annatodica/iStock via Getty Images

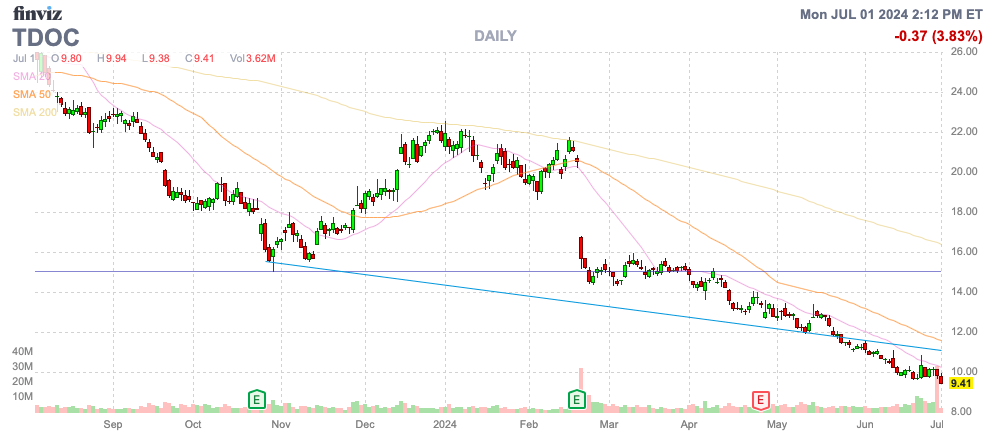

Teladoc Health, Inc. (NYSE:TDOC) is facing an internal crisis as the stock trades at all-time lows and the company recently replaced the long-time CEO. The Covid era was supposed to usher in the reign of telehealth in healthcare solutions, but the company has failed miserably to ignite growth following Covid pull forwards. My investment thesis is Bullish due to the cheap valuation and opportunity ahead, but the stock is definitely trending lower with the market waiting to see if a turnaround occurs due to the potential of weight loss management.

Source: Finviz

Weight Loss Management

The excitement surrounding GLP-1 weight loss drugs has opened up a major new market opportunity in weight loss management. Teladoc Health is perfectly positioned to participate in the sector with the recent launch of a weight loss management program and a prior focus on areas like diabetes prevention, working together to improve patient health and control escalating costs for healthcare providers.

A lot of the issue with Teladoc Health has been the go-to-market strategy and the lack of a compelling product story to drive user growth. On the recent Q1 ’24 earnings call, the company executives and analysts mentioned the following words as follows:

- Advertising or ad – 29

- Sell – 13

- AI – 5

- Weight management – 1.

Teladoc Health spent far more time on the recent earnings call talking about digital advertising spending for their BetterHelp product and cross-selling than AI and the hot new area of weight loss management. The company starts the 2H’24 as more of a telesales business than a telehealth company.

The whole Q1 earnings call should’ve been focused on the opportunity in the weight loss management portion of chronic care. The problem is that Teladoc Health doesn’t appear to have a solution that doesn’t involve sales to new members who do not take an extensive time to work through the sales process.

Not to mention, the company doesn’t discuss product innovation in the area. On June 24, Teladoc Health actually highlighted the benefits of AI in predicting members with blood sugar issues, leading to higher engagement with the diabetes management program.

The company recently hired Chuck Divita as CEO, and a big key to a strong future is whether the focus is shifted towards product innovation driving new members for Chronic Care, like weight management and mental health services, or the company is solely focused on sales and advertising. Unfortunately, the new CEO has recent experience at GuideWell, a leading health solutions organization which includes Florida Blue. The new executive appears to come from a healthcare company background as a prior financial expert than an executive capable of leading in product innovation for a telehealth provider.

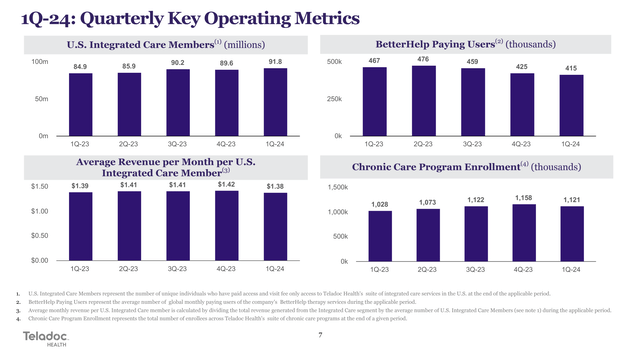

The Chronic Care program saw enrollment grow 9% YoY to only 1.121 million members. The Q1 number was actually down 37K members sequentially while Teladoc Health launched the Weight Management provider-based care program back in early 2023 and the push into managing costs around GLP-1s should drive faster growth.

Source: Teladoc Health Q1’24 presentation

After a year, Teladoc Health hasn’t seen a huge uplift in chronic care enrollment.

Beyond Cheap

Teladoc Health soared to $300 back in the Covid boom in 2021, yet the stock now trades below $10. The stock valuation is a meager $1.7 billion, while the company ended the last quarter with a cash balance of $1.1 billion, though Teladoc Health does have outstanding convertible debt of $1.5 billion.

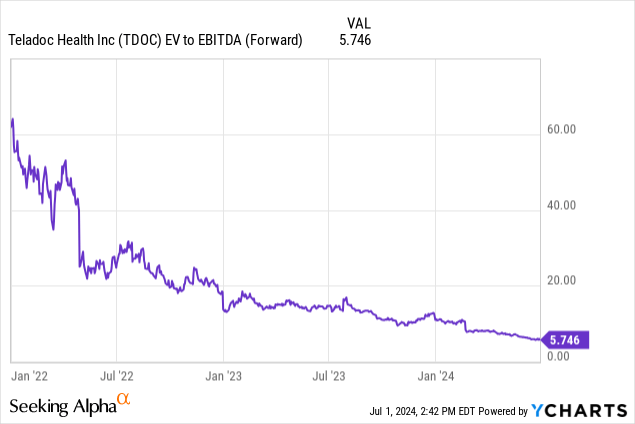

The telehealth provider has a $2.7 billion sales target for 2024. Almost unthinkable back during Covid, the technology company trades at an EV/S target below 1x. Teladoc Health has solid EBITDA profits and forecasts producing upwards of $240 million in free cash flow this year alone.

Source: Teladoc Health Q1’24 earnings release

A normal technology company producing cash with opportunities in some of the hottest technology and drug trends would usually trade closer to 3x to 5x EV/S targets, or even higher. Teladoc Health trades at just 6x EV/EBITDA targets of $370 million for the year.

The opportunity for the new CEO is to invigorate growth due to a shift back to product innovation, pushing the stock towards multiple expansion. Teladoc Health could easily trade at 20x EV/EBITA targets, which immediately leads to a tripling of the stock.

Takeaway

The key investor takeaway is that Teladoc Health could see the booming demand for weight loss management help the company, but management has to actually lean into product innovation. Currently, Teladoc Health, Inc. looks and feels a lot more like a telesales company, lacking product innovation.

The stock is a buy here due to the cheap valuation and potential in telehealth, but the gamble might not pay off, if the new CEO doesn’t lean into product innovation.