Roman Didkivskyi

By Jennifer Nash

Wholesale inflation grew more than expected last month. Here is the latest news release from the Bureau of Labor Statistics.

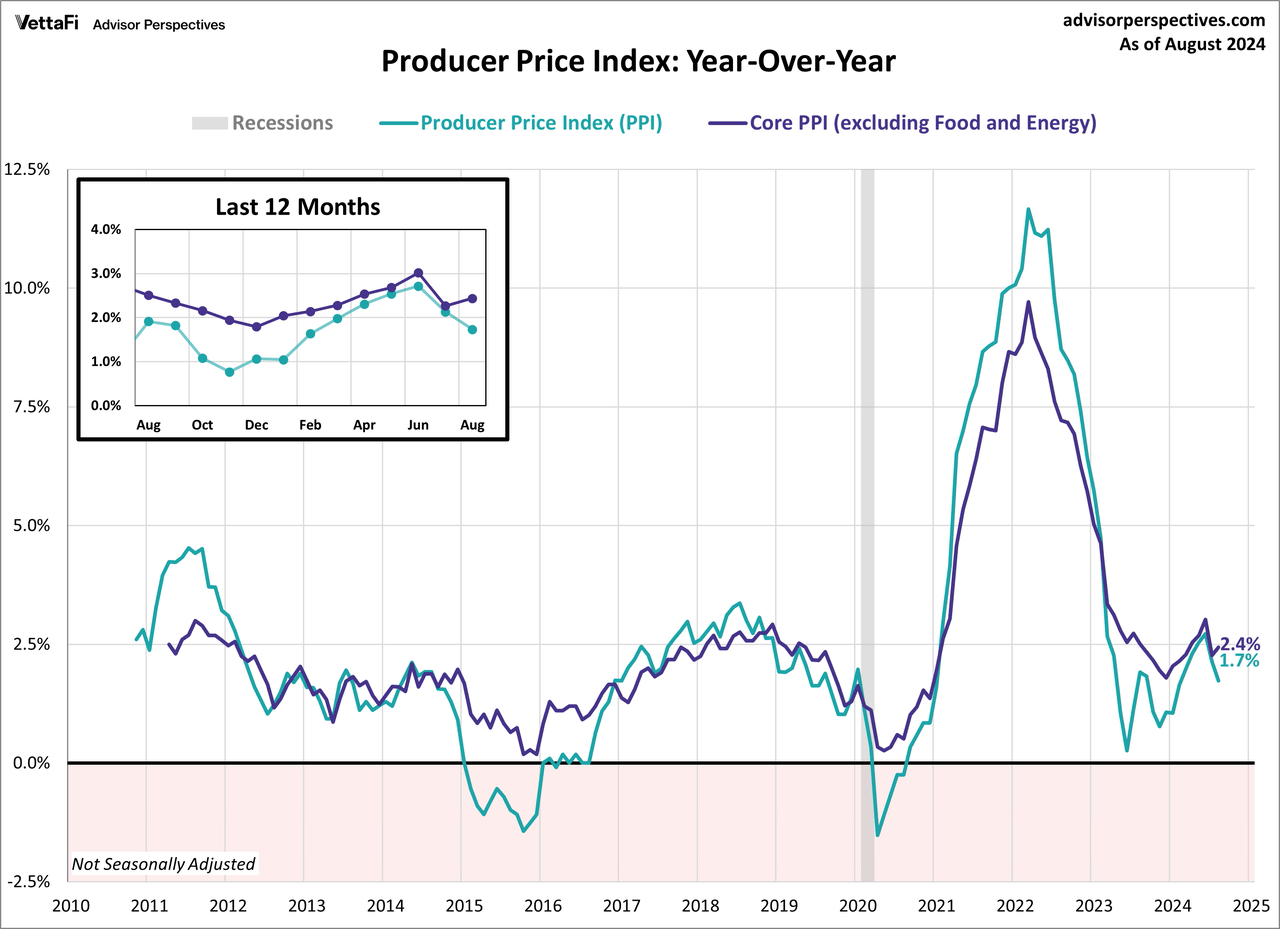

The producer price index for final demand increased 0.2% month-over-month (s.a.), more than the expected 0.1% growth. On a non-seasonally adjusted annual basis, headline PPI decelerated from 2.1% in July to 1.7% in August, coming in below the expected 1.8% growth.

Core PPI (excluding food and energy) for final demand increased 0.3% last month, more than the expected 0.2% growth. On a non-seasonally adjusted annual basis, core PPI accelerated from 2.3% year-over-year in July to 2.4% in August, coming in below the expected 2.5% growth.

Below is a chart of the historical series with a callout to the most recent 12 months.

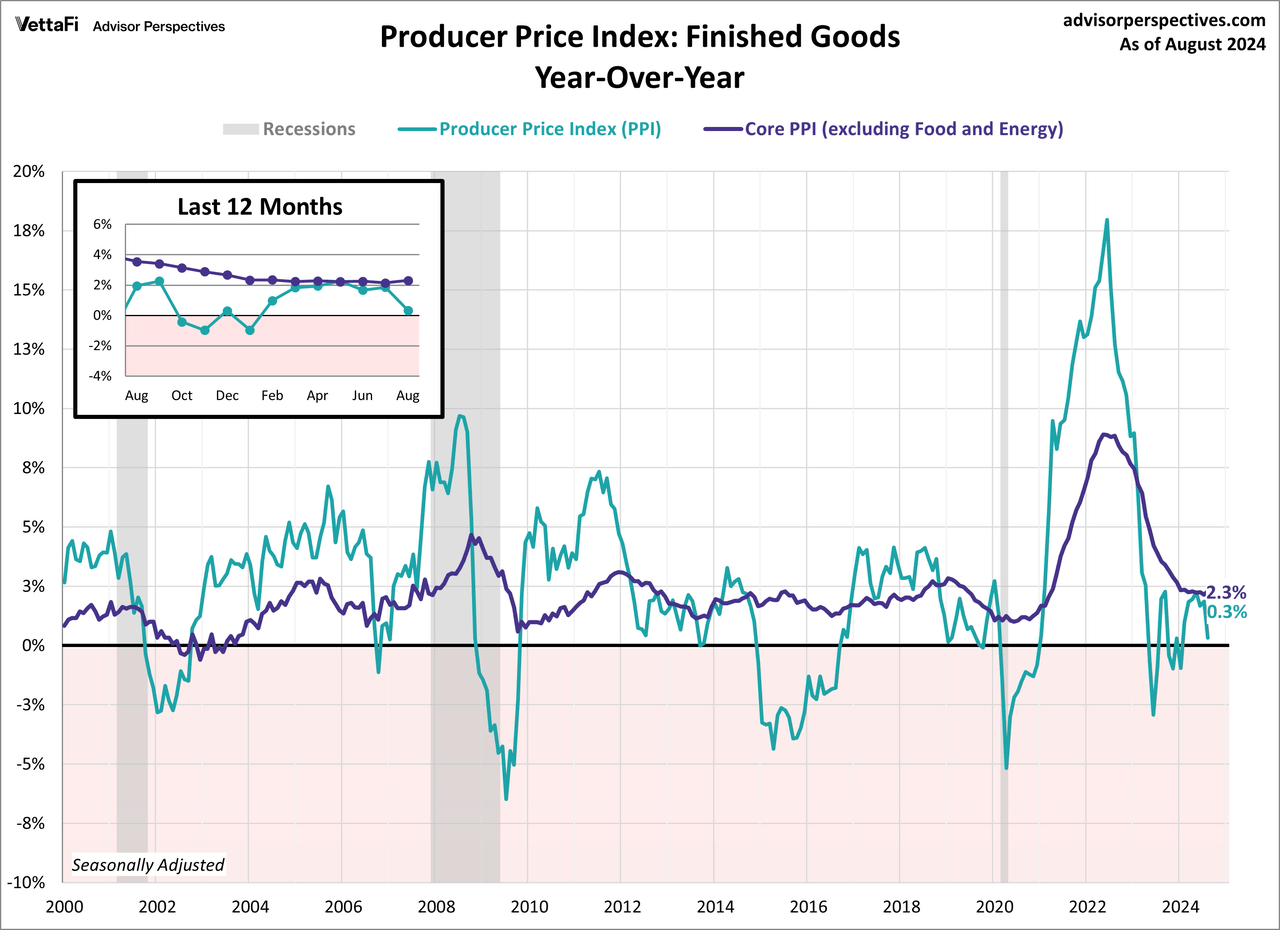

Producer Price Index: Finished Goods

The BLS shifted its focus to its new “final demand” series in 2014, a shift I support. However, the data for these series are only constructed back to November 2009 for headline and April 2010 for core.

Since our focus is on longer-term trends, we continue to track the legacy PPI for finished goods, which the BLS also includes in its monthly updates. We will see in a later overlay chart that the final demand and finished goods indexes are highly correlated.

The August PPI for finished goods rose 0.2% month-over-month seasonally adjusted, down from the previous month’s 0.5% decline. On an annual basis, headline PPI for finished goods is currently at 0.3% year-over-year, down from 1.9% the previous month (seasonally adjusted).

Core PPI for finished goods rose 0.3% month-over-month, up from the 0.1% in the previous month. On an annual basis, core PPI for finished goods is currently at 2.3% year-over-year, up from the 2.1% in the previous month (seasonally adjusted).

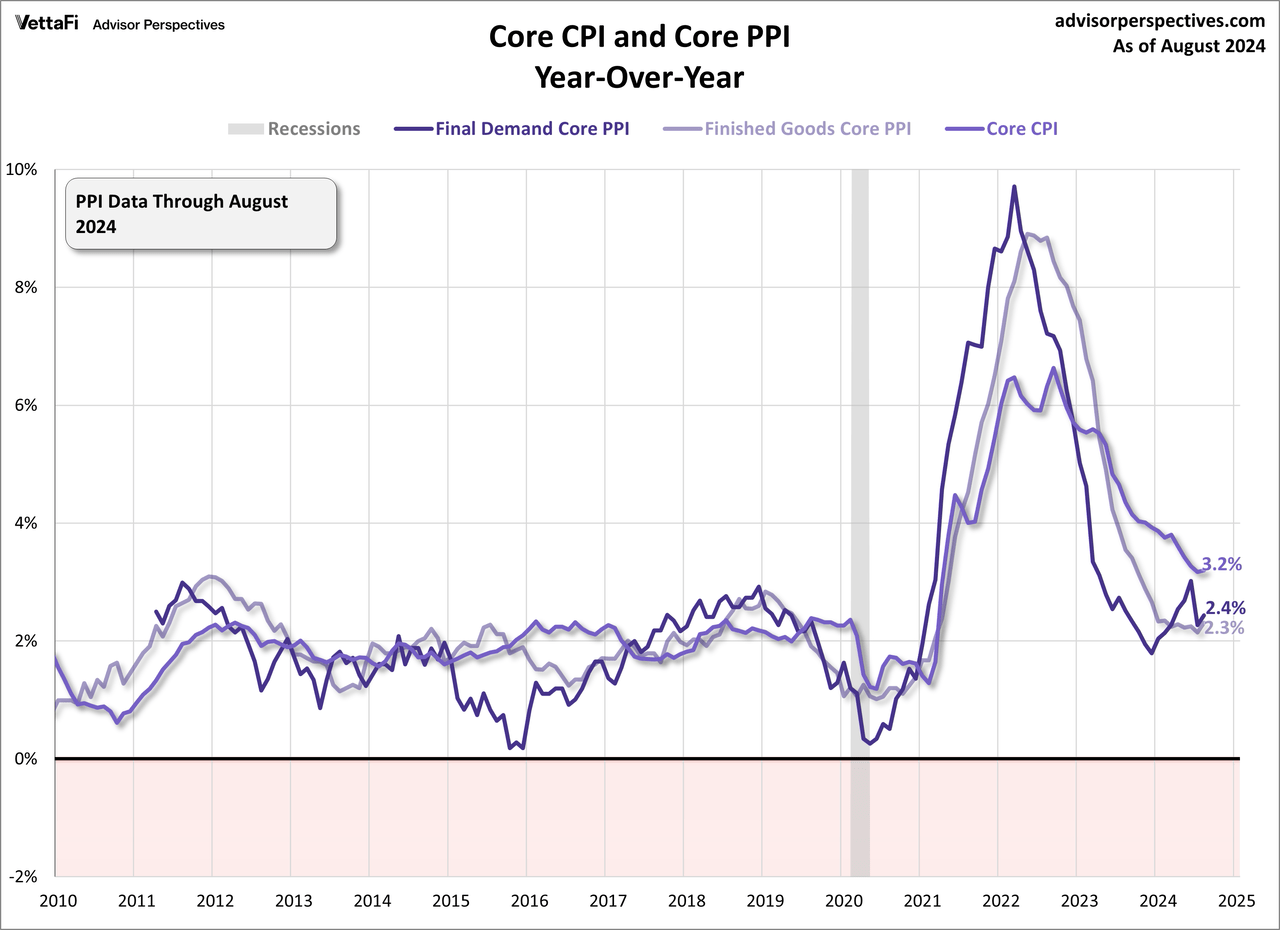

Producer Price Index (PPI) vs. Consumer Price Index (CPI)

Both PPI and CPI illustrate monthly price changes however, as their names suggest, the Producer Price Index measures price changes from the producer perspective whereas the Consumer Price Index measures price changes from the consumer perspective.

PPI is thought to be a leading indicator of consumer inflation because, for the most part, when producers pay more for goods and services they are likely to pass along those higher costs to the consumer.

With that being said, during the last recession producers were unable to pass along price increases, demonstrating the higher volatility of core PPI than core CPI.

The Fed has been in a tightening cycle to tackle high inflation, among other things. Inflation has eased over the few years, but the threat of a resurgence hangs in the air.

On the other hand, the threat of disinflation has started to emerge. Thus, a few big questions remain: “When will the Fed begin to cut rates?”, “Has the Fed waited too long to begin to cut rates?” and “Will there be a recession?”.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.