Rob_Ellis

Note:

Vantage Drilling International or “Vantage Drilling” (OTCPK:VTDRF) has been discussed by me previously, so investors should view this article as an update to my earlier coverage of the company.

Last week, small offshore driller Vantage Drilling announced the sale of its remaining jackup rigs Topaz Driller and Soehanah to strategic partner ADES Group (“ADES”) for an aggregate $190 million in cash.

(…) The transaction will expand our management services platform, further strengthen our balance sheet and will provide Vantage with important financial flexibility. The sale of this business does not end our involvement in operating these jack-up rigs as we will continue to manage the operations of the two rigs for three years.

ADES continues to demonstrate confidence in the Vantage management platform as ADES continues its international expansion. We are excited to continue to leverage our management platform to bring first-class operational performance and efficiency to our clients and partners.

At closing, Vantage Drilling and ADES will enter into a three-year management agreement for the rigs, very similar to the transaction involving the jackup rigs Emerald Driller, Sapphire Driller and Aquamarine Driller two years ago.

With both Topaz Driller and Soehanah operating on long-term contracts with an aggregate $166.5 million in profitable backlog as of the end of Q2, the purchase price looks fairly low. However, the management agreement should provide additional value to Vantage Drilling over time.

The company will be required to use the proceeds for the redemption of its $200 million 9.50% 2028 senior secured first lien notes:

(…) Under the terms of the Company’s indenture relating to its 9.50% senior secured first lien notes due 2028 (…) the Company is required to repurchase at par value the Notes using the net proceeds from any “Vessel Sale” as such term is defined therein. Each sale of the Soehanah and Topaz Driller constitutes Vessel Sales under the Indenture.

Following the proposed sale of the 7th generation drillship Tungsten Explorer to a new joint venture in which key customer TotalEnergies SE or “TotalEnergies” (TTE) will hold 75% and Vantage Drilling the remaining 25%, the company’s sole remaining asset will be the idle 6th generation drillship Platinum Explorer.

With operators increasingly focused on more efficient 7th generation assets, the Platinum Explorer is likely to experience some near-term idle time even when considering the recent blowout preventer (“BOP”) upgrade.

But with the rig having just passed its 15-year special survey, the Platinum Explorer might very well attract potential suitors similar to Transocean’s (RIG) 6th generation floaters Development Driller III and Discoverer Inspiration earlier this month.

Assuming a sales price of $150 million, Vantage Drilling’s net cash position would increase to almost $380 million or approximately $29 per share.

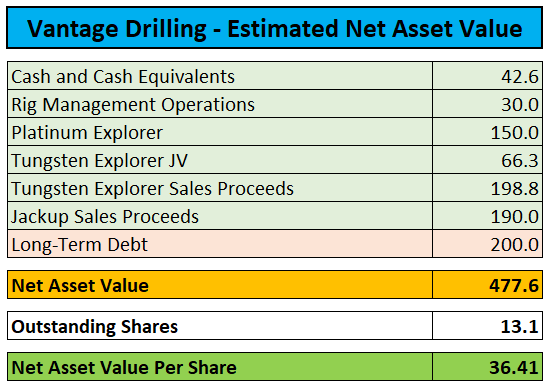

However, with the company retaining a 25% stake in the proposed Tungsten Explorer joint venture and a profitable rig management business, current net asset value (“NAV”) might be above $35 per share:

Company Press Releases / Author’s Estimates

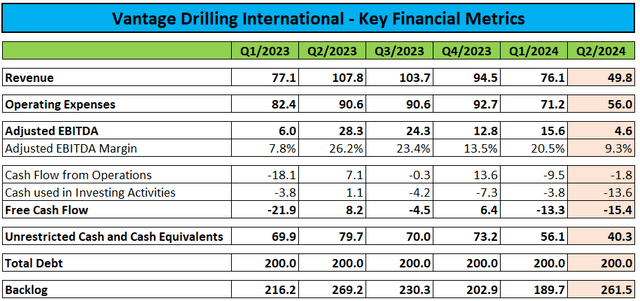

On the flip side, Vantage Drilling still has some capex commitments and operating cash flow has been negative in recent quarters:

Company Press Releases / Regulatory Filings

In combination with uncertainties regarding the fate of the Platinum Explorer and the company’s strategic direction going forward, a 20% discount to estimated NAV seems appropriate thus resulting in a price target of $29.

Given limited upside in combination with the stock’s anemic trading volume on the OTC, I am reiterating my “Hold” rating on Vantage Drilling’s shares.

Please note that the company is currently exploring a potential listing on the Euronext Growth stock exchange in Oslo which could result in increased trading activity going forward.

Bottom Line

Vantage Drilling decided to sell the remainder of its jackup fleet to strategic partner ADES, but will continue to manage the rigs for at least three years. With a majority stake in the company’s highest-specification asset expected to be sold to key customer TotalEnergies next year, Vantage Drilling’s fleet will be down to just one 6th generation drillship which is currently sitting idle.

With the offshore drilling industry currently experiencing a period of lower contracting activity, the Platinum Explorer might sit idle for several quarters. On the flip side, larger competitor Transocean recently managed to sell two warm-stacked 6th generation floaters at reasonable prices.

For my part, I would expect the Platinum Explorer to be sold sooner rather than later and Vantage Drilling to focus on rig management services going forward. In this case, a sizeable one-time dividend for common shareholders might be in the cards.

However, with the fate of the Platinum Explorer and the company’s future strategic direction still unclear, I am reiterating my “Hold” rating on Vantage Drilling’s shares.

Investors looking for exposure to the offshore drilling industry following the most recent selloff in oil service stocks, should consider an investment in much larger peers such as Borr Drilling (BORR), Noble Corporation (NE), Seadrill (SDRL) and Valaris (VAL).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.