ClaudioVentrella

This is my third Heron Therapeutics, Inc. (NASDAQ:NASDAQ:HRTX) article, coming after July 2023’s “Heron Therapeutics: Look For Continued Limbo Stick Dancing – Extreme Investor Caution Merited (“Caution Merited”).” Embarrassingly, I note that Heron was trading at $1.20 when “Caution Merited” was published. Those who threw caution to the wind and bought Heron then and held have enjoyed a ~170% gain.

What can I say? Biotech investing is a tough business. In this article, I take another look at Heron. I continue to have reservations about the company. Its operations have yet to live up to the promise of its opioid free surgical pain relief product, as I discuss.

In this article, I will reference the following sources:

- Q1, 2024 earnings call (the “CALL);

- Q1, 2024 earnings release (the “RELEASE“);

- Q1, 2024 earnings presentation (the “PRESENTATION“);

- Q1, 2024 earnings 10-Q (the “10-Q“);

- 10-K published 03/2024 (the “10-K“).

Heron’s product lineup is in a state of flux.

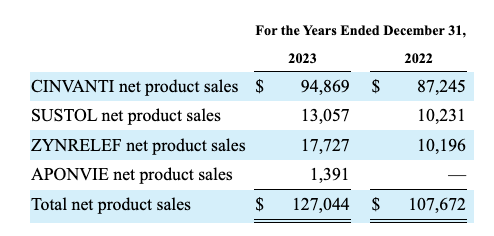

Heron’s table of disaggregated revenues from the 10-K lists four products as shown below:

seekingalpha.com

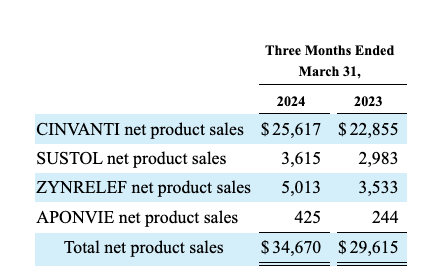

CINVANTI (aprepitant) and SUSTOL (granisetron), which are Heron’s traditional top revenue producers, are FDA-approved for the prevention of chemotherapy-induced nausea and vomiting. Heron’s disaggregated revenue table from the 10-Q brings this up to date:

seekingalpha.com

When asked during the earnings call if CINVANTI’s Q1 2024 revenues should be considered as setting a new forward base of revenues for the product, EVP Duarte responded:

…from quarter-to-quarter things vary a bit, but the market is still growing and we’re maintaining share. And so again, we’ve been very pleased with CINVANTI and the clinical value that it brings is helping us to certainly hold share and maintain price.

Presentation slide 7 showing a bar chart with 5 quarterly bars from Q1, 2023 forward for both CINVANTI and SUSTOL characterizes these two as making up Heron’s oncology care franchise. Presentation slide 8 does the same for APONVIE and ZYNRELEF which it characterizes as Heron’s acute care franchise.

Caution Merited notes how then newly serving CEO Craig Collard characterized its oncology care franchise, which was FDA approved in ~2016-2017, as steady performers, in fact, has been slowly regaining traction after losing share to biosimilars in 2020.

Heron’s future growth will not depend on these old warhorses; instead, their forward role is likely to provide underlying support for Heron’s acute care franchise, particularly ZYNRELEF. The 10-K (p. 3) describes ZYNRELEF as:

…a dual-acting local anesthetic that delivers a fixed-dose combination of the local anesthetic bupivacaine and a low dose of the nonsteroidal anti-inflammatory drug meloxicam. ZYNRELEF is the first and only modified-release local anesthetic to be classified by the FDA as an extended-release product because ZYNRELEF demonstrated in Phase 3 studies significantly reduced pain and significantly increased proportion of patients requiring no opioids through the first 72 hours following surgery compared to bupivacaine solution, the current standard-of-care local anesthetic for postoperative pain control.

It is the product which provides promise for Heron’s future growth, albeit a future growth that is playing out in dribs and drabs as discussed below.

ZYNRELEF has trifecta of growth drivers: i) expanding indications, ii) device performance and iii) sales

i) ZYNRELEF expanding indications

Back in 05/2021 ZYNRELEF netted its initial FDA approval:

…for use in adults for soft tissue or periarticular instillation to produce postsurgical analgesia for up to 72 hours after bunionectomy, open inguinal herniorrhaphy and total knee arthroplasty.

In short order, it teed up an sNDA for additional indications which was granted in 12/2021, expanding its label to cover:

…foot and ankle, small-to-medium open abdominal, and lower extremity total joint arthroplasty surgical procedures.

Most recently in 01/2024 the FDA added the following label enhancement:

…for soft tissue and orthopedic surgical procedures including foot and ankle, and other procedures in which direct exposure to articular cartilage is avoided.

In response to a CALL question on the timing and coverage of its latest label expansion Medical Affairs Senior VP Warner interestingly pointed to:

- in regard to timing — review process takes time to get into medical records, accordingly Heron expects no impact until Q3 or Q4 as changes work their way through billing procedures;

- regarding coverage — should be significant with important added procedures including soft tissue C section where it is particularly important to avoid opioids, ortho procedure targets include shoulder and spine surgeries.

ii) ZYNRELEF device performance

Caution Merited reviewed problems that ZYNRELEF’s viscosity was presenting to surgeons and the efforts Heron was making to remedy them. It referenced the following remarks from CEO Collard during its Q1, 2023 earnings call:

…the viscous nature of our ZINRELEF has slowed its withdrawal from its vial, compared to other drugs; Heron has recently started multiple enhancement programs to address some of the issues we have faced in the surgery suite during preparation, including a vial access needle or VAN and ultimately a prefilled syringe that could be game changing.

One year later during the CALL, EVP, CDO Forbes updated the situation as follows:

…we have completed all development and testing activities on the VAN and we are finishing up the submission to the FDA. We anticipate the VAN approval in Q4 of this year. The ultimate solution to speed and ease of use of ZYNRELEF is a prefilled syringe or PFS. We anticipate the PFS approval in Q4 of 2026. In this product presentation, the entire tray is sterilized and ready for immediate use. There will be no vial ZYNRELEF … just the syringe itself.

iii) ZYNRELEF sales

ZINRELEF’s rollout has been modest, as reflected by its 10-K revenues of ~$10.1 million for 2022 and ~$17.7 for 2023. Q1, 2024’s ~$5.0 million are similarly unremarkable. While management is watching for its expanded indication and device enhancement growth drivers to kick in, it is not sitting idle

It is opening a partnership with CrossLink Life Sciences to expand the sales network supporting ZYNRELEF. As stated in the 10-Q (p. 20):

In January 2024, we entered into a five-year distributor partnership with CrossLink … [it] will be the lead partner in the U.S. to expand ZYNRELEF promotion for orthopedic indications. The partnership will launch in several phases, initially at a regional level, followed by an expanded national rollout. In total, we anticipate that approximately 650 representatives will be added to Heron’s sales network over 2024.

Additional financing will be necessary to support its ZYNRELEF rollout over the next several years

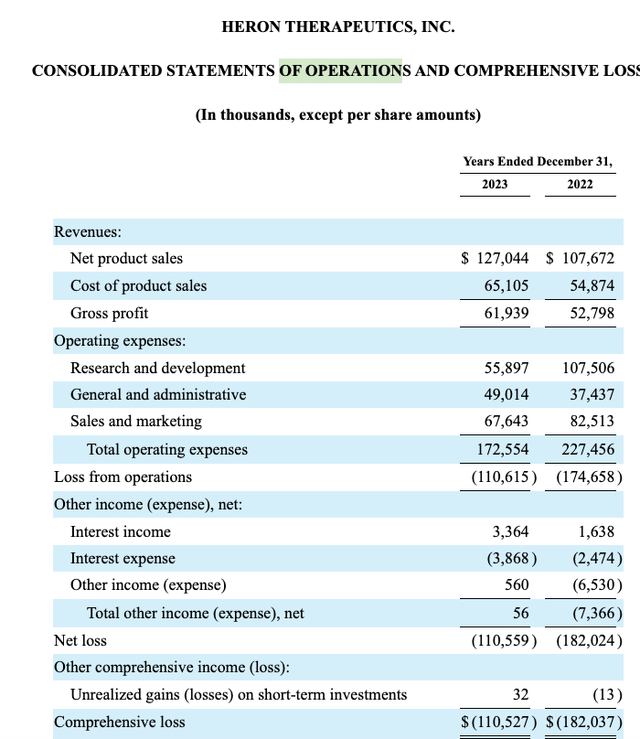

As shown by its 10-K (p. 74) statement of operations excerpted below comparing 2022 to 2023, Heron had a strong uptick for 2023 albeit it still showed a hefty loss of >$110 million:

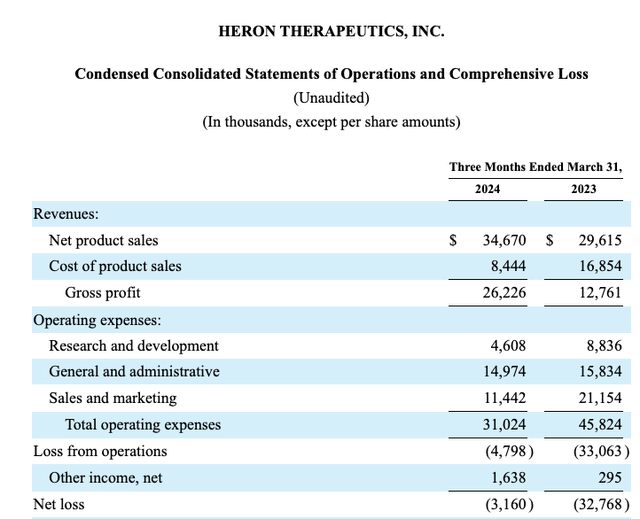

Encouragingly, its 10-Q (p. 3) reflects even better results for Q1, 2024 with its quarterly net loss winnowed down to a mere ~$3.1 million:

Surprisingly, its sales and marketing expenses show a massive reduction, even though its product sales reflect an upswing. It will be interesting to see how this encouraging dynamic plays out as CrossLink starts to take hold.

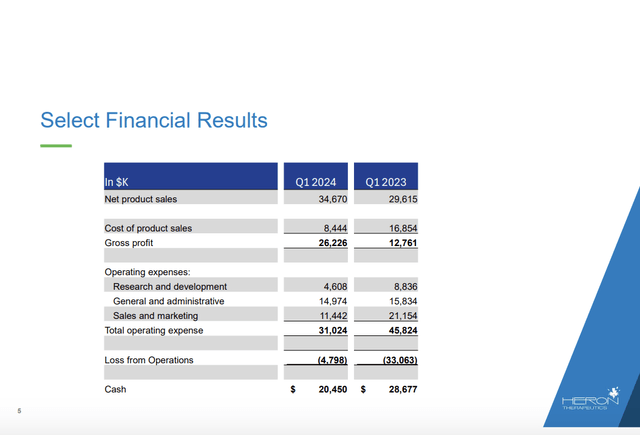

In terms of liquidity, there is no mention of Heron’s cash position in the CALL. The Presentation lists the following slide 5 with select financial results which fills the gap:

Its posted cash for Q1, 2024 of $20.4 million is paltry for an operation of its scale. The 10-K (p, 67) shows net cash used in operating activities for 2023 of $58.8 million for a quarterly cash burn of $22 million. The 10-Q (p. 24) lists its net cash used in operating activities for Q1, 2024 at $9.5 million. While its decrease in cash burn for its latest quarter is encouraging. It still speaks to a cash runway of less than a year for Heron.

Conclusion

With its $0.50 billion market cap, its accumulated deficit of $1.9 billion and its single growth asset in unproven stall mode, Heron Therapeutics, Inc. is an archetypal high-risk biotech. Accordingly, I rate it as a hold.

seekingalpha.com