tadamichi

In this article, we provide an update on the PIMCO CEF suite. Specifically, we discuss the changes in distribution coverage over July. We also discuss the allocation profile of the Dynamic Income Strategy Fund (PDX) and its apparent strategy to remain less of a credit fund and more of an Energy fund that many investors expected at the time of its strategy shift in late 2023.

Coverage Update

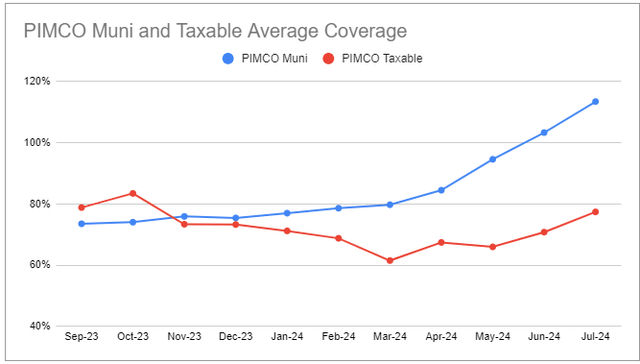

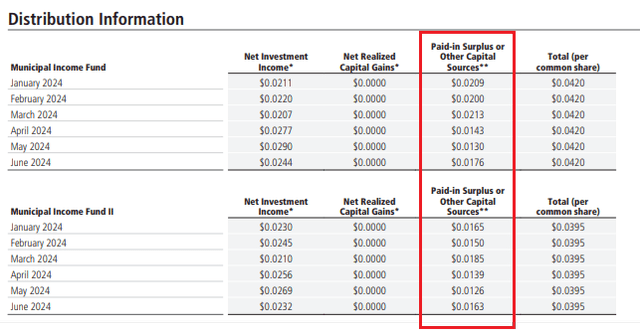

Based on six-month rolling figures, distribution coverage across the taxable and tax-exempt suites continued to grow. As we highlighted previously, much of the apparent strength in the taxable funds is in PDO, whose 6-month coverage is at 116% – the only taxable PIMCO CEF with distribution coverage above 100%. The average in the rest of the taxable suite is 73%. Although most funds have seen an increase in coverage, the absolute figures are not particularly impressive.

More interesting, perhaps, is the continued rise in Municipal fund coverage levels, with the average now moving to 113%. All PIMCO Muni CEFs have coverage north of 100%. What’s especially odd about this increase is the fact that short-term rates which serve as the anchor for leverage cost have not yet changed all that much, given the Fed has not yet cut the policy rate. This is at the same time as the funds’ fixed-rate assets are, well, fixed. With unchanged short-term rates, and hence leverage costs and unchanged asset coupons, the rising coverage of the Muni funds is somewhat of a puzzle.

That said, there are a few other factors which could be driving an increase in net investment income and, by extension, coverage. Muni yields have been falling which, via falling leverage, creates additional capacity for the funds to add assets and income. Two, the funds can be rotating into higher-coupon Municipal bonds. Three, the funds could be rotating to slightly less expensive leverage facilities such as tender option bonds over variable-rate term preferreds. Some of the funds have registered an increase in preferreds outstanding, however the increase is not large enough to explain all of the increase in coverage.

The rise in Muni coverage has coincided with the buyback of nearly all of the funds’ auction-rate preferreds or ARPS which makes sense as the ARPS were very expensive. At the same time, the above-100% coverage levels are not supported by the funds’ shareholder reports, which show a high level of ROC. Ultimately, we don’t take the 100%+ coverage figures at face value and our view remains that the funds are, in fact, overdistributing.

PDX Is Not In A Hurry

As many investors recall, PDX used to be an energy-focused fund. In late 2023, it changed its name from “Energy and Tactical Credit Opportunities” to “Dynamic Income Strategy Fund”. It also tweaked its strategy from investing at least 80% of net assets in the energy sector to investing at least 25% in the energy sector. The new name was a kind of jumble between the Income Strategy Fund (PFL) and the Dynamic Income Fund (PDI), both of which are entirely credit funds. This likely gave the impression that PDX was going to transition into more of a credit-focused fund. This hasn’t actually happened, however.

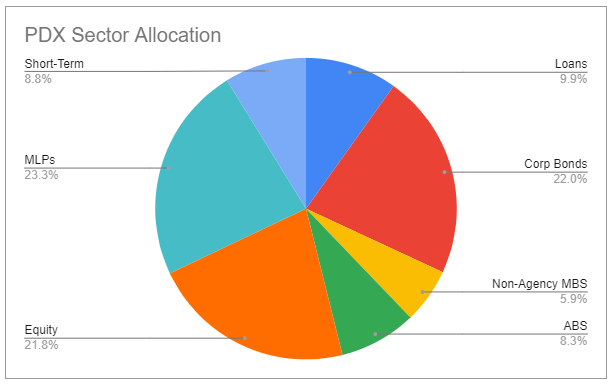

The fund retains chunky allocation to both common shares as well as MLP equity exposure, as shown below.

Systematic Income

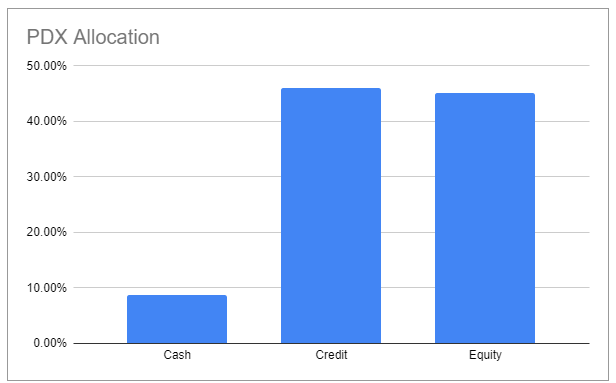

Its overall equity allocation is close to half of the portfolio and not far off the fixed-income allocation.

Systematic Income

Finally, its Energy allocation is around 65% of the portfolio, well above the 25% floor.

All in all, it’s fair to say that PDX is not in a hurry to shift its allocation and so with 9 months after its initial strategy announcement, investors shouldn’t hold their breath. Given the fund’s current allocation is entirely in line with its strategy guidelines, the significant equity and MLP allocation is likely there for the long haul. If the fund is able to shift its outsized $212m Venture Global position, perhaps it could then increase its credit allocation; however, this is a speculation.

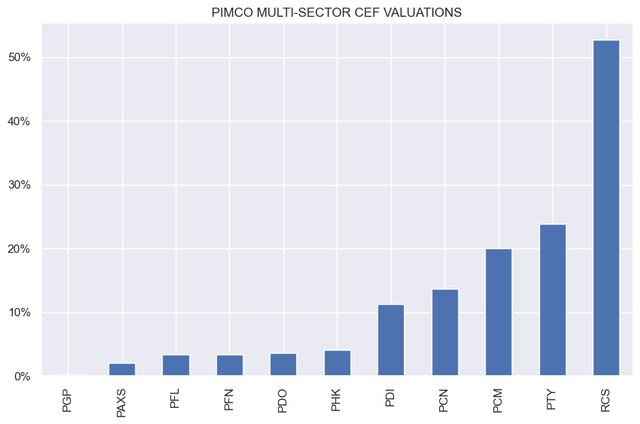

After an initial tightening in the discount after the strategy change announcement, the discount has stalled around a double-digit level. This is in contrast to a double-digit average premium in the rest of the PIMCO taxable suite. So long as the fund’s allocation remains focused on MLPs and equities, this is unlikely to change in our view. We can see this in the fact that the discount of PGP – a mixed equity / fixed-income fund trades at the lowest valuation in the PIMCO taxable suite and the fact that the MLP CEF sector features the second-widest discount in the CEF space.

Returns And Valuation

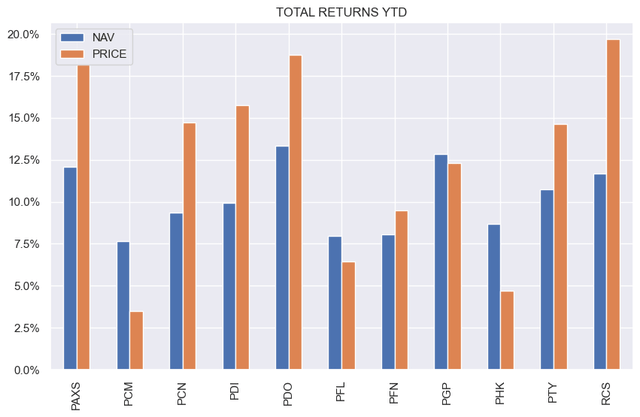

Taxable PIMCO funds with the strongest returns year-to-date are the pair of CMBS-overweight funds PAXS and PDO, as well as the equity-overweight PGP. Despite the continued crisis in the office space, the broader CMBS sector has performed well this year and continues to trade at a relatively high yield. On average, PIMCO CEFs have outperformed their multi-sector peers this year. Despite its stable discount, PDX managed to outperform in the PIMCO taxable suite due to the strength of the MLP sector.

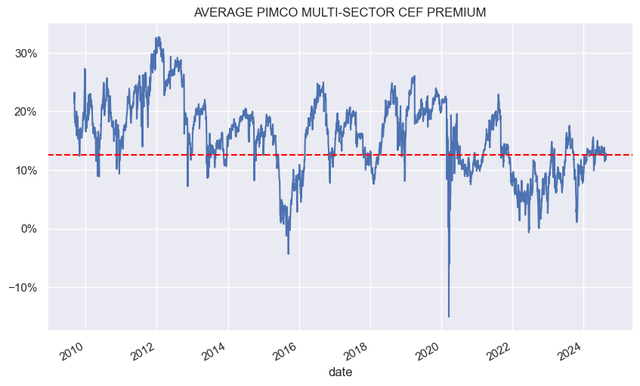

The average premium of the taxable funds is fairly high vs. the last few years, though below its historic level.

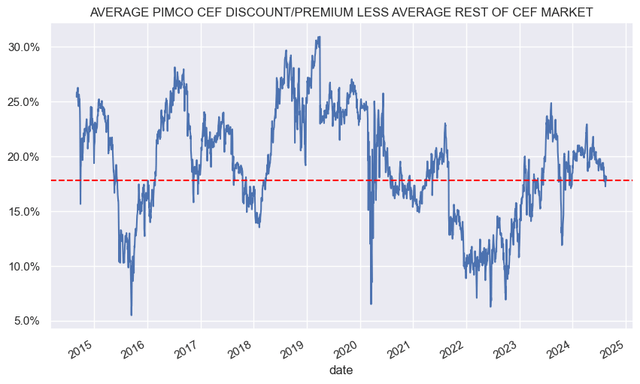

The average taxable PIMCO CEF premium is around 18% above the rest of the taxable CEF market.

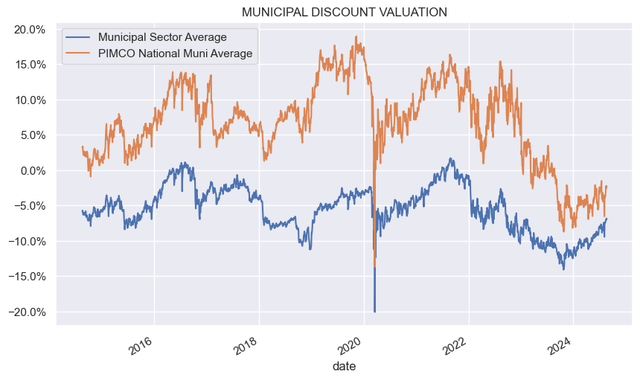

Unlike their taxable counterparts, national PIMCO Muni CEF valuations are not far off the broader Municipal CEF sector. Previous distribution cuts and disappointing performance due to high leverage have soured investor views of the suite.

RCS is somewhat unusually the highest-premium fund in the taxable suite. The fund has delivered a total NAV CAGR return of 3.5% over the last 5 years, which apparently looks exciting to a lot of people, despite underperforming the average multi-sector CEF. At that valuation and given the fund’s portfolio make-up, it’s nearly impossible for it to deliver outperformance on investor capital (i.e. taking the premium into account) going forward unless the premium continues to move even higher from its stratospheric levels.

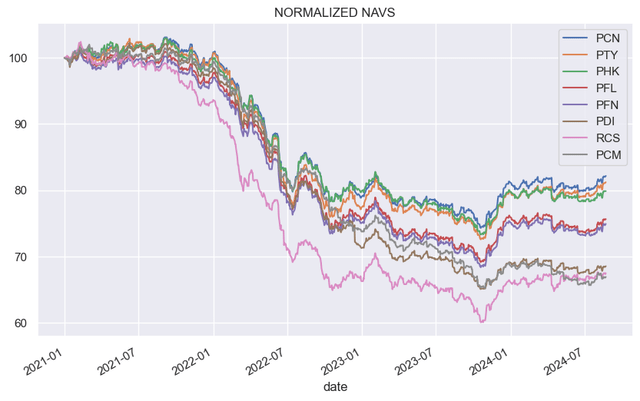

Since 2022 the NAVs of the taxable funds have fallen substantially. Because the distributions have not adjusted, this has perversely made the funds more attractive to some investors because their distribution rates have gone up.

We previously highlighted our preference for PDX and PGP, and these have worked well this year. They offer an attractive component to higher-quality / longer-duration holdings such as muni and preferreds funds in a barbelled income portfolio.

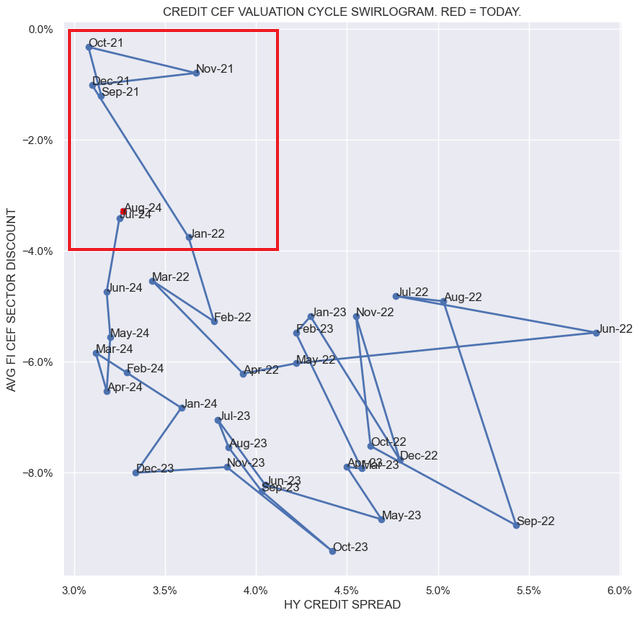

Ultimately, the performance of CEFs will be driven not only by idiosyncratic factors but by the broader market environment. And it is on this count that we remain cautious. Our go-to CEF valuation “swirlogram” shows that we are very much in the expensive CEF valuation quadrant – not far off where we were in late 2021. The only difference is that discounts are a touch wider and nominal interest rates are higher than in 2021. This suggests that we are likely to see better entry points in CEFs for new capital in the medium term.

Systematic Income