AlpamayoPhoto

As I have written here for some time, I see this as the most or one of the most dangerous environment stocks in my 38-year professional investing career. Which does not mean returns need to be poor across the board. But it does mean that investors are not likely to get away with some of the things that have worked in recent years.

It is also why I firmly believe (and practice in my own portfolio) that tactical rotation of position sizes among the stocks I own, and supplementing my stock portfolio by buying/owning put and call options on major market indexes, is essential. That said, these are not skills that new investors can pick up as easily as “buy and hold.” And I certainly don’t expect everyone to invest like me!

But I will say this: learning to play defense alongside one’s offense, and invest in the markets of today, not the ones that produced a gaudy 15-year run for the S&P 500 index and the Nasdaq 100, might be the difference between my Baby Boomer peers’ ability to maintain their lifestyle the next time the market dives. Whether that has already started or not is the subject of another upcoming article. One subject at a time.

As in the NFL, these stocks are vying for roster spots…in my portfolio

As I see it, a good next step at this stage of the market cycle (very late in it, I think) is to start collecting a short-list of names to buy after a potential “all fall down” scenario a la 2000-2003, 2007-2008 or even early 2020 and much of 2022. Investors have to decide themselves if the “long-term” from here is a repeat of the slim pickings we’ve seen the past 32 months, or something more democratic in terms of what can perform.

Plenty of investors habitually check the stocks that have reached “52-week highs” in hopes of tagging along with current momentum. I do a bit of that, but not nearly as often as I am scouting underperformers. That includes not only the classic “value” stock approach, but also using my core competency, technical (chart) analysis to determine intermediate to long-term entry points once a stock has passed my fundamental and corporate stability analysis.

With the National Football League having just started its season, I can’t help but liken this process to an NFL training camp. I only have a limited number of “roster spots” in my portfolio, and my next article will review my progress on the 40-stock portfolio of stocks based on my YARP™ dividend methodology, which I wrote about earlier this year. Hopefully, some of the stocks on this list that I don’t already own or at least follow will poke their heads up to earn a spot on my own “roster.”

Not surprisingly, when I did the study that is the focus of this article, several stocks I own, or I am considering for my “top 40” list are on this list of multi-year laggards. That’s because 4 months ago, when I officially started running YARP as a portfolio, and not just a stock research tool, most in this group were already well off their peak levels of 2022-2024.

More than 180 S&P 500 stocks down since early 2022. Here’s the list.

I conducted a quick study to see how the stocks across the S&P 500 index have actually performed since the Fed started raising rates in early 2022. Here’s the headline, and I’ll detail more of the study and some of the stocks of interest below.

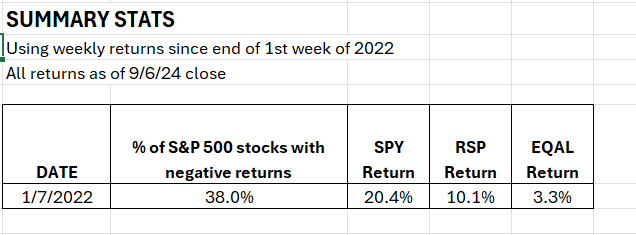

First, let’s think about what this means. So many investors are walking around thinking, “the stock market has been great.” And parts of it surely have. But this is the last 32 months in the table below, through last Friday, including dividends. SPY is up 20% in those 32 months, so around 6-7% annualized. The equal weighted S&P 500 ETF (RSP) is up only 10%. And if we extend that equal weighted analysis out to the top 1000 stocks by size, which is what EQAL tracks, we get a 3% gain. Total, in 32 months!

SungardenInvestment.com (Rob Isbitts)

Translation: most of the S&P 500 has spent nearly 3 years not moving higher, or gyrating up and down, but ending up nowhere. There are many S&P 500 components that have produced zero return over the past many years. Again, perhaps another subject for another article. This is all about 2 things:

1. Understanding the true market climate. 2022 was rough, 2023 was selectively good, which made up for 2022. And 2024 has lifted some stocks higher. But many have not really done anything, or way worse than that, since a new era of non-zero interest rates started in early 2022.

2. Using that fact in #1 above to try to identify some future buy candidates. Because, as I’ve noted in past articles and on my last Seeking Alpha Investing Experts podcast guest spot, this is either a market going through the early stages of a vicious topping process, or it is the proverbial “pause that refreshes.” That is, so many stocks have done nothing for a few years, and if that continues another 6-24 months or so, that will allow earnings to catch up, and eventually, we’ll see a needed reversal of the so-called “multiple expansion” which has helped the S&P 500 “headline” index look good, while more than 1/3 of its components stocks have either added nothing to index performance, or detracted from it.

186 S&P 500 stocks down since 1/7/22

Here’s the long list. Below that, I summarize my thoughts and highlight a small number of these that I am going to do more work on, based on their possessing high Seeking Alpha Profitability Grades and reasonably high dividend yields. Those are 2 of several inputs to my own stock selection process. Note that neither is an outright timing indicator.

This is still very much the research portion of what I do. My current portfolio, stocks, options, and ETFs, keeps me plenty busy for now! But I’m always looking forward.

| S&P 500 stocks with negative returns since 1/7/22 | ||

| Ticker | Name | Return |

| A | Agilent Technologies Inc | -3.8% |

| AAL | American Airlines Group Inc | -43.9% |

| ABNB | Airbnb Inc | -31.2% |

| ABT | Abbott Laboratories | -11.6% |

| ACN | Accenture PLC | -4.5% |

| ADM | Archer-Daniels Midland Co | -8.8% |

| ADSK | Autodesk Inc | -4.5% |

| AES | The AES Corp | -23.3% |

| AKAM | Akamai Technologies Inc | -12.7% |

| ALB | Albemarle Corp | -66.7% |

| ALGN | Align Technology Inc | -59.6% |

| AMT | American Tower Corp | -4.4% |

| ANSS | Ansys Inc | -15.8% |

| AOS | A.O. Smith Corp | -2.9% |

| APA | APA Corp | -9.2% |

| APD | Air Products & Chemicals Inc | -3.7% |

| APTV | Aptiv PLC | -59.6% |

| ARE | Alexandria Real Estate Equities Inc | -38.8% |

| AVB | AvalonBay Communities Inc | -1.9% |

| AWK | American Water Works Co Inc | -12.5% |

| BA | Boeing Co | -26.9% |

| BAC | Bank of America Corp | -15.2% |

| BALL | Ball Corp | -26.3% |

| BAX | Baxter International Inc | -52.2% |

| BBWI | Bath & Body Works Inc | -49.5% |

| BDX | Becton Dickinson & Co | -2.6% |

| BEN | Franklin Resources Inc | -38.8% |

| BF.B | Brown-Forman Corp | -31.2% |

| BIIB | Biogen Inc | -13.7% |

| BIO | Bio-Rad Laboratories Inc | -50.3% |

| BMY | Bristol-Myers Squibb Co | -14.8% |

| BWA | BorgWarner Inc | -21.2% |

| BXP | BXP Inc | -31.4% |

| CCI | Crown Castle Inc | -32.6% |

| CCL | Carnival Corp | -28.4% |

| CE | Celanese Corp | -25.8% |

| CFG | Citizens Financial Group Inc | -14.6% |

| CHRW | C.H. Robinson Worldwide Inc | -0.4% |

| CHTR | Charter Communications Inc | -46.4% |

| CMCSA | Comcast Corp | -14.9% |

| CNC | Centene Corp | -7.2% |

| COF | Capital One Financial Corp | -4.9% |

| CPT | Camden Property Trust | -20.0% |

| CRL | Charles River Laboratories International Inc | -42.8% |

| CSCO | Cisco Systems Inc | -14.1% |

| CSX | CSX Corp | -7.7% |

| CTLT | Catalent Inc | -48.0% |

| CTSH | Cognizant Technology Solutions Corp | -9.3% |

| CVS | CVS Health Corp | -39.7% |

| CZR | Caesars Entertainment Inc | -58.9% |

| D | Dominion Energy Inc | -19.1% |

| DAY | Dayforce Inc | -39.2% |

| DG | Dollar General Corp | -64.2% |

| DIS | The Walt Disney Co | -43.8% |

| DLTR | Dollar Tree Inc | -52.8% |

| DOC | Healthpeak Properties Inc | -29.2% |

| DOV | Dover Corp | -0.5% |

| DOW | Dow Inc | -1.4% |

| DPZ | Domino’s Pizza Inc | -17.0% |

| DVN | Devon Energy Corp | -1.4% |

| DXCM | DexCom Inc | -41.8% |

| EBAY | eBay Inc | -5.5% |

| EL | The Estee Lauder Companies Inc | -74.3% |

| EMN | Eastman Chemical Co | -13.2% |

| ENPH | Enphase Energy Inc | -25.2% |

| EPAM | EPAM Systems Inc | -63.2% |

| EQR | Equity Residential | -8.4% |

| ES | Eversource Energy | -17.5% |

| ESS | Essex Property Trust Inc | -4.8% |

| ETSY | Etsy Inc | -71.3% |

| EVRG | Evergy Inc | -0.6% |

| EW | Edwards Lifesciences Corp | -45.4% |

| EXPD | Expeditors International of Washington Inc | -2.7% |

| EXPE | Expedia Group Inc | -26.5% |

| EXR | Extra Space Storage Inc | -8.0% |

| F | Ford Motor Co | -47.9% |

| FCX | Freeport-McMoRan Inc | -0.4% |

| FDS | FactSet Research Systems Inc | -1.6% |

| FFIV | F5 Inc | -14.2% |

| FIS | Fidelity National Information Services Inc | -26.0% |

| FITB | Fifth Third Bancorp | -7.4% |

| FMC | FMC Corp | -40.5% |

| FRT | Federal Realty Investment Trust | -4.3% |

| FTV | Fortive Corp | -0.7% |

| GM | General Motors Co | -22.5% |

| GNRC | Generac Holdings Inc | -55.9% |

| GPN | Global Payments Inc | -26.5% |

| HAS | Hasbro Inc | -27.0% |

| HBAN | Huntington Bancshares Inc | -5.9% |

| HD | The Home Depot Inc | -1.8% |

| HON | Honeywell International Inc | -2.6% |

| HPQ | HP Inc | -4.8% |

| HRL | Hormel Foods Corp | -29.5% |

| HSIC | Henry Schein Inc | -12.8% |

| IDXX | IDEXX Laboratories Inc | -14.2% |

| IEX | IDEX Corp | -11.4% |

| IFF | International Flavors & Fragrances Inc | -21.4% |

| INCY | Incyte Corp | -16.3% |

| INTC | Intel Corp | -61.9% |

| INVH | Invitation Homes Inc | -9.3% |

| IPG | The Interpublic Group of Companies Inc | -8.2% |

| IQV | IQVIA Holdings Inc | -5.4% |

| IVZ | Invesco Ltd | -27.2% |

| JBHT | JB Hunt Transport Services Inc | -14.0% |

| JCI | Johnson Controls International PLC | -9.0% |

| KEY | KeyCorp | -30.9% |

| KEYS | Keysight Technologies Inc | -23.9% |

| KMX | CarMax Inc | -34.4% |

| LH | Labcorp Holdings Inc | -5.5% |

| LKQ | LKQ Corp | -27.0% |

| LULU | Lululemon Athletica Inc | -28.5% |

| LUV | Southwest Airlines Co | -31.5% |

| LW | Lamb Weston Holdings Inc | -6.8% |

| LYV | Live Nation Entertainment Inc | -19.9% |

| MAA | Mid-America Apartment Communities Inc | -18.8% |

| MCHP | Microchip Technology Inc | -4.8% |

| MDT | Medtronic PLC | -7.3% |

| MGM | MGM Resorts International | -21.4% |

| MHK | Mohawk Industries Inc | -16.2% |

| MKC | McCormick & Co Inc | -9.2% |

| MKTX | MarketAxess Holdings Inc | -30.1% |

| MMM | 3M Co | -0.8% |

| MOS | The Mosaic Co | -32.6% |

| MRNA | Moderna Inc | -65.9% |

| MTCH | Match Group Inc | -71.4% |

| MTD | Mettler-Toledo International Inc | -10.9% |

| MU | Micron Technology Inc | -7.0% |

| NCLH | Norwegian Cruise Line Holdings Ltd | -23.6% |

| NEE | NextEra Energy Inc | -0.6% |

| NEM | Newmont Corp | -6.5% |

| NKE | Nike Inc | -46.8% |

| NSC | Norfolk Southern Corp | -10.4% |

| NTRS | Northern Trust Corp | -26.6% |

| PARA | Paramount Global | -69.4% |

| PAYC | Paycom Software Inc | -56.0% |

| PFE | Pfizer Inc | -42.2% |

| PLD | Prologis Inc | -11.3% |

| PNC | PNC Financial Services Group Inc | -11.9% |

| PODD | Insulet Corp | -14.1% |

| POOL | Pool Corp | -29.9% |

| PPG | PPG Industries Inc | -21.6% |

| PYPL | PayPal Holdings Inc | -63.3% |

| QCOM | Qualcomm Inc | -6.7% |

| QRVO | Qorvo Inc | -32.6% |

| RF | Regions Financial Corp | -0.7% |

| ROK | Rockwell Automation Inc | -18.0% |

| RVTY | Revvity Inc | -36.1% |

| SBAC | SBA Communications Corp | -28.8% |

| SBUX | Starbucks Corp | -9.7% |

| SCHW | Charles Schwab Corp | -28.7% |

| SJM | JM Smucker Co | -8.6% |

| STT | State Street Corp | -10.5% |

| STX | Seagate Technology Holdings PLC | -2.5% |

| SW | Smurfit WestRock PLC | -8.6% |

| SWK | Stanley Black & Decker Inc | -43.6% |

| SWKS | Skyworks Solutions Inc | -31.4% |

| TDY | Teledyne Technologies Inc | -0.1% |

| TECH | Bio-Techne Corp | -30.4% |

| TEL | TE Connectivity Ltd | -5.2% |

| TER | Teradyne Inc | -22.3% |

| TFC | Truist Financial Corp | -25.3% |

| TFX | Teleflex Inc | -21.5% |

| TGT | Target Corp | -29.4% |

| TRMB | Trimble Inc | -31.6% |

| TROW | T. Rowe Price Group Inc | -40.9% |

| TSLA | Tesla Inc | -38.5% |

| TSN | Tyson Foods Inc | -21.2% |

| TTWO | Take-Two Interactive Software Inc | -4.9% |

| UAL | United Airlines Holdings Inc | -2.7% |

| UDR | UDR Inc | -16.4% |

| ULTA | Ulta Beauty Inc | -7.4% |

| UPS | United Parcel Service Inc | -35.0% |

| USB | U.S. Bancorp | -17.9% |

| VRSN | VeriSign Inc | -23.5% |

| VTRS | Viatris Inc | -13.9% |

| VZ | Verizon Communications Inc | -10.9% |

| WAT | Waters Corp | -5.2% |

| WBA | Walgreens Boots Alliance Inc | -80.8% |

| WDC | Western Digital Corp | -7.7% |

| WST | West Pharmaceutical Services Inc | -23.4% |

| WY | Weyerhaeuser Co | -14.3% |

| WYNN | Wynn Resorts Ltd | -7.8% |

| XEL | Xcel Energy Inc | -1.2% |

| ZBH | Zimmer Biomet Holdings Inc | -14.0% |

| ZBRA | Zebra Technologies Corp | -39.6% |

| ZTS | Zoetis Inc | -8.2% |

INITIAL IMPLICATIONS FOR INVESTORS

1. I see a lot of names on this list that would help investors understand why their portfolio might not be “doing what the market is doing” the past 2-3 years. It includes 39 stocks that are still in the top 1/3 of the S&P 500 by weight, despite that lagging performance over the past 32 months. So, 39 out of about 165 stocks at the top of the S&P 500 are down over that time. Nearly 1/4 of them. That’s a lot. And it goes to my belief that this is a very deceiving market.

2. This also might be a helpful hunting ground for investors starting to buy into the narrative about the stock market broadening out beyond Mag-7 and other mega cap names.

Narrowing the field for future stock research

Granted, this is just a peek into the quantitative part of my own process, and I just performed this study over the weekend, motivated in large part by my view that we could be in for more of what we saw last week. Because I’ve learned over the decades that the time to start putting a shopping list together is not AFTER the market has fallen hard. It is beforehand, so I can “sit back” and wait for the names I know I like to come to me.

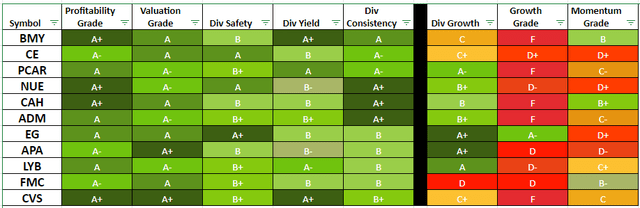

Here is a list of stocks I culled from that larger list. 11 of the more than 180 meet all of the following 5 criteria, according to the world of Seeking Alpha quant ratings:

- Profitability Grade A- or better

- Valuation Grade A- or better

- Dividend Safety B or better

- Dividend Yield B or better

- Dividend Consistency B or better

SungardenInvestment.com (Seeking Alpha data)

I also included Dividend Growth, Growth and Momentum Grades on the right side, with a divider in between. I will look at these in more depth, but I did not filter out stocks based on them.

While I won’t go into more detail on these stocks here, given that I’ve already discussed a lot, I’ll note that only two of these stocks CVS Health (CVS) and LyondellBasell (LYB) are currently in my portfolio, and both are held at my minimum 1% position size. So this list and my current portfolio do not overlap to a big degree.

There are a lot of opportunities out there. And at the same time, I find very few stocks I feel I can “pound the table” on as timely buys. The S&P 500 has been deceiving, and perhaps the disjointed nature of the market for the past 32 months is about to catch up with it. After all, more than 1/3 of that index is selling at prices (including dividends) below early 2022.

Conclusion: 2 investment priorities this study confirms for me

That to me implies both a contrarian opportunity (though in the research stage, not the “buy them now” stage) and a great reason to play some really strong defense. That’s my playbook for now.