Klaus Vedfelt

Dividend stocks and ETFs have performed well in recent months, which is obviously great if you already have significant holdings, and not so good if you are looking to buy. Juicy dividend yields are getting harder to find, and my scan reveals only 47 stocks in the S&P 500 (SPY) with a TTM yield of over 4%. Many of these have questionable fundamentals.

Equity dividend ETFs are in a similar situation, and yields in the 4-5% area are rare. Buy-write ETFs seem to be the solution to higher yields, but are not for everyone. I decided to look at whether international equity ETFs are a valid alternative, and this article focuses on the Schwab International Dividend Equity ETF (SCHY) with its attractive FWD yield of 4.58%.

Introducing SCHY

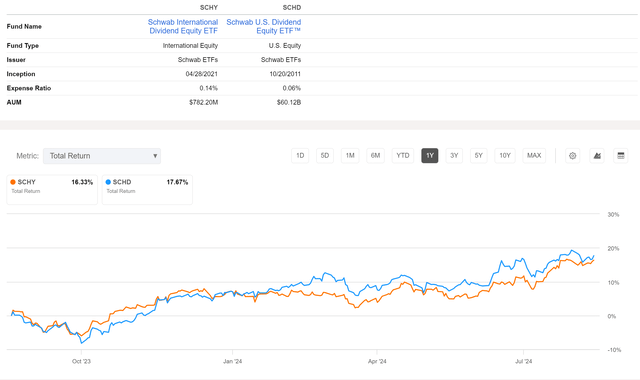

SCHY was launched fairly recently in 2021 and is basically the international version of the popular Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD).

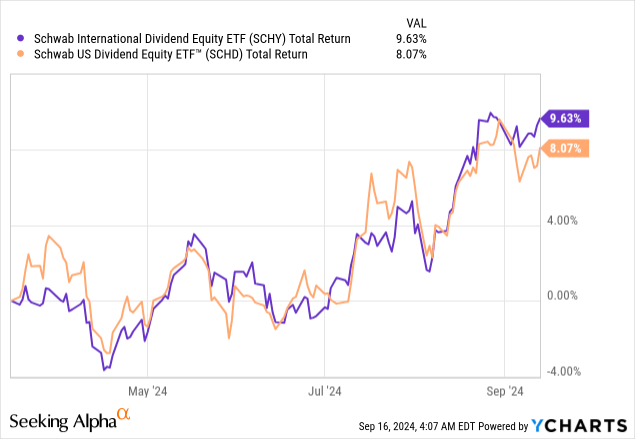

A higher expense ratio of 0.14% is perhaps expected given the international exposure and fees. The total return over the last year is similar to SCHD, but SCHD has a slight edge. I do find it interesting how correlated the two funds are, given one is only US focused, and the other is international.

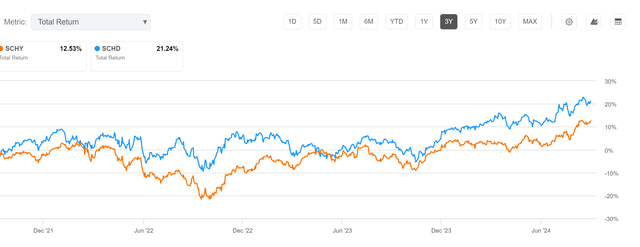

This correlation decreases over the longer-term, and over three years, SCHD is the clear outperformer. Most international stocks have lagged the US for a number of years now.

SCHY Holdings

SCHY is a passively managed index which tracks the Dow Jones International Dividend 100 Index. This has a sophisticated screening process “focused on the quality and sustainability of dividends by screening non-U.S. companies based on four dividend quality attributes.”

This is encouraging. I see international stocks as higher risk than US and if the high dividends were achieved through holdings in poor quality stocks with large price declines it would be a major red flag.

The selection methodology does get complicated, but I will try and break it down simply, as it is important to know exactly what the fund holds.

The first screens remove certain risky stock markets and sectors, such as REITs.

The index universe is defined as the constituents of the Dow Jones Global ex-U.S. Large-Cap & the Dow Jones Global ex-U.S. Mid-Cap.

REITs are excluded from the universe.

For China, only stocks of companies that trade on developed market exchanges are eligible.

Additional screens are made. MDVT stands for 6-Month Median Daily Value Traded. So is basically ensuring liquidity. FMC stands for float-adjusted market cap, and thereby removes any small-cap stocks.

Stocks must pass the following screens:

• Minimum 10 consecutive years of dividend payments

• Minimum FMC of $500 million (current constituents $400 million)

• Minimum six-month MDVT of $2 million

The eligible securities are then ranked on four fundamental-based metrics, which are given equal weight.

Free cash flow to total debt: Annual net cash flow from operating activities divided by total debt. Companies with zero total debt are ranked first.

• Return on equity: Annual net income divided by total shareholders’ equity.

• IAD yield

•Five-year dividend growth rate.

These are solid screens and I particularly like the inclusion of five-year dividend growth rate. The goal is to include fundamentally sound stocks with a reliable, high-yielding dividend. An additional screen filters for volatility and the top 100 stocks are then selected and weighed as below –

No single security can represent more than 4.0% of the index, no single Global Industry Classification Standard (GICS®) sector can represent more than 15% of the index, and the Emerging Markets exposure is capped at a 15% weight…

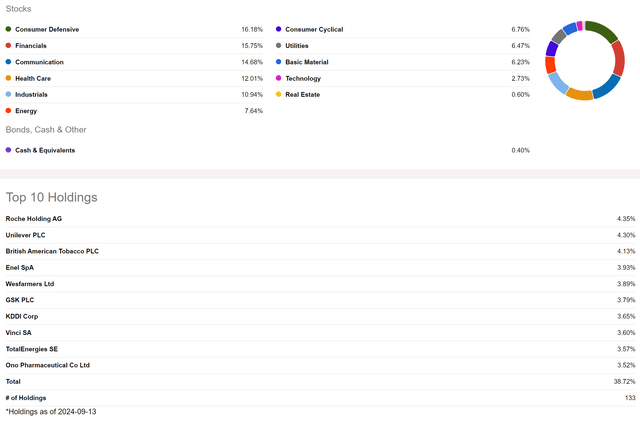

The process is actually a lot more complicated, but I think you can see the general thinking behind it. It all leads to a portfolio with the following exposure-

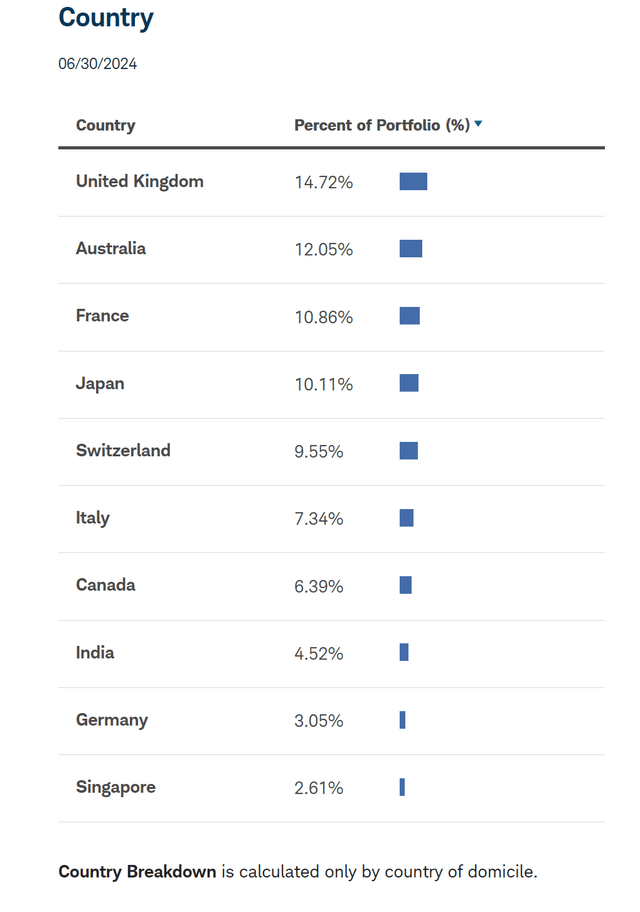

Geographical exposure is shown below. The 15% cap on emerging markets is mostly taken up by India, so China’s exposure is low.

Geographical Exposure (Schwab)

The Case for SCHY

With 133 stocks and a nearly equal distribution between its top 3 sectors – consumer defensive, financials and health care – SCHY is reasonably well diversified. I noticed one of its peers, the Vanguard International High Dividend Yield Index Fund ETF (VYMI) holds 1566 stocks, but surely, its screening process is less rigorous, and it achieves safety through huge diversification rather than quality. I prefer SCHY’s approach, although the stats do suggest VYMI is the better performing fund.

SCHY v VYMI (Portfolio Visualizer)

As we have already seen, SCHY lags it US counterpart SCHD in total return over the last year and three years. The stats heavily favor SCHD.

SCHY v SCHD (Portfolio Visualizer)

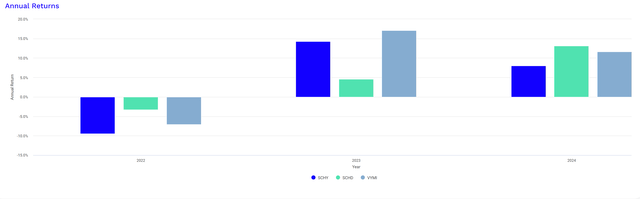

However, these stats are skewed by a poor start in SCHY’s first full year of 2022 which saw a drawdown of over -9%. 2023 was much better, although VYMI still outperformed.

Annual Returns (Portfolio Visualizer)

Furthermore, SCHY has managed to outperform SCHD over the last six months, and there is a strong correlation which suggests price performance may be similar going forward.

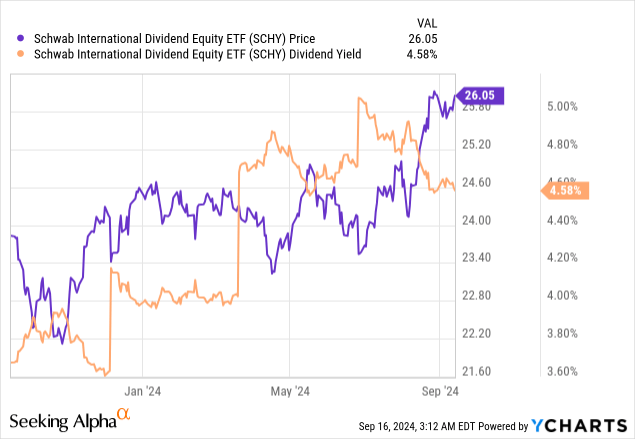

SCHY’s attraction is mostly its dividend. Its FWD yield is a decent 4.58% while SCHD is just 3.4%. Distributions are paid quarterly.

I do like that the dividend isn’t high because of price declines, and it has actually risen alongside price over the last year (although it has fallen from its high of over 5% in recent months). Distributions are rising.

In conclusion, SCHY’s performance has been improving and there is a case to be made for international stocks to boost yield. VYMI looks like the better fund, however, and merits further investigation.

Risks

Many central banks are already cutting, and the ECB has cut twice before the Fed has even started easing. This has likely helped SCHY’s price performance this year, but the risk is the cuts reflect a weaker EU economy. Since the majority of SCHY’s holdings are in Europe and the UK, its stocks may be weighed down by a sluggish economic backdrop.

I do think SCHY’s selection process has filtered out high-risk stocks, but its exposure to diverse countries and sectors does carry risk. With 39% of the fund in its top 10 holdings, it is relatively concentrated for an international ETF.

Conclusions

With US dividends dropping, investors may look to international stocks and ETFs for higher yields. There is some merit in this, and SCHY provides a 4.58% FWD yield from high-quality stocks. It has also performed well in the last six months and one year, although longer-term, most international funds have underperformed the US.

Despite its sophisticated methodology, VYMI may well be the better international fund and has outperformed. I therefore rate SCHY as a “hold.”