PonyWang/E+ via Getty Images

Count me as a guy that thinks the market has gone a bit Artificial Intelligence (AI) crazy. I’m not claiming that AI stocks are poor investments, but it seems as if investors are throwing money at anything and everything with a toehold in AI.

Therefore, it seems a bit odd to me that many are shying away from an investment in Taiwan Semiconductor Manufacturing Company (NYSE:TSM). Obviously, some are concerned that China will invade Taiwan. But on the other hand, I believe others do not fully appreciate TSM’s presence in the AI industry.

As this article unfolds, I will endeavor to provide insights into TSM’s position in the AI industry. I will also provide my perspective on the risk associated with China.

A Glance At Q1 Earnings And The Q2 Forecast

TSM provided Q1 2024 earnings in mid April. With EPS of $1.38 hitting $0.06 above consensus and revenue of $18.32 billion nearly $225 million better than analysts’ forecasts, the company beat on the top and bottom lines.

Year over year, net revenue was up 16.5% and net profit increased 8.9% for Q1.

However, despite those solid results, the share price initially fell when the company lowered its overall semiconductor industry growth outlook to 10% from a prior “more than 10%” forecast.

In retrospect, that represented a buying opportunity, as the stock bottomed just below $128 a share within a few days of the earnings report and has since risen over 30%.

TSM’s Q2 earnings are scheduled for the middle of next month. Management forecasts revenue in a range of $19.6 billion to $20.4 billion.

Earlier this year, the company projected revenue growth for FY 2024 of at least 20%, which is more than double the industry outlook.

Management also sees robust demand for the firm’s advanced chips.

For the second quarter of 2024, we expect our business to be supported by strong demand for our industry-leading 3-nanometer and 5-nanometer technologies,…

Wendell Huang – SVP, Finance & CFO

Analysts EPS forecast for the quarter is $1.34, a substantial increase from the $1.14 reported in Q1 of last year. The revenue consensus of $20.08 billion would represent an approximate 28% year-over-year increase.

These Trends Are TSM’s Friends

Qualcomm (QCOM), Broadcom (AVGO), Nvidia (NVDA), Advanced Micro Devices (AMD),and Apple (AAPL): this is a short list of companies that do not operate fabrication facilities (“fabs”).

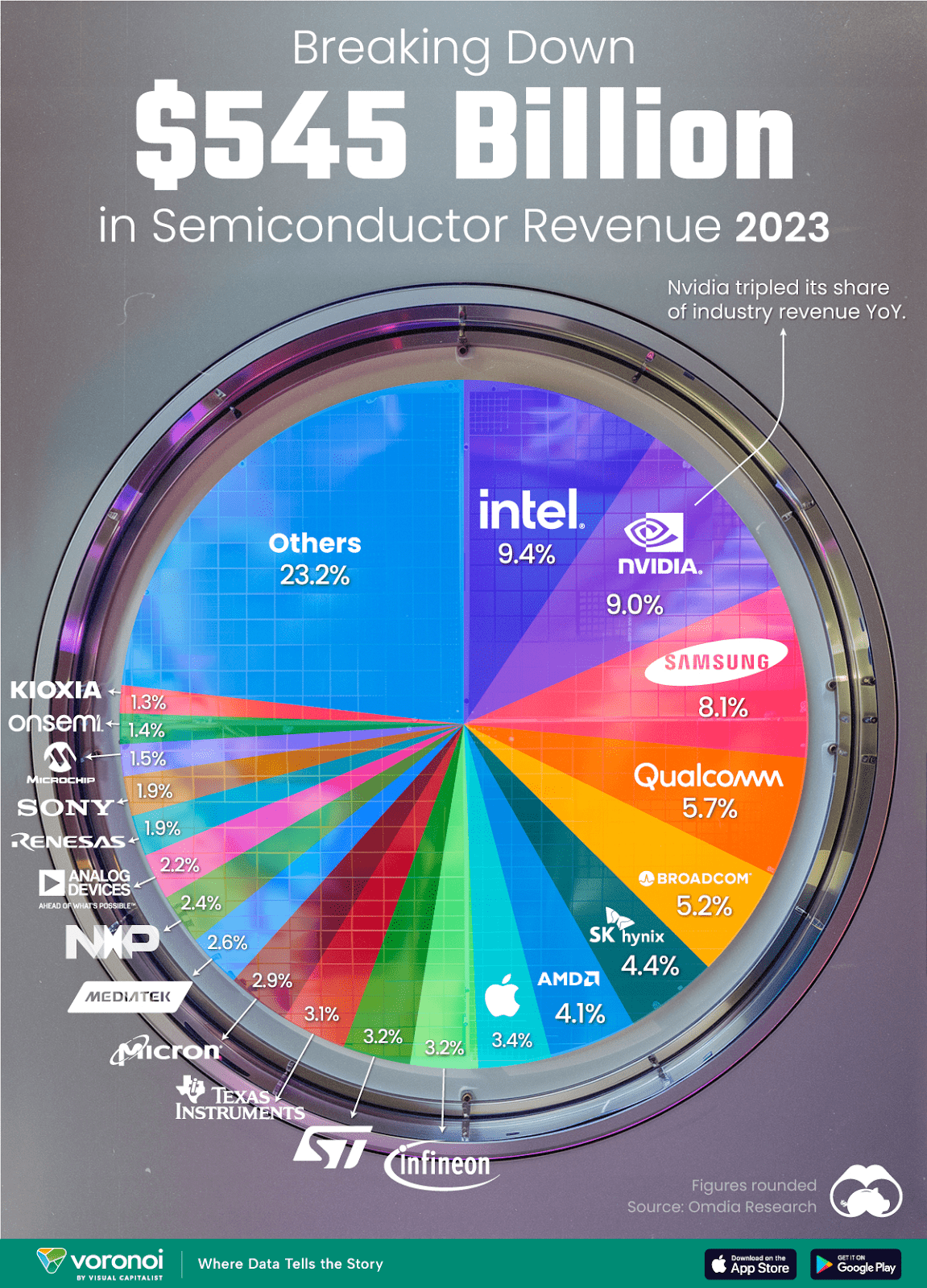

Visual Capitalist

Those companies alone accounted for over a quarter of all semiconductor sales in 2023, and four of those five names are among TSM’s top five clients.

The surge in AI related chip sales has fabless companies jockeying for manufacturing capacity and TSM is building new foundries to match demand. This dynamic provides TSM with significant negotiating power and results in the company garnering multi-billion dollar prepayments from fabless semiconductor companies.

We have placed non-cancellable inventory orders for certain products in advance of our normal lead times, paid premiums and provided deposits to secure normal and incremental future supply and capacity and may need to continue to do so in the future

A statement by Nvidia

It is important to note that TSM dominates the advanced semiconductor market. As of 2023, the company held 70 to 80 percent of the globe’s 5nm market and over 90% of the world’s 3nm market share. Furthermore, TSM is at the forefront of 2nm production technology.

Investors can expect strong demand for smaller chips as they provide increased capacity, lower costs, lower power consumption, and higher speeds.

If there is a downside in all of this, it is that as of 2023 TSM’s top ten customers accounted for 91% of the firm’s revenue, with Apple alone providing a 25% share.

However, another trend that is TSM’s friend is the evolution to AI personal computers. The COVID crisis resulted in a surge in PC sales when employers adopted the remote work model. Unfortunately, as the coronavirus ebbed, so too did sales of PCs.

Sales of PCs had fallen by roughly 28% in the first quarter of 2023, marking a new low for the industry. However, Q1 of this year marked a resurgence in orders as demand for AI PCs spurred a surge in sales.

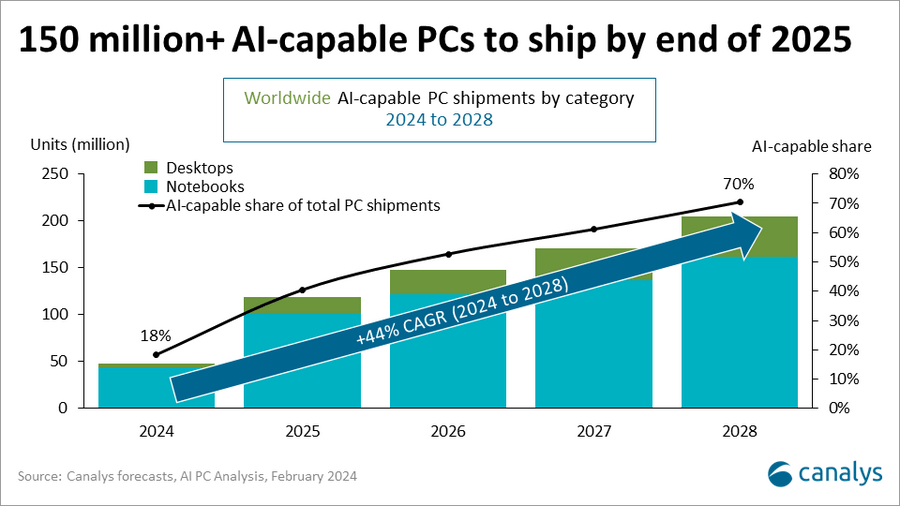

Research by Canalys forecasts sales of AI PCs will hit 48 million this year, constituting 18% of global personal computer sales. Canalys also predicts AI-capable shipments will represent 40% of PC sales next year, with AI PCs CAGR hitting 44% between 2024

canalys

The wider availability of AI-accelerating silicon in personal computing will be transformative, leading to over 150 million AI-capable PCs shipping through to the end of 2025. PCs with dedicated on-device AI capabilities will enable new and improved user experiences, driving productivity gains and personalizing devices at scale while offering better power efficiency, stronger security and reduced costs associated with running AI workloads. This emerging PC category opens new frontiers for both software developers and hardware vendors to innovate and deliver compelling use cases to customers across consumer, commercial and education scenarios.

Ishan Dutt, analyst at Canalys.

The forecast by Canalys is largely mirrored by a study by IDC that forecasts AI PCs will garner 60% of the global market by 2027.

During the last earnings report, TSM’s CEO provided the company’s AI related revenue forecast.

We forecast the revenue contribution from several AI processors to more than double this year and account for low-teens percent of our total revenue in 2024.

For the next 5 years, we forecast it to grow at 50% CAGR and increase to higher than 20% of our revenue by 2028.

C. C. Wei, CEO

Last but perhaps not least, and rather ironically, TSM is benefiting from the threat posed by China. The company will receive up to $6.6 billion in federal funding from the CHIPS Act for an Arizona facility, as well as $5 billion in loans.

Debt, Dividend, And Valuation

TSM has solid investment grade debt with an AA-/stable rating by Standard & Poor’s and Aa3/stable by Moody’s.

The company finished the last quarter with $64.4 billion in cash & cash equivalents, an increase from $55 billion in the prior quarter. Debt at the end of 2023 stood at $30 billion.

The stock yields 1.17%, and the 5-year dividend growth rate is 9.83%. However, TSM raised the dividend by roughly 12% at the end of Q4. With a single-digit payout ratio, investors can rest assured that the dividend is safe and likely to continue to grow at a healthy pace.

TSM currently trades for $167.69 per share. The average 12-month price target of the 14 analysts that follow the company is $176.39. Eight analysts rate TSM as a strong buy and 4 rate the stock as a buy.

The forward P/E of 27.36x is well above the stock’s 5-year average P/E of 21.94x. The forward PEG is 2.05X.

My View Of The China Threat

When reading comments on TSM articles on SA, it is common to come across posts of those that believe the threat posed by China makes TSM uninvestable.

I’ll admit that I am befuddled to see investors making big bets on fabless companies that rely heavily on TSM to produce their semiconductors, while presumably steering clear of an investment in chip manufacturers in Taiwan.

My response is to simply point to the chart I provided that includes the share of industry production held by fabless semiconductor firms. Consider that Nvidia and Apple, two companies prominently displayed in that chart, are prime examples of stocks that would be crushed if TSM’s production was cut off.

Furthermore, a wide variety of companies rely on semiconductors to manufacture their products. For example, the average new automobile now has 1,400 to 1,500 chips. Now add in the fact that the US relies on China for a broad array of products, including those used in manufacturing processes.

So, I’ll opine that if China were to invade Taiwan, we would experience a stock market crash greater than any witnessed in my lifetime.

Is TSM A Buy, Sell, Or Hold?

I estimate that TSM is trading in a fair value range. Normally I rate stocks as Holds when they trade in a fair value range; however, I consider TSM as an investment of such high quality that I believe shareholders will fare well over the long term by buying at this valuation level.

I will also note that TSM and Samsung Electronics are the only two companies selling 5 nm chips, and that in 2023, TSM generated roughly 61% of all third-party chip production.

So with an enormous moat and growth that is bumpy over the short term but likely to continue at a steady pace over the long haul, I see the current valuation as providing a reasonable margin of safety.

I rate TSM as a Buy.

I own a moderate sized position in the stock and hope to add to the investment in the coming months.