Marilyn Nieves/iStock Unreleased via Getty Images

Introduction

Garmin Ltd. (NYSE:GRMN) recently reported its Q2 earnings, so I thought I’d revisit the company once again to see if the beat and a raise changed my mind about it. I do think the company is worth more than previously assumed because of the great performance recently. However, I am still in no rush to purchase any shares. I would like to see how the rest of the year turns out in terms of the company and the global economy.

Q2 Results

GRMN’s top line came in at $1.51B, a beat of $73m, and a 14% y/y growth. Pro forma EPS and GAAP EPS came in at $1.58 and $1.56, respectively. A beat of $0.14 vs. consensus estimated and around 9% growth y/y, which may not seem like much, but the company paid double in tax this time around, compared to the previous year (8.9% vs 17.9%). In terms of margins, GM is flat sequentially, while operating margins saw around 200bps expansion q/q and around 120bps y/y. No mention of what had changed to improve the company’s operating margins, but it would be safe to assume a better product mix was a big part of it.

The company went ahead and increased its guidance for the rest of the year. The management is looking at $5.95B in revenues vs. consensus $5.83B and pro forma EPS of $6.00 vs. consensus $5.69. Gross margins to stay at 57% while operating margins will be around 21.3%.

In terms of the company’s financial position, as of the latest quarter, GRMN had around $2.2B in cash and equivalents, against zero debt. It’s a great position to be in. The company’s cash flows are free to be used as the management sees fit, without the burden of annual interest expenses on debt.

Overall, a beat and a raise are very positive for the company. However, comparing it to the previous quarters, especially Q1 ’24, there has been a slight slowdown in the top-line growth. I don’t think it is anything to be worried about, especially because consensus expected less, and that Q4 and Q3 ’23 were in similar ranges. Last quarter, the company’s fitness and automotive OEM did spectacularly, so I wasn’t too surprised that these did come down slightly this quarter. However, those are still very healthy growth numbers.

Comments on the Outlook

I am quite impressed with how the fitness and auto OEM have been progressing throughout the last few quarters. It is not a surprise that the company saw some slowdown here. However, I would like to see the management taking it up a notch to continue to at least grow at 20% growth for the foreseeable future if they want the company’s valuation to align.

The next quarter will have two months of summer, so I am expecting continued strength in the fitness segment, while hopefully, the company’s outdoor business will see a tick-up because it has been rather disappointing over the last few quarters. The same goes for the other laggard, the Aviation segment, although I’m not sure what kind of growth numbers Aviation could do. Nowhere near the Fitness or Auto OEM segments.

Speaking of Auto OEM, the company’s quickly becoming a go-to manufacturer for many car brands. The company’s innovations are paying off, as evidenced by a very impressive growth rate in the segment, which, if it continues, could really drive the company’s top-line growth to new levels.

I would like to see the company establish more partnerships with automakers, so the momentum builds up and continues to go strong and be the main catalyst of the revenue growth going forward. If the company maintains this momentum of growth in the Auto segment, in 5 years, the segment will overtake many of the well-established segments of the company.

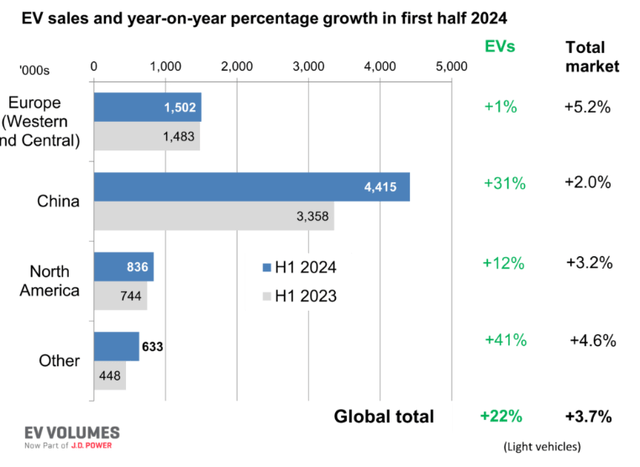

Everyone knows that the electric vehicle (“EV”) market has been in a bit of trouble recently, after an exceptional few years in 2020, and 2021. Nevertheless, it appears that EVs are making a comeback. In the first half of 2024, global EV sales came in at 22% compared to the same half last year, which is well above the market growth. Most of the growth can be attributed to China.

As we can see, Europe continues to underperform, which according to this article, may be because incentives weren’t as enticing as they were just a few years back, leading to less production overall. Nevertheless, EVs are not going anywhere and will continue to become more cost-efficient as new iterations come out. It may not seem worth it to get one right now because of how expensive it is to maintain it, especially if something unexpected happens. However, hybrids and ICE vehicles will continue to pick up the slack here, so Garmin is not limited as its products most likely cover all these vehicles.

Valuation

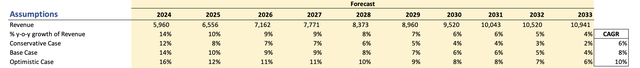

In light of the updated outlook for the year, I decided to look back at my assumptions from June, I was already assuming around $6 a share on EPS so that basically stayed the same. What I did change was the company’s revenue outlook.

Instead of around 6% CAGR for the next decade, I went with 8% CAGR due to very well-performing segments like the Fitness and Auto OEM.

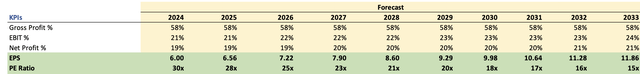

For Margins and EPS, see an updated table also, since revenue did go up slightly.

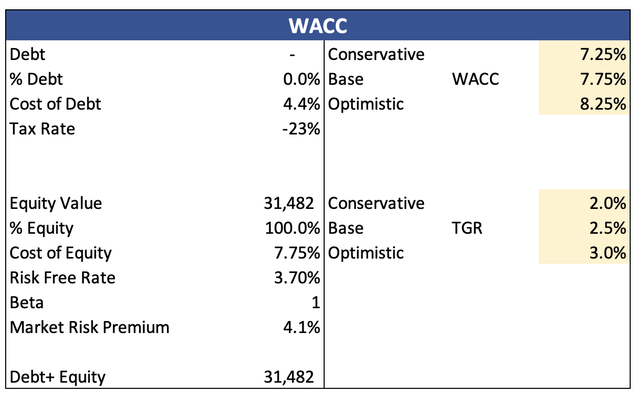

For the discounted cash flow (“DCF”) model, I went with the company’s WACC of 7.75% as my discount rate and a 2.5% terminal growth rate.

Additionally, I decided not to discount the final intrinsic value because the company has zero debt, and I feel that I may have been quite conservative on the company’s margin profile over the long run. With that said, GRMN’s intrinsic value is around $147 and slightly higher than what I had in June ($119 a share).

Closing Comments

What would change my mind about Garmin Ltd. is if the laggards start to perform on par with the Fitness and Auto OEM segments and if the momentum remains in the said segments. The company’s revenue growth has not been the greatest, around 7% in the past 10 years, 8.6% in the last 5, and 2.4% in the last 3, so it looks worse, however, high inflation and interest rates did play a massive role here. I would expect the company to at least return to its 10-year CAGR, and ideally, even higher for me to justify the company’s current valuation. For now, I am in no rush to start a position and will continue to monitor how the company will progress over the other half of the year and how the global economy will turn out. Are we going to see a recession that will be severe or a soft landing? Or no recession at all? Time will tell.

I really like the company and what it is producing. However, I don’t think I am comfortable starting a position here.