tazytaz/E+ via Getty Images

Today, we are going to do something different to close out another trading week. In this column, I highlight three biotech stocks with favorable risk/reward profiles and that are trading for under ten bucks a share.

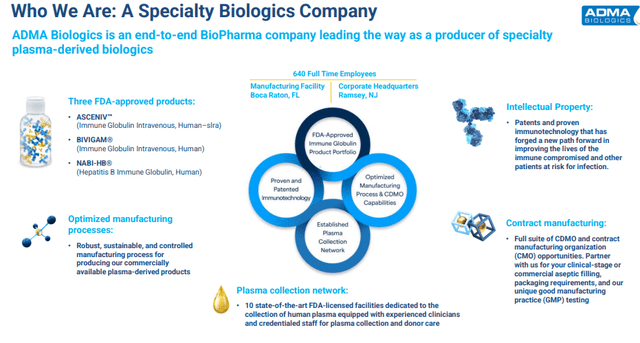

Let’s start with ADMA Biologics, Inc. (ADMA). This company is focused on manufacturing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases. ADMA Biologics recently brought online the last of 10 large plasma collection facilities in its network. The company has a couple of key products on the market and is seeing solid sales growth.

March 2024 Company Presentation

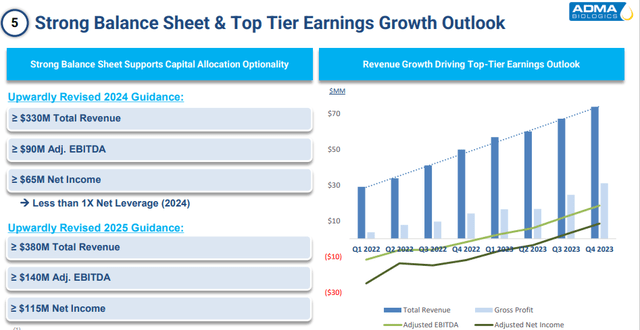

More importantly, the company is at an inflection as it becomes consistently profitable this year. ADMA Biologics lost 13 cents a share in FY2023 on just under $260 million in sales. The current analyst firm consensus has the company churning out a profit of 30 cents a share in FY2024 as revenues rise to just under $340 million. They project further profit growth to 50 cents a share in FY2025 on sales growth in the high teens.

March 2024 Company Presentation

The company has guided for between $65 million to $115 million in net income this fiscal year and currently has an approximate market cap of $1.5 billion. The company ended FY2023 with just over $50 million in cash and marketable securities on its balance sheet. Management also reduced long-term debt by $12 million to a tad over $130 million, according to the company’s filed 10-K. The stock currently trades around $6.50 a share.

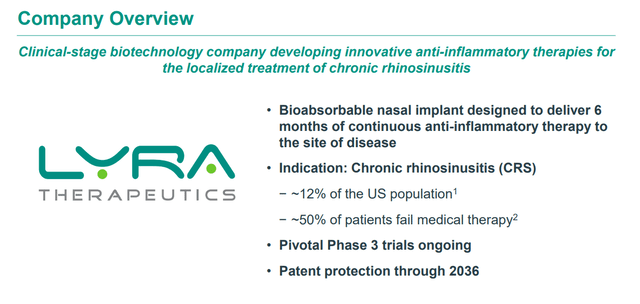

Next up is Lyra Therapeutics (LYRA), whose stock trades at just over five bucks a share. The analyst community sees considerable upside in this name currently. Since the company reported fourth quarter results on March 21st, BTIG ($15 price target), H.C. Wainwright ($12 price target) and Bank of America Securities ($11 price target) have all reissued Buy ratings on the stock.

March 2024 Company Presentation

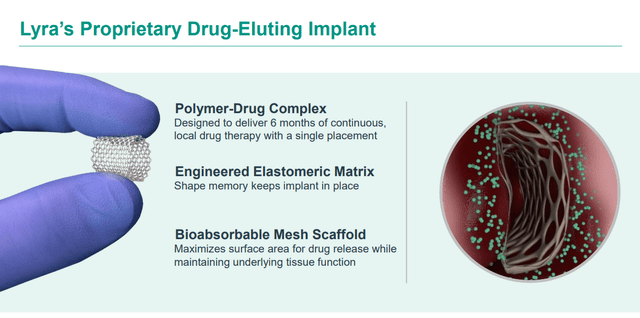

Lyra Therapeutics develops products off its proprietary XTreo technology platform, which is designed to deliver medicines directly to the affected tissue for sustained periods with a single administration. The company is focused on developing unique and integrated drug and delivery solutions for the localized treatments for ear, nose, and throat diseases. This clinical stage biopharma concern core pipeline assets are a couple of bioabsorbable nasal inserts, LYR-210 and LYR-220.

March 2024 Company Presentation

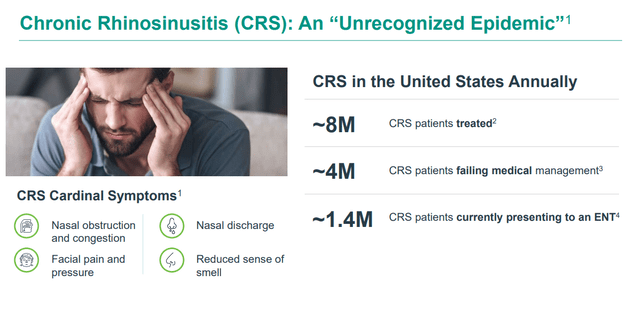

Both of which are targeting individuals with chronic rhinosinusitis or CRS, and management believes the population that could be helped via these candidates is some four million individuals just in the United States that are not being effectively served by current therapies on the market.

March 2024 Company Presentation

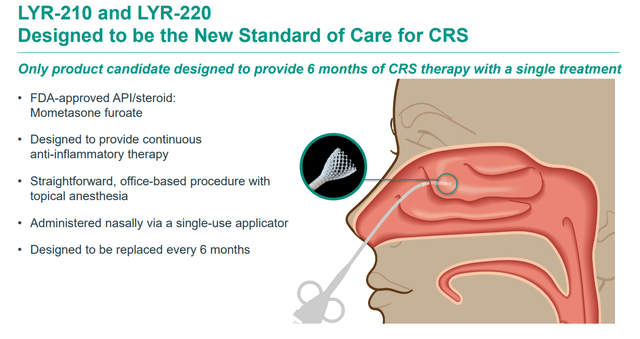

These inserts are intended to be able to be installed by a simple in-office procedure, which will deliver six months of continuous mometasone furoate drug therapy. LYR-210 is the smaller of the two inserts and is targeting individuals who have not undergone ethmoid sinus surgery (ESS). The company is currently enrolling subjects for a second pivotal Phase 3 study that should kick off by the end of this year. Topline results from its first pivotal study should be out shortly.

March 2024 Company Presentation

LYR-220 is designed for CRS patients whose nasal cavity is enlarged due to previous ESS. A 220-patient trial ‘BEACON’ met its primary endpoint with no adverse effects last summer. Management will meet in the second half of this year with the FDA to design a pivotal phase three trial. With a market cap of just over $300 million and with just over $100 million in cash and marketable securities on hand at the end of FY2023, the stock seems undervalued given the size of Lyra’s potential market.

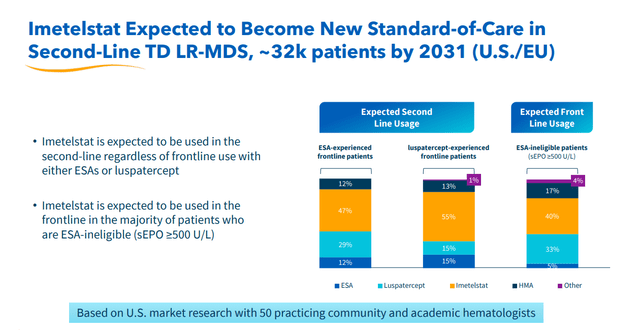

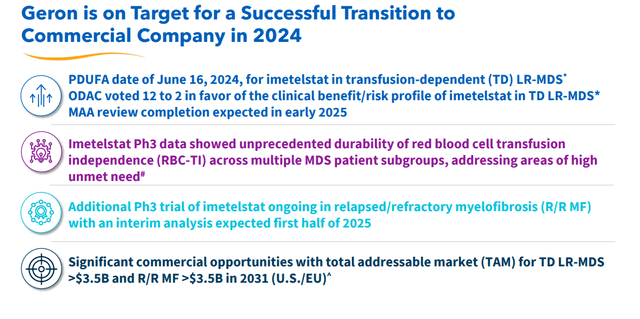

Finally, we end with Geron (GERN), an oncology concern whose lead drug candidate looks like it is finally on its way to garner the company’s first FDA approval. The stock currently trades at around $3.50 a share and sports an approximate market capitalization of $2.1 billion.

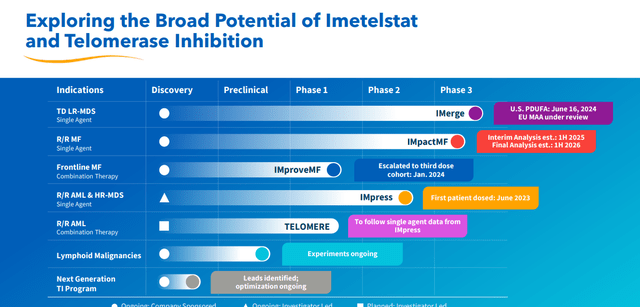

In mid-March, lead asset imetelstat was recommended by an Ad Com panel to be approved to treat late-line therapy for transfusion-dependent anemia in myelodysplastic syndromes or MDS. Formal FDA approval should follow in June. Once approved, imetelstat will compete with products from Bristol-Myers Squibb (BMY) and Merck (MRK) in the anemia market. Also in March, Cantor Fitzgerald had Geron on a list of names that make potential buyout targets, given oncology is one of the hottest M&A subsectors in the healthcare space. Four other analyst firms, including Goldman Sachs and Needham, have reissued Buy ratings on GERN since the Ad Com recommendation as well. Price targets proffered are in a tight range of $5 to $6 a share.

Geron ended FY2023 with just under $380 million in cash and management guided it saw between $270 million to $280 million in operating expenses in FY2024, which will be offset somewhat by net product sales from imetelstat. The company raised an additional $150 million via a secondary offering in March to support the launch of imetelstat.

March 2024 Company Presentation

It should be noted that Geron is also evaluating a combination of ruxolitinib (brand name of Jakafi) with imetelstat in intermediate-2 or high-risk myelofibrosis in a Phase 3 trial ‘IMpactMF’ where overall survival is the primary endpoint. Initial results should be out sometime in 2025 with final results hopefully out by 2026. Geron also has other clinical efforts ongoing (above). Management has stated both indications (MDS and high-risk myelofibrosis) are approximate $3.5 billion opportunities. Analyst firms are currently modeling a median sales estimate of $230 million for FY2025; it should be noted with a wide variance of projections ($40 million to $380 million).

March 2024 Company Presentation

I own all three of these small-cap biotech concerns within my portfolio, primarily within covered call positions.