Vectorian/iStock via Getty Images

Investment Thesis

DigitalOcean’s (NYSE:DOCN) is not an expensive stock. Accordingly, I believe that paying 17x this year’s free cash flow is a fair multiple for what the business offers.

That being said, the issue I have is that this business’ revenue growth rates are rather meek. And on top of that, investors must take on about $1 billion of net debt.

In short, investors are facing slowing down revenue growth rates and a lot of debt, is that truly all that compelling? I argue that it’s not.

Rapid Recap

In my previous analysis, on the back of its Q4 earnings report, I said,

I believe that this [premarket rally] is mostly a relief rally and don’t believe there’s enough in this report to get new investors looking at this stock to back it with fresh capital.

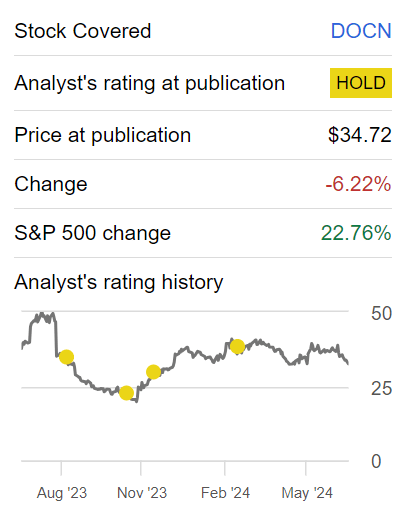

Author’s work on DOCN

Not only was I right to expect DOCN’s stock to fade the rally, but as you can see above, this is a stock that I’ve been neutral on for some time.

Indeed, in the past year, as I’ve been neutral on DOCN, the S&P500 has been rallying ahead and is up more than 22%, significantly outperforming DOCN. Further, as I look ahead, I remain neutral on this stock.

Why DigitalOcean? Why Now?

DigitalOcean is a cloud infrastructure provider that simplifies the process for developers to deploy, manage, and scale applications. It offers a range of services such as virtual private servers (Droplets) and scalable storage, all designed to be easy to use with a competitive price-to-performance ratio. DigitalOcean’s key value proposition lies in its user-friendly platform, robust technical support, and a strong community of developers, making it an attractive choice for small to medium-sized businesses and startups.

Looking ahead, DigitalOcean prospects are driven by its expanding product offerings and the increasing adoption of AI and machine learning technologies.

The company has been accelerating its product innovation, recently introducing new features such as daily Droplet backups, memory, and storage-optimized droplets.

These innovations attract new customers and increase usage among existing users, reflected in its rising net dollar retention rate, up 100 basis points from 96% in Q1 2023 to 97% in Q1 2024.

Additionally, the launch of AI-specific services, including GPU-based infrastructure and platform-as-a-service offerings, is gaining traction, indicating a robust demand that is likely to continue driving revenue growth.

Given this balanced background, let’s now discuss its fundamentals.

Revenue Growth Rates Point to 13% CAGR

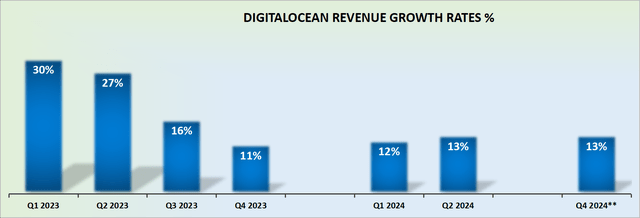

DOCN revenue growth rates

In my previous analysis, I said,

DigitalOcean guides for just over double-digit growth rates for the year ahead. Given that management is likely to be lowballing their estimates, I believe that increasing the company’s guidance slightly to 13% CAGR for the year ahead makes sense.

Today, even as I once again expect that DigitalOcean may reach 13% CAGR for this year, I don’t believe investors should ”expect” an easy beat on this guidance.

Even though DigitalOcean has had more visibility into the year, DigitalOcean didn’t see it in their outlook to raise the company’s revenue guidance further.

Simply put, it appears that although DigitalOcean’s comparables ease up in the back half of 2024, its revenue growth rates will still hover around the mid-teens revenue growth rates.

Consequently, this reinforces my contention over the past year, that beyond a narrative of how DigitalOcean’s cloud services to help developers and businesses easily deploy, manage, and scale applications online, the underlying facts are rather more subdued.

Given this consideration, let’s now discuss its valuation.

DOCN Stock Valuation — 17x Forward Free Cash Flow

In my previous analysis, I said,

[…] as we look ahead, in the best-case scenario, [DigitalOcean’s] free cash flow margins will be in line with the free cash flow levels reported in 2023, at approximately 22%.

With another set of quarterly results on which to base this analysis, I’m increasingly confident that investors should not be too aggressive in expecting DigitalOcean’s free cash flow margins to expand beyond 22%.

Therefore, this means that somewhere in the ballpark of $180 million is perhaps as good as it’s going to get for DigitalOcean’s free cash flow this year.

Is this a stretched valuation? I don’t believe it is. Particularly if interest rates drop next year, this could be a reasonable entry point.

That being said, the one aspect that causes me unease here is that DigitalOcean carries more than $1 billion of net debt. On the other hand, this isn’t a major concern, since DigitalOcean is undoubtedly a highly free cash flow generative.

But I do believe this amount of debt will still get in the way of management’s ability to meaningfully return capital to shareholders.

All in all, I believe that DigitalOcean is fairly valued and that there are ample more attractive opportunities elsewhere, either faster-growing cloud businesses or slower-growing businesses with better balance sheets.

The Bottom Line

Investing in DigitalOcean at 17x this year’s free cash flow is already a fair price, particularly given its prospects in cloud infrastructure in the near-term.

While concerns persist over its debt burden potentially limiting shareholder returns, its current valuation already reflects a balanced outlook. All in all, I believe that there are better investment opportunities elsewhere.