Ljupco/iStock via Getty Images

Investment Thesis

LifeMD, Inc. (NASDAQ:LFMD) reported a mixed Q2 2024 earnings result and guidance. Management states that its non-core asset, WorkSimpli, had some mishaps in Q2, but these aspects are now behind themselves.

And yet, this was the same narrative that they provided last quarter. Consequently, I now believe that WorkSimpli has no value. Or better put, I award it no value, as I do not believe management has any ability to monetize its WorkSimpli asset. If LifeMD took serious measures to sell WorkSimpli, this would provide investors with some upside potential.

For my part, I’ve only focused on its GLP1 offering and related telehealth business.

And still, even as cut back on all my future assumptions for LifeMD, I continue to believe that this stock is priced at 14x forward EBITDA. And I continue to believe that this stock has a lot of upside potential.

However, I revise my price target from $20 to $15 per share by summer 2025. In essence, I’m bullish on LFMD, even though I’m disappointed with management’s over-promising and under-delivered actions.

Why LifeMD? Why Now?

LifeMD is a telehealth company that provides convenient access to medical care and wellness products. It allows patients to consult doctors online, receive prescriptions, and get medications delivered to their doorsteps. By offering a range of services from primary care to specialized treatments, LifeMD aims to make healthcare more accessible and efficient for everyone, eliminating the need for in-person visits for many common health issues.

The thesis is not straightforward, since it owns WorkSimpli, a DocuSign like a business too, as a non-core asset. Management has for a long time stated that it would sell this business unit. But so far, it appears unwilling to do so, after quarters of stating that it’s intending to do so “near-year.” A narrative that management has been given since around 2022.

The core of the narrative and the core of my thesis are on LifeMD’s GLP1 prospects. Given that LifeMD’s GLP1 prospects are still nascent, it’s difficult to get too much information on the sustainability of its patient demand. During the earnings call, management discussed how its retention figures are better than expected, but they don’t have any figures, so it’s difficult to give any weight to these words.

Given this background, let’s now discuss its fundamentals.

LifeMD Reaffirms Its Guidance, But Details Matter

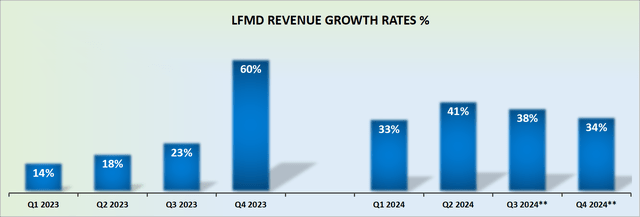

LFMD Revenue Growth Rates (Author’s Work)

The market loves to get behind elementary stories. And the story with LFMD is far from simple.

- There are two different businesses. That’s one problem.

- The next issue is that WorkSimpli, while it makes a fair amount of cash flow for LifeMD, it’s rapidly shrinking in size. So, that’s one aspect that the market is giving no value to. And for my part, I’m also writing it off. I don’t buy management’s spiel that they’ll ever manage to spin off this business.

- Thirdly, while GLP1 is growing extremely fast, the market is unwilling to give any credence to these prospects. This is because of the news that GLP1 is soon coming off the shortages list, which will see the price of these weight-loss compounds fall dramatically.

Please re-read all these points, so you can understand the issue that this business faces, in getting investors’ trust.

In other words, yes, the business is growing very fast, but investors are cautious. To summarize it further, there’s a lot of uncertainty over its future prospects.

Meanwhile, my contention is that even if GLP1 drugs and weight loss become commoditized, this doesn’t stop LifeMD from gaining market share in this opportunity. It’s like any commodity. Just because you can buy oil from different places doesn’t make it worthless.

Given these unvarnished considerations, let’s now discuss its valuation.

LFMD Stock Valuation – 10x EBITDA

Previously, LifeMD stated that its telehealth business would deliver about $3 million to $5 million in Q4 2024. Now, its telehealth guidance implies that its EBITDA figures in Q4 will be around $2.5 million.

So there is a progression in the profitability of its telehealth business, see the graph above. But this is unquestionably less than I had expected. Is management being conservative? I don’t know.

But this is what I do know. LifeMD stated in its Q1 earnings call that its telehealth business would only turn profitable in Q3 2024. And yet, here we are in Q2 2024 and its telehealth business has already delivered $800K EBITDA profit, which is an impressive figure to deliver ahead of schedule. So, again, this indicates that this telehealth business can be seriously profitable, but then again, what of its Q4 guidance?

And yet again, keep in mind that management had previously stated that its telehealth business could make $20 million of EBITDA in 2025. Will management reach this target? I don’t know. So, I’ve put in a margin of safety into my assumption and assumed that LifeMD’s EBITDA will instead deliver $15 to $18 million in 2025.

Therefore, the stock is priced at about 14x next year’s EBITDA. Moreover, the business has about $18 million of net cash, meaning that its market cap has about 7% of net cash in it.

What’s more, the way GLP1 business operates is that they get a lot of cash upfront, for the future delivery of the drugs. You can see that in its cash flow statement, under deferred revenues:

LFMD Q2 2024

This means that on a cash flow basis, LifeMD is even cheaper than my estimate of 10x forward EBITDA.

So, even as I strip this business down beyond the bare bones, I continue to strongly believe that this stock is compelling. But I’ve now written down my estimate from $20 per share down to $15 per share by summer 2025.

Risk Factors to Consider

-

Management’s credibility issues: Repeated failure to deliver on promises, particularly regarding selling the non-core WorkSimpli asset, raises concerns about the management’s ability to execute plans.

-

Uncertainty in GLP1 business prospects: While GLP1 is growing fast, there is uncertainty about patient demand sustainability, compounded by management’s lack of concrete data on retention figures and the potential price drop due to the drug coming off the shortage list.

-

Shrinking non-core asset value: WorkSimpli, although generating cash flow, is rapidly shrinking in size, and both the market and the author are assigning it no value, which diminishes the company’s overall asset base.

The Bottom Line

Even with stringent assumptions, I believe LifeMD is a compelling investment at 10x forward EBITDA. The company’s strong balance sheet, bolstered by $18 million in net cash, provides a solid foundation for growth.

Despite the challenges, such as management’s over-promising and the uncertain future of the WorkSimpli business unit, LifeMD’s core telehealth and GLP1 offerings demonstrate significant potential.

The business is not without its blemishes, but the underlying fundamentals and market position suggest substantial upside. Given these factors, I remain confident in LifeMD’s value proposition-it’s a “healthy” investment at a bargain price.

But I still have downgraded my rating on this stock to $10 to $15 per share (down from my previous assumption of $20 per share). At its core, this is a high-return, high-risk investment and readers should size this appropriately in their portfolios.