Duncan Nicholls and Simon Webb

Thesis

It is not often that one can invest in a growth stock at a value price. Investing in gambling affiliate Gambling.com (NASDAQ:GAMB) presents one of those rare opportunities. The potential stems from Gambling.com’s rare below market PE but well above market revenue and EPS growth. In their most recent quarter, the company blew out expectations and raised their guidance but in recent weeks the stock has given back some of those gains. This presents a unique opportunity to buy shares in a dependable company that will continue to benefit from a strong business model along with consistent secular tailwinds. For reasons laid out below, I see the price doubling over the next two years.

An Under The Radar Stock

With the NFL season starting this week, there is much excitement around sports betting and the gambling industry as a whole. In terms of gambling stocks, most investors know the big names such as DraftKings (DKNG) or Caesars (CZR), but today I will discuss an under the radar gambling play. Gambling.com, founded in 2006, provides digital marketing services for the gambling industry. It is the Hotels.com (EXPE) of online casinos. Gambling.com owns more than 50 gambling related websites in over fifteen countries with plans to expand its footprint even further. The company delivered 108,000 NDS (new depositing customers) just this quarter leading to over $30.5 million in revenue.

Strong Growth Trends

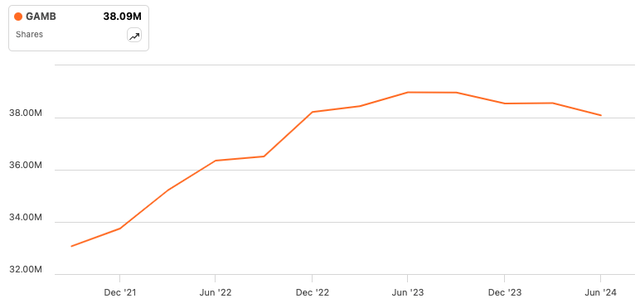

Gambling.com makes money in three main ways, Cost Per Acquisition (CPA), Revenue Share and Hybrid. Cost Per Acquisition is where Gambling.com receives a one-time cash payment from the casino operator per player they refer. In the revenue share model, Gambling.com receives a share of the operator’s net gaming revenue per referred player. Hybrid is a combination of the two. Gambling.com has a tremendous track record of growing revenues through these three avenues. From 2021 – 2023 it grew annual revenues from $42.3 million to $108.7 million and adjusted EBITDA grew from $18.4 million to $36.7 million. In 2024, the company expects revenues of $123 – $127 million and $44 – $47 million of adjusted EBITDA. Gambling.com has achieved this strong growth despite recent challenges to its business.

Historical Financial Performance (Q2 2024 Earnings Presentation)

One of the main problems with the digital marketing services business is the reliance on major search engines such as Google. During Gambling.com’s Q1 earnings call, management had to lower their guidance due to uncertainties surrounding Google’s evolving algorithm. On May 5th, Google changed the way their algorithm prioritizes content, which put pressure on Gambling.com’s media partnerships, as much of that content was deprioritized under the new algorithm. This made Gambling.com very pessimistic about the rest of 2024. Despite this drawback, Gambling.com was able to shift its focus to prioritize its higher margin company-owned sites such as Gambling.com, Rotowire, Bookies.com, etc. Q1 earnings turned out to be a clearing event for the stock as shortly following the Q1 price drop, the stock bottomed and began a steady upward course. The Q2 earnings report provided further support to the bull case.

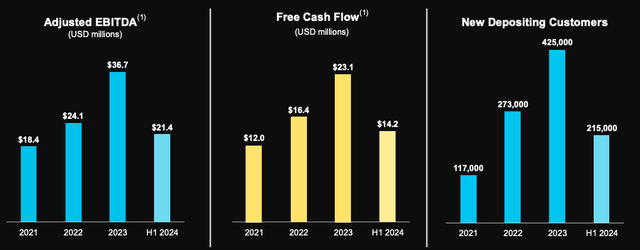

Q2 Earnings

When Gambling.com reported earnings on August 15th, the stock surged 23% following a strong beat and raise quarter. However, since the peak the stock has declined 10%. In the quarter, Gambling.com proved it was able to successfully navigate the uncertain search environment through a strategic shift. The company reported $30.5 million in revenue and $11.2 million in adjusted EBITDA. Management also raised their guidance for FY 2024. Margins also increased.

Financial Highlights (Q2 2024 Earnings Presentation)

One of the key drivers of their strong Q2 performance was the shift from their media partnerships towards their higher margin company-owned and operated website. This brought their gross margins up 300 basis points quarter over quarter from 92% – 95%. In the words of their CEO from the Q2 call, “And as you can see from our Q2 results and our raised guidance, our owned and operated sites performed strongly during the quarter and were ahead of our expectations. The diminished visibility of media partnerships and search engines directly translates to improved visibility of our owned and operated sites where our margins are substantially better.” Despite initial concerns about slowing top-line growth, the strategic shift towards the higher margin business has been more positive than their Q1 guidance indicated. Clearly, management was able to nimbly address the difficult situation regarding the Google policy change and pivot towards more profitable areas of their business.

Growth Opportunities

Gambling.com sees growth opportunities within three buckets; organic growth, new opportunities, and acquisitions. Their organic revenues grew 41% year over year in 2023 with signs it should continue due to their strong assortment of premium brands and the stable growth of established markets. In terms of new opportunities, there is potential for geographic expansion into under penetrated markets such as Canada and Latin America along with potential for legalization of online gambling in more US states. Gambling.com has been able to do this adeptly as unlike most businesses, the affiliate marketing business has very few costs upfront costs. Acquisitions have been another core segment of Gambling.com’s growth algorithm. Historically the company has used acquisitions as a way to maintain high growth, as it has bought companies such as Rotowire and Freebets. Gambling.com’s strong balance sheet and easy access to capital make it a good candidate to make more acquisitions. In fact, based on the commentary from the recent earnings call, management seemed to be discussing an imminent acquisition. Gillespie said, “As we’ve already mentioned, we are spending a lot of time evaluating opportunities, which are tangential or adjacent to the real money online gambling affiliate business that we know and love … So, we’ll be delighted when we announce something, but can’t say any more than that, at the moment.” As the gambling affiliate industry leader, Gambling.com has a great opportunity for continued horizontal integration of the business. This allows the company to maintain its moat.

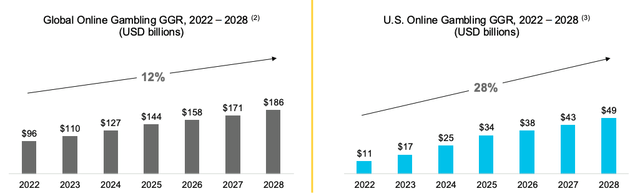

Industry Tailwinds

In addition to many idiosyncratic growth opportunities, the gambling industry continues to grow at a rapid pace. Ever since the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) in 2018, numerous states have been legalizing online gambling. The US online gambling industry is projected to grow at a 28% CAGR, while global online gambling should grow at a still rapid 12% CAGR. As the online casino industry grows, competition for gamblers should increase leading to increased advertising spending, benefiting Gambling.com.

Online Gambling Industry Projections (Q2 2024 Earnings Presentation)

Cash Management

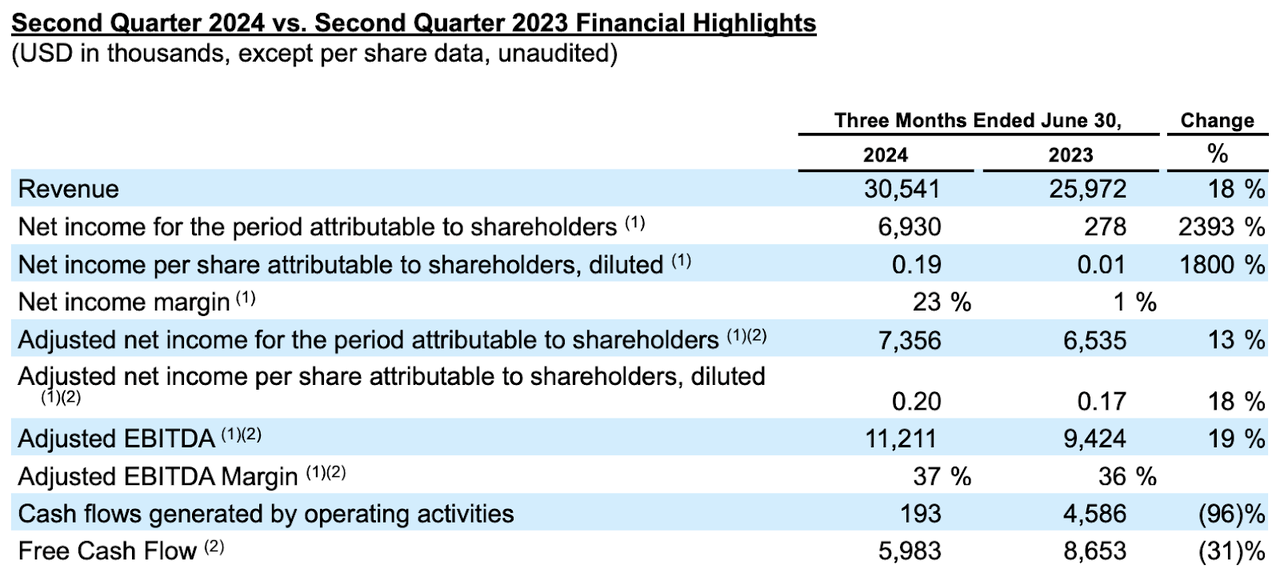

As is often the case with recently public companies, Gambling.com has had dilution issues. Following their 2021 IPO, Gambling.com increased share-based compensation, diluting their shareholders. Recently, the company has been able to buck this trend. Since the summer 2023 peak of 39 million, shares outstanding has been on a slow decline. This has occurred due to their disciplined share repurchase program. In 2023, Gambling.com bought back 283,410 shares and 2.3 million so far in 2024. additionally the board recently approved another $10 million share repurchase authorization. These improving trends should be beneficial to shareholders long term.

Valuation

Based on the analysis up to this point it would appear that Gambling.com should trade somewhat close to a market multiple due to its strong, consistent growth and high margins. However, expectations do not always line up with reality, and Gambling.com surprisingly trades at a 13.2x forward P/E multiple, versus 22.3x for the Russell 2000 representing a massive discount. In my view, the price/earnings-to-growth (PEG) ratio can be a better valuation method as it also considers growth rates. Because Gambling.com is growing rapidly, its PEG stands at a compelling .03 which is extremely low, but partly due to the high percentage EPS jump on a low EPS base. Since the company does not guide on net income, to arrive at a more accurate PEG, one can use their 24% adjusted EBITDA guide, which leads to a still well below market .55 PEG ratio.

When evaluating potential investments, calculating fair value is a useful but imperfect exercise. In terms of assessing the fair value of a rapidly growing company like Gambling.com, I prefer using a PEG ratio of 1 for a baseline, as a company should trade at a multiple in line with its growth rate. Dividing Gambling.com’s current share price of $10.13 by the .55 PEG leads to a fair value of $18.4, representing 82% upside.

Evaluating peer comparisons is much more an art than a science especially for Gambling.com as its public comparisons operate in different markets and geographies. Because much of the industry is not yet profitable, it is difficult to make comparisons on any earnings basis. While EV/Sales comparisons can be made, these fall short as a comprehensive method for evaluating companies, as they neglect the crucial aspect of cost management within any business.

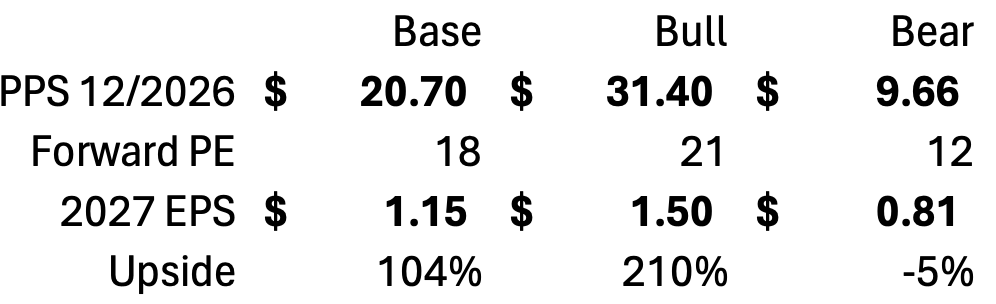

Bull – Bear – Base

My base case price target for December 2026 is $20.7 based on a Seeking Alpha consensus 2027 EPS estimate of $1.15 and a forward PE of 18 (slightly above the industry average and below Gambling.com’s historical average PE) leading to 104% upside. The base case implies five turns of multiple expansion but from a very low starting point. An 18 PE would still be well below the average market multiple.

December 2026 Price Target (Author’s Estimates)

The bear and bull cases represent 210% and -5% upside respectively. It’s worth noting that the bear case, though unfavorable, appears highly improbable. This stems from the fact that an EPS of $.81 in 2027 would entail no EPS growth from 2024-2027, which seems unreasonable for a company with such strong growth and cost discipline. While this scenario is within the realm of possibility, investing inherently carries risks. At its core, investing involves identifying opportunities with favorable risk-reward profiles where the potential upside outweighs the associated risks. Gambling.com is one of those rare cases where the asymmetric upside is too promising to pass up. Investing, like gambling, is about making big bets when the odds are in your favor. In order to holistically evaluate the opportunity, an expected value analysis of the different scenarios can add clarity. Assuming the chances of the base/bull/bear cases happening are 50%/30%/20% leads to an expected share price of (50%*$20.7+30%*$31.4+20%*$9.66) $21.7 or 214% upside over two years.

Risks

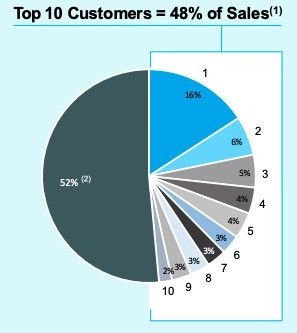

Gambling.com is subject to many risks inherent in the casino industry. Revenue over concentration is a particularly significant one. 48% of Gambling.com’s revenue in 2023 came from their top ten customers and the largest customer accounted for 16% of revenue.

Customer Concentration (Q2 2024 Earnings Presentation)

There is additional risk to this threat as the casino industry has seen increasing consolidation which could lead to casinos reducing their advertising spend. Second, in a world of increasing risks of cyberattacks, Gambling.com is a high-risk target. An attack of this sort would be devastating to its reputation and longevity as a company. Additionally, the business is especially prone to changes in the search engine landscape. Events such as Google changing their search algorithm in May of 2024 could happen at increased frequency, jeopardizing the extent to which Gambling.com’s web pages get prioritized on the web.

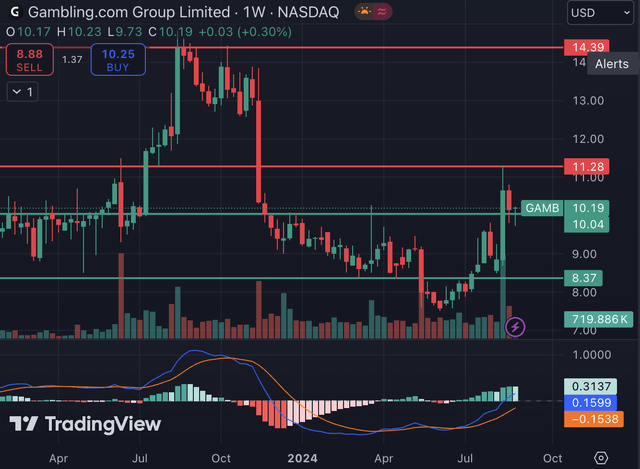

Technicals

While the fundamental story should take priority in a name, technicals can provide added clarity in terms of attractive entry and exit points. Looking at the chart of Gambling.com, there are some key trends and levels to consider.

The most important short-term levels are $8.40, $10.20, and $11.30. The stock is currently near the $10.20 short-term support level, and a drop below that level would not find support until the $8.40 level. In terms of resistance, $11.30 was the level where the post Q2 share appreciation hit resistance. This level has acted as resistance going back to 2022. Following a breakout of this level, there is no clear resistance level until $14.39 which acted as a ceiling in October of 2023 and August of 2021.

The moving average convergence divergence (MACD) shown below the chart has recently been trending higher due to strong price momentum. Overall, the Gambling.com technicals have a slightly positive bias but one should watch how the stock performs near the $10.20 level.

Summary

Again, I see asymmetric upside ahead for Gambling.com as a growth company trading like a business in decline. Its strong growth trends, industry tailwinds and disciplined cash management should propel the stock to stellar returns. In my view, buying the stock for the long term is the best course of action as the duration will give the market time to appreciate Gambling.com’s story.