Robert Way/iStock Editorial via Getty Images

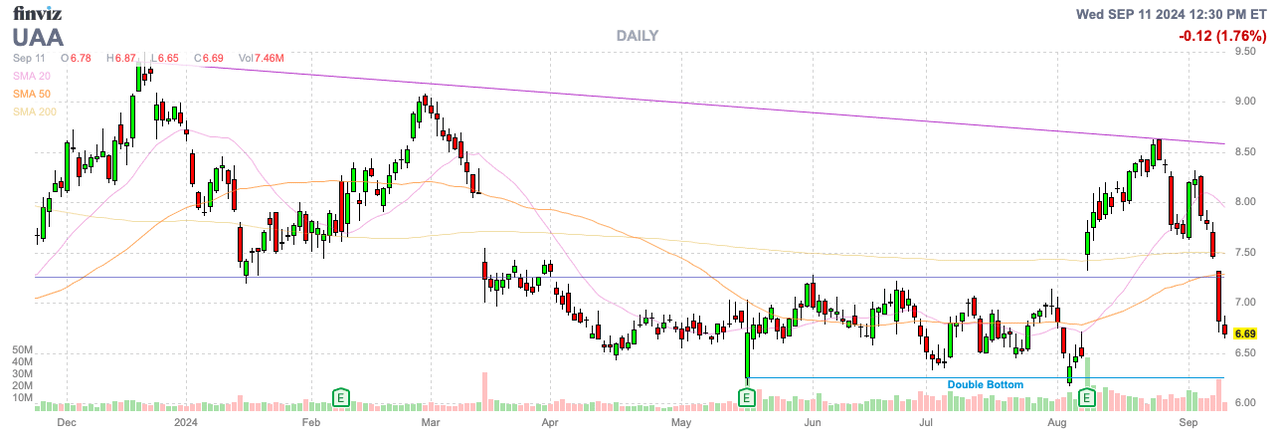

Under Armour, Inc. (NYSE:UA)(NYSE:UAA) seems to fall sometimes just for releasing news. The stock jumped following FQ1 results and signs that Stephen Curry is working with the athletic apparel retailer to expand the Curry Brand, yet a simple update crushed the stock. My investment thesis remains ultra-Bullish on the stock, with the return of founder Kevin Plank set to help return the company to glory.

Founder Returns

Under Armour is back on offense with the return of Kevin Plank, and hence the original stock rise following FQ1’25 results. The founder returned on April 1 and the August earnings call was naturally the first call where Plank had been in charge during the quarter and had over 5 months to articulate an updated plan by the call.

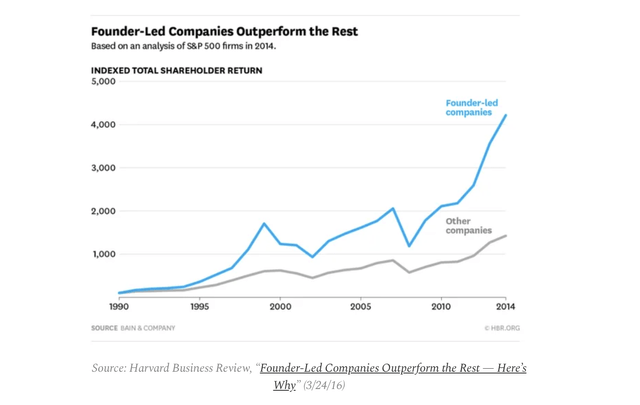

One key aspect of the investment thesis is Kevin Plank returning as the founder. A lot of the most successful companies, from Nvidia (NVDA) to Amazon (AMZN) and Apple (AAPL) in their heyday, was the leadership from a founder pushing innovation.

A company led by their founders can often benefit from the leader’s entrepreneurial spirit, lower bureaucracy, and clarity of vision. Research discovered founder CEOs were far more innovative than other S&P 500 firms visible via more patents and financial performance, while a Bain & Co. study saw 3.1x better performance over a 15-year period through 2014.

Source: Harvard Business Review

Ironically, though, all of the excitement of the founder returning and the better FQ1 results eroded after Under Armour updated the market with higher FY25 restructuring charges. The market doesn’t typically even care whether a company identified another $70 million of charges, mostly related to exiting a distribution facility in California by March 2026. In fact, Under Armour likely caused the stock to tank, with algos jumping on the headlines of the retailer slashing guidance with a larger operating loss.

Under Armour basically doubled the pre-tax restructuring charge to $140 to $160 million, yet the company only increased the operating loss to $220 to $240 million, up from the previous expectation of $194 to $214 million. The limited boost to the loss would suggest Under Armour is beating prior expectations.

The company updated the adjusted EPS target to $0.19 to $0.22 to match the original estimate. The reality is that investors should only care about this adjusted EPS target, questioning the need for an update by the retailer.

Besides, the numbers for FY25 aren’t particularly useful. The founding CEO returned right at the start of the fiscal year, and any updated plans won’t get rolling until the 2H of the year.

The acqui-hiring of Eric Liedtke could provide a huge boost to the brand value after the executive successfully implemented a brand overhaul for Adidas last decade. The executive will lead the brand strategy while continuing to lead and curate UNLESS, where Eric and other industry veterans worked since 2020 focused on sustainable clothing products.

Crazy Gap

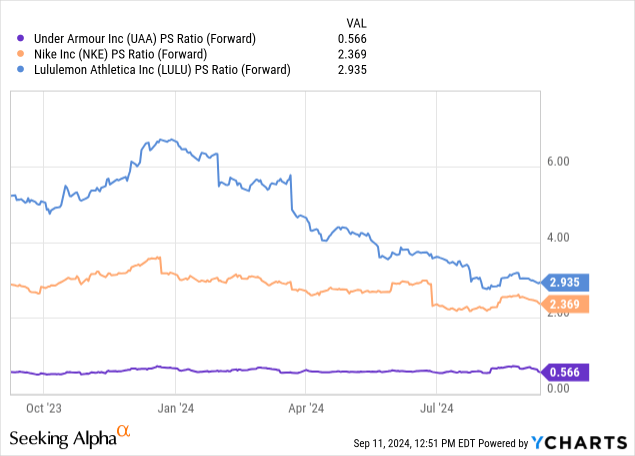

Even as Lululemon Athletica (LULU) has come back to the pack with weak results, the stock still trades at over 5x the forward P/S multiple of Under Armour. Even weak Nike (NKE) trades at 4x the multiple of UA, suggesting substantial upside on the brand returning to glory.

Sales gains will provide additional upside to the stock. Under Armour has already made progress in pushing the gross margin back up to 47.5%. As the company shifts more into premium pricing and away from promotional items with just a logo, the valuation multiple will improve.

The key here is for investors to understand how the market doesn’t even value the brand. Nike forecasts sales to slump 10% in FQ1’25, yet the stock still trades at a premium valuation. Under Armour needs to rally to the mid-$20s to be similarly valued as Nike, while higher gross margins and possibly growth rates with the return of Plank could ultimately lead to a higher multiple for Under Armour.

Takeaway

The key investor takeaway is that investors should continue using any weakness to load up on the stock. Under Armour is back to trading at the lows, while excitement over the return of the founder should lead to a higher multiple. Not to mention, if Plank is successful at turning around the retailer and returning the company to growth, Under Armour will be a home run at this valuation.