HJBC

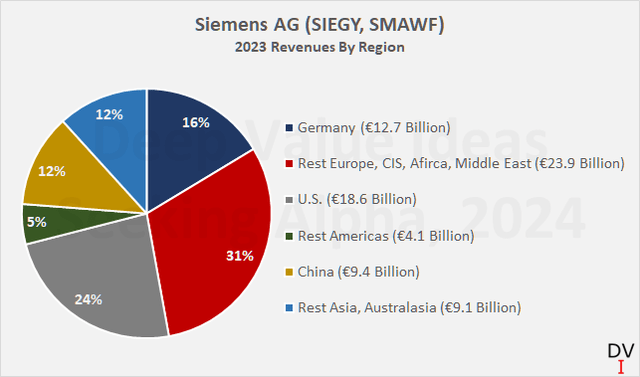

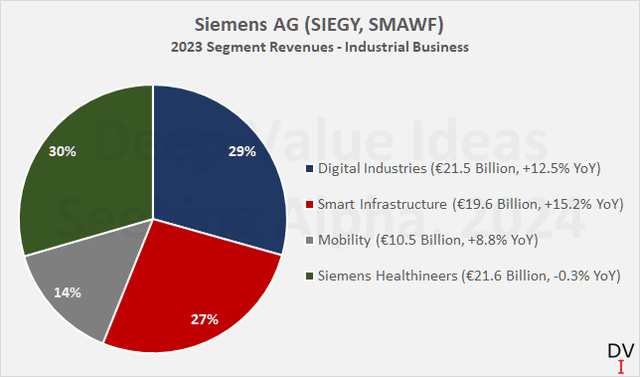

It has been a little over two years since I last covered the German industrial conglomerate Siemens AG (OTCPK:SIEGY, OTCPK:SMAWF). Back then, in early 2022, I concluded that the company was very well positioned in the context of current major trends such as energy transition and digitalization, but not cheap at the time of writing. However, against the backdrop of the Russian invasion of Ukraine, European stocks plunged and a short window of opportunity opened for investors who were willing to look past these uncertainties and who appreciated the fact that Siemens is a globally (Figure 1) and operationally diversified (Figure 2) conglomerate.

Figure 1: Siemens AG (SIEGY, SMAWF): 2023 revenues by geographic region (own work, based on company filings)

Figure 2: Siemens AG (SIEGY, SMAWF): 2023 industrial business revenues by operating segment (own work, based on company filings)

Of course, when thinking of an industrial conglomerate, a complex and cyclical business, weak margins, the risk of growth through expensive acquisitions and a leveraged balance sheet come to mind. Although Siemens is a conglomerate, and a large one at that, with sales of almost €80 billion in 2023, it doesn’t really fit this description. In this article, I’ll share three reasons why I believe Siemens stock remains an excellent long-time investment and is anything but an “old-economy conglomerate”.

Reason 1: A Well-Managed Portfolio Company With Increasingly Robust Earnings And Cash Flows

Siemens is known for being active in a broad range of industries and growing both organically and through acquisitions. This of course carries the risk of overpaying, eventually resulting in write-downs and an overleveraged balance sheet. And while a still relatively small and “low-profile” company like Halma p.l.c. (OTCPK:HALMY, OTCPK:HLMAF) (see my articles) can move the needle through relatively easy to integrate acquisitions, it is much more difficult for a €80 billion giant like Siemens to grow inorganically and maintain good profitability in the process.

However, Siemens’ management has been relatively quick to recognize industrial trends and the need to build a leading portfolio in software, smart infrastructure and healthcare technology. Notable acquisitions include those of UGS Corp., Mentor Graphics Corp., and Varian Medical Systems, Inc.

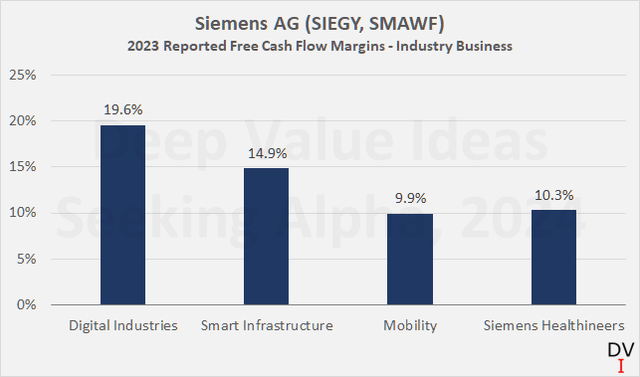

So, while Siemens’ position in digital solutions in particular is undeniably very strong – underlined by the segment’s leading free cash flow margin (Figure 3) – Siemens is also actively divesting assets (e.g. the electric motor company Innomotics for €3.5 billion). If we include the acquisition of Varian in fiscal 2021, Siemens has spent an average of €3.0 billion per year on acquisitions since fiscal 2016 – net of divestitures and excluding the sale of Innomotics, which is expected to close in fiscal 2025. However, Siemens also generates positive cash flow through IPOs or spin-offs.

Figure 3: Siemens AG (SIEGY, SMAWF): 2023 industrial business reported free cash flow margins (own work, based on company filings)

Long-time holders of SIEGY shares or those who have them on their watch list may remember the IPO of Siemens Healthineers AG (OTCPK:SEMHF, OTCPK:SMMNY), a company specializing in medical imaging technology, in 2018. Healthineers is developing splendidly – partly of course due to the merger with Varian in fiscal 2021 – so as a Siemens shareholder, I am very happy that the former parent company retains a 75% stake.

Similarly, Siemens spun off its energy business (Siemens Energy AG, OTCPK:SMEGF, OTCPK:SMNEY) in fiscal 2020, which consists of the former gas and electricity business and Siemens Gamesa (wind engineering). In contrast to Healthineers, which is still majority-controlled by Siemens, the Energy business was always intended to be a spin-off that would be managed independently of Siemens AG. After the initial listing in September 2020, Siemens retained 35.1%, while 9.9% was held by the Siemens pension trust and the remainder by Siemens shareholders. Due to the contribution of a further 6.8% of Siemens’ holding to the Pension Trust and a capital increase in which Siemens did not participate, the former parent company’s shareholding declined to 25.1% in fiscal 2023 (p. 12, 2023 annual report). In the first half of fiscal 2024, Siemens transferred a further 8% to the pension trust, allowing it to seize accounting of the stake as an equity investment (p. 11, 2024 H1 report).

I don’t think it’s difficult to see that Siemens Energy is a highly cyclical business with low margins. Therefore, I welcome management’s decision to gradually reduce its holding, thereby reducing not only cash flow volatility but also unfunded pension liabilities (more on this later).

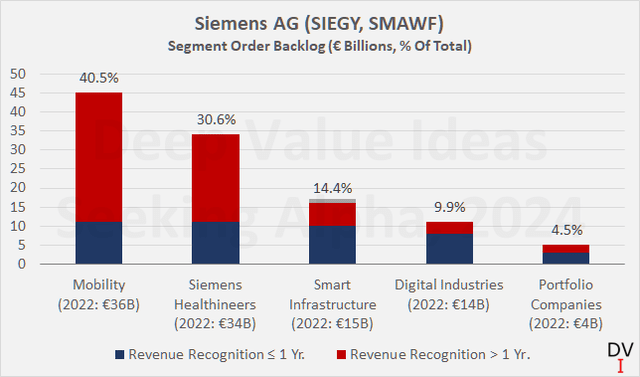

However, the volatility of earnings and cash flow is not only dampened by the reduction in exposure to cyclical industries. By participating in projects that are naturally associated with long-term contracts (this applies in particular to the Mobility and Healthineers segments), the company has excellent visibility of revenue in the more distant future. This can be seen from the fact that the expected revenue recognition of the order backlog is strongly geared towards later years (Figure 4). At the same time, the segments in which Siemens manufactures long life cycle products benefit from upgrade- and service-related revenues, which further dampens the volatility of earnings and cash flow. However, this should not be taken to mean that the Digital Industries segment is suffering from volatile cash flows due to its short-term order backlog. While it is true that the segment is currently experiencing a temporary period of weakness, the growing emphasis on subscription offerings will most certainly lead to an increasingly strong and reliable cash flow contribution. Digital Industries is already by far Siemens’ most profitable segment (recall Figure 3).

Figure 4: Siemens AG (SIEGY, SMAWF): 2023 year-end segment backlog and expected revenue recognition (own work, based on company filings)

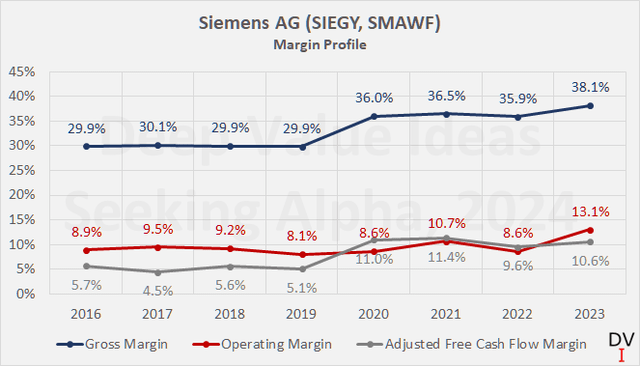

The quality of earnings and cash flow is probably best illustrated by the gross, operating and free cash flow margins (Figure 4), all of which have improved significantly over the years, confirming sound portfolio management. As a side note, free cash flow was calculated by deducting net capital expenditures, cash interest expenses, stock-based compensation, and dividends paid to non-controlling interests from operating cash flow. However, the figures were not adjusted for net proceeds from financial investments and movements in working capital, including financing receivables.

Figure 5: Siemens AG (SIEGY, SMAWF): 2016 – 2023 gross, operating, and free cash flow margin (own work, based on company filings)

In addition to the improvement in margins, the gradual decline in the cash conversion cycle – a combination of various working capital metrics – from around 140 days in fiscal 2016 to around 70 days in recent years confirms that Siemens management is doing a fine job of maintaining profitable operations despite the ongoing portfolio transformation.

A look at goodwill impairments over the last eight years shows that only €130 million has been written off – a small fraction of the €32.2 billion that was on the books at the end of fiscal 2023 and a further sign that Siemens is taking a balanced approach to portfolio management.

Reason 2: A Strong Balance Sheet And Management Committed To Reducing Pension Obligations

As I noted in the introduction, conglomerates often have quite high levels of debt, accumulated through more or less expensive acquisitions to stabilize a business that is otherwise either in decline or under pressure from more agile competitors.

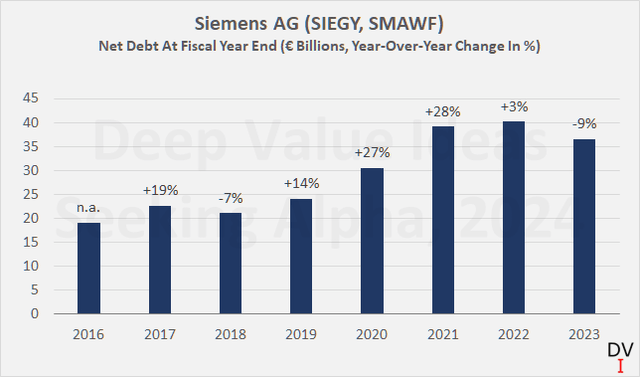

While it is true that Siemens’ debt has increased significantly over the years (Figure 6), these numbers should be seen in the context of the company’s – steadily improving – profitability and growing free cash flow. A leverage ratio of less than five times the three-year average adjusted free cash flow is not worrisome, especially as Siemens is becoming an increasingly high-margin company thanks to skillful portfolio management, significant cross-selling synergies, and increasing recurring revenues thanks to upgrade cycles and scheduled maintenance. According to Moody’s credit analysis from early 2024, Siemens’ leverage as measured by adjusted EBITDA has declined to less than 1.5x, down from a peak of more than 3.5x at the end of fiscal 2020. In any case, a long-term credit rating of Aa3 with a stable outlook can be considered very solid, especially for a largely industrial company, and it is also reassuring to see that Siemens has received the best corporate governance rating from Moody’s in its January 2024 assessment.

Figure 6: Siemens AG (SIEGY, SMAWF): 2016 – 2023 net debt at fiscal year-end (own work, based on company filings)

Siemens routinely reports net interest income due in part to its sizable cash and cash-equivalents position (typically around €10 billion), but also due to financing income. Generating cash flows through financing transactions with customers can be a risky endeavor, but I would not over-interpret this aspect as it represents a reasonably small contribution.

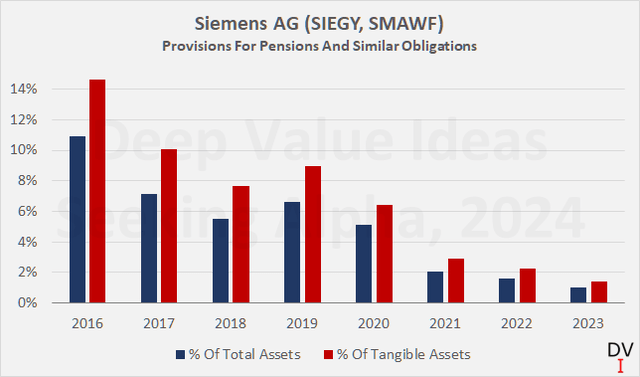

Conglomerates with a history of decades – or in the case of Siemens, more than 170 years – can be expected to have a significant liability on their balance sheet related to unfunded pension plans, which can pose a significant risk to financial stability. In the case of Siemens, pension liabilities amounted to €13.7 billion at the end of fiscal 2016 – around 11% and 15% of total and tangible assets respectively (Figure 7). This is undoubtedly a significant figure (see my recent article on Lockheed Martin Corp. (LMT) for a comparison), but management placed great emphasis on reducing these liabilities. Not least due to the transactions related to Siemens’ stake in Siemens Energy AG, the liability at the end of fiscal 2023 represented only about 1.0% of total assets – or about 1.4% if we conservatively deduct goodwill and other intangible assets from total assets.

Figure 7: Siemens AG (SIEGY, SMAWF): 2016 – 2023 provisions for pensions and similar obligations at fiscal year-end in percent of total and tangible assets (own work, based on company filings)

Reason 3: The Tendency To Outspend Competitors While Still Being Able To Return Generous Amounts Of Cash To Shareholders

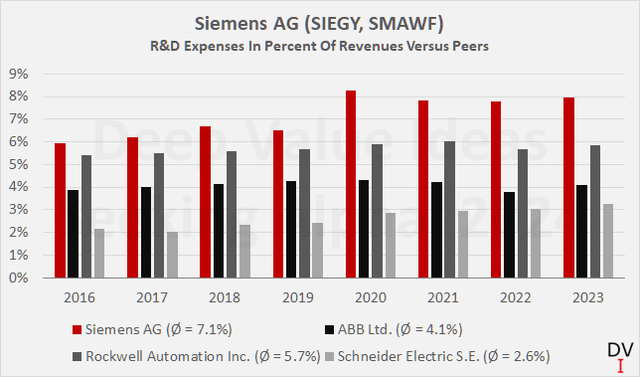

By increasingly focusing on high-margin businesses with a growing share of recurring revenue and a strong balance sheet, Siemens has ample financial flexibility. This enables the company to invest prudently in its future. Delaying investments, including in research and development, benefits short-term profits and cash flows, but can pose a significant risk in the longer term.

In the case of Siemens, it is very encouraging to see that the company regularly spends more money on research and development than its competitors. It is of course difficult to compare Siemens directly with ABB Ltd. (OTCPK:ABBNY), Rockwell Automation Inc. (ROK) or Schneider Electric S.E. (OTCPK:SBGSF, OTCPK:SBGSY), but I think it is nevertheless telling that Siemens routinely reinvests up to around 8% of its revenues in the form of research and development in the business (red bars in Figure 8).

Figure 8: Siemens AG (SIEGY, SMAWF): Research and development expenses in percent of revenues versus peers (own work, based on company filings)

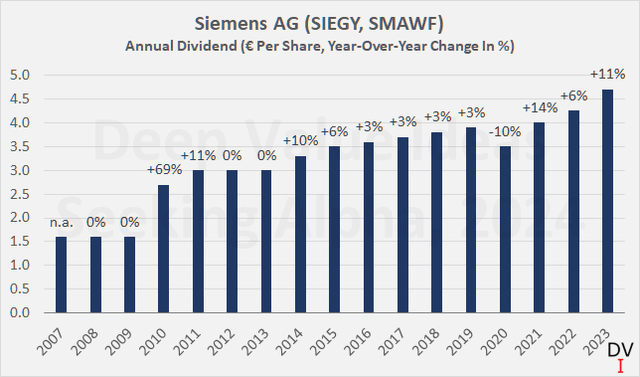

In addition, Siemens’ well-rounded portfolio, solid profitability and strong balance sheet allow it to return generous amounts of cash to shareholders. The last dividend increase was very solid at 10.6%, well above the 10-year CAGR of 4.6%. As shown in Figure 9, Siemens cut its dividend by 10% in 2020, but this was due to the spin-off of Siemens Energy and should not be seen as a sign of weakness. On the contrary, I personally consider the fact that the industrial technology conglomerate continued to pay a meaningful dividend despite the uncertainties of the COVID-19 pandemic at the time as a sign of strength and shareholder-friendly management.

Figure 9: Siemens AG (SIEGY, SMAWF): Dividend history since 2007 (own work, based on company filings)

As an aside, foreign investors should be aware of the German withholding tax of 26.375% on dividends, part of which (usually 15%) can be credited against local taxes in many countries.

Siemens typically pays out 40-60% of its adjusted free cash flow, which leaves ample room for growth and to at least maintain the dividend in the event of a cyclical downturn. In addition to dividends, Siemens buys back shares more or less regularly. A new share buyback program worth €6 billion was announced for November 2023, corresponding to around 4.4% of market capitalization at the current price of SIEGY stock.

Conclusion

Siemens has evolved over the years and decades into a well-diversified conglomerate with solid margins and benefiting from several secular growth trends. Earnings and cash flow volatility has declined thanks to smart acquisitions, divestitures and spin-offs, providing the foundation for a solid dividend growth investment, in my view. The 10% dividend cut in 2020 as part of the Siemens Energy spin-off should not be seen as a sign of weakness, but instead as evidence of management’s shareholder-friendly stance in light of the uncertainties surrounding the pandemic at the time.

However, Siemens’ management does not only strike me as shareholder-friendly. Their conservative and forward-looking stance is best illustrated by the fact that the industrial conglomerate with a history of more than 170 years is a market leader in many areas, has manageable debt on its balance sheet, rarely reports goodwill impairments, and has aggressively reduced its pension liabilities in recent years.

Thanks to its well-rounded portfolio, strong balance sheet and good profitability, Siemens generates a very robust (and growing) free cash flow, which not only allows the company to return ample cash to its shareholders, but it also allows it to return a lot of cash to its shareholders. By outspending its major competitors in terms of research and development expenses, Siemens ensures that its dominant position and deep entrenchment in many business fields (see my previous article) are not jeopardized and instead further solidified.

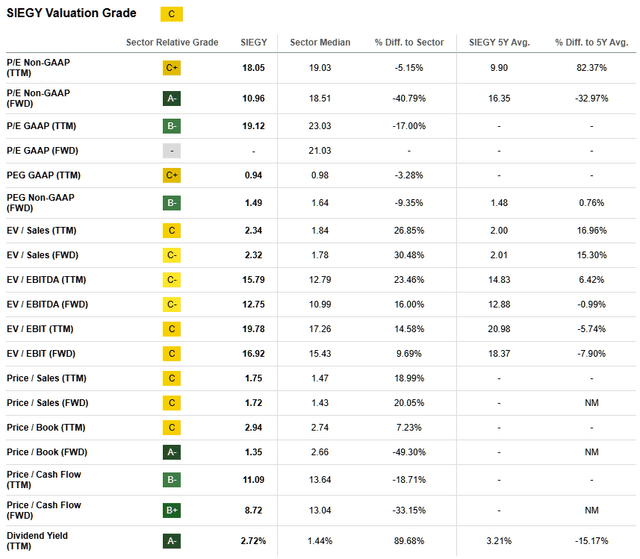

However, the market has readily accepted Siemens’ excellent position and also recognized that this is anything but a dusty German industrial conglomerate. I wouldn’t go so far as to say Siemens shares are overvalued, but with a price-to-earnings ratio of 18 (Table 1), an adjusted free cash flow yield of 5.4% (three-year average) and a dividend yield of just 2.7%, I’m not really interested in adding to my holdings. While the stock may look cheap compared to similar U.S.-based companies, I believe that a certain valuation discount is appropriate given the macroeconomic and political outlook in many parts of Europe.

Table 1: Siemens AG (SIEGY, SMAWF): Valuation metrics (Seeking Alpha)

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.