Just_Super

MongoDB’s (NASDAQ:MDB) Q2 results were solid, contributing to a sharp rebound in the company’s share price. Forward guidance and reasonably upbeat management commentary may have been more responsible for the share price movement though.

After soft Q1 results, sentiment towards MongoDB had become overly bearish, with investors beginning to question the company’s competitive positioning. MongoDB’s ability to continue landing customers and expanding within existing customers at a healthy pace should help to allay some of these fears though. As should MongoDB’s commentary around its Search product gaining traction.

I previously suggested that after the Q1 share price drop, MongoDB was positioned to generate fairly strong returns for investors over a long enough time frame. I felt that the company could be in for an extended period of weakness though, due largely to the weak demand environment and MongoDB’s large investments in future growth, which continue to weigh on margins. While MongoDB’s Q2 results were solid, I expect fairly flat growth and margins in the near-term, rather than a meaningful improvement in performance.

Market Conditions

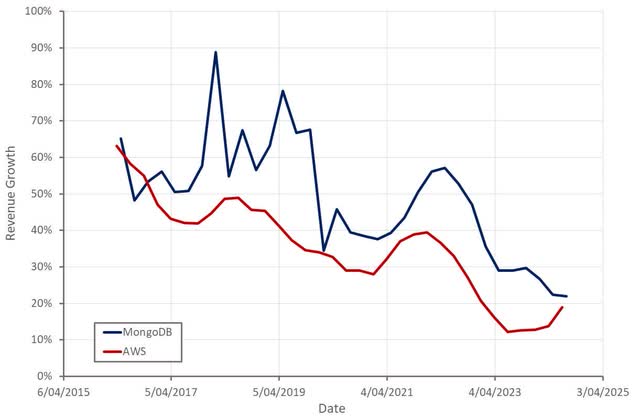

MongoDB witnessed a broad-based consumption slowdown in the first quarter of FY2025, which carried over into the second quarter. Cloud spend appears to be picking up again, but this may primarily be the result of AI, limiting its broader implications. MongoDB’s growth has closely followed AWS’ in the past but I think there is a possibility that the growth rate of the two businesses diverges going forward due to the impact of AI.

The macro environment is not impacting MongoDB’s ability to attract new customers though. As a result, I expect the company’s growth to rebound sharply when macro conditions improve. While lower interest rates could be a catalyst for improved demand, this must be weighed against the risk of a recession.

Figure 1: MongoDB and AWS Revenue Growth (source: Created by author using data from company reports)

While there continue to be large expectations around AI, it isn’t a meaningful tailwind for MongoDB yet. Companies are generally directing investment toward hardware and developing foundation models. In addition, many companies that want to implement AI are still experimenting with the technology. Elastic (ESTC) has suggested that projects are beginning to progress into production, although MongoDB hasn’t seen a lot of inference workloads in production.

Generative AI should force companies to modernize infrastructure, which is the real opportunity for MongoDB. AI can also accelerate this shift by lowering the cost and time of modernizing legacy applications. While MongoDB has promising initiatives in this area, it is too early to be a growth driver.

MongoDB Business Updates

MongoDB believes it is the ideal data layer for AI apps as it can process queries against complex data structures quickly. It also negates the need for multiple database systems, reducing complexity. This article is a nice overview of generative AIs unique demands and why MongoDB is well placed versus something like PostrgreSQL. MongoDB also believes that is positioned to benefit as the latency of LLMs declines and real-time data becomes more important.

In support of driving adoption of MongoDB in AI use cases, the company has launched the MongoDB AI Applications Program. This program offers customers a range of resources (reference architectures, end-to-end tech stack, professional services, unified support system) to help them implement AI using MongoDB.

MongoDB has also been piloting programs with customers to shift legacy applications onto its database. The migration from a relational database to a document database is relatively easy. It is rewriting applications that is difficult. Generative AI has the potential to make this a far less labor-intensive process though. MongoDB has seen a dramatic reduction in the time and cost of rewriting application code and generating test suites that ensure that new code performs the same as the old code. It will take time for this program to generate meaningful revenue though.

MongoDB is seeing solid momentum in search, which validates the company’s belief that its platform can address all use cases. Delivery Hero is using MongoDB Atlas Vector Search and one of the world’s largest gaming companies shifted its content moderation platform to Atlas and Atlas Search. This company is using Atlas Search Nodes for workload isolation and high performance. Stream Processing was made generally available in May and there has reportedly been strong interest.

Financial Analysis

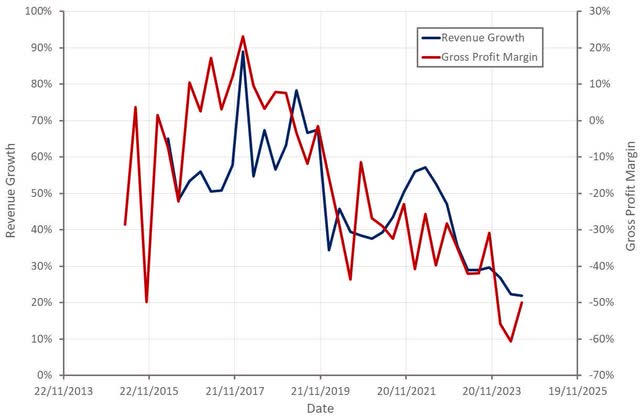

MongoDB generated 478 million USD revenue in the second quarter, an increase of 13% YoY. While this appears weak, much of this is due to a difficult comparable period in the prior year due to the accounting treatment of multi-year licensing. Adjusting for this growth more like 22%. Atlas revenue was only up 27% YoY, although consumption growth was better than expected in the second quarter.

MongoDB expects 493-497 million USD revenue in the third quarter, a 14% increase YoY. For the full financial year, the company is guiding to 1.92-1.93 million USD revenue, also representing a 14% growth rate. MongoDB faces increasingly difficult comparable periods as the year progresses due to unused Atlas commitments in the prior year.

Figure 2: MongoDB Revenue Growth and Service Gross Profit Margin (source: Created by author using data from MongoDB)

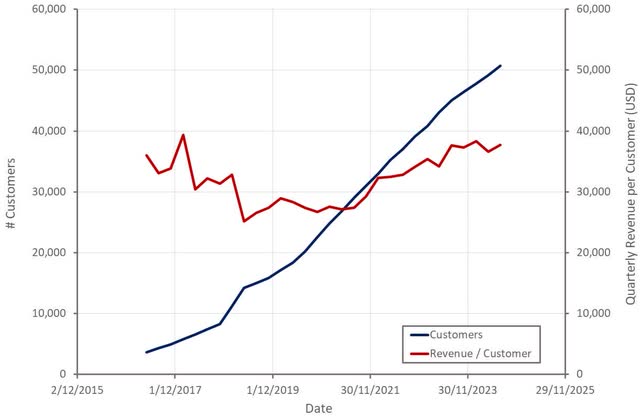

MongoDB had 50,700 total customers at the end of the second quarter, an increase of 13% YoY. There were 2,189 customers with more than 100,000 USD ARR, an increase of 18% YoY.

MongoDB’s retention rate remained strong in the second quarter. The company’s net ARR expansion rate was 119%. While MongoDB has been trying to focus sales on acquiring higher quality workloads, it is too early to assess the impact of this.

Figure 3: MongoDB Customers (source: Created by author using data from MongoDB)

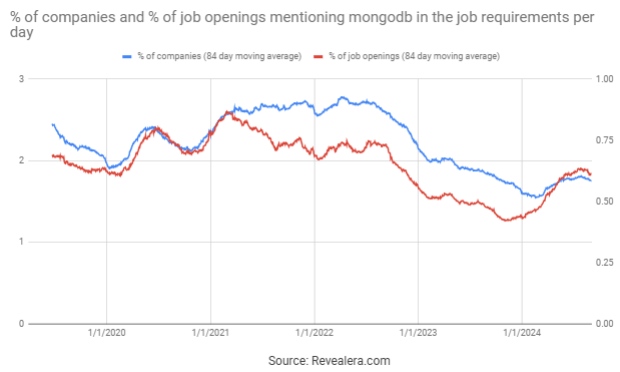

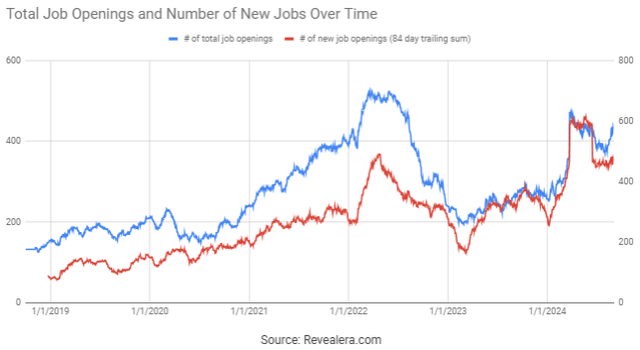

The number of job openings mentioning MongoDB in the job requirements rebounded modestly in early 2024 but has been fairly flat in recent months. MongoDB continues to attract new customers at a fairly healthy pace, supporting the notion that demand for its software remains solid.

Figure 4: Job Openings Mentioning MongoDB in the Job Requirements (source: Revealera.com)

MongoDB’s gross margin declined YoY due to a lower mix of high margin licensing revenue. While Atlas gross margins are still lower, the delta is shrinking. Services margins are also a drag at the moment, although services are now a relatively small contributor to revenue.

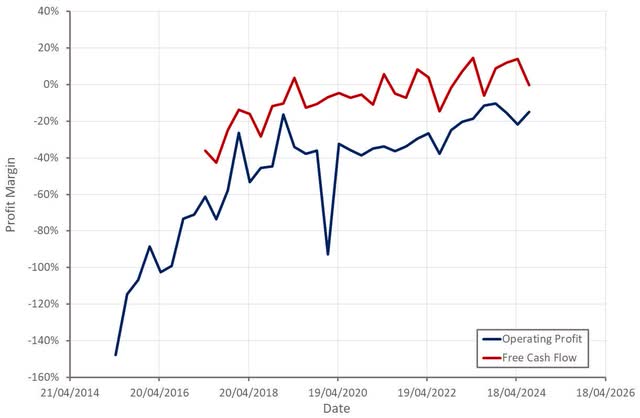

MongoDB’s non-GAAP operating margin was 11% in Q2. The quarter benefitted from the timing of marketing and certain other spend though. This is expected to hit in the second half, which will be a drag on margins.

Cash flows will also likely come under pressure for a number of reasons. MongoDB started paying some cloud costs upfront in Q2 in return for a discount on pricing. This is expected to have a 20 million USD per quarter negative impact on cash flows in the second half. MongoDB is also investing 20-25 million USD in the third quarter to acquire IPv4 addresses which will reduce cloud infrastructure costs in the future.

Figure 5: MongoDB Margins (source: Created by author using data from MongoDB)

The number of MongoDB job openings continues to increase, which suggests that the company isn’t facing any problems outside of temporary demand weakness. I don’t expect a meaningful increase in growth in the short run though, meaning hiring is likely to weigh on margins going forward.

Figure 6: MongoDB Job Openings (source: Revealera.com)

Conclusion

While MongoDB’s Q2 results were solid, I am not expecting a meaningful reacceleration of the business in the short run. The demand environment remains soft, and it will take time for MongoDB to see any real benefit from generative AI. MongoDB also continues to invest aggressively in future growth, which will likely cap near-term profitability improvements.

While MongoDB’s share price is up significantly from the lows of 2024, its valuation remains attractive given the company’s long-term potential. MongoDB still has the potential to grow in excess of 30% annually in a stronger demand environment and should generate high margins as it matures. I am fairly neutral on the stock at the moment though due to the likelihood of weakening economic conditions further undermining consumption growth.