Andrii Dodonov

UBER’s Investment Thesis Remains Promising – Albeit With Inherent Growth Risks

We previously covered Uber Technologies, Inc. (NYSE:UBER) in June 2024, discussing why we had reiterated our Buy rating upon the mixed FQ1’24 earnings call, thanks to the improved margin of safety and its undisputed moat in the ride share market.

Even so, with Tesla’s (TSLA) Robo-Taxi event coming on October 10, 2024, we might also see moderate volatility in UBER’s stock prices, with it remaining to be seen if their existing partnership might be deepened.

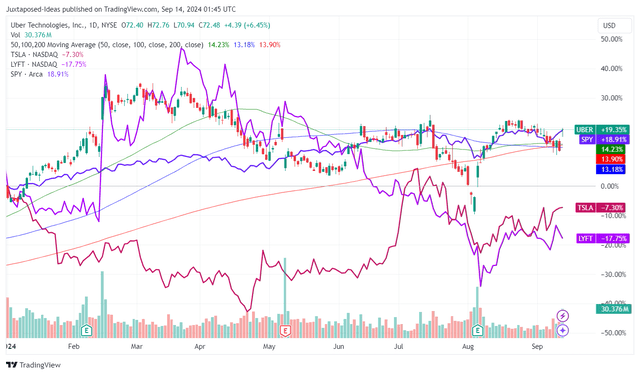

UBER YTD Stock Price

Since then, UBER has had a tumultuous stock performance, as TSLA reportedly opted to go forward with “a proprietary ride-hailing app powered by a fleet of both purpose-built robotaxis and consumer cars that don’t require a human driver.”

With this strategy naturally triggering intensified competition for UBER, we can understand why market sentiments surrounding its prospects have been mixed, as observed in the recent plunge in August 2024.

Even so, these developments have also been well balanced by UBER’s growing partnership with ten “autonomous vehicle makers amid an increased adoption of the technology,” including Waymo under Alphabet (GOOG) and Cruise under General Motors (GM) – allowing the former to remain somewhat competitive in the increasingly crowded robotaxi market moving forward.

These developments have played out as discussed in our previous article, with UBER likely to experience more volatility until there is more clarity in TSLA’s upcoming October 2024 event.

On the other hand, we remain optimistic about UBER’s long-term prospects, as observed in the management’s highly strategic investment in Wayve, a company specializing in Embodied AI for autonomous driving.

They expect to accelerate the adoption of Level 2+ advanced driver assistance and Level 3 automated driving capabilities in global OEMs, while developing a “globally scalable Level 4 autonomous vehicles for future deployment on Uber.”

It is apparent from these developments that UBER seeks to be a power house in both the conventional ride hailing and robotaxi markets, with the latter naturally being a new growth opportunity leveraging on its global consumer data base.

This also builds upon its existing offerings, which has proved to be highly attractive – based on the ability to attract new users while increasingly monetizing its existing users, as observed in the growing Monthly Active Platform Consumers [MACP] of 156M (+7M QoQ/ +19M YoY) and monthly trips per MAPC at 5.9 (+1.7% QoQ/ +5.3% YoY).

These have already contributed to the double beat FQ2’24 earnings call and promising FQ3’24 guidance, with it implying UBER’s ability to operate at scale while growing its profit margins despite the potential headwinds from the pay increases for rideshare drivers, as discussed in our previous article.

If anything, the ride hailing company has already been growing the number of drivers and couriers aggressively to 7.4M (+4.2% QoQ/ +13.8% from FQ3’23 levels), allowing the platform to bring down prices for users while naturally feeding into the demand flywheel as the company expands its mindshare.

Lastly, readers must not forget UBER’s biggest area of growth, advertising, which has already achieved “in excess of a billion dollars on a run rate basis” (+11.1% QoQ/ +100% from FQ4’22 levels) – comprising approximately 2.3% of its FQ2’24 revenues.

While the management has yet to break down the segment’s bottom-line, readers must note that advertising is typically a high margin business.

This explains why the ride hailing company has looked to grow its sponsor listing on the grocery side while “actively launching in markets outside the U.S., expanding into what Khosrowshahi (CEO of UBER) considers a highly profitable business.”

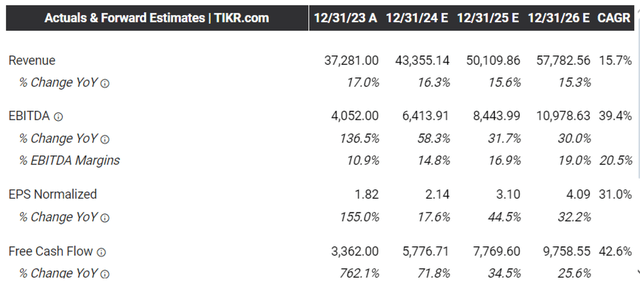

The Consensus Forward Estimates

Perhaps this is why the consensus maintains a relatively promising forward estimates, with UBER expected to generate a robust top/ bottom-line growth at a CAGR of +15.7%/ +31% through FY2026.

This is compared to the original estimates of +16.1%/ +19.2%, while building upon the top-line growth at a CAGR of +27% between FY2018 and FY2023, respectively.

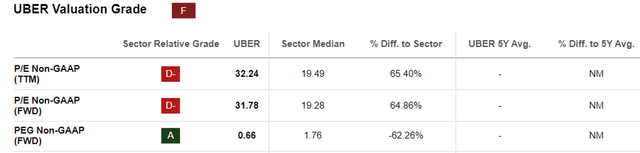

UBER Valuations

As a result, we believe that UBER is not expensive at FWD P/E non-GAAP valuations of 31.78x, compared to the sector median of 19.28x.

This is because of its extremely cheap PEG non-GAAP ratio of 0.66x, compared to the sector median of 1.76x and LYFT at 0.76x, with GRAB currently still unprofitable.

This is significantly aided by UBER’s robust Free Cash Flow generation at $4.75B over the LTM (+172.9% sequentially) and lower net debts on balance sheet at -$3.17B (-14.3% QoQ/ -14.3 YoY), as the management also aims “to use the majority of its incremental capital towards buybacks, with a goal of reducing the share base of the company going forward.”

So, Is UBER Stock A Buy, Sell, or Hold?

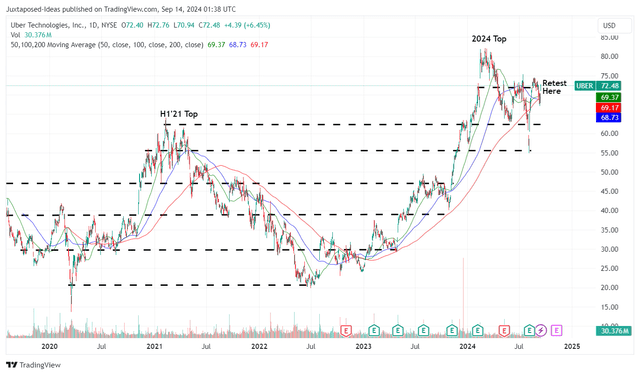

UBER 5Y Stock Price

For now, the bulls have came in to defend UBER during the deep pullback in August 2024, with the stock retesting its intermediate resistance levels of $72s.

Based on the annualized FQ2’24 adj EPS of $1.88 (+251.6% QoQ/ +161.1% YoY) and the FWD P/E non-GAAP valuations of 31.78x, it appears that the stock is trading at a notable +21.4% premium to our fair value estimate of $59.70.

Despite so, based on the consensus lowered FY2026 adj EPS estimates from $4.29 to $4.09 (likely attributed to the uncertain robotaxi development) and the same P/E valuations, we believe that there remains an excellent upside potential of +79.2% to our updated long-term price target of $129.90.

As a result of the still attractive risk/ reward ratio, we are reiterating our Buy rating for the UBER stock here.

Risk Warning

For now, it goes without saying that UBER’s stock performance is likely to remain mixed until TSLA’s robotaxi ambition proves to be a minimal threat.

Otherwise, we may see the former’s stock valuations and consensus forward estimates continue to moderate as the market turns even more pessimistic about its ability to sustain the high growth trend.

While UBER has hinted that it is “in late stage discussions with additional global AV players to join our platform and will have more announcements in the coming weeks and months,” readers may want to temper their near-term expectations indeed.

This is especially since TSLA has sold over 4.97M EVs to date globally, while delivering an annualized sum of 1.77M vehicles by the latest quarter (+14.7% QoQ/ -4.7% YoY) – implying its ability to rapidly scale its robotaxi dreams upon regulatory approval.

This is also why we urge investors to observe the UBER stock’s price movement for a little longer, before adding upon a moderate retracement, preferably at the established support level of $62s for an improved margin of safety.

Patience may be more prudent indeed, since it remains to be seen if the stock is able to sustain the upward momentum from the recent bottom.