Fokusiert

First Industrial Realty Trust (NYSE:FR) is an industrial REIT that owned 424 properties with 67.9m sq. ft. of gross leasable area across 19 states (June 30, 2024).

I have had the pleasure of covering FR twice since my journey on Seeking Alpha started. Both times, I assigned it with a ‘buy’ rating. To get a better grasp of the development of my views on FR, please refer to the links below:

After publishing my first article on FR, I didn’t follow my own advice and purchase, as I concentrated on other opportunities, including a leading industrial property player – Prologis (PLD). However, not so long after publishing the second time, FR’s stock experienced a short decline, and that’s when I initiated my position.

Some investors may consider that counter-intuitive, as the Company’s valuation has increased substantially since the April – June 2024 period, but let me tell you:

- FR has great things going for it, which we will mention later

- The tough market conditions surrounding FR and creating headwinds for the whole industrial property sector show even more signs of the upcoming shift than before, making industrial property players more attractive, with FR as one of the top REITs on my industrial sector list right now

Let’s start with the latter – the market shift is upcoming

Before we address the positives, let’s summarize the concerns

The industrial property sector has been facing headwinds related to the rising interest rates and oversupply in most markets. The oversupply was caused by cooling demand (temporarily), with large-scale construction finishes supporting the supply. The unfavourable supply-to-demand relationship led to less dynamic asking rent growth and a dynamic rise in the market vacancy rate. According to the Wells Fargo Q2 2024 report:

- the vacancy rate recorded a solid increase for the eighth consecutive quarter and reached 6.5% in Q2 2024

- the rent growth has fallen to the lowest annual pace recorded since 2014. The fall of the growth pace is even more evident when considering the quarterly changes

Q2 also brought eight consecutive quarters of net completions above 100m sq. ft. (102.3m sq. ft. in Q2 2024), further strengthening the industrial property supply and, thus, negatively impacting the oversupply issue.

CoStar Inc. and Wells Fargo Economics CoStar Inc. and Wells Fargo Economics

The abovementioned data doesn’t paint a good picture of the industrial property sector, but let’s look even broader and try to establish some expectations for the upcoming years.

The night looks the darkest before the dawn

On the demand front, net absorptions remain far below historical standards. However, they recorded the first improvement in seven quarters, amounting to 30.3m sq. ft., i.e., ~triple the amount recorded in Q1 2024. That’s a positive signal suggesting that tenants’ decision-making processes are starting to pick up.

Moreover, industrial space under construction keeps on dropping, setting the floor for the upcoming improvement in the supply-to-demand relationship. With the demand picking up the pace and the cooling construction starts (expected by most industrial property REITs’ management teams and already reflected in the data), we are likely to witness the current oversupply turning into undersupply in the upcoming years, positively impacting industrial REITs negotiating positions and business metrics (rent growth and occupancy rates).

CoStar Inc. and Wells Fargo Economics

Summary of FR’s business

I consider FR one of the best picks in the industrial property sector due to its attractive risk-to-reward ratio. The margin of safety resulting from valuation is reasonable when compared to some of its peers (we will delve into that later).

I don’t want to get too extensive about FR’s business or credit metrics, as I’ve already discussed it in detail within my previous coverage. However, I wish to provide a brief insight into its most crucial numbers to provide a holistic outlook on my current investment thesis and the decision to start a position in FR.

- significant rent increases: for context, the market rent growth has substantially outpaced the rent growth resulting from contractual rent escalators, typically amounting to low single-digit values. As a result, industrial property players can significantly bump their rents upon lease expirations (through releases or leases with new entities). For instance, FR recorded cash rental increases of 58.3% and 43.4% during 2023 and Q2 2024, respectively. That will continue as FR’s historical leases terminate in the upcoming quarters/years.

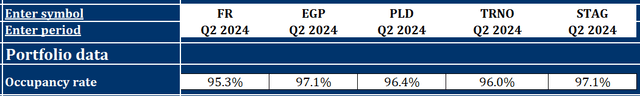

- occupancy rate: as mentioned before, the oversupply-related headwinds have driven the market vacancy rate upwards, which is well reflected in recent occupancy rate records of leading industrial REITs. Please review the table below for details regarding the occupancy rate of FR and some of its peers.

Author based on FR, PLD, EGP, STAG, and TRNO

- dynamic FFO and DPS growth: FR’s DPS recorded a ~8% CAGR during the 2019 – 2023 period, and I don’t believe this dynamic to change, especially considering FR’s investment pipeline and upgraded 2024 FFO per share guidance. Its current guidance assumes FFO per share ranging from $2.57 to $2.65, representing a 3-cent increase at the midpoint. Should FR achieve its midpoint guidance, that would constitute a 7% FFO per share growth year-over-year.

- balance sheet strength: the dividends are supported by a reasonable, ‘sleep sound’ balance sheet with BBB credit rating, 4.4x fixed charge coverage, and no debt maturities until 2026. On the other hand, its overall debt maturity schedule is relatively short term, standing at 4.3 years on average, and features exposition to the interest rate risk due to its ~11% floating-rated debt outstanding.

The valuation outlook and risk factors

Market-related and company-specific risks accompany each stock market investment. In the case of FR, it’s worth mentioning:

- high interest rate environment negatively impacts the Company’s cost of capital, as it has some exposure (~10.8% of its outstanding debt) to the floating-rated debt. Moreover, such an environment causes a wide gap between buyers’ and sellers’ expectations, slowing down the transactional market

- there’s no definite answer to how long the oversupply issues will remain. Such an environment negatively impacts FR’s ability to uplift its occupancy rate and sign new / expiring leases

- the valuation remains attractive compared to some of its peers, and the Company’s valuation increased substantially during the last couple of months. At the same time, industrial property players are relatively highly valued, so investors accustomed to retail-oriented REITs may find it discouraging

With that said, let’s move on to the valuation outlook. As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

The forward-looking P/FFO multiple stood at:

- 21.6x for FR

- 23.6x for PLD

- 16.7x for STAG Industrial (STAG)

- 28.3x for Terreno Realty (TRNO)

- 23.9x for Americold (COLD)

- 22.4x for EastGroup Properties (EGP)

Since the last time I covered FR, its P/FFO multiple has appreciated by ~70 bps. Therefore, this suggests less room for potential upside resulting from the multiple expansion. Previously, I indicated that the 22-23x P/FFO range is attainable for FR.

However, with the even more likely positive shift in the supply-to-demand relationship upcoming, I am a stronger advocate of FR’s multiple appreciation. Therefore, I consider 23x P/FFO a more appropriate (and still conservative) scenario. While that alone wouldn’t result in a substantial upside, combining it with a dynamically growing (8% CAGR during the 2019 – 2023 period) DPS, one could hope for low double-digit total returns at a moderate risk level.

Investment Thesis and Key Takeaways

Even though FR’s stock price recorded solid increases in the last couple of months, I believe there’s more upside to be realised, considering its valuation compared to peers. The Company offers a double-digit upside potential, which I still consider a ‘buy’.

- income-oriented investors will benefit from dynamically growing dividends

- cautious investors will appreciate the safe financing structure and stability and predictability of FR’s cash flows

- advocates of Benjamin Graham’s margin of safety approach should feel taken care of given the valuation gap between FR and some of its peers

FR is one of the top industrial players on my list and one of the only two industrial REITs in which I am currently invested. I believe the Company will benefit its existing and new shareholders, as it has set the ground to capitalize on the upcoming positive shifts in the market environment (considering both the interest rate environment and the industrial property sector). I am bullish on FR.