John M Lund Photography Inc

Business Introduction

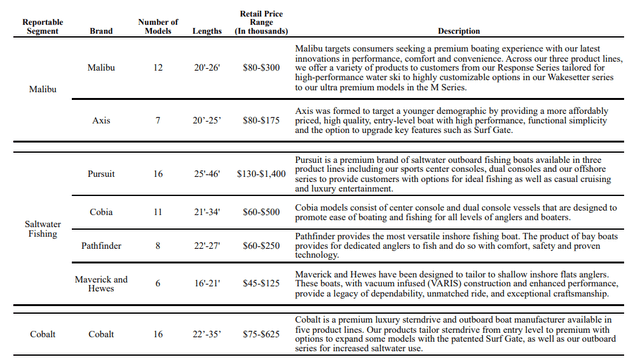

Malibu Boats (NASDAQ:MBUU) is a leading company in the manufacturing design and marketing of a wide range of recreational boats, offering everything from sterndrive to performance sport boats and outboard boats under an umbrella of eight brands. Malibu, Pursuit, Axis, Cobia, Maverick, Hewes, Pathfinder, and Cobalt. According to SSI, As of June 30th this year, the company held the top market share in the US for the performance sport boats through the Malibu and Axis brands. Through the cobalt brand, they also lead the sterndrive category, and they are among the leaders in the fiberglass outboard fishing boat market with their maverick and pursuit brands.

The company has expanded their market share in the performance sports boat category from 24.5% in 2010 to 30.5% in 2023 and they have expanded their market share in the 24’-29’ segment of the sterndrive from 14.2% in 2010 to 40.8% in 2023.

Their portfolio includes brands that are designed for a variety of recreational boating activities, including fishing, general boating and water sports like waterboarding, water surfing, and skiing. They have also developed propriety technologies such as the Surf Gate, which allows you to create perfect waves for wake surfers of every level. This has helped them introduce new and exciting recreational activities, expanding the market for their products.

Their flagship Malibu Boats brand caters to those seeking premium performance sport boat experience, comfort and convenience. Pursuit boats expand their offering in the salt water outboard fishing market. The Axis brand targets consumers who want a more affordable choice without compromising too much on the performance. Cobalt boats consist of mid to large luxury cruisers and bowriders, proving the ultimate experience in comfort, performance and quality. The Maverick Boat Group, which includes Maverick, cobia, pathfinder, and Hewes, compliments Pursuit by focusing on boats under 30 feet in length.

They distribute their boats through a dealer network. As of June 30th, 2024, their global distribution channel included over 400 dealer locations.

The Company seems to be serving in an oligopoly sector where the only other big competitor is master crafts boats.

Leadership Change

Malibu Boats has announced a new CEO Steve Manneto replacing Jack Springer who left in a mutual agreement with the company, this change is related to the lawsuits the company has been facing regarding the allegations from one of their biggest dealers, Tommy boats.

The new CEO spent nearly 3 decades with Polaris. Recently, he led the largest business, the off-road vehicle division, nearly doubling the revenues over 5 years. This included planning, developing and building gold manufacturing footprints that supply hundreds of thousands of vehicles worldwide. He also spearheaded he commercialization efforts on the on-road division, driving the launch and expansion of the Indian motorcycle business.

Investment Thesis

When we look at the market’s valuation of the business, the company seems to be trading at a very low valuation, but there are few very good justifications behind Mr. Markets’ thinking. First, the company has a cyclical nature and right now, it’s navigating through very turbulent waters as the fed’s record tightening has weakened consumer spending. Secondly, Malibu lost its biggest dealer, Tommy Boats, and was sued for malicious accounting practices. Thirdly, it can be argued that the valuation has normalized as the company moves from a high-growth stage to more of a mature company with low growth and the other very strong argument is the normalization after the zero rate environment in 2021 as seen across the industries.

We want to make a strong argument for Mr. Market to rethink its status when it comes to this company.

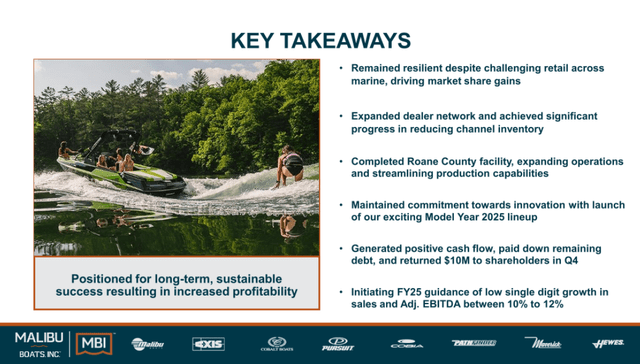

The company lost over 40% of its sales this year because of slower consumer spending. But apart from just pure cyclicality, the company also suffered from higher dealer inventories and the loss of its biggest dealer, Tommy Boats. As of last quarter in 14 out of the 15 sites which Tommy was serving, new authorized dealers are up and running. As for the dealer inventories, the company achieved a much necessary feat of taking the dealer inventories down to the historical averages through increased promotional support and decreased production. Although the margins were impacted, but this was a much-needed step, and now we feel more comfortable holding this name through the current cycle.

2021 was a crazy period where companies like Malibu benefited a lot from the zero-rate environment, but a lot has happened since then and the company is not trading at those absurd multiples anymore. As an example, the company has come down from 6x book value to 1.3x book value now. If you look at the future consensus, there is very little growth projected for this company, even if we believe the organic growth will be very small, the company has grown a lot from inorganic means as well. In the last earnings call, management reaffirmed that one of the growth strategies is to look for accretive acquisitions. If you look at the balance sheet, the management has got plenty of dry powder to pursue accretive acquisitions. So, the growth can come.

As inferred from the last fed meeting, the market now believes that there is a 100% chance of a fed rate cut in the coming meeting. This is very positive for a company like Malibu Boats where the majority of their products sold are financed, a good question to ask is, when will be the exact inflection point after the rate cuts for this company? A simple answer: No one knows. No one can time the market, what we do know is that the rate cuts are highly beneficial for this company in the long run and with inventories now at sustainable levels, no debt, and new management, it feels safe to hold the company to ride the upcoming rate cut trajectory.

Valuation and Analysis

Malibu Boats’ Fourth Quarter 2024 Financial Update

Malibu Boats experienced a steep decline in Q4, with sales dropping by over 57% and unit volumes falling 59%. This sharp downturn led the company to report a loss.

The Company faced significant challenges, including high interest rates and a slowdown in retail activity, which contributed to an 88% drop in gross profits compared to the previous year. This decline reduced the profit margin to just 7.9%, down from 27.5% a year earlier.

The drop in profit margins was primarily due to increased promotional activity across all segments, a reduced mix of high margin Malibu and Axis model, and fixed cost leveraging.

On a per-share basis, Malibu Boats reported a loss of $0.39, a stark contrast to the profit of $2.98 per share reported in the same quarter last year, missing the consensus estimates by 7 cents. Total revenue came in at $158.7 million, exceeding expectations by $1.8 million. Adjusted EBITDA also turned negative, with a loss of $4.1 million, representing 104.5% year-over-year decline.

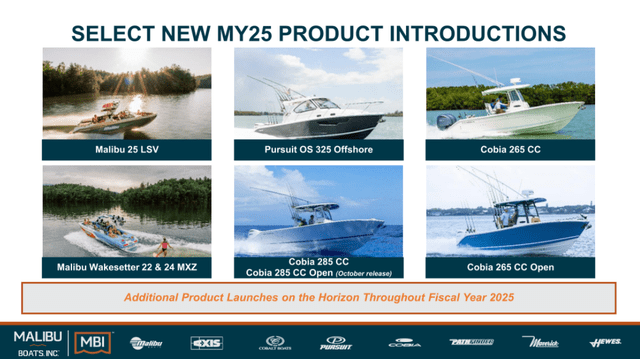

New CEO Steve Menneto expressed his commitment to guiding the company through these turbulent headwinds and showed his enthusiasm about the upcoming model year 2025 lineup. CFO Bruce Beckman shared a positive outlook despite the challenging retail environment.

Looking ahead to fiscal year 2025, Malibu Boats anticipates net sales growth in the low single digits and expects an adjusted EBITDA margin between 10 and 12%.

On the positive side, the company has made significant progress on bringing the dealer inventories to the historical averages, upgrading the dealer network, paying off the remaining debt, and returning $10 million back to the shareholders in the form of buybacks, achieving all of that while reporting a positive cashflow despite a loss. The Company has also pledged to return $10 million to the shareholders via buybacks each quarter until 2025YE.

Valuation

After trying to convince Mr. Market to reassess its position regarding this company, we want to look at the numbers as well and analyze where the stock is trading relative to its intrinsic valuation under some skeptical assumptions.

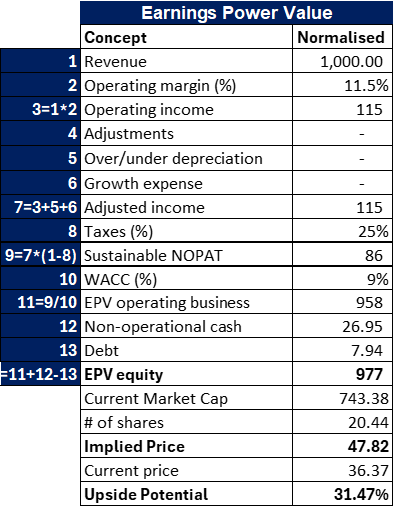

I plan to model the scenarios surrounding Malibu in both EPV and DCF model. Although EPV might not be as useful here, but if we assume no growth, we can identify exactly how much below the company is trading relative to its earnings power value under the value investing regime.

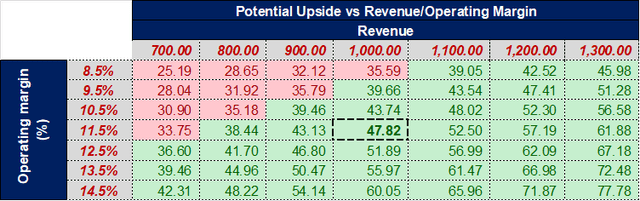

We will model the sustainable revenue at a billion dollars and use a below-average margin of only 11.5% intrinsically, assuming that the company cannot go back to the previous 10 years average margins of around 16%. Using a cost of capital of 9% it gives us a valuation of around $48.

Moat Investing

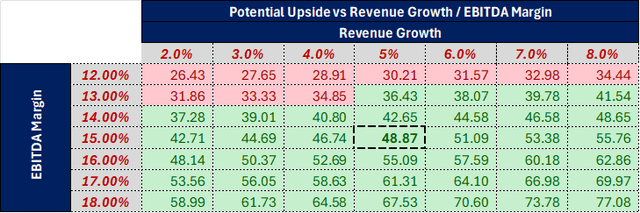

We are aware that our assumptions are conservative, and everyone might not agree with them, the sensitivity table below highlights how stock performs under different assumptions of revenue and operating margins.

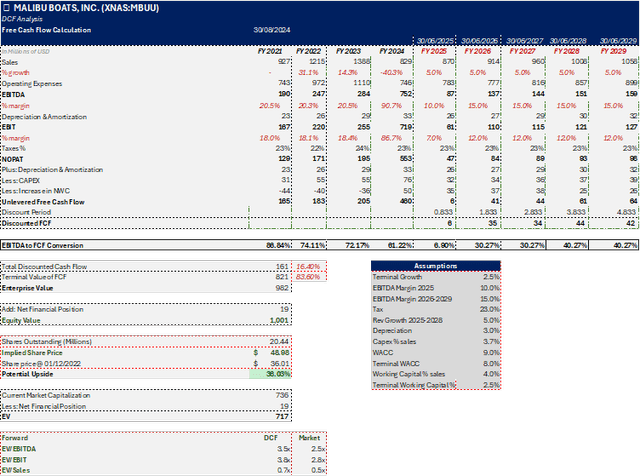

To further analyze the potential upside under some conservative assumptions, we employ a DCF approach. Using a 5-year DCF framework, I am normalizing the growth recovery to only 5% for the next 5 years and a terminal growth of 2.5% assuming that after these 5 years period the company will only grow as much as to cover the inflation. Although if you look at reinvestment and ROIC it can justify a higher growth, but we want to side with the conservative side of the market’s belief and see if I have enough margin of safety.

For the coming year, I am using the lower end of the guidance for the EBITDA margin and after that, I am assuming a small improvement in the long-term operating margins of just 50 bps compared to what I used in my EPV calculation. I am relying on the historical averages, management guidance and the street estimates for Capex, depreciation/amortization, and tax.

For working capital, I am putting a stress for the coming years by using a 4% of the revenue, in contrast to the long-term average of around 2.5%. I am only modelling the resumption back to normality in working capital by the terminal year.

On the WACC side, we are using a cost of capital of 9% for the next five years and 8% for the terminal year, highlighting the impact of the rate cuts, potential leveraging and the reduced risk premiums.

We have an implied price of $48.87 which represents a 34% upside from the current level. The purpose of doing the DCF exercise was to see if we can get enough margin of safety under conservative assumptions. A 34% margin seems assuring and is enough for us to hold the name through the current down cycle.

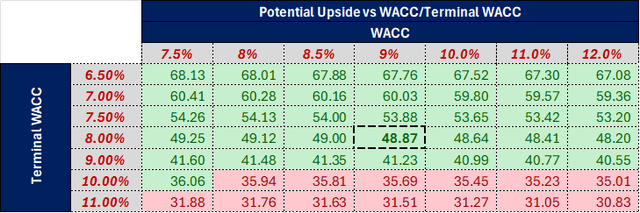

We have performed a sensitivity analysis on the main value drivers affecting the potential upside.

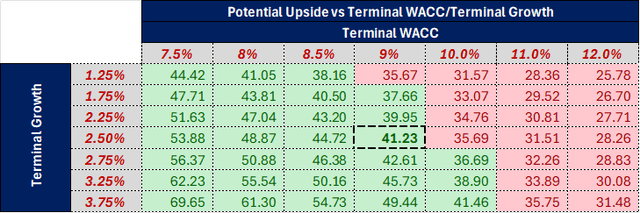

Since we have only used enough terminal growth to cover the potential inflation, there can be multiple arguments against or in favor of this. In the following table, we have a sensitivity analysis on the implied share price vs different terminal growth and discount rates.

Considering our below average operating margins and skeptical revenue growth, the table below is helpful to understand the impact different margins and growth rates can have on the valuation.

Conclusion

In conclusion, we believe that although the coming few quarters might be tough for Malibu Boats and the other companies in this sector, but the management has addressed the fundamental problems, namely the issues with Tommy Boats and high dealer inventories. Although debt was not a problem but since they have paid the remaining debt off the company has got plenty of dry powder now to pursue accretive acquisitions like they have in the past. On top of this, we will get a 5.6% yield from the buybacks expected in the next twelve months. Looking at the valuation side we get almost the same upside, which reassures us of the margin of safety at this price, so it seems like a relatively safer stock to hold now during the current downturn and wait to ride the coming rate cuts trajectory.