Nuthawut Somsuk

With rate cuts unanimously expected by the markets, the latest labor market report serves to provide an insight into exactly how much they would be cut. After all, Fed Chair Powell remarked in his recent speech at the Jackson Hole Symposium that “We do not seek or welcome further cooling in labor market conditions.”

But the labor market report does more than just provide pointers for policy rates. It also provides an important perspective on the state of the US economy, at a time when there could be a downside risk. So, here, I first take a look at what the report says and then make an assessment of what it means for growth and interest rates. Finally, I briefly discuss the investments that look good now.

Labor market report confirms broad softening trend

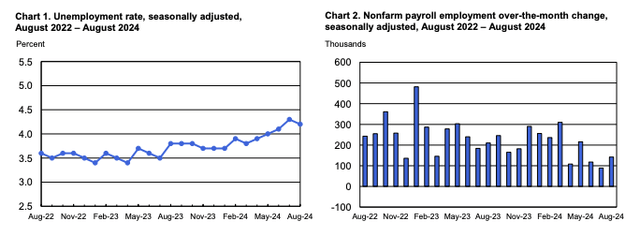

The unemployment rate was down just a tad, at 4.2% in August, from 4.3% in July. But it’s still higher than the number a year ago, at 3.8%. The change in non-farm payroll figures at 142,000 fared much better, compared with a 114,000 figure as per the last report. However, in this case, the number is significantly down from the average increase of 202,000 over the past year.

Source: Bureau of Labor Statistics

Notwithstanding the month-on-month [MoM] improvement in numbers, the broader trend of softening in the labor market is clear. This is also further backed by the fact that the average hourly earnings for all employees are up by just 0.4%, compared to the average rise of 3.8% over the past 12 months.

Likelihood of growth softening increases

With the unemployment rate staying at 4% or higher for the past four months, the average rate for 2024 so far is at 4%. It was already close enough in July, at 3.96%, but the latest figures confirm more of the same.

The significance of 4% unemployment rate

The 4% figure is important since it coincides with the Fed’s own projections for 2024. The critical point to note about these projections, is that they pertain to the fourth quarter (Q4) of the year (see Note on Table 1 on Pg 2 of the link). Considering that the unemployment rate is already averaging at this number, and that the rate has risen more than not MoM this year, it can be derived that the rate might just be higher by Q4 2024.

Now, the Fed’s projections also find this unemployment rate consistent with a GDP growth rate of 2.1% in Q4 2024, which is just about the trend rate of growth. Based on Okun’s law, that I discussed in my previous article on the labor market report, there’s a negative correlation between unemployment rate and GDP growth rate. Specifically, a percentage point rise in unemployment rate shaves off 1.5 percentage points from GDP growth.

How much can growth slow down?

It might not be a perfect correlation, but for the sake of argument assuming it is, if unemployment rate were to stay at 4.2% through the remainder of 2024, GDP growth rate would be down to 1.5% in Q4 2024. In other words, if the Fed doesn’t move on rates, and fast, a slowdown is all but confirmed.

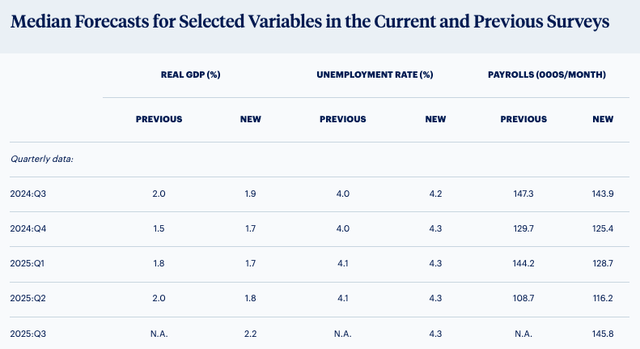

This is further reinforced by the latest results from the survey of professional forecasters conducted quarterly by the Federal Reserve Bank of Philadelphia. The median projections of 36 forecasters put both Q3 and Q4 GDP growth at sub-trend levels of 1.9% and 1.7% respectively (see table below). It’s worth noting that the number of Q4 2024 comes rather close to my quick estimates based on Okun’s law. The unemployment rates in the quarters are seen at 4.2% and 4.3% respectively.

Source: Federal Reserve Bank of Philadelphia

By how much would the rates be cut?

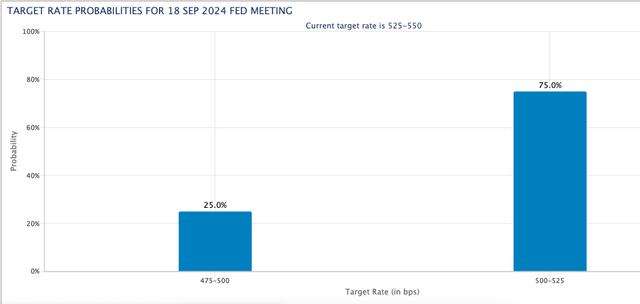

Interestingly, the probability of a rate cuts based on the 30-day Fed funds future rate is still heavily biased towards 25 basis points [bps] cut (see chart below). It gets better, though. An over 50% probability is ascribed to a 25bps rate cut in November and an over 40% to another one in December (with 50bps cut running a close second).

If the probabilities are a true predictor of rates, then it’s a real possibility that the policy rate will be a whole percentage point lower before the year closes.

For now, though, I tend to agree with the majority view that a 25bps rate cut is the likely course of action going by the Fed’s cautious approach so far. Not only have labor market trends seen MoM improvement, the second estimate for GDP growth in Q2 2024 has seen an upward revision to 3% from the earlier 2.8%. At the same time, I also believe that once the rate cut cycle starts, it will be consistent.

What’s next for the stock markets

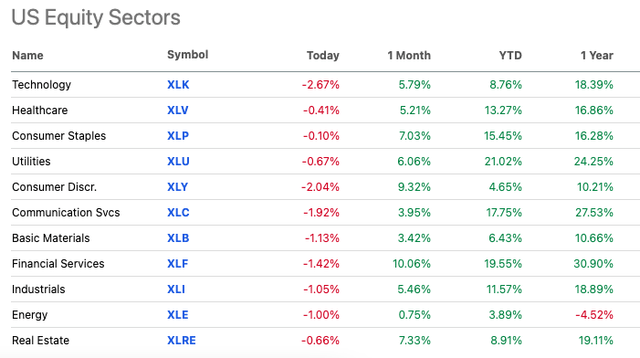

Unsurprisingly, the report coincides with weakness across major indices. The NASDAQ 100-Index (NDX, QQQ) is down the most by 2.8%, followed by the S&P 500 (SP500, SPX, SPY) by 1.8% and Dow Jones Industrial Average (DJI) by 1%, presumably with the smaller likelihood of a 50bps rate cut contributing to the softening.

Labor market report is a non-negative for longer-term investors

Ironically, though, the labor market report is actually not a negative for investors looking beyond just the next rate cuts. A break in the consistent increase in unemployment rate after four consecutive months, upward revision in GDP growth and the impending start of a rate cut cycle indicates that the economy might not eventually be too-badly impacted.

This, in turn, can be a positive for cyclical sectors like energy, consumer discretionary and basic materials, which have seen only a muted increase so far this year (see table below). For the more risk-averse investors, though, I’d pick healthcare among the defensives.

In conclusion

To go back to the initial questions that the labor market report could answer, it points to a 25bps rate cut. This is based on the small come-off in unemployment rate MoM and some strengthening in non-farm payroll increase. Along with the GDP reflecting strength so far, the Fed could want to stay cautious on slashing rates too fast. That said, consistent rate cuts are likely once the monetary policy loosening cycle starts. 75-100bps of cuts are being priced in for 2024 alone.

While the markets don’t seem to have taken too well to the news, a potential soft landing is actually a positive for investors who are looking beyond the upcoming Fed meeting. Buying into the least loved sectors this year, which are, unsurprisingly, cyclicals, might even hold investors in good stead. Though, as has been the case for some time, my pick for safer investing is healthcare.