Adam Gault

CPI Card Group Inc. (NASDAQ:PMTS) has reported the company’s Q1 results since my previous article on the company, and also more recently refinanced its long-term debt.

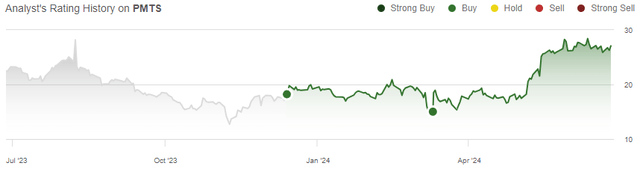

My previous article on the stock, titled “CPI Card Group Q4: Unjustified Sell-Off Provides A Buying Opportunity,” was published on the 10th of March, a couple of days after CPI Card Group’s Q4 report. In the article, I remained at my prior Buy rating as the large sell-off to the Q4 earnings seemed unjustified, creating an even wider undervaluation. Since the previous article was published, CPI Card Group’s stock has returned 80% compared to S&P 500’s (SP500) 7%, closing the wide valuation gap.

My Rating History on PMTS (Seeking Alpha)

Q1 Report Showed Expected Weakness

CPI Card Group’s Q1 results, reported in May, showed sales weakness as was already previously anticipated as customers continued to lower their inventory levels. Revenues declined by -7.4% year-over-year into $111.9 million, still beating Wall Street estimates by $8.3 million, as the sequential growth from Q4 weakness was a strong 8.8%. Prepaid Debit cards still showed an impressive 26% growth in the quarter, shown in the Q1 presentation, while the main Debit and Credit segment’s revenues declined by -14%.

Profitability took a hit in Q1, mainly explained by the weaker revenues. The gross margin still performed well with a 1.4 percentage point year-over-year leverage into 37.1%, but lower total gross profit, and increased SG&A pushed operating income into $14.1 million, down -31%. The operating margin in the quarter was 12.6%, a good sequential improvement from 10.2% but below the achieved total 2023 level.

The reported SG&A increased by $5.0 million, weakening profitability. As told in the Q1 earnings call, the expenses were raised primarily due to increased compensation costs related to the change in CEO. Lower professional service fees partly mitigated the effect, but increased salaries and medical expenses also elevated total SG&A. Going forward, CPI Card Group expects growth investments to push SG&A up, mitigating a part of the lower expected compensation. I believe that investors should watch SG&A closely going forward, as very significant increases could push the sustainable margin level down.

Revenue Growth Is Anticipated To Gradually Resume

The company’s 2024 revenue and income outlook was reaffirmed with the Q1 results – CPI Card Group still expects sales and adjusted EBITDA to show slight increases driven by gradually recovering customer demand as inventory levels continue to normalize and as underlying circulating payment cards continue stable growth.

To aid growth, CPI Card Group managed to sign an expanded relationship with one of its largest customers during the first quarter, pushing higher incremental sales over the contract’s life until 2029. The committed volumes are growing throughout the deal, making the deal more meaningful in the back end of the period. Due to an up-front incentive payment to win the customer, CPI Card Group had to push the free cash flow guidance down for 2024 with the Q1 report.

I believe that CPI Card Group should have good drivers to push higher revenues in upcoming years. While short-term revenue turbulence could still negatively surprise investors in the rest of 2024, great Prepaid Debit segment growth and the new signed deal should push good top-line growth as CPI Card Group continues to invest in growth.

Senior Note Refinancing

CPI Card Group still has a highly leveraged balance sheet, with $265.3 million in long-term debt after Q1. The company recently announced a refinancing of the debt, and published the pricing on the 26th of June.

Senior secured notes of $285 million were announced to be offered through a private offering to finance the previous notes that were due in 2026, and to finance the related fees. The new senior notes were priced at a 10.000% interest rate, up from the previous 8.625% interest rate. The new refinanced notes are due in 2029, and the offering is expected to close on July 11th.

The interest rate appears to be surprisingly high, and is higher than previously despite continued showcasing of healthy earnings. The note refinancing was also made quite prematurely as the previous notes were due only in 2026, being intriguing as the interest rate is now priced higher. The relatively high interest rate does still make sense with the still leveraged financial position, though.

The Valuation Gap Is Now Smaller

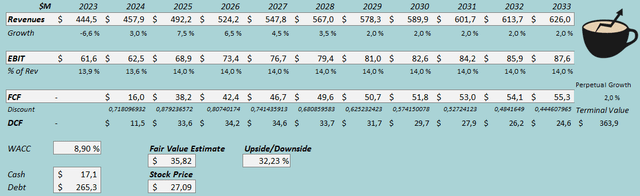

I updated my discounted cash flow [DCF] model from previous estimates. I now estimate slightly higher growth in the model in the next few years, aided by the new deal. The CAGR estimate from 2023 to 2028 now stands at 5.0%, and afterward, I estimate stable 2% growth.

Due to the recently increased SG&A, I estimate the EBIT margin slightly lower at 13.6% in 2024 and 14.0% afterward, down slightly from 14.2% previously from 2025 forward.

DCF Model (Author’s Calculation)

The estimates put CPI Card Group’s fair value estimates at $35.82, 32% above the stock price at the time of writing. The fair value estimate is up from $29.74 previously due to CPI Card Group’s great share repurchases and elevated growth outlook with the new customer partnership expansion, as well as a lower WACC. Due to the significant recent share rally, though, the upside is now significantly lower.

The valuation still represents excellent upside, but more caution is also now needed at the higher valuation – a shareholder holding a significant position could already consider locking in recently gained profits.

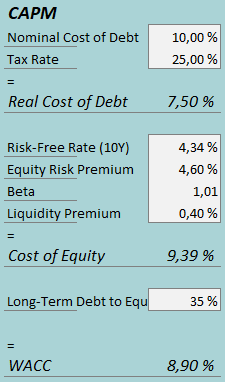

A weighted average cost of capital of 8.90% is used in the DCF model, down from 9.19% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I now estimate an interest rate of 10%, in line with the recently announced senior notes. I continue estimating a 35% long-term debt-to-equity ratio. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.34% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. I have kept the beta estimate the same at 1.01. Finally, I add a liquidity premium of 0.4% instead of 0.5% previously due to increased volume, creating a cost of equity of 9.39% and a WACC of 8.90%.

Takeaway

CPI Card Group Inc. showed expected sales weakness in Q1, but medium-term growth catalysts still seem good with great Prepaid Debit growth, a new significant deal signed during the quarter, and continued growth investments. Elevated SG&A could slightly eat away future profitability with continued growth initiatives, though. The recent stock rally has closed most of the gap between my estimated fair value and the market valuation, but a fairly good amount of upside still stands. As such, I remain at a Buy rating for CPI Card Group, but start to suggest more caution, especially around short-term revenues and SG&A.