PPAMPicture

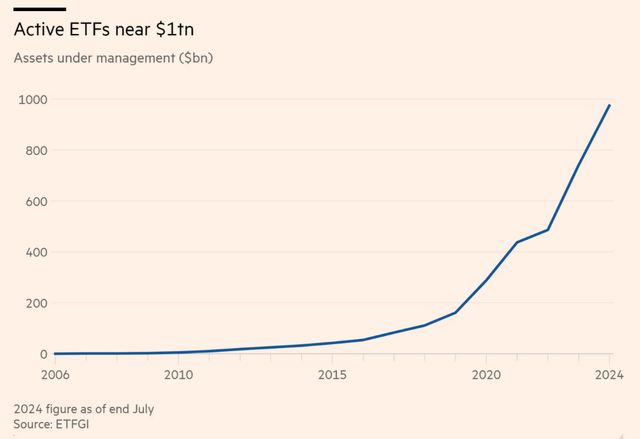

The era of passive being the primary ETF inflow trend is long gone. Actively managed ETFs have surged in popularity in the past few years. The Financial Times reported that active is on the rise so much so that its total assets under management will likely swell to more than $1 trillion by the end of this year.

Now, we must clarify that “active” funds are not your father’s style of selecting stocks and then tactically tweaking a portfolio over the years. Rather, modern active ETFs feature specific, often quantitative, strategies, such as selling options to generate income.

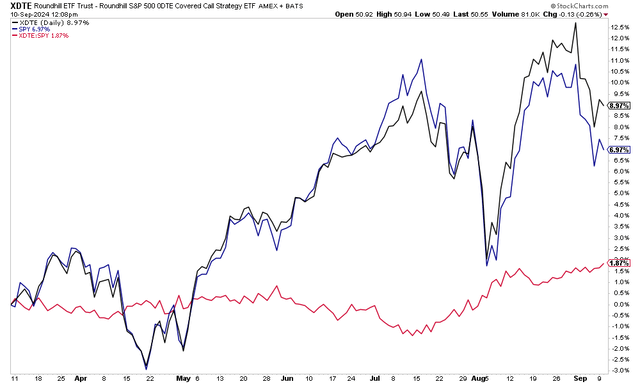

The Roundhill S&P 500 0DTE Covered Call Strategy ETF (BATS:XDTE) is an emerging product that fits that mold. While still modest in size, its total return has been strong, outperforming the S&P 500 ETF (SPY) since its inception this past March.

I have a buy rating on the ETF but urge investors to consider the fund’s cost and its broader strategy when it comes to long-term asset allocation. I don’t expect this zero days to expiration (0DTE) covered call play to produce alpha over multiple market cycles due to the high fee and the nature of option selling as it is generally simply a tradeoff of risk and upside potential.

Active ETFs’ Popularity Surges

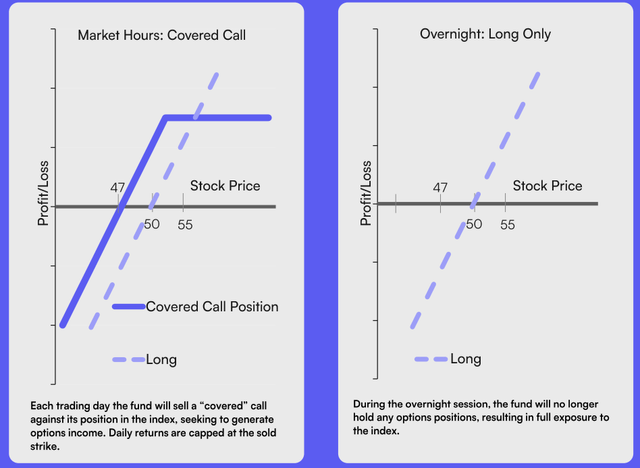

According to the issuer, XDTE is the first ETF to utilize zero-day expiry options on the S&P 500. XDTE seeks to provide overnight exposure to the S&P 500 and generate income each morning by selling out-of-the-money 0DTE calls on the Index. XDTE is an actively managed ETF.

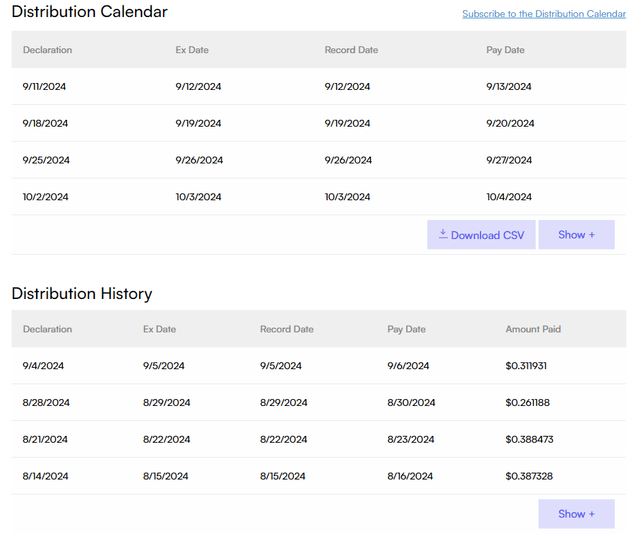

XDTE is a small ETF with just $113 million in assets under management as of September 9, 2024. But that’s respectable considering that the fund debuted in Q1 of this year. Its annual expense ratio is high at 0.95% and the current yield (distribution rate), noted on the fund’s website, is 25.93%. That distribution rate largely comes from selling option premiums, not from, say, cash flows of individual company stock holdings as you might find with traditional funds.

Share-price momentum has been solid since March, with XDTE trading sideways and paying a high yield along the way. Risk levels are mixed, and prospective investors should acknowledge that the fund will likely underperform when the S&P 500 rises quickly.

The ETF will likely outperform, though, when the S&P 500 moves sideways to down. Finally, liquidity metrics are mixed – XDTE features an average daily volume of about 70,000 shares while its 30-day median bid/ask spread is 0.14%, so using limit orders during the trading day is a good practice, in my opinion.

Mechanically, the ETF sells 0DTE calls on the S&P 500 as a covered call play. It issues weekly distributions from premium earned selling out-of-the-money calls. It’s also key to point out that XDTE is a long-only S&P 500 product from the market close to the following day’s open. So, if we see a major gap down on, say, a Monday morning from turmoil over the weekend, then XDTE is exposed to the same risk.

XDTE Summary

Roundhill ETFs

XDTE: Covered Call Exposure During Market Hours, Long-Only Exposure Overnight

Income investors are likely drawn to XDTE’s high payout rate. In fact, the fund has distributed dividends on the order of $0.26 to $0.39 per share over each of the last handful of weeks. Future payouts are expected to occur on upcoming Fridays – sort of like receiving a paycheck. Of course, the fund should be treated as a risky asset and not a predictable income stream.

In general, the higher the implied volatility on the S&P 500’s near-dated options, the more income can be generated from selling upside calls. I will assert later in the article that the current market environment is conducive to a solid return since the SPX has been without an uptrend in the last few months with heightened volatility.

XDTE Distribution Calendar & History

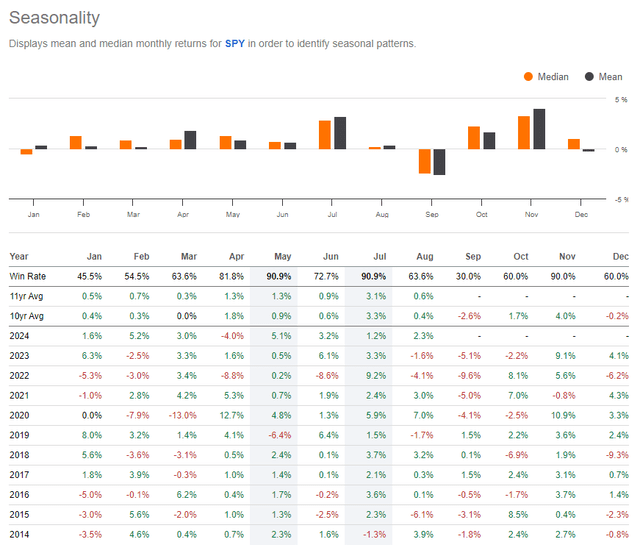

Seasonally, now is also an ideal time to take a slightly more defensive stance in Markets. September is historically the worst month of the year, and we often see enhanced volatility ahead of the US general elections into late October. That setup is favorable for owning XDTE as opposed to an outright-long SPX position.

S&P 500 Seasonality: Weak September Trends

With the S&P 500 trading under its peak from July 16, but still trending higher, it has been a good time to be long XDTE. Since its inception, the ETF has returned about 9% – more than a percentage point above the performance of the S&P 500 ETF. Alpha, as charted by the red line below, has been on the rise since the middle of July when the SPX topped out. With the Volatility Index (VIX) hovering around 20 lately, that’s an added option premium to be collected by the fund.

A cautionary tale is seen in what happened in early August, however. While XDTE outperformed SPY during the Tokyo crash, it had no protection from the close on Friday, August 2 to the open on Monday, August 5. Selling out-of-the-money calls is by no means a strictly protective play (buying puts would achieve that effort), but during trading hours, XDTE may offer a slightly below-market beta.

XDTE Outperforming the S&P 500 ETF Since Mid-July

The Bottom Line

I have a short-term buy rating on XDTE. With elevated volatility in the S&P 500 today, a trendless price range ongoing, and slightly bearish seasonality in play over the next several weeks before the US election, I anticipate XDTE outperforming SPY.