The Good Brigade/DigitalVision via Getty Images

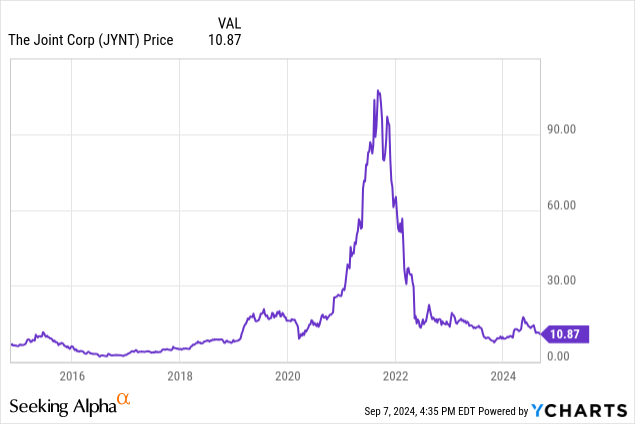

Since my last update, the share price of The Joint Corp (NASDAQ:JYNT) has seen a continued decline in share price, reflecting the market’s current lukewarm sentiment towards the stock. The 2025 Q2 earnings call presented mixed results, yet the company’s underlying strength remains evident. Despite the market’s current skepticism, JYNT still offers an attractive buying opportunity, thanks to its resilient business model and unrealized earnings potential. In this analysis, I’ll delve into the factors supporting this bullish outlook.

Numbers Not Impressive, But Business Still Growing

In JYNT’s Q2 call, management continues to highlight business expansion in terms of sales and store counts. However, the numbers are not impressive. Q2 2024 revenue increased by 3% to $30.3 million. Same-store sales with 13 months’ comparisons grew 2% compared to the prior year period. However, stores open for 48 months saw a 4% decline. These comparable sales numbers are worse than last quarter. The performance of mature stores (48 months) is particularly concerning, reminiscent of the challenging times in Q3 2023 when people questioned JYNT’s sustainability.

This performance is understandable given that JYNT’s chiropractic service is not the best in the market. Their main selling points are access and affordability, as their target customers are those who typically can’t afford continuous chiropractic care through traditional insurance providers. During economic downturns when consumers are under pressure, it’s conceivable that people might delay treatment for their pain or turn to free alternatives like YouTube videos for self-stretching remedies.

However, it would be premature to conclude that JYNT’s business has no growth potential or is in permanent decline. After all, they have increased system-wide sales by 8% to $129.6 million. The total clinic count has grown to 960 as of June 30, 2024, with 829 franchised clinics and 131 company-owned or managed clinics. The business is clearly reaching more people, and brand recognition and trust continue to build. As more people engage with the brand, the business is likely getting stronger.

Another positive sign is that early numbers for Q3 show July comparable sales reached 5%, with franchised clinics achieving 6% growth. This suggests a potential turnaround in performance.

Cost control concerns may start to ease.

One of my biggest long-term concerns about JYNT is its capability to achieve high profitability. The management has struggled to control costs effectively, with gross margins staying high at around 90%, but SG&A rising from 77% in 2019 to 84% currently. The Q2 adjusted EBITDA was $2.1 million, much smaller than last year’s $3.2 million. However, this number includes $1.5 million in litigation expenses, $1.4 million in loss on disposition or impairment, and costs associated with an in-person national franchise conference. These are all one-time expenses that last year’s $3.2 million figure didn’t have. This is good news because the underlying profitability should be higher than it appears, potentially around $5 million EBITDA. Corporate headquarter expenses (excluding Corporate-owned Clinics) in the overall Adjusted EBITDA is $5 million, lower than Q1’s $5.1 million. I’d really like to see this number not increase further so the company can control costs and improve profitability.

The profitability boost is delayed but should come in 2025

JYNT’s refranchising strategy is designed to be shareholder-friendly, potentially boosting the stock price by generating higher margins, facilitating Regional Developer (“RD”) territory acquisitions, and enabling stock buybacks. However, the process has been slower than anticipated. To date, only two clinics have been sold for $224,000, falling far short of the expected $20 million target for the entire corporate portfolio. The CEO has indicated that the process may extend into 2025, which is frustrating for investors expecting quicker results. Despite this delay, management’s cautious approach, involving thorough due diligence, may be prudent given the valuable nature of these assets. While the slow pace is concerning, a careful strategy isn’t bad for ultimately yielding better long-term results.

Risks from a mediocre operation

During the call, the management has highlighted recent improvements such as standardizing storefront design, implementing digital sign-in and calendar tools, and diversifying marketing efforts across digital, social, and coupon formats. However, these improvements seem mediocre and their execution has been slow. The fact that they’re only now standardizing storefront design and construction sourcing processes is concerning for a company of this size. Moreover, the digitization of new patient onboarding has been remarkably delayed. Since their 2014 IPO, patients still have to complete lengthy forms by hand, with no option to scan a QR code or access a digital page. Additionally, there’s still no app for users to manage their accounts to make payments or cancel their plans. For a franchise with nearly 1,000 stores, these basic operational elements should have been implemented much sooner. I start to wonder if JYNT has the ability to adapt and optimize its operations efficiently.

Bottom Line

Overall, JYNT remains a promising investment opportunity. With a current enterprise value of $163 million, the valuation is not excessively high. The ongoing refranchising process could generate proceeds of around $20 million. Assuming full refranchising, we can project annual revenue of about $56 million (14M quarterly) at a 30% operating margin, yielding $16.8 million. If unallocated corporate expenses can be reduced from $7.2 million to $2.2 million, we could expect annual earnings of around $8 million. Adding back one-time costs such as litigation ($1.5M), impairment ($1.4M), and amortization ($0.5M) per quarter, we can estimate an annual EBITDA of approximately $20 million. This conservative estimate doesn’t account for potential growth from new clinics, maturation of young clinics, or acquisition of regional directors. Furthermore, JYNT’s strong balance sheet with minimal debt and moderate share compensation makes it an attractive candidate for future share buybacks, potentially enhancing shareholder returns.