bjdlzx

The last article on Africa Oil Corp. (OTCPK:AOIFF) discussed the consolidation of prime ownership under the company umbrella in exchange for company stock. Since that time, management has continued to streamline its investments while also reducing future cash needs. The result of this is carried interests in key areas while the company’s financials will be a bit easier to understand in the future. There’s also a focus on areas that will be growth areas while maybe some more speculative (or uncertain) projects go by the wayside as this process continues. Africa Oil was, for a long time, a story company that’s one of the rare companies transitioning to an actual operating entity with a very bright future and some impressive partners.

What made the transition possible was the association at the time with the Lundin Energy Group of companies. That sizable organization is well respected for its record with investors. But that association has now ended. The proposed combination not only simplifies the whole structure, but also places another major (well-respected) shareholder behind the company to help this company continue to grow. It’s hard to understate the necessity of that kind of relationship when it comes to growing a small company in the offshore business.

Second Quarter

Another announcement made previously was a drilling campaign to add to production for the company’s major producing asset off the coast of Nigeria. That was going to interrupt ongoing production to a certain extent and the current results show that. However, the breakeven results were overshadowed by a distribution from Prime and a reduction in the net debt.

A combination of a different tax structure and the key transactions shown below have affected both comparisons and reported results. The details are shown in the quarterly report. A combination of issues may continue to affect quarterly results until all of this completed, which makes quarterly comparisons a real challenge.

Africa Oil itself is debt-free. However, Prime does have debt that’s being paid down and therefore shows on the consolidated balance sheet of Africa Oil.

Probably the most important consideration is the structure and health of the company after all the anticipated transactions are complete. The same goes for the drilling campaign.

Key Transactions

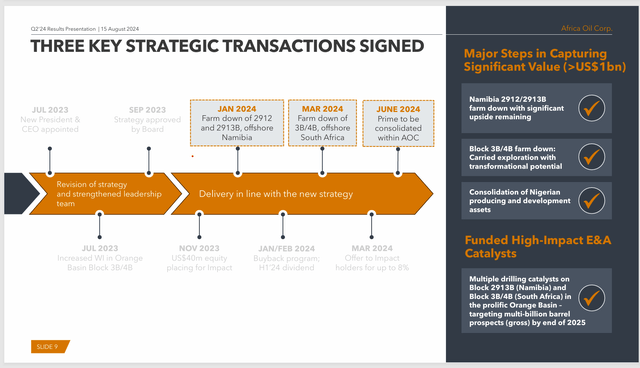

This is a summary of what was announced during the fiscal quarter. After the quarter ended, the company announced an offer to minority shareholders of the subsidiary Impact to buy out their shares.

Africa Oil Rationalization Strategy (Africa Oil Corporate Presentation Second Quarter 2024)

All of this activity sort of makes the second quarter earnings announcement largely irrelevant. Once the drilling campaign is completed, production interruptions are no longer a concern and the steps shown above are likewise complete, this will be a very different company going forward.

Management also announced an agreement to trade its nearly 15% interest in Eco (Atlantic) Oil & Gas Ltd. (OTCPK:ECAOF) for a 1% interest that Eco held in 3B/4B. This was part of the earnings announcement and further rationalizes the company holdings. As a result, this company now only has interests in the African Continent.

Throughout all of this Africa Oil itself will remain debt-free. The only issue would be the drilling campaign and how production issues as a result of that campaign affect cash flow and debt repayments in the future.

The Business Going Forward

The transaction with Eco Atlantic will, in effect, end the business relationship with that company.

Any relatively small player in the offshore business will have down years and up years rather than a smooth “straight-line” up.

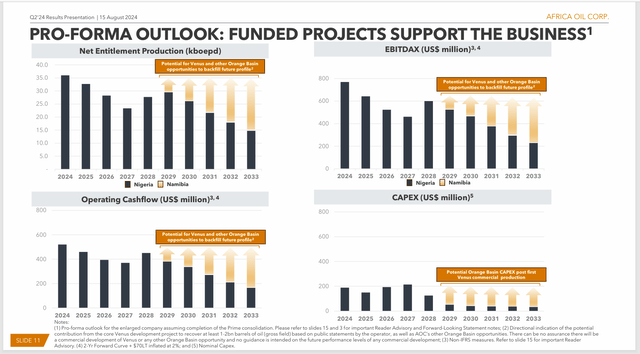

Africa Oil Pro-Forma Future Guidance (Africa Oil Corporate Presentation Second Quarter 2024)

In this case, the latest drilling campaign will provide an immediate production (and cash flow) boost until the next campaign. Later, another project will come online and provide another source of cash flow. That diversification will provide the start of the company’s effort to smooth earnings.

It’s harder to tell the effects on the stock price because the industry has been in the doghouse for some time. As a result, it may well be worth the wait for the better years ahead because the industry could return to more normal historical valuations that would provide some upside potential even if production declines between drilling campaigns. There’s also some potential for another accretive acquisition using some cash flow.

The key part of the slide is the low capex required to get to that second production source shown on the lower right-hand corner of the slide.

Summary Of The Future Business

Africa Oil is a Canadian company that reports in United States dollars.

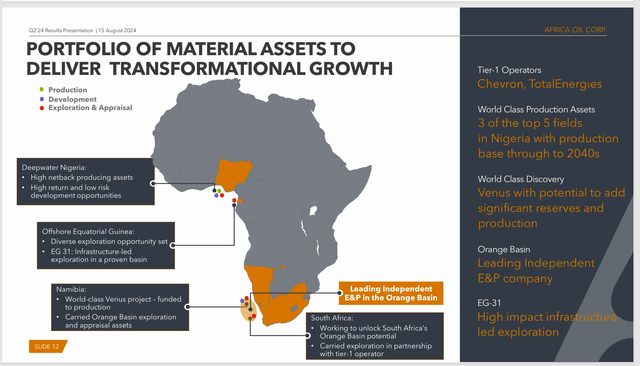

Africa Oil Business Summary (Africa Oil Corporate Presentation Second Quarter 2024)

One of the things that gives this company credibility over many of its size is the partners shown above. Both Chevron Corporation (CVX) and TotalEnergies SE (TTE) are well-regarded operators that very much elevate this offshore operator considerably above many offshore operators of the same size.

This could well make the search for a “name” partner for the Equatorial Guinea project much easier than it otherwise would be.

The end of the strategy of minimizing cash out in exchange for some working interest in a project is finally within the view of the future.

The coming online of projects in South Africa and Namibia is bringing income located in two of the most advanced countries in Africa. They’re also two of the most stable countries on the continent. This represents a higher valuation location than the location of the source of the current cash flow.

It is going to take some time for that future to arrive and begin to diversify cash flow. Therefore, this stock may be appreciated when the latest drilling campaign is completed. But there’s a lot more appreciation potential that’s a few years away.

Valuation of the stock will depend upon market conditions at the time another project begins to contribute to total company production and profits. Overall, though, this is a small player with decent-sized interests in some relatively large projects.

Summary

Between the drilling campaign that is affecting the cash flow from the one cash source, and all the announced simplification strategies, the company’s financial statements are very likely to undergo a major (positive) transition that will end with the consolidation of Prime within the company. Overall, every step appears to be a major plus for the company.

Africa Oil, as a smaller offshore operator, naturally has an elevated risk to the point it’s considered speculative at this point. However, for those who can handle the risk of an issue like this, it’s probably a strong buy idea. This company is likely to be a materially different and far more valuable company by the end of a decade (and likely before that). This is that rare company that’s making the transition from a “story company” to an operating model.

Africa Oil itself is debt-free. However, Prime does have debt that it’s paying down and is consolidated on the balance sheet. That debt is at conservative levels. The low requirements of cash needed to bring the next projects online (because a carry has been negotiated) means that the company will continue to have a strong balance sheet.

Risks

Any upstream company is exposed to the volatility and low visibility of future oil prices. A sustained and severe downturn in commodity prices could change the outlook for this company and some of its promising projects.

The drilling campaign underway has so far been successful. But success for the rest of the campaign is not assured.

Similarly, all the simplification steps have necessary approvals and administrative steps that need to be successful. A review of all of this could find some unforeseen challenges to get all the anticipated steps done. It’s unlikely. But it’s a risk.

A loss of key personnel could materially set back the company’s future prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.