cemagraphics

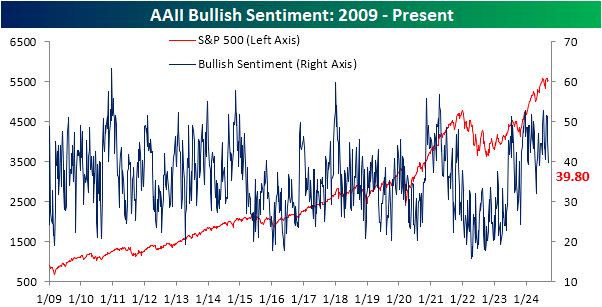

The typical seasonal September slump for stocks has left the S&P 500 (SPX) down 1.5% month-to-date. Regardless of the rebound in the past few sessions, the weak start to the month has put a dampener on investor sentiment. In the final two weeks of August, the percentage of respondents reporting as bullish to the AAII Investor Sentiment Survey came in above 50%. Since peaking the week of August 22nd at 51.6%, bullish sentiment has now slid for 3 straight weeks and is down to 39.8%. That is the lowest level of bullish sentiment and the first sub-40% reading since the first week of June.

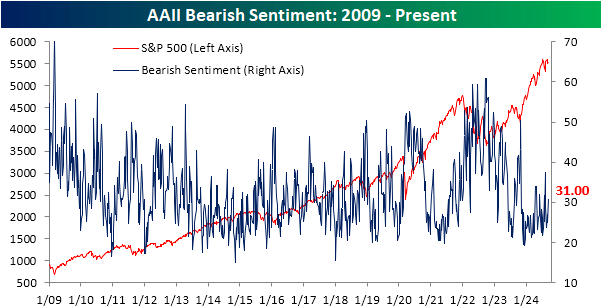

With the drop in bulls, bearish sentiment has been on the rise. Bears came in at 31% today, which is the highest level in five weeks and right in line with the historical average for that reading since the start of the survey in 1987.

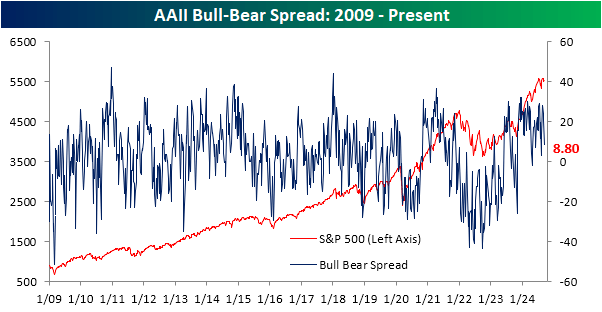

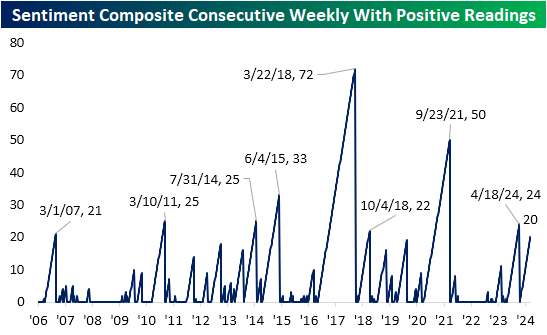

Bulls falling and bears rising would mean that the survey’s bull-bear spread has pivoted lower. The spread fell from a reading above 20 last week down to 8.8. While that is a significant drop, bulls still outnumber bears, as has been the case for the past 20 weeks. Through the history of the survey, there have only been 13 other streaks of 20+ weeks of positive bull-bear readings, the most recent of which ended this past April at 24 weeks.

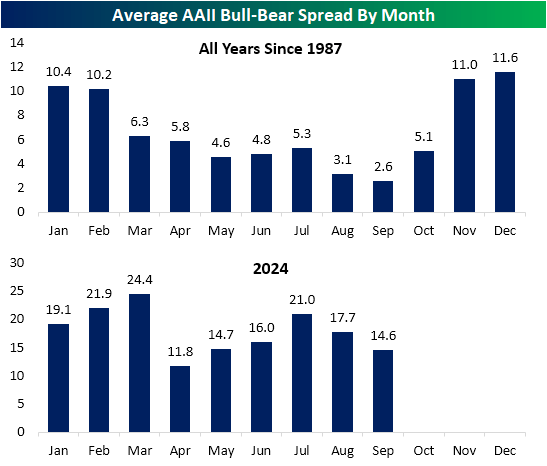

September has historically been a rough month for equities from a seasonal perspective. As such, sentiment has also tended to be weak. The charts below show the average bull-bear spread reading by month for all years since 1987 and so far in 2024. Sentiment is usually strongest at the bookends of the year (January and February) and tends to fall in the late-Summer, with September marking the annual low.This year has to some degree followed that pattern. Sentiment was strong in the first two months of the year and unusually carried through into March. Sentiment slumped in April but began to pick up through July before reversing lower in the past two months.

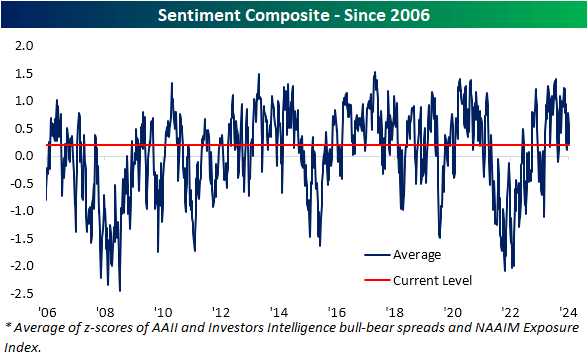

The AAII survey hasn’t been the only measure of sentiment to moderate lately. This week’s bull-bear spread in the Investors Intelligence survey similarly dropped, with the weakest reading since last November. The NAAIM Exposure index was modestly higher but continues to show equity exposure was significantly higher a couple of weeks ago. All combined into our sentiment composite, sentiment favors bullishness, but to the weakest level in a month.

Like the AAII survey, although investor outlooks are not as rosy as they were previously, it has been an impressive streak of net bullish readings. Our sentiment composite has now come in with a positive reading for 20 straight weeks. That immediately follows a 24-week-long streak that ended in April, with only one week of bearish sentiment in between the two. Before that, there were only seven other streaks that lasted at least 20 weeks. In other words, it has been an impressively long stretch of bullish investor sentiment.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.