SusanneB

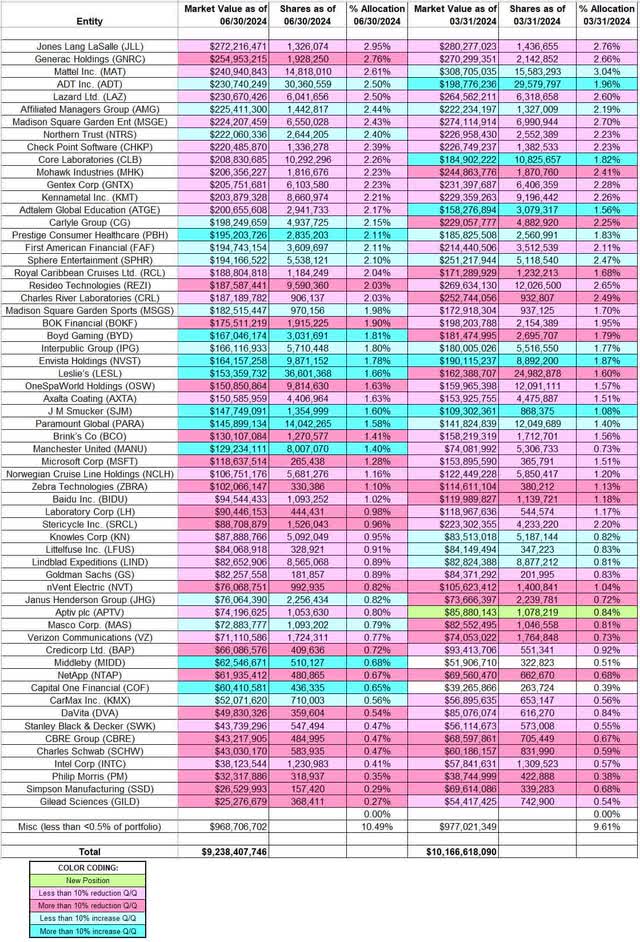

This article is part of a series that provides an ongoing analysis of the changes made to Ariel Investments’ 13F stock portfolio on a quarterly basis. It is based on Ariel Investments’ regulatory 13F Form filed on 08/14/2024. John Rogers’ 13F portfolio value decreased from $10.17B to $9.24B this quarter. The portfolio is diversified, with recent 13F reports showing around 150 positions. There are 61 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Jones Lang LaSelle, Generac Holdings, Mattel, ADT, and Lazard. They add up to ~14% of the portfolio. Please visit our Tracking John Rogers’ Ariel Investments Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2024.

Their flagship mutual fund is the Ariel Fund (MUTF:ARGFX) incepted in 1986. Ariel Fund has a lifetime annualized return of 10.53% compared to 10.34% for the Russell 2500 Index and 10.99% for the S&P 500 Index. The other mutual funds in the group are Ariel Appreciation Fund (MUTF:CAAPX), Ariel Focus Fund (MUTF:ARFFX), Ariel International Fund (MUTF:AINTX), and Ariel Global Fund (MUTF:AGLOX). They also co-manage the Schwab Ariel ESG ETF (NYSEARCA:SAEF).

Stake Increases:

ADT Inc. (ADT): ADT is currently a top five position at 2.5% of the portfolio. The original stake was increased by ~30% in the last quarter at prices between ~$6 and ~$7.50. This quarter also saw a ~3% stake increase. The stock currently trades at $6.90.

Affiliated Managers Group (AMG): The 2.44% AMG stake saw a ~9% increase this quarter at prices between ~$148 and ~$170. The stock is now at ~$165.

Northern Trust (NTRS): NTRS is a 2.40% very long-term position, first purchased in 2002. The 2002-2004 timeframe saw a ~10M share stake built at prices between ~$30 and ~$60. The position has since been sold down. The bulk of the selling was in the 2005-2007 timeframe at prices between ~$42 and ~$81. The stock currently trades at $87.23. There was a minor ~4% increase this quarter.

Carlyle Group (CG): The 2.15% CG stake was built during the two quarters through Q3 2023 at prices between $27.50 and $42. The stake was decreased by 24% during the last quarter at prices between $37.83 and $47.23. The stock currently trades at $37.75. This quarter saw a marginal increase.

First American Financial (FAF): FAF is a 2.11% of the portfolio stake established in 2011 at prices between ~$11 and ~$17. 2013 also saw a ~25% stake increase at prices between ~$21 and ~$28. Recent activity follows: There was a ~25% increase in Q1 2021 at prices between ~$51 and ~$58. The next quarter saw a ~15% selling at prices between ~$64 and ~$81. The stock is now at $64.44. The last several quarters saw only minor adjustments.

Sphere Entertainment (SPHR): The SPHR position came about as a result of the spin-out from MSG Entertainment. They had 6.66M shares of MSG Entertainment, which now trades under this ticker. The net stake was reduced by ~20% during Q2 2023 and another ~15% in the next quarter. This quarter saw an ~8% increase at prices between $32.49 and $49.16. The stock currently trades at $41.77.

Note: they control ~19% of the business.

Boyd Gaming (BYD), Capital One Financial (COF), CarMax, Inc. (KMX), Envista Holdings (NVST), Interpublic Group (IPG), J. M. Smucker (SJM), Leslie’s (LESL), Madison Square Garden Sports (MSGS), Janus Henderson Group (JHG), Manchester United (MANU), Masco Corp. (MAS), Middleby (MIDD), Prestige Consumer Healthcare (PBH), and Paramount Global (PARA): These positions were increased this quarter.

Note: They have significant ownership stakes in Manchester United and Prestige Consumer Healthcare.

Stake Decreases:

Jones Lang LaSalle (JLL): The 2.95% JLL position is currently the largest 13F stake. It is a very long-term position, first purchased in 2001. Next year saw a huge stake build-up at prices between ~$14.50 and ~$25. The position had seen selling since 2004. The bulk of the selling happened in 2006 at prices between ~$55 and ~$93. Recent activity follows. H2 2020 saw a ~25% stake increase at prices between ~$90 and ~$154. That was followed with a ~11% increase during Q1 2023 at prices between ~$137 and ~$185. There was an ~8% trimming this quarter at prices between ~$173 and ~$212. The stock currently trades at ~$254.

Generac Holdings (GNRC): GNRC is a 2.76% stake that saw a ~27% increase during Q1 2023 at prices between ~$98 and ~$135. There was a ~15% increase during Q3 2023 at prices between ~$103 and ~$154. This quarter saw a ~10% trimming at prices between ~$127 and ~$154. The stock is now at ~$143.

Mattel, Inc. (MAT): MAT is currently a top three stake at 2.61% of the portfolio. It was first purchased in 2016 at prices between ~$25 and ~$34. Next year saw a stake doubling at prices between ~$13 and ~$30.50. 2018 also saw a one-third stake increase at prices between ~$9.50 and ~$18. The stock currently trades at $18.23. There was minor trimming this quarter.

Lazard, Inc. (LAZ): LAZ is a 2.50% of the portfolio position, first purchased in 2009 at prices between ~$19 and ~$38. The next year saw a stake-tripling at prices between ~$25 and ~$36. In 2014, there was a ~25% selling at prices between ~$39 and ~$50. Recent activity follows. The three quarters through Q3 2021 saw a ~45% stake increase at prices between $38.70 and $48.75. The stock is now at $45.57. There was a ~40% trimming in the last two years. They are harvesting gains.

Note: Ariel Investments has a ~5.7% ownership stake in Lazard.

Check Point Software (CHKP): The 2.39% stake in CHKP was built during H2 2023 at prices between ~$125 and ~$154 and the stock currently trades at ~$190. There was a ~12% trimming over the last two quarters.

Mohawk Industries (MHK): MHK is a 2.23% of the portfolio position built over the three years through Q1 2022 at prices between ~$117 and ~$230. The stake was decreased by 13% during the last quarter at prices between ~$98 and ~$131. This quarter also saw a ~3% trimming. The stock is now at ~$148.

Gentex Corp. (GNTX): The 2.23% GNTX stake was purchased in Q3 2021 at prices between ~$27.50 and ~$38. Q3 2023 saw an ~18% selling at prices between ~$29 and ~$34. The stock currently trades at $29.26. There was a minor ~5% trimming this quarter.

Kennametal Inc. (KMT): KMT is a 2.21% of the portfolio position. It was established in 2014 at prices between $34 and $52. The position had seen minor buying over the years. Q1 2020 saw a ~15% stake increase at prices between $15 and $37. The three quarters through Q3 2021 had seen another ~43% stake increase at prices between ~$33 and ~$42. The stock currently trades at $24.73. The last few quarters have seen minor trimming.

Note: Ariel Investments has a ~11% ownership stake in Kennametal Inc.

Resideo Technologies (REZI): The ~2% REZI stake was built during the three quarters through Q2 2022 at prices between ~$19.50 and ~$28 and the stock currently trades below that range at $18.15. There was a ~20% trimming this quarter at prices between $19.20 and $22.34.

Note: They have a ~7% ownership stake in the business.

Charles River Laboratories (CRL): The CRL stake saw a ~50% stake increase during Q2 2023 at prices between ~$184 and ~$210. The next quarter saw a minor increase while during Q4 2023 there was marginal trimming. The stake was decreased by 11% in the last quarter at prices between ~$204 and ~$273. The stock currently trades at ~$194 and the stake is at ~2% of the portfolio. There was a minor ~3% trimming this quarter.

Microsoft Corp. (MSFT): MSFT is now at 1.28% of the 13F portfolio. It was a very small stake, first purchased in 2010. The 2013-2015 timeframe saw a 2.2M share build-up at prices between ~$26 and ~$56. Recent activity follows: The first three quarters of 2023 saw a ~50% reduction at prices between ~$222 and ~$358. Q4 2023 saw another ~37% selling at prices between ~$313 and ~$383. This quarter also saw a ~27% further selling at prices between ~$388 and ~$452. The stock currently trades at ~$423. They are harvesting gains.

Baidu, Inc. (BIDU): BIDU is currently at ~1% of the portfolio. It was established in 2013 with the bulk of the current position purchased in 2015 at prices between ~$134 and ~$234. The stake has wavered. Recent activity follows. Q3 2023 saw a ~22% selling at prices between ~$125 and ~$156. That was followed by another ~30% reduction in the next quarter at prices between ~$105 and ~$135. The stake was decreased by 25% in the last quarter at prices between ~$98 and ~$118. The stock currently trades at $83.95. This quarter saw a minor ~4% trimming.

Aptiv PLC (APTV): The small 0.80% APTV position was established during the last quarter at prices between $76.20 and $90.17. The stock currently trades at $65.47. There was a minor ~2% trimming this quarter.

Philip Morris (PM): A very small position in PM was first purchased in 2013. By 2017, the stake was built to a ~1M share stake. Next year saw the position increased by ~220% at prices between $66 and $110. Recent activity follows. There was a ~18% selling during Q3 2023 at prices between ~$90 and ~$99. That was followed by a ~48% reduction in the next quarter at prices between ~$87 and ~$95. The stake was decreased by 67% in the last quarter at prices between $87.76 and $94.97. That was followed by a ~25% reduction this quarter at prices between ~$87 and ~$103. The stock currently trades at ~$125, and it is now a very small position at 0.35% of the portfolio.

Adtalem Global Education (ATGE), Axalta Coating (AXTA), Brink’s Co. (BCO), BOK Financial (BOKF), Core Laboratories (CLB), CBRE Group (CBRE), Charles Schwab (SCHW), Credicorp Ltd. (BAP), DaVita (DVA), Goldman Sachs (GS), Gilead Sciences (GILD), Intel Corp. (INTC), Knowles Corp. (KN), Labcorp Holdings (LH), Littelfuse, Inc. (LFUS), Lindblad Expeditions (LIND), Madison Square Garden Entertainment (MSGE), Norwegian Cruise Line Holdings (NCLH), NetApp (NTAP), nVent Electric (NVT), OneSpaWorld Holdings (OSW), Royal Caribbean Cruises Ltd. (RCL), Stanley Black & Decker (SWK), Simpson Manufacturing (SSD), Stericycle, Inc. (SRCL), Verizon Communications (VZ), and Zebra Technologies (ZBRA): These positions were reduced during the quarter.

Note: They have significant ownership stakes in Adtalem Global Education, Core Laboratories, Knowles Corp., Lindblad Expeditions, and OneSpaWorld Holdings.

Below is a spreadsheet that shows the changes to John Rogers’ Ariel Investments 13F portfolio holdings as of Q2 2024:

John Rogers – Ariel Investments – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Ariel Investments’ 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.