Adam Gault/DigitalVision via Getty Images

I took a bunch of flak in April here for warning readers about the odds becoming heavily stacked against profitable ownership of the Direxion Daily Semiconductor Bull 3x Shares ETF (NYSEARCA:SOXL). This product is one of the highest leveraged (and risk-centric) plays on the Big Tech area of Wall Street.

Seeking Alpha – Paul Franke, SOXL Article, April 7th, 2024

This ultra-leveraged investment holds names like NVIDIA (NVDA), Advanced Micro Devices (AMD), Intel (INTC), Micron (MU), Broadcom (AVGO), Applied Materials (AMAT), Qualcomm (QCOM), Marvell (MRVL), Taiwan Semiconductor (TSM), and Monolithic Power Systems (MPWR), the supposed “cannot miss” AI datacenter and semiconductor beneficiaries.

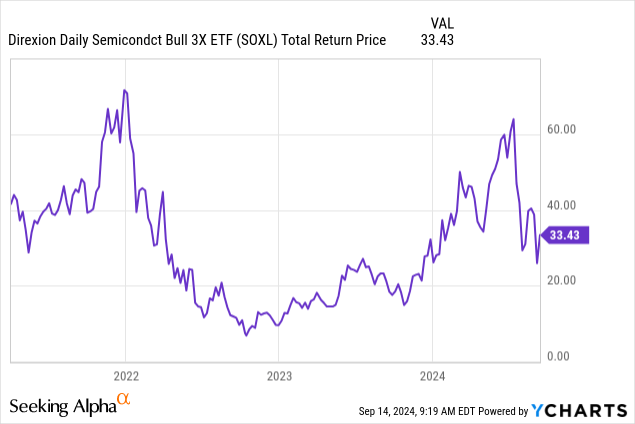

I will agree price first moved higher into early summer, encouraging bulls to double down on nutty risk-taking. Yet, SOXL has now dropped a good -25% in price from $45, measured from my original article publication.

Here is my opinion in a nutshell. If SOXL is basically a casino gamble on AI productivity and efficiency outcomes over the immediate future (which are really quite minor to date), the chances of rolling snake eyes and losing your shirt could actually be rising. It increasingly looks like the dice are now weighted in favor of rotten outcomes the rest of 2024 and perhaps most of 2025, as the AI investment boom turns to bust.

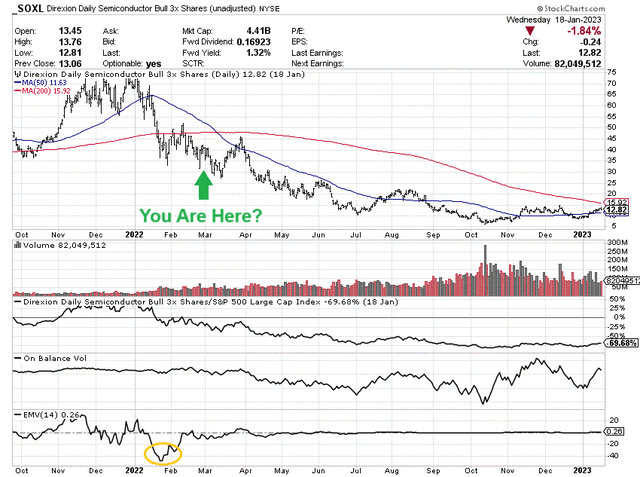

Why do I say such things? Well, the chart is downright ugly from a technical perspective. It looks nearly identical to the monster SOXL bust of 2022, which amounted to a -90% loss of capital from its December 2021 peak. And, with a negative total return vs. April 2021 three years ago, buying and holding this ETF makes no rational sense.

Given an AI boom could not deliver long-term SOXL gains vs. years ago, what situation will? The daily rebalancing feature (making math compounding difficult to recover from losses) with expensive holding costs (time decay on futures and forward swap premiums) are extraordinary obstacles to overcome.

My conclusion – if you do not have the stomach for another -50% to -80% in brokerage account losses, getting out now may still be the correct decision to retain your financial wealth. Clearly, just avoiding this ETF near a Big Tech bubble top is what the average retail investor should do.

YCharts – SOXL, Total Return, Since April 2021

History Rhyme – 2024 vs. 2022

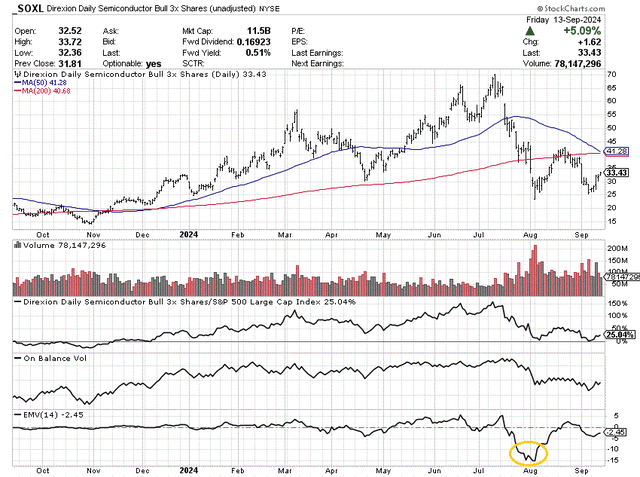

What bothers me most about SOXL, and provides the main excuse for writing this article, is the super-bearish chart trading pattern. The massive -60% shellacking in July and early August is testament to the “risk” holding this 3x leveraged ETF.

The price decline wiped clean most all of the “outperformance” of the S&P 500 witnessed during the oversized and overhyped updraft between late 2023 into July 2024. Unfortunately, investor/fund selling could just be getting started.

The wickedly bad dump in the 14-day Ease of Movement indicator action into the first week of August (circled in gold below) is screaming at investors to get out of the way. When very little sell volume can create a massive price decline, what will happen to price in the future if high-volume selling is next?

StockCharts.com – SOXL, 12 Months of Daily Price & Volume Changes, Author Reference Point

2021-22 Bust Repeat?

We can answer the question of what can play out after serious EMV weakness by reviewing the starkly similar selloff pattern during early 2022. The 2021 boom in Big Tech stocks reversed in January 2022, partly from an exhaustion of buying power, partly from the realization inflation and interest rates were going to spiral higher.

The 14-day EMV warned of significant trouble early in 2022 (circled in gold again), which was followed by “rising” sell volumes all year. The first rapid price decline of -50% proved just the initial phase of SOXL’s implosion. As you can see on the chart below, sell volumes steadily increased between January and October 2022. The net result was a -90% price dump over 11 months. However, you could have still salvaged most of your money had you sold on the bounce after the EMV sell signal (close to where we may be sitting today).

StockCharts.com – SOXL, Daily Price & Volume Changes, Oct 2021 – Dec 2022, Author Reference Points

Final Thoughts

How could SOXL be saved over the next 6-12 months? One variable that will be different over the next year vs. several years ago, which may support semiconductor pricing, is Federal Reserve banking policy. While 2022 included a major shift to credit tightening, late 2024 looks to be the point in time where the Fed will try to ease credit conditions through lower interest rates.

The problem with this usually bullish change in money creation is the U.S. has not yet experienced a recession during 2024. If we do experience a downturn in semiconductor demand globally soon, SOXL will get hit extremely hard, with its 3x leverage on any industrywide hiccup in results. Such would represent a true economic bust if you will.

A second possible outcome may not be any rosier. Short-term interest rate easing may backfire and launch inflation higher in 2025, assuming a recession is avoided. What this could mean is long-term interest rates may actually RISE next year on inflation worries. Such a result would not be productive for investors valuing business worth. Higher necessary profits and yields to match climbing long-term interest rates could rerate the U.S. stock market dramatically lower, with the highest overvaluations sold mercilessly (think today’s over-owned Big Tech sector).

Really, the only possible bullish scenario for SOXL semiconductor names would be a “Goldilocks” economic outcome of falling inflation and interest rates, alongside an expanding economy with better business demand for chips.

If we don’t get a Hollywood happy ending, the Direxion Daily Semiconductor Bull 3x Shares ETF will almost surely continue to zigzag lower. To me, the odds do not favor throwing the dice at the SOXL gambling table. I suggest keeping your money and playing at a different table. Or, you could leave the casino and go do something constructive with your time and money.

I continue to rate SOXL a Sell. Avoiding this name altogether has the best odds of long-term investment success, unless you enjoy losing money. To each his own, I guess.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.