lovelyday12

Allbirds, Inc. (NASDAQ:BIRD) has recently announced a 1/20 reverse split to maintain compliance with the NASDAQ’s minimum bid price requirement of $1 per share.

Since then, the share price has increased over 30%, showing some optimism among shareholders.

In this article, I considered reviewing Allbirds’ recent financial performance, with an emphasis on the headwinds that the company is facing, such as declining demand for their products, which has resulted in poor financial results.

In the outlook section, I will go through their financials and I will provide the rationale behind my Hold rating. For now, I will begin with a company overview section, for those new to this stock.

Company Overview

Cofounded by Tim Brown, a former New Zealand soccer player, and Joey Zwillinger, an engineer and renewables expert, Allbirds is a global lifestyle brand that designs and sells footwear and apparel.

Most of their sales come from digital channels, although they own and operate 43 physical retail stores in the US and other countries.

They have a single business segment. Considering that they operate globally, I considered including below a breakdown of the revenue per geographical area, based on their latest annual report.

| Year | United States ($ millions) | International ($ millions) | Total Revenue ($ millions) |

|---|---|---|---|

| 2023 | 191.1 | 63.0 | 254.1 |

| 2022 | 229.8 | 68.0 | 297.8 |

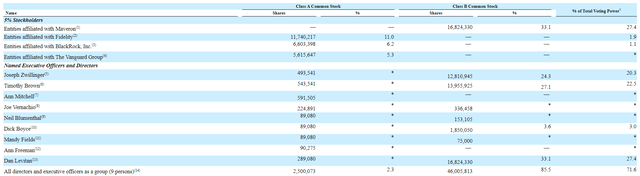

In regard to the beneficial ownership of the company, all 9 directors and executive officers own 85.5% of the class B common stock. The new CEO appointed in March this year, Joe Vernachio, has a beneficial ownership of less than 1%.

I have to admit that I would like to see more skin in the game by the new CEO of the company.

Headwinds, Pressures And Challenges

Let’s start with the 26.8% YoY decline in revenue due to lower unit sales. One of the drivers behind this decline was management’s shift towards full-price selling.

My investment style favors companies that focus on high margins and low volumes. However, a key consideration is how sensitive demand is to price increases. If the company has a great product, and if that product is not found anywhere else, then this strategy makes sense.

However, Allbirds has built its brand around sustainability and comfort, and I’m afraid that these attributes may not be enough to differentiate their brand in an increasingly competitive market.

The footwear industry is saturated with brands offering similar environmental credentials, like Nike, Adidas, and emerging DTC players like Rothy’s and Veja.

Additionally, their product portfolio has been relatively stagnant, with only three new launches during the first half of 2024: Wool Runner 2, Tree Runner Go, and Canvas Piper.

There are upcoming launches, like the Tree Glider, and new materials, like corduroy and rugged waterproof designs, but these products are not radically different from their competitors.

Which makes me sweat when I see full price tags on their products. If they could offer a unique product, the price tag becomes irrelevant (up to a certain point, of course). But if they can’t, which I believe is the case, then it doesn’t make sense to focus on high margins, as you may alienate cost-sensitive consumers.

Another factor contributing to declining revenues was the decision to close underperforming retail stores.

In 2024, the company closed 14 stores in the US as part of this initiative, including 10 closures in Q2 alone, and incurring $3 million in cash charges due to the shutdowns.

Given the importance of in-store experiences for footwear brands, the reduction in the company’s retail footprint may make it harder to compete with more established players.

I can’t speak for everyone, but I always like to try on a new pair of shoes before making a purchase, especially when I’m paying the full price tag (notice I am a cost-sensitive consumer).

International markets have also contributed to the decline in revenue due to the recent transition towards a distributor model, which resulted in a 24% drop in international sales.

This new strategy is projected to result in a $15 million to $18 million drop in annual revenue as the company completes the transition from DTC to distributor sales.

I have to admit that I am discouraged about this initiative, as it could lead to a weakened international brand image. My main concern is that the distributors may not execute the brand experience to the same standard as the company would in a DTC model.

Another pressure comes from increased marketing expenses. In Q2 2024, marketing expenses accounted for 22.8% of the total revenue, which is an increase from 17.8% in Q2 2023. This increase in marketing expenses, without an increase in revenue, makes me sweat because it could be an indication of low demand for their current products.

Outlook

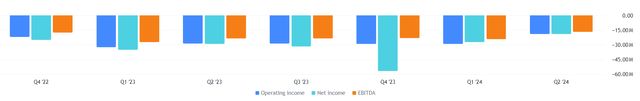

Aside from the headwinds mentioned above, there were a few small improvements, like the increase in gross margins, reaching 50.5%, up from 42.8% in Q2 2023. This increase was driven by lower freight and duty costs, fewer inventory writedowns, and cost savings from shifting production to new factories.

SG&A costs declined to $33.6 million, which is a significant improvement from $46.2 million in Q2 last year. Additionally, their inventory decreased by 42% YoY, which contributed to the improvement in gross margins.

Although Allbirds is still operating at a significant loss, the net loss was smaller than last year. In Q2 2024 was $19.1 million, compared to $28.9 million in the previous year.

Despite net losses, they have $87.2 million in cash and cash equivalents. Additionally, they have no outstanding borrowings on their $50 million revolving credit facility, which gives them flexibility to fund the introduction of new products in the future.

Before we have a look at their weekly chart, I need to mention the 1/20 reverse stock split, which was motivated by the NASDAQ minimum bid price requirement of $1. This reverse stock split took effect on September 4.

If we look at the weekly chart since they started trading on the NASDAQ in November 2021, the decline is so pronounced, that we cannot see the recent price moves.

For this reason, I considered including a daily chart to better see the recent price changes.

Since the 60% drop in share price in March 2023, following Q4 2022 earnings results, the share price has been on a continuous downward trend.

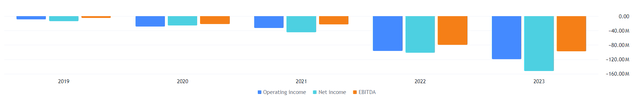

When we look at the income statement, this decline makes sense. As seen below, both operating income, EBITDA and net income have decreased over the past few years.

However, if instead of using annual data, we use a quarterly timeframe, we can observe that these losses have been stabilizing, and even improving, over the past quarters.

A quick look at their valuation metrics shows that the price to sales ratio is close to 50% below the median of the consumer discretionary sector, and 60% below their 5-year average.

Additionally, price to book value is 65% below the sector median, and 30% below their own 5-year average.

Therefore, despite their poor earnings results, their strong cash position, with no debt, and the recent improvement in some of their financial metrics motivate my Hold rating.

Conclusion

To conclude, while there are strong headwinds and pressures that the company is currently facing, including declining revenues, competitive pressures, and challenges in its international strategy, I see some reasons for optimism.

The company’s recent gross margin improvements, reduction in SG&A costs, and strong cash position with no debt are positive indicators.

However, I don’t believe there will be a turnaround in the short term due to the lack of differentiating factors to set them apart from their competitors. The increased marketing expenses, without an increase in revenue, could be an indication that demand for their products is not where they are expecting.

However, if they succeed with one of their future product launches, like the Tree Glider, they could be on a good trajectory for growth. Until then, I maintain a Hold rating.