EXTREME-PHOTOGRAPHER/E+ via Getty Images

Investment Thesis

Academy Sports and Outdoors (NASDAQ:ASO) has big expansion plans. ASO’s five-year long-range plan (LRP) includes opening 160 – 180 new stores in the next five years, with an ROIC hurdle of no less than 20% for each store, improving its supply chain, and increasing annual sales by at least 66%.

If the company can come anywhere close to delivering the type of free cash flow growth that it has from its recent new and same-store performance, it could be a huge winner from here. The company’s own 5-year goals might make the stock undervalued by 100%.

Q2 Earnings

ASO reported Q2 2024 net sales of $1.55 billion, a YoY decline of 2.2%, with a comp sales decline of 6.9%. GAAP diluted EPS was $1.95, and adjusted diluted EPS was $2.03, down 3.0% and 2.9%, respectively. Year to date, sales have declined 2.9%, with a decline in comp sales of 5.4%. Both GAAP and adjusted net income were down 9.2%, ASO’s buyback of roughly 4.3 million shares helped to improve EPS significantly versus net income.

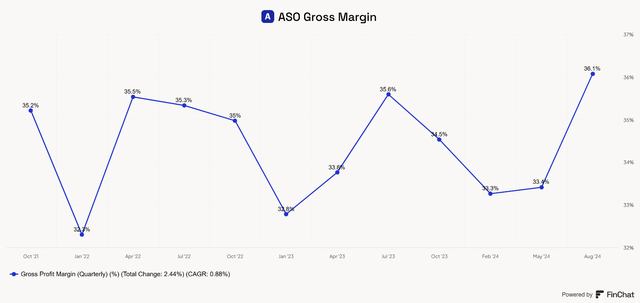

Despite expanding gross margin by 50 basis points to 36.1%, ASO’s management explained the rationale behind lowering guidance for revenue to a range of $5.9 billion to $6.07 billion by saying that its primary customers are remaining very conscious of their budgets and that some discretionary categories are under pressure. Credit card and buy now pay it later (BNPL) transactions are also at multi-year highs. Comp tickets were 0.5% higher than last year, but comp tickets declined 7.4%.

Improved inventory management and lower freight expenses have driven gross margin expansion. This improvement appears to be a trend in the making, as ASO says that full-year gross margin is now expected to come in between 34.3% and 34.7%, which would mark a 10 to 40 bps improvement over its current 34.2% YTD gross margin.

I like to see expanding margins, and for a retailer, gross margin is particularly important. This is a potential sign that the company has some level of pricing power, especially during challenging times. Inflation is certainly a reason for this, but until the company must resort to increased discounting or sees absolute declines in comp ticket prices and margins I see this as a strong point to ASO. It also shows how important managing the cost of goods sold is for ASO.

ASO’s Improving Gross Margins (FinChat)

These cost improvements go beyond COGS, as ASO has improved the cost structure of its new stores.

Growth Ambitions

After opening two new stores during Q1, ASO opened two in Q2, including its first store in Georgia, expanding its reach into its nineteenth state. The company reiterated its plan to open between 15 and 17 stores during the year. In the calendar for 2025, ASO plans to increase the number of new openings beyond this year’s total, without giving a specific number.

ASO’s 5-year plan is to open 160-180 new stores. However, management has stated that they believe 800 stores is possible eventually, conservatively putting the company at a total of $16 billion in revenue, given a $20 million per store contribution rate.

During the Q2 call, management said its SG&A increases (+4.6% YoY) mainly focus on growth. In previous calls, management stated that 90% of spending increases above the prior year were growth initiative spending.

Growth Expectations Pulled Back

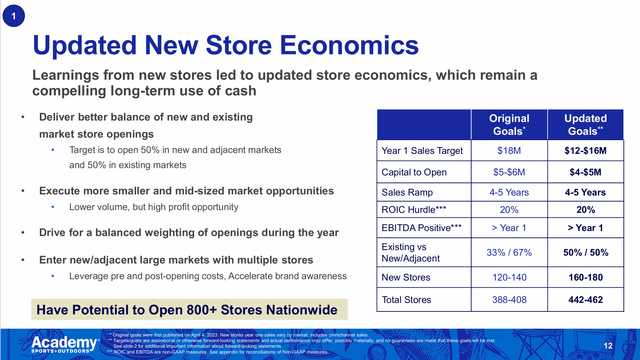

ASO saw some challenges in recent quarters and has reset expectations for new store growth and contribution.

In recent years, ASO’s new store sales have not kept up with the trends seen during the pandemic. After reevaluating historical performance from pre-pandemic years, the company lowered its new store sales contribution range from $18 million to a range of $12 to $16 million. ASO is also optimizing its new store growth strategy, citing a lower cost to open, maintaining its ROIC hurdle and expectations for turning EBITDA positive, and adding a higher new store target.

ASO’s Improving Gross Margins (ASO Annual Presentation)

During the Q2 call, management said that its 2022 vintage of new stores is posting positive comps, and its 2023 vintage has been outperforming the 2022 stores from a sales trajectory standpoint. ASO says its 2024 vintage is outperforming the 2023 vintage in the early days of operations, pointing to its improved new store opening and operations process.

Going back to previous calls, management had mentioned that they were learning a lot about their new stores after reviewing trends from previous years. Stores that opened in existing markets outperformed those in new markets. Dense market openings, where multiple stores open in the same market in short order, have been more efficient due to the pooling of marketing expenses and better brand recognition. ASO is still refining its growth plans and its cost structure for new stores, and the improvement the company is making gives me confidence that the runway for growth remains even though it is challenged right now.

Lowering new store expectations is one reason that analysts got spooked earlier this year, leading to downgrades and sell-offs of the stock following Q4 2023 and Q1 2024 earnings. It challenged the growth thesis for ASO, but I think the company’s impressive per-store metrics and substantial white space in US retail give reason to remain bullish on its potential.

Only 17% of the US population is within a 10-square-mile radius of an ASO store. A more measured and surgical approach to store openings may be what the company needs to both improve the new store performance and sustainably grow its store count in existing and new markets.

Valuation

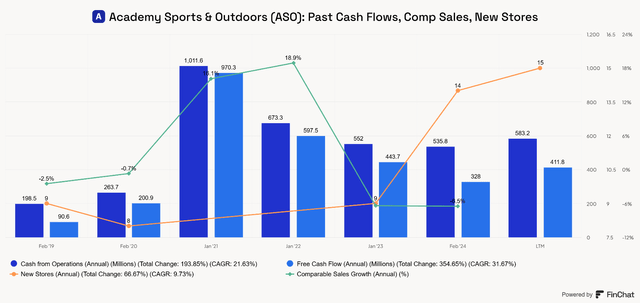

ASO has grown OCF at a 21.6% CAGR and FCF at a 31.7% CAGR since 2019. New stores have grown at a 9.7% CAGR during the same timeframe.

FinChat

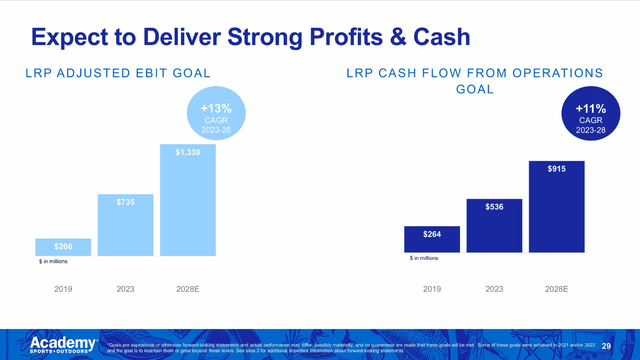

ASO Annual Investor Presentation

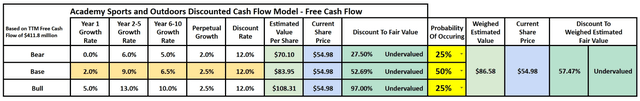

Going forward, ASO expects to be able to deliver an 11% CAGR on cash flows from operations from 2023 to 2028. If I create a DCF model using more conservative assumptions than ASO’s management lays out, the stock looks incredibly undervalued.

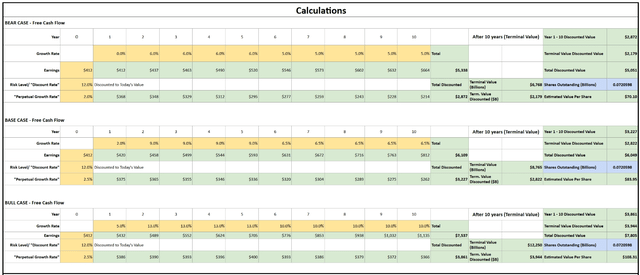

Base Case Methodology: I took the 11% OCF CAGR laid out by management and reduced year one’s outlook to a 2.0% growth off ASO’s TTM FCF of $411.8 million. For years 2-5, I modeled a 9.0% FCF CAGR and stepped down the growth rate to 6.5% for years 6-10. I used a perpetual growth rate of 2.5% for FCF, roughly in line with the high end of GDP growth. This could be conservative, if ASO continues to grow store count beyond ten years, but ten years is all I’m comfortable modeling. I weighted the probability of the base case to 50%.

Bull Case Methodology: I reduced year one’s outlook to a 5.0% growth off ASO’s TTM FCF of $411.8 million. For years 2-5, I modeled a 13.0% FCF CAGR and stepped down the growth rate to 10.0% for years 6-10. The higher growth rate in the bull case assumes that ASO grows FCF at a higher rate than OCF, which lines up with past trends. I used a perpetual growth rate of 2.5% for FCF. I weighted the probability of the base case to 25%.

Bear Case Methodology: I reduced year one’s outlook to a 0% growth off ASO’s TTM FCF of $411.8 million. For years 2-5, I modeled a 6.0% FCF CAGR and stepped down the growth rate to 5.0% for years 6-10. The lower growth rate in the bear case assumes that ASO doesn’t fully achieve its growth plans but continues to grow. I used a perpetual growth rate of 2.0% for FCF. I weighted the probability of the base case to 25%.

Author-generated DCF Model

In all cases, the stock appears to be intrinsically undervalued due to its free cash flow potential and potentially undervalued by as much as 57%. If ASO can deliver on 11% OCF growth over the next five years and continue that growth for the next five years, the stock is likely roughly 100% undervalued, considering that my bull case only comes up with a $108 fair value price with less growth assumed.

Author’s DCF Calculations

Risks

DCF models are inherently flawed, and mine will not be accurate. However, it shows the potential for massive returns and an investment case that might favor long-term investors. If it is only directionally correct, then ASO will be a winning investment.

The retail industry is very competitive, and new store growth that converts to stable cash flows is not a guarantee. It’s possible that ASO can’t expand successfully into new markets and remains more of a regional player rather than a national player in retail.

Weakening consumers and a recession could hamper the company’s growth prospects, delay free cash flow growth, and/or lower the total store potential. This would reduce the company’s margin of safety and risk/reward profile. If this happens, my growth assumptions may appear bold. However, they seem to align with what ASO’s management believes is possible, if not a little more conservative.

Counterpoints To Risks

I believe that the market is currently hesitant to invest in growth companies in economically sensitive sectors. Retail appears to be one of these sectors. This might be just the right time to be looking for hidden gem investment ideas in the retail space. However, it’s important to understand that an investment in ASO is not one to enter with a short-term mindset. Not that one can’t trade in and out of the stock, but that with a long runway for growth, ASO could deliver big returns, but only for investors willing to let it sit in their portfolios through turbulent times while periodically revisiting the thesis.

My attempt to keep the inputs conservative means that I could be underselling the potential for ASO. However, it’s important to remember that ambitious growth is often overly ambitious. My bull case assumptions appear to be more conservative than ASO’s management believes its potential to be. The company sees an ultimate $16 billion in revenue potential, not adjusted for inflation.

Conclusion

With a long runway for growth ahead, I believe ASO stock is highly skewed toward the reward end of the risk-reward spectrum. While it is potentially undervalued by 57%, based on my weight 3-case DCF model, I see better fundamental reasons to invest in the stock. The company operates efficiently, but hasn’t yet refined its expansion plans and continues to find areas of improvement. Management’s commentary on the performance of its new stores, the cost improvements it has made in the opening process, and the refinement of its location strategy keep me confident in its ability to continue its expansion plans.

I rate ASO as a strong buy, but caution potential investors to consider taking a long-term approach with the company and its stock.