dnaveh/iStock Editorial via Getty Images

Since the last time I wrote about the skateboarding shoe brand Vans’ owner V.F. Corporation (NYSE:VFC) in January, its price is down by 21%. Even then, the company’s weakening fundamentals inspired little faith in the stock, prompting a Hold rating.

But changes in leadership and a restructuring plan called Project Reinvent underway gave reason for hope. Also, pockets of encouraging performance could impact overall financial performance positively if held steady. Three months after the last look at VFC, here I assess how things have played out for it.

Positives not sustained

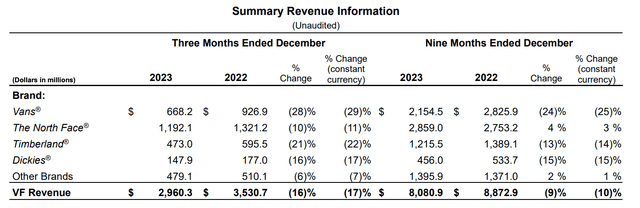

In the results released in January, the company’s CEO, Bracken Darrell starts by saying “Our third quarter top-line performance was disappointing”. And indeed it was. Not only did revenues continue to contract for the sixth consecutive quarter, the rate of decline accelerated to 16.2% making it the sharpest drop in as many quarters.

EMEA disappoints

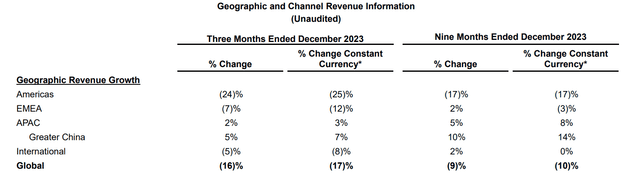

But even that’s not the biggest disappointment in my view. Revenue weakness was visible even when I last checked. However, I was optimistic on two counts. The first was the EMEA market’s performance, which saw revenues at market exchange rates grow by 8% in the first six months of the year (H1 FY24). If sustained it could support V.F. Corporation at a time when its big Americas market was slowing down.

But the trend has reversed (see table below), adding to the drag from the Americas. The forward push is now provided only by the APAC market, which is a relatively small contributor to revenues anyway.

Operating performance weakens

Second, the operating figures have also taken a turn for the worse after an improvement in the reported operating margin to 6.9% in H1 FY24 from an operating loss in H1 2022. V.F. Corporation reported an operating loss once again, on account of a sharp revenue drop in Q3 FY24 and despite a slight decline in the combined cost of goods sold and operating costs. As a result, the operating margin for the first nine months of FY24 has also declined, to 4%.

To be fair, if it weren’t for the USD 50.9 million expense for Reinvent, the company would have clocked an operating profit of USD 18.6 million. Even then, though, the operating margin would be just 0.6% and the 9m FY24 margin would be 4.6%, which is still lower than that for H1 FY24. Further, the adjusted operating margin has declined to 7.8% for 9m FY24 (9m FY23: 11.1%) as well.

Project reinvent

Progress on the restructuring has had better luck, in that the company has seen positives on the balance sheet front and with regards to cost cuts even as it lags on other targets.

Bigger contractions in the Americas and Vans brand

As noted earlier, the company’s sales took a turn for the worse in Q3 FY24. This is also visible in the two areas V.F. Corporation wants to revitalise, indicating that so far the restructuring efforts haven’t borne fruit.

The first of these is the Americas market. The company intended to make changes to its operating model for better results. However, contrary to intention, in Q3 FY24, the geography saw a bigger 25% year-on-year (YoY) decline in revenues compared to the 17% for 9m FY24.

Next is Vans’ performance. Vans used to be V.F. Corporation’s biggest brand by revenue, but its declining popularity has now made it second to the outerwear brand, The North Face. It’s still significant to the company, to be sure, with a 27% revenue contribution in 9m FY24. But its performance is a separate matter. At constant currency, its revenues fell by 29% in Q3 FY24, compared with the 25% fall for 9m FY24.

Impressive cost cuts

The company’s progress in cost reduction is impressive, though. Both its costs of goods sold and SGA expenses have declined by 17% and 1% YoY respectively in Q3 FY24. In absolute terms, this is a decline of ~USD 280 million put together. The company had targeted a fixed cost reduction of USD 300 million as part of the restructuring. While it’s not known how much of the expense cutback is fixed costs, the fact that the number comes close enough is still notable.

Balance sheet improvements

Coming to the balance sheet, the company’s net debt reduced by USD 640 million YoY in Q3 FY24. The net debt-to-assets ratio has also reduced, to 0.5x, from 0.56x the last I checked. Also, the company’s inventories have seen the second consecutive quarter of decline. Also, the extent of decline accelerated to 17.1% YoY compared to a 9.8% contraction in Q2 FY24.

The outlook and market multiples

The company doesn’t provide a profit outlook for FY24, but going by the trends so far, it will in all likelihood, clock a reported loss for the full year too, as it has for 9m FY24. The adjusted net earnings, however, have been positive so far, even as the adjusted EPS has declined by 45% YoY.

If it comes in Q4 FY24 at the average of the 9m 2023 figure of USD 1.06, the full-year number would be at USD 1.41. This results in a forward non-GAAP price-to-earnings (P/E) ratio of 8.9x, which is far lower than the stock’s five-year average of 26.5x.

However, this is a case of a stock that is trading at a discount for good reason and not an indication that it’s undervalued. The reason, of course, is its performance.

What next?

It’s clear from the discussion that there’s still a limited impact of the restructuring on the company’s numbers, particularly the income statement. For now, its financials look even more dismal than they did the last I checked, particularly as the Americas market and Vans brand saw deteriorating performance in Q3FY24.

There’s something to be said about the company’s cost-cutting though, and the improvements in its balance sheet. This, along with the fact that its stock price is at over-decadal lows, means that anyone already holding the stock, may as well wait to see the impact of restructuring in the coming quarters. I just don’t see a reason to sell now. I’m retaining a Hold rating on V.F. Corporation.