digicomphoto/iStock via Getty Images

Investment thesis

Paysign’s (NASDAQ:PAYS) mature plasma donor payment business has shown solid profitable growth in recent quarters. As its growth is expected to moderate going forward, the cash flows generated are being allocated to fund the patient affordability programs in its pharma business, which has recently experienced exceptional growth. Additionally, the pharma business segment has a long runway for continued expansion.

When valuing the overall business based on a SOTP analysis, I arrive at a valuation of $4.2 per share. This implies that the business is close to fully valued, and leaves a limited margin of safety for investors, especially considering the risk of competition in the pharma segment. Therefore, I assign a neutral rating to Paysign’s shares.

Q1 earnings snapshot

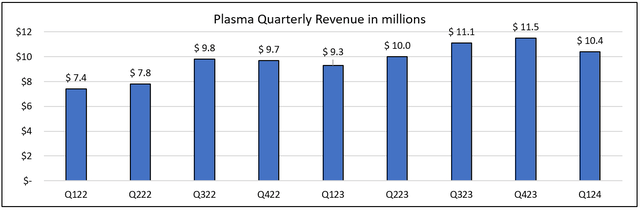

Continued profitable growth in Plasma

Plasma donor compensation revenue increased 11% in Q1 to $10.4 million, as shown in the figure above. Growth was driven by the company serving an increased number of plasma centers, which totaled 469 compared to 439 in the year ago quarter. Though growth was down nearly 10% sequentially, this is expected considering the seasonal nature of the business, where donors typically benefit from tax refunds in Q1. Nevertheless, the business continued to gain market share as it added five net new plasma centers during the quarter.

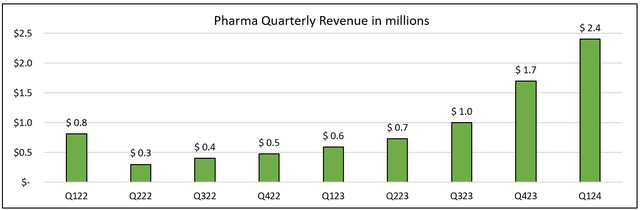

Exceptional performance from the Pharma solutions

Boosted by the launch of 27 net new pharma patient affordability programs over the past 12 months, pharma solutions revenue increased to $2.4 million, as shown above. This compares to just $0.6 million in the prior year period. Furthermore, 10 new pharma patient affordability programs were launched during Q1 alone, which is a sign that the momentum in revenue growth is expected to be sustained even in the next quarter.

Expectations for the remainder of 2024

Steady growth in Plasma and strong advancement in Pharma

Management expects total revenues to increase 27.5% year over year in Q2 2024, with adjusted EBITDA margin expected to in the range of 13.5% to 14%. Although the company plans to add 15 to 25 new plasma centers in 2024, revenue growth within the plasma segment is expected to be modest, as explained by CEO Mark Newcomer during the Q1 2024 earnings call when he stated:

We expect moderate but stable growth in our plasma compensation business as the plasma collection industry stabilizes after a period of rapid expansion.

With respect to pharma revenue, management expects it to account for approximately 18% of the total revenue in Q2. Using this guidance, I estimate pharma revenue in Q2 to be around $2.5 million, which would represent a 5% sequential growth over Q1. When questioned on the earnings call regarding the pipeline of opportunities related to the patient affordability program, the company’s President of Patient Affordability, Matt Turner optimistically stated:

Yes, we’re stacked with business between now and the end of the year.

There appears to be a long runway of growth ahead for the pharma business as management estimates that there are presently a total of around 1,600 active co-pay programs, representing a TAM of at least $500 million. Therefore the company’s 53 active programs that involve more than 40 different pharma companies has ample room to expand further. Its CEO expanded on this opportunity and put forward his expectation that the pharma business could eventually become larger than the plasma business. He said:

I mean we have a much larger TAM associated. And basically, from my view, and we’ve been looking at this for a number of years, it’s not a matter of if, it’s a matter of when it’s going to surpass the plasma. So I do feel that’s coming.

Rising interest income due to growing customer cash balances

Interest income earned by the company due to the cash balances held by its customers totaled $0.7 million in the last quarter. This represents approximately $2.8 million of interest income on an annualised basis, which is significant in comparison to the company’s trailing twelve month EBITDA of $7.7 million. As long as its customer accounts continue to grow, the company continues to benefit from interest income as we remain in a high interest rate environment.

Ramp up in share repurchases

The company initiated a $5 million share repurchase program last year, which has around $3.9 million still remaining. Management chose to not purchase any shares during the last quarter. However as more cash builds up on its balance sheet in the upcoming quarters, I expect the company to deploy more cash towards buybacks, and potentially initiate a new share repurchase program as soon as the current one is concluded.

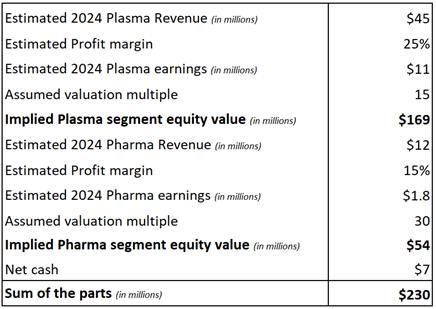

SOTP based valuation

Since the company’s plasma and pharma segments operate as separate businesses, I believe that a SOTP based analysis is the most appropriate way to value the entire business. With respect to the Plasma segment, I expect profit margins to be close to 25% on a GAAP basis. Accordingly, I choose to give it a valuation multiple of 15, considering the recession-resistant nature of this business and modest high single-digit growth expectations. The Pharma business is in the very early stages of its growth, making it somewhat more challenging to accurately value. I chose to adopt a conservative approach, by assuming that steady state margins could reach 15%, and assign it an earnings multiple of 30, given its high growth potential.

My valuation model based on data from the company and Seeking Alpha

The company receives a marginal revenue contribution from its Other business segment, which is related to payments processing for corporate incentive and disbursement programs. I chose to exclude this segment from my analysis, mainly due to its small size and lack of clarity. As shown in my valuation table, after accounting for the company’s net cash position, I arrive at a valuation of $217 million for the entire company. Assuming 54.8 million diluted shares outstanding, this translates to a share price of $4.2. This implies an upside potential of 5% from today’s share price of $4. Therefore based on my valuation model, I believe Paysign’s shares are close to fully valued and present limited upside potential.

Risks

While the company maintains a dominant position with a 40% market share in the plasma donor payment processing market, its future revenue growth is heavily reliant on its pharma revenue stream. This sector is highly competitive, with many rivals operating as subsidiaries of much larger corporations. A notable example is CoverMyMeds, owned by McKesson (MCK). The presence of such formidable competitors underscores the challenges the company faces in expanding its market share in patient affordability programs.

Conclusion

Paysign continues to achieve strong profitability in its steadily growing plasma business. Meanwhile, its much smaller pharma business is experiencing rapid growth and has significant potential for future expansion. Upon considering the risks involved, I believe the current valuation provides limited potential for upside and lacks a margin of safety for investors. Therefore, I maintain a neutral stance towards the shares.