Oil Tanker HeliRy

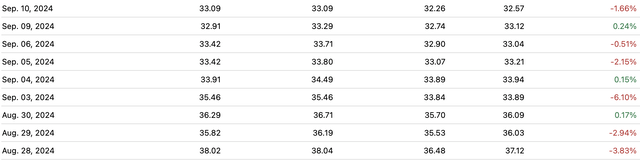

In the two weeks ended September 10, TORM plc (NASDAQ:TRMD) crashed approximately 14% to $32.26, a level not seen in years.

TORM plc historical prices (Seeking Alpha Quant)

The culprit behind the crash appears to have been falling oil prices. On Tuesday, the WTI crude price dipped below $70 and took most related equities along with it. By the close of the trading day, Brent Crude was below $70 per barrel, while WTI was near $65. These price levels were even lower than those seen in late 2023, which saw prices down nearly 50% from the mid-2022 highs.

Although TORM is not directly involved in buying and selling crude oil, its client base is; therefore its price tends to be correlated with those of oil and gas companies. We saw this effect last week when TRMD stock fell along with its exploration and production (E&P) cousins.

TORM plc is an oil tanker company, meaning it transports oil and other petroleum products by sea. Oil prices influence long-term profitability in TORM’s industry, although not as strongly as they influence oil companies’ profitability. It’s more the demand for oil and size of the tanker fleet that influence tanker profitability, rather than price. Basically, a lot of demand for oil will usually keep tankers full, even if excess supply is weighing on prices. This is doubly the case when oil has to be shipped by sea for whatever reason. Sanctions on Russia in the wake of the Ukraine invasion led to more maritime shipping, as many European buyers could not accept oil from Russian pipelines. Many of the suppliers that replaced Russia-such as the U.S.-were separated from Europe by large oceans. This fact was a boon to TORM plc and other tankers in 2022 and 2023, as they got more business thanks to the sanctions.

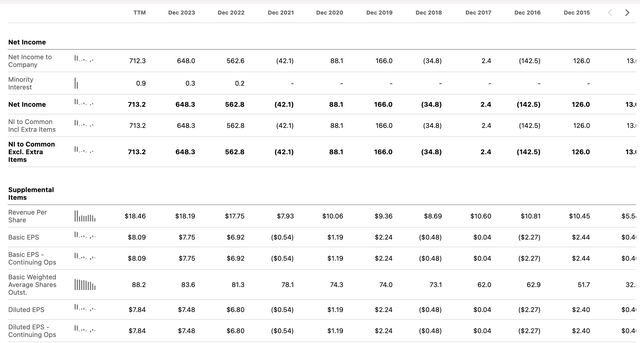

An interesting fact about TRMD is that, unlike E&Ps, its earnings continued growing in 2023 and into the trailing-12-month (TTM) period. As the financials in Seeking Alpha Quant show, the company hit record levels of gross profit, net income and free cash flow in the TTM period. This is quite different from the fate of oil companies, whose profits peaked in 2022, underscoring the fact that oil prices aren’t the biggest factor in TRMD’s profitability.

TORM at all-time high net income (Seeking Alpha Quant) TORM at all-time high FCF per share (Seeking Alpha Quant)

What is the major driver in TRMD’s profitability?

It’s hard to point to one single factor, but favorable geopolitics would seem to be part of it. The company benefitted from buyers seeking alternatives to Russian crude in 2022, and now appears to be benefitting from the disruptions in the Red Sea. According to TORM’s most recent earnings release, the rerouting resulting from the Red Sea attacks led to robust demand for the company’s services. The newly rerouted routes cover a longer distance than the old ones did, resulting in higher revenue tanker miles and greater overall revenue.

Another factor in TRMD’s profitability is where we are in the tanker cycle. The “tanker cycle” is a cyclical pattern that plays out in the tanker industry. It is not always perfectly correlated with the broader economy. The cycle consists of a growth phase caused by increased demand; a plateau where tanker rates are high and companies are buying more ships; and finally a contraction phase in which excess tankers in the ocean leads to price competition and lower fees. The length of a tanker cycle is thought to be between three and 10 years.

If we knew exactly where we were in the tanker cycle, then we’d have a truly invaluable edge in evaluating a company like TORM. Unfortunately, it’s not exactly easy to predict these things, and even the best forecasts of future demand are only “roughly” correct. TORM seems to think that the good times will last, as it purchased nine vessels over the last 12 months while selling only one. That would indicate bullishness from management for now; but on the other hand, this exact type of stockpiling of vessels leads to downward pressure on rates in the later stages of the cycle. Most forecasts for the tanker industry are currently bullish, and we definitely aren’t near the end of a cycle; however, we aren’t at the beginning of an expansion phase either. Most likely, we are somewhere near the late stages of an expansion and the early stages of a peak. This would tend to indicate that TRMD has some good years of profitability remaining, and perhaps even a continued period of active earnings growth-albeit growth at a slower pace than was seen in 2022 and 2023.

When I last covered TORM plc, I gave the stock a ‘buy’ rating because it was extremely cheap while tanker industry fundamentals remained sound. Today, I hold largely similar views about the company and its prospects, but the now-lower stock price increases my enthusiasm. In this article, I explain why I’m upgrading my rating to strong buy.

Massively Improving Fundamentals

TORM plc’s fundamentals have improved on essentially every meaningful metric in recent years. The only risk to the long thesis essentially is a meaningful change in the economics of the tanker industry that causes a decline in earnings. That would be a major risk to TORM because the stock currently has a very high payout ratio and even a moderate-sized decline in earnings could potentially force a dividend reduction. I’ll explore the likelihood of that happening in a later section. For now, I will look at the last few years’ improvement in fundamentals, and why the stock is a buy if it can be determined that this success will last for at least a few more years.

We can start with the income statement.

Over the last five years, TRMD has compounded some of its key income statement metrics at the following rates:

-

Revenue: 19.72%.

-

EBITDA: 40.5%.

-

Net income: 230%.

-

Earnings per share (EPS): 233%.

These are compounded annual growth rates, not cumulative rates. The cumulative growth has been truly remarkable, with net income up 5,384% over the last ten years.

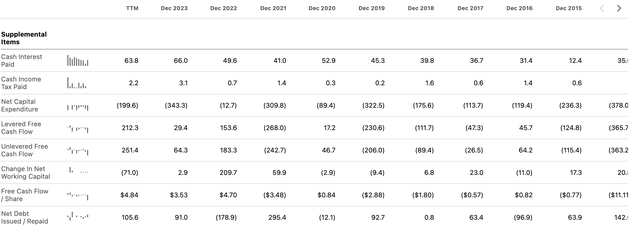

When we look at the cash flow statement, we see similar trends:

-

Operating cash flow: $866 million, up 400% over five years.

-

Free cash flow per share: $4.84, up from negative figures both five and ten years ago.

Finally, we can see considerable improvements to the balance sheet. In the TTM period, the company had a 3.43 current ratio (higher is better) and a 0.615 debt to equity ratio (lower is better). These ratios haven’t exploded the way net income and free cash flow have, but both were basically worse five years ago than in the TTM period.

Finally, we should look at the TTM profitability metrics. Here is where the company really shines. In the last 12 months, TORM had:

-

A 58% gross margin.

-

A 42% EBIT margin.

-

A 43% net margin.

-

A 39% ROE.

-

A 21% return on total capital.

These figures are all above average, indicating that TORM was very profitable in the trailing 12-month period.

Earnings Sustainability

It’s great to know that TORM was thriving in past years, but it doesn’t necessarily mean that the company will thrive in the future. It operates in a cyclical industry that is currently in an uptrend-the question is how long will the company’s current strength will persist. If you look at TORM’s historical financial statements, you will see plenty of losing years. The question is how long until the next leg down in the company’s fortunes cause similar things to happen again.

Evidently, last week’s crash in oil prices got people worried that TRMD’s next “leg down” would be happening sooner rather than later. I suspect that that’s not the case. Oil prices play a role in tanker profitability, but they don’t single-handedly determine it, as is the case with E&Ps. The supply of tankers on the sea is ultimately a bigger factor in tanker profitability; as long as producers see oil prices as high enough to justify shipping oil and there aren’t enough tankers, then TORM should make good money.

We know that TORM itself sees its prospects as being good. It is investing in new ships (or rather purchasing second-hand ships), and the overall tone of its most recent earnings release was optimistic.

Is management right to be optimistic?

Here’s one encouraging sign: despite oil prices having risen 89% or 15.6% CAGR over the last four years, the tanker fleet has only been growing at 1% to 2% per year. So the fleet size is lagging oil prices, and probably demand for oil as well. Also, many tankers on the seas today are old and in need of being replaced. That could reduce the size of the tanker fleet, which would improve profitability at companies like TORM.

Of course, if oil prices collapse to unprecedented lows, then the tanker market could go down with them. That would be bad news, but as I wrote in my recent article on Occidental Petroleum (OXY), the global picture for oil is one of slowly growing demand, reduced OPEC supply, and many supply disruptions. I’d imagine oil prices will hold a reasonable level over the next five years.

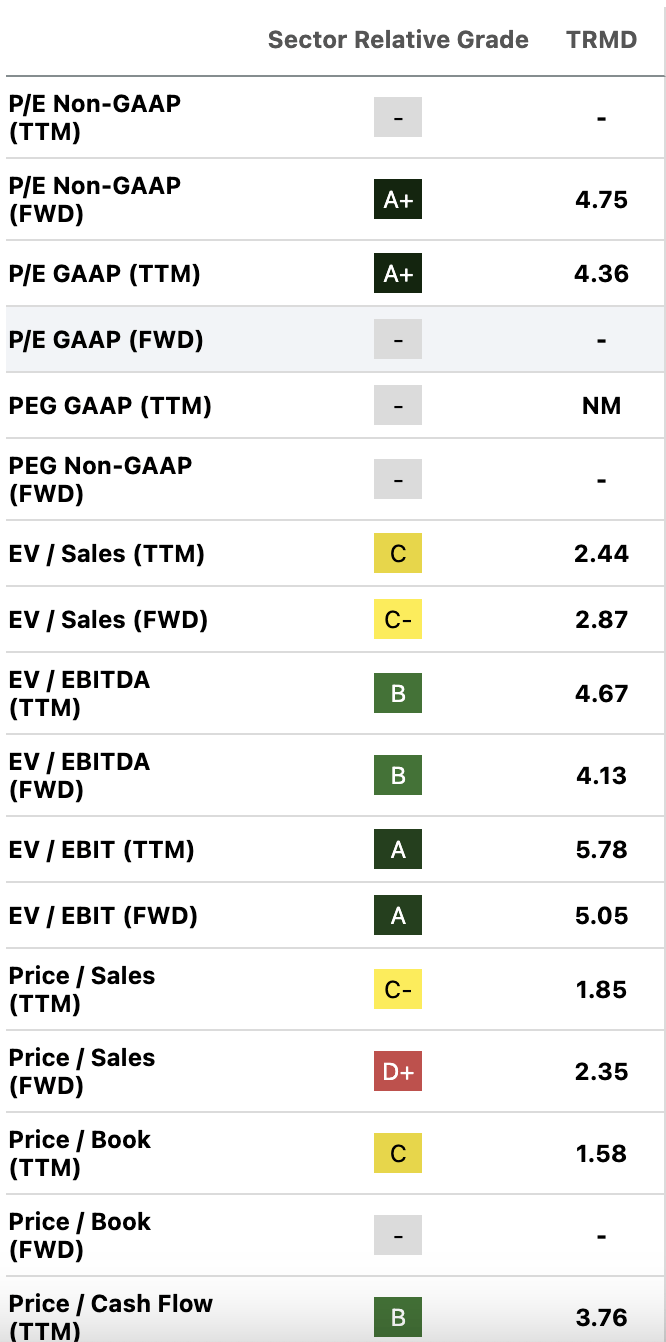

Valuation

If my above forecast sounds surprisingly muted for a ‘strong buy’ rating, then it might help to look at the multiples below. TORM trades at rock bottom earnings and cash flow multiples. It doesn’t actually need to continue its recent growth streak to be worth the investment. It just needs not to shrink.

TRMD multiples (Seeking Alpha Quant)

If you take TORM’s $4.84 in TTM FCF per share, and discount it at 10% assuming no more growth, you end up with a $48.8 fair value estimate. The stock has 43.3% upside if you assume it never grows again and value it with a discount rate that implies a truly enormous amount of risk! It’s this cheapness that has me very optimistic about TRMD at these newly lower prices. I don’t think the company will keep on growing like it has in recent years-overall, I expect just moderate growth for the next year or two. But when you look at how cheap the stock is, it might just be worth it anyway.

Risks

Before concluding, I should touch on some company-specific risks that TORM plc faces. The ‘macro’ risks were reviewed earlier, some specific to this company include:

- Environmental regulations. TORM recently acquired 22 new eco-friendly vessels at a significant cost. The investments were necessary but came at great price, as the eco-friendly features increased the cost of the ships. That extra cost was due to regulatory pressures from the EU, which now demands more efficient modes of transportation than before.

- A high payout ratio. According to Seeking Alpha Quant, TRMD’s payout ratio is 84%. This means that the company’s dividend risks being cut if earnings decline, or eliminated if earnings go negative. For now, TORM’s industry appears healthy enough to support continued dividends. But this is not a stock one should just sleep on. Looking out further than two years, cuts are possible.

The Bottom Line

TRMD is a stock that has pretty much everything you’d want-high growth, cheapness and high margins, all in one package. The main “catch” here is that this is a cyclical stock, and there will be a downturn in the company’s fortunes at some point. However, most signs indicate that “some point” is a fair way’s off.