photoschmidt

We previously covered Uber Technologies, Inc. (NYSE:UBER) in March 2024, discussing why it had been upgraded to a Buy, with the company’s market dominance and profitable growth trend unlikely to ever come cheap.

Combined with the promising FQ1’24 guidance and the surprising announcement of $7B in share repurchases, it appeared that the management remained highly convinced about its ability to consistently deliver robust cash flow ahead.

Even so, we had recommended investors to wait for a moderate retracement to its previous trading ranges of between $60s and $70s for an improved margin of safety, one which had materialized after the management reported a mixed FQ1’24 earnings call and offered a supposedly underwhelming FQ2’24 guidance.

Moving forward, with UBER facing cost headwinds in numerous US states, investors may want to pay attention to how the management aims to resolve the situation.

At the same time, with Tesla’s (TSLA) Robo-Taxi event coming in August 2024, we may also see moderate volatility in UBER’s stock prices, with it remaining to be seen if their existing partnership may be deepened. We shall discuss further.

UBER’s FQ1’24 Performance Remains Robust

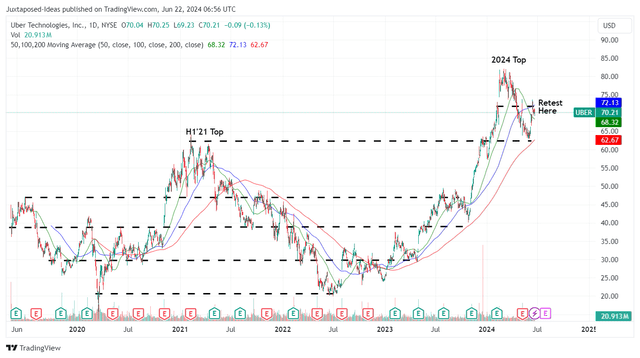

UBER 5Y Stock Price

For now, UBER has traded sideways since the mixed FQ1’24 earnings call, with the stock currently trading near to its 50/ 100 day moving averages.

Part of the headwinds are attributed to the supposed bottom-line miss with EPS of -$0.32 (-148.4% QoQ/ -300% YoY) compared to the consensus estimates of $0.22 (-66.6% QoQ/ +375% YoY).

However, we believe that this is a mere understanding, since much of UBER’s bottom-line impact is attributed to the -$721M in non cash losses attributed to the re-evaluation of its equity investments, namely -$505M for Aurora, -$123M for GRAB (GRAB), and -$69M for DIDI (OTCPK:DIDIY).

Otherwise, with FQ1’24 bringing forth increasingly rich adj EBITDA margins of 13.6% (+0.7 points QoQ/ +5 YoY) and adj Free Cash Flow margins of 13.4% (+5.7 points QoQ/ +7.2 YoY), it is apparent that the market has overreacted.

At the same time, while the management’s FQ2’24 booking guidance of $39.5B at the midpoint (+4.9% QoQ/ +17.5% YoY) has missed the consensus expectations of $40B (+6.2% QoQ/ +19% YoY), the projected adj EBITDA of $1.49B (+7.9% QoQ/ +62.6% YoY) continues to imply a highly profitable YoY growth trend indeed.

As a result, we believe that the market’s recent uncertainty on the UBER stock may not be attributed to its recent financial performance, since these numbers are undeniably robust.

Is Rising Costs The Issue?

Perhaps, part of the headwind may be attributed to the historic increase in pay for rideshare drivers by a blended rate of +20% in Minnesota, with it potentially setting a nationwide wage standard for other rideshare drivers moving forward.

With UBER and its competitor, Lyft (LYFT) accepting the new arrangement, there are a few ways to look at this situation.

One, UBER may potentially absorb these additional costs, naturally triggering headwinds to their bottom-lines, especially since the UCAN region comprises $5.47B (+4.5% QoQ/ +6.6% YoY) or the equivalent 53.9% (+1.3 points QoQ/ -4.2 YoY) of its FQ1’24 revenues.

Two, the rideshare company may attempt to fully pass on these additional costs to consumers instead, triggering headwinds in its retention rate/ booking growth as consumers search for alternative rideshare platforms and/ or taxis, whichever that offers cheaper rates.

This is a very real problem indeed, especially due to the high inflationary and elevated interest rate environment, with a macroeconomic normalization process likely to be prolonged through 2026, if not 2027.

Combined with the recent lost court appeal in California, it is unsurprising that the market is increasingly uncertain about UBER’s intermediate term prospects, with the state potentially inflicting a similar raise in pay for rideshare drivers by up to +20%.

As a result, readers may want to pay attention to how the management may eventually address these issues, since it will be critical to its long-term business prospects.

Tesla’s Robo-Taxi Event Is Another Headwind

It goes without saying that the rideshare and taxi markets are also looking forward to TSLA’s upcoming Robo-Taxi event in August 08, 2024, since it may trigger drastic impacts on UBER’s long-term prospects.

While Elon Musk has been touting the launch of Robo-Taxi for the past few years, this is the first time that a separate event has been planned, with it potentially highlighting the market readiness of its Robo-Taxi segment.

With TSLA still reporting massive inventories on the balance sheet at $16.03B (+17.6% QoQ/ +11.5% YoY) in FQ1’24 and the market observing growing “EV graveyards” in Australia, Germany, and the US, we believe that the upcoming launch may likely utilize these existing fleets first, pacifying market enthusiasts as demand for EVs cooled.

Now, how will this impact UBER?

Well, we have previously covered General Motor’s Cruise (GM) here and TSLA’s Robo-Taxi dreams here, concluding that the market may be large enough to accommodate multiple players, with profitability being the more important metric to monitor.

We maintain our belief that the best-case scenario will be TSLA partnering with UBER, building upon their existing EV partnership while leveraging on TSLA’s unused inventory and UBER’s commercial platform/ highly sticky consumer base.

This will also mirror Google’s (GOOG) (GOOGL) strategic partnership with UBER through Waymo, naturally heralding the latter’s platform as the ultimate rideshare winner.

On the other hand, given Elon Musk’s propensity for starting/ pursuing multiple businesses, it will not be surprising if TSLA builds its own Robo-Taxi platform while fully monetizing its existing FSD technology, naturally triggering further competition and margin headwinds for UBER.

With TSLA’s Robo-Taxi event looming, interested readers may want to keep a close lookout for any hints of partnership.

So, Is UBER Stock A Buy, Sell, or Hold?

For now, we believe that the market has overreacted to these issues, with UBER’s recent sideways trade unjustified.

Much of our optimism arises from the company still being highly profitable while commanding the leading US market share of 76% as of March 2024 (+2 points from August 2023 levels), on top of the growing FQ1’24 Monthly Active Platform Consumers at 149M (+14.6% YoY) and the higher average monthly sales per customer at $107 (+6% YoY).

At the same time, we believe that opportunistic investors may consider dollar cost averaging at current levels, due to the promising upside potential to our reiterated long-term price target of $149.60.

This is based on the FY2026 adj EPS estimates of $4.29 (expanding at a CAGR of over +30% as guided by the management) and the same P/E of 34.88x (relatively inline to its 1Y P/E mean of 33.84x), as discussed in our last article.

With the UBER stock’s recent sideways trade also triggering an improved upside potential, we are reiterating our Buy rating here.

Naturally, as discussed above, with multiple intermediate term headwinds, the stock is only suitable for those with moderate risk tolerance and long investing trajectory, especially since it remains uncertain who may emerge as the eventual winner of the rideshare/ Robo-Taxi market.