alberto clemares expósito

SHOP’s High Growth Investment Thesis Is Undeniable, With Robust Bullish Support

We previously covered Shopify Inc. (NYSE:SHOP) in May 2024, discussing why we had reiterated our Buy rating as the market over-reacted to the FQ1’24 adj EPS miss/ supposedly softer FQ2’24 guidance and the stock consequently fell below our previous recommended entry point around the $65s.

With the e-commerce platform still reporting robust monthly recurring revenue/ subscription growth, growing adjusted operating margins, and a healthy balance sheet, we had believed that it remained a great Buy for opportunistic investors looking to buy the deep pullback.

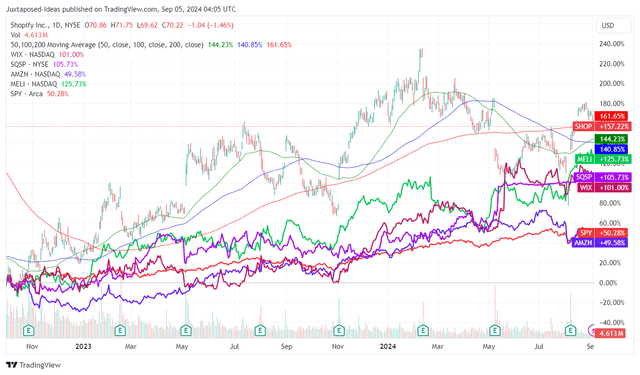

SHOP 2Y Stock Price

Since then, SHOP has charted an impressive recovery by +25%, with it well outperforming the wider market at +4.2%, or by +157%/ +50% from the October 2022 bottom, respectively.

Much of the tailwinds are attributed to the overly drastic stock correction from the November 2021 tops and the recovering market sentiments surrounding the still robust e-commerce performance globally.

For example, Statista estimates that the global e-commerce market size may grow from $4.11T in 2024 to $6.47T in 2029, expanding at a CAGR of +9.49% – with SHOP already estimating an immense Total Addressable Market size of $849B in the 2023 Investor Day Presentation, expanding drastically by 18x since its IPO in 2015.

It is apparent that the management’s decision to focus on the headless commerce solutions have paid off extremely well too, after the divestiture of its logistics business in May 2023, as observed in its double beat FQ2’24 performance.

SHOP has reported total revenues of $2.04B (+9.6% QoQ/ +20.7% YoY) and adj EPS of $0.26 (+30% QoQ/ +85.7% YoY) – with the accelerating bottom-line growth demonstrating its improving operating scale and its inherently profitable SaaS business.

Much of the tailwinds are attributed to the expanding subscription solutions revenue to $563M (+10.1% QoQ/ +26.8% YoY) and merchant solutions revenue to $1.48B (+9.6% QoQ/ +18.4% YoY), with the YoY growth partly attributed to the raised subscription prices as it highlights the SaaS company’s robust pricing power and sticky consumer base.

These developments are only possible through SHOP’s stellar headless commerce solutions with flexible customizations in front-end/ back-end, across different sizes/ price points, online/ offline platforms, B2C/ B2B offerings, and payment solutions/ digital wallets, significantly aided by the strategic partnership with numerous global logistics companies.

The SaaS company’s growing relevance in the commerce market cannot be denied either, based on the expansion in its Gross Merchandise Volume [GMV] to $67.2B (+10.3% QoQ/ +22.1% YoY) and Gross Payment Volume [GPV] to $41.1B (+13.5% QoQ/ +29.6% YoY).

This is despite the uncertain macroeconomic outlook and the supposedly tightened discretionary spending, as reported by numerous consumer discretionary companies.

Most importantly, SHOP has been strategically focusing on its International growth, as observed in the segment’s robust GMV growth by +27% YoY outpacing the North America segment and the international merchant increasing by +30% YoY, attributed to the expansion of its offerings in multiple markets and the exemplary marketing/ go-to-market efforts.

With the company stating “over 50% of the merchants that joined our platform in Q2 coming from outside the core English-speaking markets of the US, Canada, UK, Ireland, Australia and New Zealand,” it is apparent that the SaaS company is growing its brand awareness along with market share, with it likely to sustain the high-growth trend.

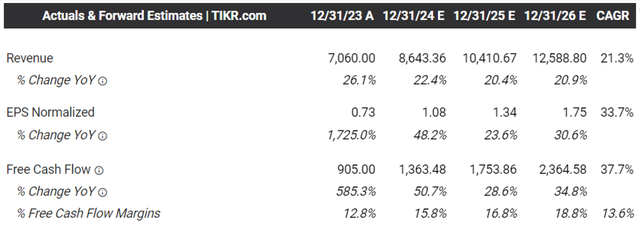

The Consensus Forward Estimates

Given the robust H1’24 top-line growth at +21.8% YoY and the triple digit adj EPS growth at +213.3%, it is unsurprising that the consensus have raised their forward estimates, with SHOP expected to generate an accelerated top/ bottom-line expansion at a CAGR of +21.3%/ +33.7% through FY2026.

This will build upon its historical top-line growth at +51.3% between FY2016 and FY2023, with the e-commerce SaaS company already operating at scale while reporting robust profitable growth trend.

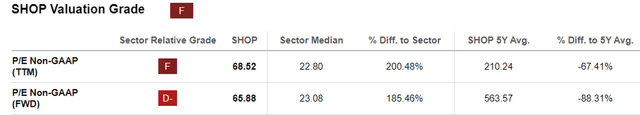

SHOP Valuations

This is also why we believe that the market has rewarded SHOP the premium FWD P/E valuations of 65.88x and the premium non-GAAP PEG ratio of 1.95x (author’s calculation).

This is based on the FWD non-GAAP P/E valuations of 65.88x and the projected expansion in its adj EPS at a CAGR of +33.7% through FY2026.

When compared to the sector median non-GAAP PEG ratio of 1.82x, or other e-commerce/ e-commerce SaaS peers, such as:

- Amazon.com, Inc. (AMZN) at 1x (author’s calculation, based a similar calculation method FWD P/E of 36.74x and adj EPS growth at +36.6%),

- MercadoLibre, Inc. (MELI) at 1.14x (author’s calculation at 45x and +39.3%),

- Wix.com Ltd. (WIX) at 1.1x (author’s calculation at 26.75x and +24.2%),

- Squarespace, Inc. (SQSP) at 1.17x (author’s calculation at 43.01x and +36.5%),

it is undeniable that SHOP appears to be expensive here.

Perhaps part of the premium may be attributed to SHOP’s market leadership in the US Headless Commerce SaaS market with 29% in share as of August 20, 2024 (including Shopify Plus), notably higher than WIX at 21% and SQSP at 15%, with the former’s market leading position rarely coming cheap.

So, Is SHOP Stock A Buy, Sell, or Hold?

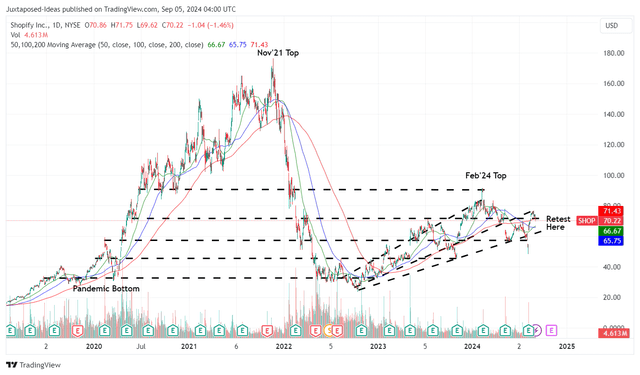

SHOP 5Y Stock Price

For now, SHOP has already lost much of its 2024 gains, albeit they were continuously defended as observed in the bulls’ immense support during the recent August 2024 correction.

For context, we had recommended investors to buy at its established support levels around the $58s, despite the stock trading at a premium to $52.90 – based on the FWD P/E of 72.53x (near to its 1Y mean of 72x) and the FY2023 adj EPS of $0.73.

Based on the LTM adj EPS of $1.04 ending FQ2’24 (+420% sequentially) and the last observed FWD P/E valuations of 65.88x, it is apparent that SHOP has finally grown into its premium valuations, with the stock trading near to our updated fair value estimates of $68.50.

Based on the consensus raised FY2026 adj EPS estimates from $1.61 to $1.75, we are also looking at an updated long-term price target of $115.30 – with there remaining an upside potential of +64.1% from current levels.

Combined with the sustained uptrend pattern since the October 2022 bottom, we believe that SHOP remains well positioned to record robust capital appreciation ahead.

As a result, we are maintaining our Buy rating.

Risk Warning

It goes without saying that with SHOP’s premium P/E and PEG valuations come great expectations, with any earning misses and/ or underwhelming forward guidance likely to bring forth painful corrections – as observed after the FQ1’24 earnings call.

Stock Market Volatility

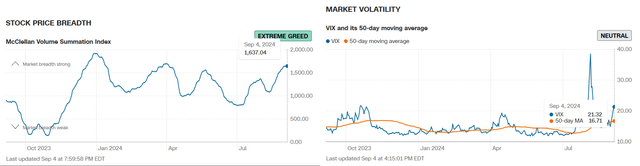

With the CBOE Volatility Index already exceeding October 2023 levels and the McClellan Volume Summation Index hitting extreme greed levels of 1,637 (compared to the neutral levels of 1,000x), we believe that there may be more volatility in the near term indeed.

As a result, while we remain optimistic about SHOP’s long-term prospects, we believe that there may be a near-term market-wide correction as observed in SPY’s moderation since the end of August 2024.

Interested investors may want to monitor its stock movement for a little longer before adding at its upcoming pullback to the support levels of between $63 and $65 for an improved margin of safety.