ogichobanov

High-yield funds can be a great source of passive income for investors, especially retirees who want simplicity and safety, as well as the ability to be relatively agnostic to broader market behavior so they can kick back, relax, and enjoy their golden years. These funds provide significant and instant diversification for portfolios, so retirees do not have to spend time studying individual stocks, valuing companies, and actively managing their portfolios. Of course, some retirees enjoy picking stocks as a hobby and also enjoy the extra returns and income they can generate by following an individual stock-picking approach. But for those who do not and wish to spend their time on other things, funds are a great go-to.

High-yield funds are also great because they can pay high dividend yields that enable investors to cover their living expenses with cash flow from their portfolios, reducing the need to sell stocks at inopportune times. Instead of worrying about a prolonged bear market and the risk of locking in permanent losses by selling stocks when they are heavily out of favor, investors can live off dividends and avoid sequence-of-return risk. This means that they can rely on the fundamental strength of their holdings rather than the market’s perception of them.

That being said, not all high-yield funds are worth owning. In this article, I will discuss two overrated high-yield funds and two underrated funds that deliver attractive passive income to investors.

Overrated Fund #1

The first overrated fund I will discuss today is the PIMCO Dynamic Income Fund (PDI). There are several reasons why I believe it is overrated. First and foremost, it trades at a hefty 12.38% premium to its net asset value, which is well above its 52-week average of 9.28% and particularly high relative to its 52-week low of -4.08%. Its 52-week high is 14.88%, which is not much higher than where it currently trades, indicating that the fund is expensive.

Additionally, while its 13.68% distribution rate, paid out monthly, looks attractive on the surface, a closer look reveals that this is a very risky yield. It is driven by a 37.27% leverage ratio. On top of that, the fund charges a total expense ratio of 6.13%, which includes the interest expense on its leverage. Moreover, the investment portfolio is quite risky, with less than 10% of it being invested in investment-grade debt, while the remainder is in riskier junk or unrated assets.

When you combine the risky nature of its loans, the high expense ratio, significant leverage, and high valuation, PDI does not offer an attractive risk-reward profile, particularly given the growing number of signals that an economic slowdown may be imminent. This could cause a spike in defaults in its junk-rated loan investments. Additionally, the premium to NAV could rapidly shrink to a steep discount, as seen even within the past 52 weeks, especially during events like the COVID crash. As a result, investors who are paying a premium today may be setting themselves up for heavy losses due to a spike in defaults and a shrinking premium to NAV, while also continuing to pay a very high expense ratio to management.

Overrated Fund #2

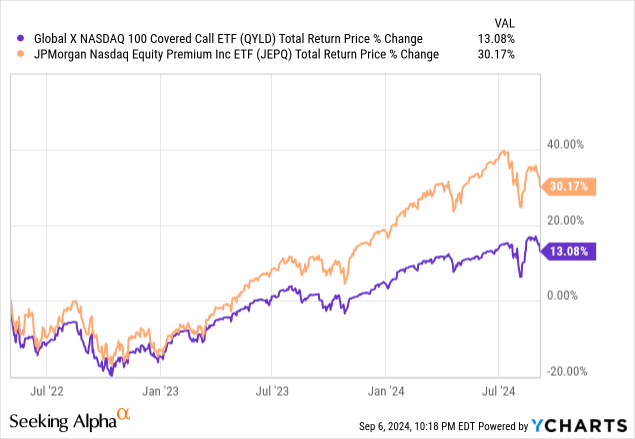

Another overrated fund right now is the Global X NASDAQ 100 Covered Call ETF (QYLD). In addition to the fact that the NASDAQ has been struggling lately as the AI bubble appears to be bursting to some extent, I see little reason to hold QYLD in one’s portfolio given there are cheaper alternatives, such as the JPMorgan NASDAQ Equity Premium Income ETF (JEPQ). Both pay monthly distributions and are heavily concentrated in mega-cap tech stocks, with QYLD having virtually identical exposure to the tech sector (51% vs. 50% for JEPQ), communication services, and other sectors.

The main difference between them is that JEPQ has an expense ratio of just 0.35%, whereas QYLD has an expense ratio of 0.61%, making JEPQ much more attractively priced and more likely to outperform over time. In fact, since both funds began trading, JEPQ has crushed QYLD, delivering 30.17% total returns versus just 13.08% for QYLD. Therefore, I see little reason for an investor to hold QYLD.

Underrated Fund #1

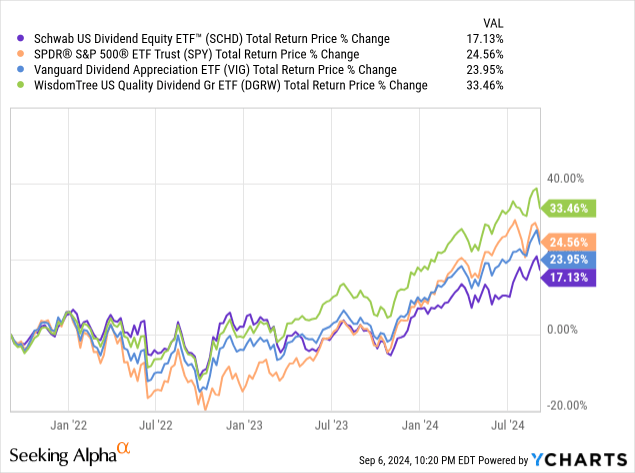

As for underrated funds, the Schwab U.S. Dividend Equity ETF (SCHD) has received some negative comments recently due to its lackluster total returns relative to the S&P 500 (SPY) and some of its peers, like the Vanguard Dividend Appreciation ETF (VIG) and the WisdomTree U.S. Quality Dividend Growth ETF (DGRW). However, it is important to keep in mind that SCHD goes toe-to-toe with them in terms of its expense ratio, having a lower expense ratio than SPY and DGRW, and an identical expense ratio to VIG. In fact, there is no dividend growth ETF that I know of with a lower expense ratio than SCHD’s 0.06%.

Additionally, in an environment where mega-cap and AI tech are falling out of favor, SCHD’s mere 10.19% exposure to technology is a strength rather than a weakness. This positioning could drive outperformance moving forward, especially in a Federal Reserve rate-cutting cycle where concerns about a recession are rising, bolstering its more defensive focus on financials, healthcare, and consumer defensive stocks.

Perhaps most importantly, SCHD’s dividend growth track record is as good as any, with an 11.1% CAGR over the past ten years, a 12.88% CAGR over the past five years, and a 9% CAGR over the past three years. When combined with its 3.42% dividend yield, SCHD remains the preeminent dividend growth ETF. While some investors may dwell on past performance as the primary determiner of future investments, the fundamentals for SCHD remain strong, and we expect it to continue being a powerful dividend growth ETF for years to come.

Underrated Fund #2

Another underrated high-yield fund is the Infracap REIT Preferred ETF (PFFR). The reason I like it so much is that it offers a nice 7.51% dividend yield in an environment where interest rates are falling. The defensive nature of holding preferred shares makes it a nice defensive play in a weakening economic environment. Additionally, its 0.45% expense ratio is fairly competitive with other preferred share ETFs, including the iShares Preferred and Income Securities ETF (PFF), which has a 0.46% expense ratio. PFFR also pays out dividends monthly and has been a consistent dividend payer for several years.

On top of that, REIT preferreds are considered to be safer than many others, as it is quite rare for REITs to go bankrupt compared to other types of firms. This makes their preferreds some of the most attractive on a risk-adjusted basis. Given these factors, for investors looking to lock in sustainable and attractive income, PFFR is a solid option, especially for those who want real estate exposure but want to be more defensive while getting a higher current yield than what most strong investment-grade REIT common stocks provide today.

Investor Takeaway

By avoiding overrated funds, investors can set themselves up for more attractive risk-adjusted total returns and more sustainable dividends over the long term. By investing in underrated funds, investors can lock in a combination of attractive high yields from funds like PFFR, along with an above-average yield and outstanding dividend growth from funds like SCHD, while avoiding hefty expense ratios that erode long-term total returns.