krblokhin

Altria Group (NYSE:MO) – formerly Philip Morris – is one of the world’s largest producers and marketers of cigarettes and other tobacco products. However, the company’s current motto is “Moving Beyond Smoking” as it pushes smoke-free products and harm reduction.

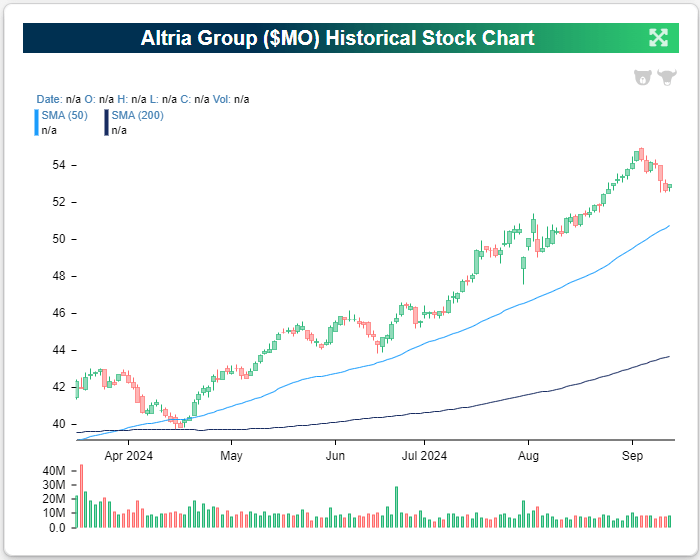

Regardless of your stance on tobacco stocks, Altria Group still does more than $20 billion in annual revenues and has a market cap of just under $90 billion. As shown below, the stock has also been trending steadily higher for the last six months.

While Altria has seen share price appreciation over the last six months, it is most known for its high dividend yield. MO currently has a dividend yield of more than 7.5%, which makes it the second-highest-yielding stock in the S&P 500 behind Walgreens (WBA). According to Insider Monkey, Altria has increased its dividend for 54 consecutive years, making it one of the longest-running Dividend Aristocrats.

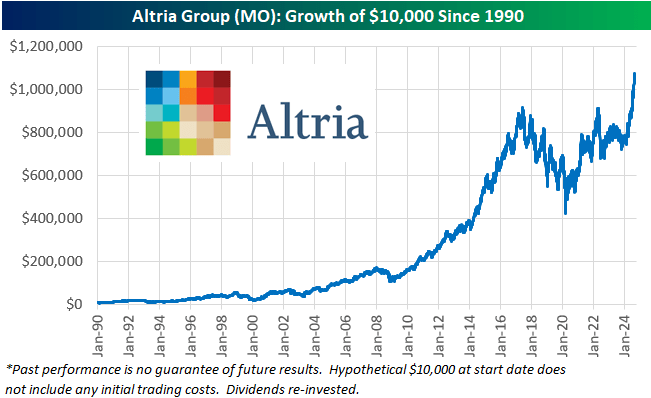

Hypothetically, had you invested $10,000 in Altria Group shares at the start of 1990, re-invested dividends, and held to today, your shares would currently be worth roughly $1,041,000. That’s a gain of more than 10,000%!

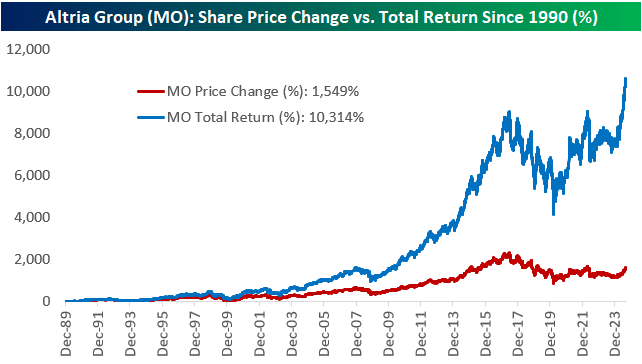

A huge chunk of those gains since 1990 have come from re-investing dividends. As shown below, MO shares are only up 1,549% (8.4% annualized) in price over this time frame compared to its total return of more than 10,000% (14.3% annualized).

It will be tough to find a better example of the compounding effects of re-investing big dividend payments than MO. Using the Rule of 72, with no share price appreciation at all, MO’s annual dividend yield of 7.8% would double your money in just over 9 years.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.