jgroup

So, this is going to be another one of those “it’s the valuation that matters” sort of articles.

In this case, the valuation matters regarding Enbridge (NYSE:ENB) (TSX:ENB:CA), an energy and pipeline business that we bought at the tail end of the last year of 2023. We did that buy at below $32/share for the US ticker ENB.

We’re writing this article because we believe that investors are now facing a problem.

The company has recently moved up well over $40/share, and currently, as we are writing this article, trades at over $40.6/share.

This might seem a bit of a “luxury” problem, of course – and there is both a bullish and a bearish side to things here – that’s for sure.

But if you know our writing, you’ll know that we’re extremely value-conscious, and we always have a price target for the investments that we make.

This is not a business that, we believe, has the potential for massive, outsized outperformance, which leaves us surprised. Indeed, it actually fails to meet targets negatively by 33.3% of the time, if we look at the forecast accuracy.

So this is a problem.

In order to justify this sort of price, we need to have a great deal of overall upside for Enbridge. In this article, we will show you if we have that, and if we don’t, what we do about it.

Enbridge – Successful investment, recalibrating.

Many investors would be fine letting this one be.

We’re also not arguing that it might not technically be the right thing to do.

One doesn’t have to act simply because the company is above $40/share.

But people were telling us that we were nutty for investing at $31.7/share, and the company would be trailing at below $31 for years.

Obviously, this has not become the case.

Since buying, our stake is now up over 40% annualized.

This is a very impressive sort of return for a BBB+-rated Canadian Oil & Gas Storage company.

And while some investors might take the stance that, of course, this company is solid to the degree where it doesn’t need to be considered a candidate for selling, we at least want to give you the facts to consider.

We called Enbridge one of the best long-term energy plays, and indeed, that is what the company is.

With over $70B in market cap and BBB+, this company’s safety is not in question.

Our YoC is down from close to 8% to around 6.6%, which is a marked reduction. The company’s primary business is in pipelines and energy, which isn’t exactly known for stability.

Volatility is in fact part of Enbridge’s business profile.

We want you to recall that in our previous co-produced article, we said the following:

I haven’t been invested in Enbridge for long. Not in the prefs, nor in the common shares. That’s because I have very stringent return requirements.

I want a good possibility of making market-beating returns even if the company develops worse than the market expects.

We want you to also keep this in mind as we look at the recent results.

The mid-year results which we got a few weeks back were solid.

The company’s M&A funding program is complete through over $2.5B of funding in the form of ATM & Hybrid issuances, and the company has returned to an equity self-funding model.

Debt to EBITDA is down to 4.7x, which is within the target range (though not low), and the company’s base business performance is very much on track.

Asset utilization is high and impressive, with good reliability across the company’s overall franchises.

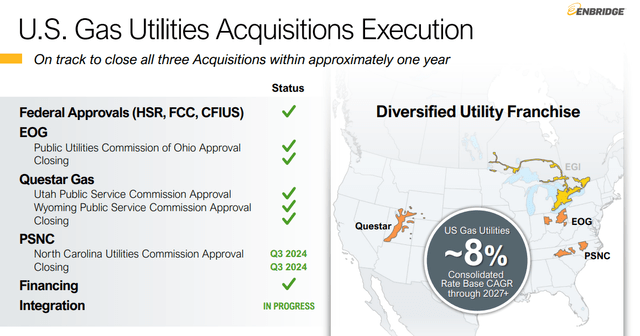

Enbridge also closed on Questar Gas and Enbridge Gas Ohio early this year, and PSNC, the Public Service Company of North Carolina.

Growth ambitions are on track, with new Solar power farms, the Whistler JV, and the sanction of the expansion of the Gray Oak pipeline. In short, much of what the company has worked on is going very well.

Enbridge IR (Enbridge IR)

Due to future requirements in the way of liquid storage and pipeline, the company’s assets are seeing heavy utilization here as well.

The Permian franchise, where the Gray Oak expansion is found, is expecting growth, and ENB is expecting 18M barrels of storage capacity at Ingleside, with an additional 2.5M barrels under construction and expected to finish next year.

Several records were set this quarter, with one of them being a single-day loading record for Ingleside. The natgas portion of operations is also working very well.

Enbridge IR

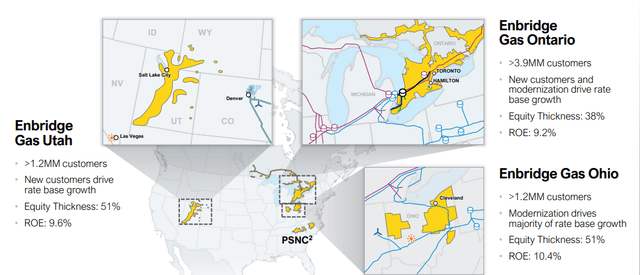

Enbridge is very much on track to create one of the largest natgas utilities in all of NA, while also creating a very impressive asset base of renewable assets across the US, including Texas, Ohio, and Canada.

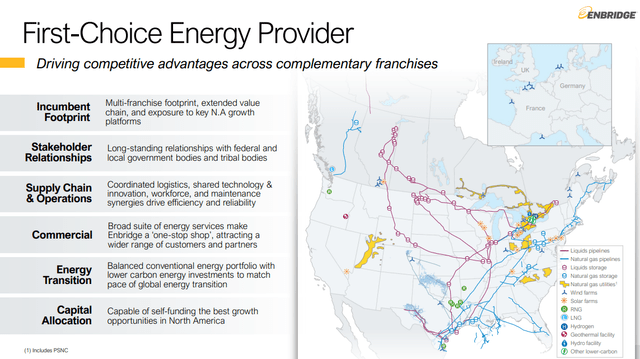

It seeks to become a very complete sort of energy provider, and many investors argue that this makes the company a primary play and worth owning, even at a much higher valuation than the company has historically been able to justify.

Enbridge IR

Is that the case?

That’s what we’ll look at.

Suffice it to say, there are no real worries on the operational side of things.

This is a company that really stands out among the NA midstream operators with what we can only as a conservative investor describe as an almost utility sort of profile.

This is very attractive to us.

With the recent settlements it has managed over contracts in Mainline, the company is really increasing its profile for its coming expansions – which is good because the expansion in Trans Mountain is going to cost at over $30B CAD.

The company’s income trends and returns are protected, and the company’s shippers are now using the Mainline system before the new system enters overall service.

All of these facts and characteristics speak in its favor.

The company’s dividend is one we would expect to continue to grow at 3% per year, which means that any alternative investment needs to beat this, or we at least need to take this into consideration.

The cancellation of Keystone XL puts the company in a forward position to capture new projects and expansions because this leaves a void in the pipeline market.

However, the less flattering parts of the company are definitely there.

It’s no secret that beating on Enbridge has been very common for ESG-friendly investors, not just in Dakota Access, but in Lines 3 and 5 as well.

The company’s oil profile is also much in Canadian oil sands, which is one of the least ESG-friendly plays out there.

This needs to be closely considered as well.

Also, while Enbridge has been working on its renewable arm, this is nowhere near finished, which brings with it decent capital risks.

Let’s look at the company valuation.

Enbridge – The upside is now very limited, and thus we’re looking to change our rating

Here are a few undeniable facts to begin with as we look at Enbridge’s valuation.

First off, the company’s valuation is now significantly less attractive than when we invested the first time.

It’s a difference of nearly $9/share at a $40/share price.

The yield only does a bit to improve this upside.

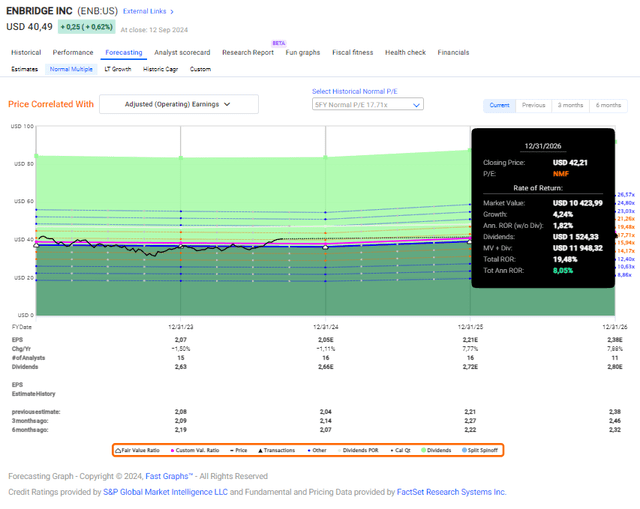

We’re trading at close to 20x normalized P/E for Enbridge, and this is high.

The 5-year average P/E for Enbridge is closer to 17.5x, and even though the 20-year comes to around 20.5x P/E, the company’s upside for both of these valuations is an implied annualized RoR of less than 15% annualized.

That’s undeniable – at least in terms of current forecasts.

Now, the company is expected to improve its earnings growth profile.

We’re now expecting upwards of 7-8% per year at 2025-2026.

But we argue this doesn’t take many of the aforementioned risk impacts into consideration.

It’s possible that the combination of rate cuts coupled with earnings growth could see us return to a $43-$45/share valuation, which the company has seen before.

It’s equally possible, given the 1Q24 expectation of earnings decline, that we’ll see the company’s share price decline back down towards the $36-$38/share level.

We said in our previous thesis for this company that we’re going no higher than $37/share.

We’re now at $40.6/share.

That means we’re meaningfully above our highest acceptable rating for the company, and close to a level where we would consider the company not only a “Hold” but also a rotational target.

The upside and bullish side seem to be predicated on earnings growth, but we argue that at this valuation it ignores the pricing, ESG, and macro risks associated with its business sector.

We estimate Enbridge at no higher than a 10.5x EV/EBITDA.

That’s the highest possible valuation we’re willing to go for here, and unlike forecasts, we discount EBITDA growth to 5-6% rather than 7-8% given some of these aforementioned risks.

That Enbridge is a buy below $35/share or even $36/share is to us undeniable. At that price, even at only 17-18x P/E, we’re seeing that sweet 15x P/E annualized upside.

Now, though?

This is what we expect and what we consider to be likely.

FAST Graphs

As analysts, we view it as part of our job to warn you when we believe we’ve reached a point of inflection in any stock.

And while ENB could continue unabated upward, we believe the upside if you were to buy here would be rather low. For that reason, here is our thesis for Enbridge right now.

Thesis

- Enbridge is a class-leading investment in the energy sector, with a solid overall upside at the right price. The right price, as we see it, is below $35/share to really ensure that upside here, and not going higher than $37/share. The company has now gone up to over $40/share, and thus the situation is now completely different.

- We believe Enbridge represents one of the safest income investments in the entire NA energy sector at the right price, based on how the company has been developing its portfolio for the past decade. However, given the slew of investment options including prefs, you want to be sure to pick the “right” avenue to enter this investment – and that is no longer possible here.

- At under or around $36/share, we believe the company represents a great value and an upside over 15% per year conservatively. Due to this, we say “Hold” here, and we’re now looking to potentially rotate this investment to invest in more appealing and upside-heavy businesses.

Enbridge is no longer cheap, and we no longer consider it buyable at this valuation. We’re changing the rating to a “Hold”, and we’re now looking for different investments to put money into.