, logistics and payment services.

Jumia has managed to create a niche market for itself in Africa, boldly dominating the space. With over half of the e-commerce market share, Nigeria is Jumia’s biggest market and a large chunk of its operations are based there, so is a large portion of its revenue from its operations there.

The case for Jumia

The thing with Jumia is that despite its juggernaut status in Africa, it still has a lot of things it needs to work on. Having an e-commerce platform with only 24 million active customers – on rough estimate, is still quite low for an e-commerce platform. Though in Africa, as an investor currently on the continent, I know that access to the Internet and onboarding of Technology is a whole lot better than that.

Not very fair for a comparison, but I’ll use it anyway. Amazon has ~230 million customers in the United States, a country with access to the Internet of about 322 million as of March 2024. This represents about 71.4 percent of the population with Internet access. Now, my case for Jumia and arguably so is that the number of persons with access to the Internet in Nigeria (one of its markets in Africa) is 154.8 million as of 2023, it has obviously grown as of now. Therefore, Jumia’s juggernaut status in Africa accounts for only 15.5 percent of the population of active internet users in Nigeria (using the estimated 24 million annual e-commerce platform customers), now this is not accounting for Africa as a whole.

I’m not undermining its position as the leading e-commerce platform in the continent, but I’m just highlighting that it has a potential wider and by far larger market than it is holding on to. I’ll blame this largely on the lack of competition in the space. Jumia should be less comfortable being just the largest one and really dominate the space.

Then there’s the currency issue

Nigeria is Jumia’s biggest market. The country’s proprietary currency, the Naira has seen one of the worst devaluations among currencies in the past year. Highlighting longer time frames, such as within the past 3 years and 5 years, the picture looks even more grim. However, for the sake of my analysis, I would be using the past year.

Jumia performance report

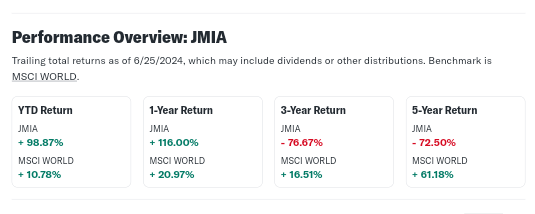

While new holders (within the past year) of the stock have their investments in the green. Investors who have owned the stock for periods of 3 to 5 years have seen near abysmal losses around the -75% to -76% range. While I would partially believe that that would be widely linked to the intense devaluation of the Naira within the period, but at the same time, within the past year, it has seen a 116% increase, while the Nigerian Naira has decreased in value by about 2.34 times its former value [using the Annual average exchange rate of one U.S. dollar in Nigerian Naira (NGN)]. Within the past 3 and 5 years, it has decreased ~3.78 times and 4.61 times its value, respectively.

Not being too intricate now, but apart from the Nigerian Naira devaluation and the inflation in the country’s economy which is considerably worse in the past year, I believe its previous poor performance should be linked to something else (that is to say in context, it has been having a poor financial performance over the past year, however, when the Nigerian economy was significantly worse and witnessed its worst currency devaluation, Jumia managed to record an impressive stock performance). This being said, acknowledging that Nigeria is just one of its markets, though its largest.

Segments Review

Jumia’s operations are based on the following segments;

-

Online Marketplace (e-commerce) business

-

Logistics business

-

Payment services

Online Marketplace (e-commerce) business

Jumia’s online marketplace, which has mostly been addressed earlier in this analysis, is the biggest of its segments. A majority of its customers are based in a single market – Nigeria.

Nigeria is currently in a not so pleasant economic situation, which according to the business is affecting its e-commerce business.

Its competitors in the e-commerce (online marketplace) space include; jiji and Konga (see Statista’s e-commerce research). On a bigger scope (in Africa), its dominance is still unrivaled, with its customer base being over double its nearest competitor.

Logistics business

Jumia’s Logistics business (Jumia com)

Its logistics business, though regarded as a segment, is majorly dependent on its e-commerce business. This service mostly deals with delivery of goods purchased on its e-commerce platform. Further, it doesn’t have the monopoly on this, as both customers and sellers on the platform can opt for other delivery methods. I see this as a red flag, as it widely limits the potential of the segment, making it impossible to stand alone. Low sales in its e-commerce business will inevitably affect the logistics business. Operating in an industry with the size of ~US$10 billion (in Nigeria) opens up a window of intense opportunities. However, Jumia seems to be struggling in this regard as it recently suspended its ‘logistics as a service’ business, losing the potential of tapping into this large market.

Payment service business

Jumia’s payment service (Jumia)

Valued at over $22 billion in 2022, the Nigerian payment services industry positions as another potential market for Jumia. In the 2023 financial year, its proprietary payment service JumiaPay handled transactions to the tune of $192.2 million dollars (this covers all its operations in all its markets), showing its ability to effectively handle large amounts and volumes of payments. However, quoting directly from its 2023 financial reports:

JumiaPay Transactions corresponds to the total number of orders for products and services on our marketplace for which JumiaPay was used, irrespective of cancellations or returns, for the relevant period.”

Indicating that outside the Jumia e-commerce marketplace, this segment is equally not up to its full potential as a majority of its transactions are related to its e-commerce business (however, it also handles other forms of payments outside its e-commerce business). I, personally, think that this is sad seeing that based on the number of transactions it handles, there’s no major statement of its relevance outside the e-commerce space. Again to note that despite strides, if the e-commerce business suffers, this segment suffers also. Should the company plan to dive fully into the market, major competitors would be Opay, Palmpay, Flutterwave, Paystack, etc., with significantly higher market share.

This goes without saying, I believe that both its logistics business and payment service business should evolve to be independent of its e-commerce business. It has operated in the African space long enough to at least attempt to properly market the idea to its large customer base.

Financials

Its earnings per share of the past 12 months (EPS TTM) is -1.09, that’s not good-looking forward as an investor, even though I know that projecting past performance forward is not the most logical investment analysis, I believe it generally gives a picture of the company. I mean what’s the point of history if we won’t at least try to learn from it (though projecting past performance forward will not give an accurate picture of the company’s future performance, it will definitely help in seeing its current standing and would also help to create an outlook to work with).

So, it had a revenue of $186 million in the past fiscal year, this is darkened by its operating loss of $78 million (~42% of total revenue). It has been able to manage the decrease in its liquidity, a good one from that end.

Speaking to its shareholders in its report for 2023, it acknowledged the above highlighted economic issues I predicted.

Upheavals on the global stage have had a significant impact on African economies and its people. High inflation rates and currency depreciation have led to a scarcity of supply and have adversely impacted the purchasing power of customers. These have been challenging times for tech and retail businesses across the continent. Against that unsettling backdrop, we embarked on a fundamental transformation of our company in order to rapidly improve our financials and establish a stronger foundation for our e-commerce business. This transformation obviously came with a painful short-term impact, as we discontinued activities with poor growth prospects, stopped expensive marketing practices, and radically streamlined our organization…”

Further, highlighted its commitment to axe off business activities and segments that are causing the ship to sink.

We believe that Jumia is now a much leaner, more agile and more focused company. We have reevaluated our portfolio and made tough decisions regarding business activities that did not bring the right value. Recently, we discontinued our food delivery operations as we concluded that the growth prospects did not justify the complexity it created. We believe our focus and resources will be better invested in our physical goods business, where we see more opportunity for revenue growth and higher margins.”

However, regardless of its commitments and encouragement to shareholders, I see its financials in a mess, its assets to liabilities ratio shows liabilities is about 64.2%, this is a high risk, especially since its major problems based on my analysis and also confirmed by itself is majorly macroeconomic, as such it is very much out of its control.

By means of a holistic analysis

While there are double-digit revenue increases in constant currency, there happens to be a decline in the reported currency (USD). Further, its reduction in operating costs, improvements in gross profits give it a positive outlook moving forward. However, it also needs to address its reducing liquidity and decreasing cash flows. Most of the negativity, I attribute to the devaluation of the Naira in its main market, reflecting how dangerous it is as it can make positive steps forward look like steps in the opposite direction. Overall, the company’s financials show a positive sign of improvement as regards its operational metrics and a more sustainable cost structure. These are some of the reasons why it is still worth holding.

Some of the trends I’ve noticed in the company’s performance is, firstly, the lack of interest in diversifying beyond its overreliance on a particular segment – e-commerce. While this has probably helped it build its leadership status in the industry, I strongly believe it could achieve more if it steps out of its comfort zone.

Further on a macroeconomic level, the devaluation of the Nigerian Naira has been a major issue for the country, with its Apex Bank (the Central Bank of Nigeria – CBN) working round the clock to address. Issues the CBN highlighted and aims to address is the speculative holding of the US dollar and other foreign currencies in anticipation of a wider increase in their value and consequently a decrease in the value of the Naira, heightened interest in Cryptocurrencies, heavy reliance on imports leading to trade deficits, increased demand for foreign currencies, Inflation, etc., combined with its Debt Servicing Costs creates a multifaceted economic issue. My assertion is that at this point Jumia can only react to it, take decisions to safeguard itself, apart from these it cannot really do anything about it.

Opportunities

Within the past couple of months earlier in 2024, the Nigerian Naira witnessed an impressive surge in value, becoming the best performing currency during the time frame of a couple of months. If such an event repeats itself, and the economy of the nation stabilizes in such a state, the story would be totally different as Jumia would not only automatically be on an incredibly profitable side, but its e-commerce engagements as well as other segments would primarily benefit in no small way. This would also make me change my rating to a buy.

Also, a move to make other segments independent would in my opinion be a positive game changer for the stock as its performance won’t be tied to a certain segment.

Further, its status topping the leaderboard of the e-commerce space in Africa would set it up for benefits should the industry on the continent witness a positive increase.

Risks

The economy of its major market could further deteriorate, while I don’t see this happening, as it seems to have stabilized. I acknowledge that it is still a very valid risk. Further, any major issues with its e-commerce platform would adversely affect other segments, seeing they are so closely attached.

I failed to carry out a comparison to other pairs in the e-commerce space in Nigeria, because of its market share and the fact that none of its competitors are listed in a US stock exchange, I felt no proper comparison is available. JUMIA is uniquely in a class of its own. Also, the analysis so far is majorly based on its highest grossing segment by revenue – e-commerce, plus I believe it is important to note that other segments: payment services and logistics are riding on its e-commerce business, outside its e-commerce platform, the other segments are negligible as they don’t stand on their own in any significant way, thus, the success or failure of the e-commerce business would tell on every other segments.

Concluding thoughts

The economic issues in Nigeria, though valid as an excuse for underperformance, would buttress why I believe a company’s operation should not be too overweight on an economy, particularly on one popularly regarded as volatile.

Seeing that JMIA’s issues are mostly macroeconomic, thus majorly out of its control. It could only react to or at best be proactive to stay afloat.

My rating on JMIA is HOLD, it seems to be taking some major steps which in my opinion is in the right direction. Its YTD and 1 year stock review shows a positive uptrend further, it is fixated on the right things.

Although I’m not too impressed that it didn’t highlight a decision and steps to rapidly and aggressively expand operations, especially out of its major stronghold – Nigeria. Now, I believe Nigeria, one of Africa’s largest economies, is still a plus for the company, after all, it has a population of active internet users which is significantly more than the entire population of other African nations. Saying this, I also believe that worthy of note is that a major positive increase in the Nation’s currency and economy would instantly skyrocket Jumia’s revenue and growth. I assert also, that working on the independence of its payment service and logistics businesses would be very helpful for its stability moving forward.

However, further outlook not just for Jumia but the nation’s economy is essential to make investment decisions moving forward, with a potential to change my current rating.