miniseries/E+ via Getty Images

Let’s face it – put selling doesn’t have the best reputation publicly amongst investors. Between high profile blow-ups and those who argue the rewards don’t pay for the risks, it’s not a popular strategy to write or talk about.

However, in our view, selling put options on high-quality stocks is one of the best strategies around. When you sell a put option, you gain a solid yield on your capital in the form of a cash premium to your investment account.

Then, if the underlying stock dips, you have to be ready to buy shares at a discount to where the market was when you sold them. Otherwise, you keep the cash free and clear.

If the underlying stock is high quality, then it’s hard to see selling put options as anything other than a win-win proposition.

The only real downside of selling put options is that it caps your returns by crystalizing potential appreciation into an immediate cash payment.

For high-growth stocks, this can be a tricky proposition. However, for stable, high-quality stocks that don’t have explosive upside potential, this can be a feature, not a bug.

In this article, we’re covering Procter & Gamble (NYSE:PG), the consumer staples giant.

While the stock is richly valued and the dividend payouts are quite low, the company’s lines of business are well protected against economic cycles and other macro risks.

Thus, you could buy the stock, but we think selling put options is the best way to play it. With a fully baked valuation and a ~2.4% distribution, upside for holding PG appears minimal. Conversely, selling put options comes with a lower level of risk, and yields just shy of 9% (annualized).

For our money, this seems like a better option (no pun intended).

Today, we’ll show you how to execute a simple option trade like this to boost portfolio yield while simultaneously reducing your overall risk.

Sound good? Let’s dive in.

PG’s Financials

Before we explain the trade idea in more detail, let’s first take a look at PG’s financials and valuation to get a better sense of where the underlying stock sits.

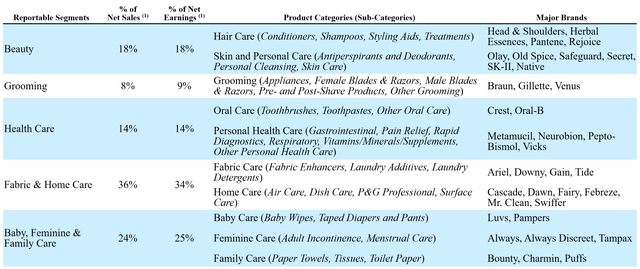

In short, PG is a ‘SWAN’ – a ‘sleep well at night’ company. The consumer staples giant manufactures a broad range of fast-moving consumer goods – everything from diapers to laundry detergent:

10K

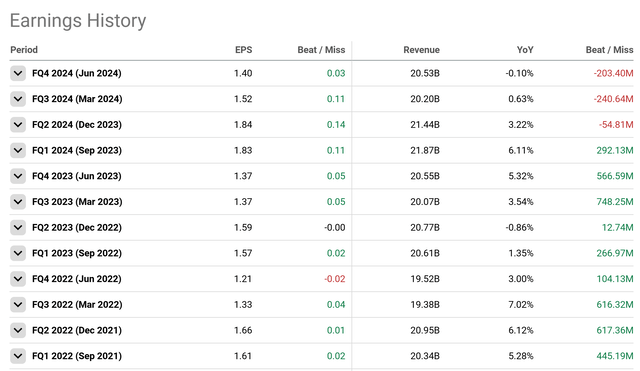

Recent earnings show the company’s profile well. Financial results have largely been stable, growing slightly over time:

Seeking Alpha

As you can see, PG’s EPS has beat consistently over the last few years, even with inflationary pressures, although recent consumer weakness has caused a few top line misses that have held YoY growth flat.

All in all, it’s mostly what you would expect from a company of this size and ‘shape’.

Given PG’s multiple brands, expansive operating network, and massive size, PG’s financial results are largely a result of global macro forces.

Sure, there’s management and execution risk involved here as well, but given how saturated PG’s end markets are, the real inputs to watch for in the short and medium term are Consumer Sentiment and Economic Health.

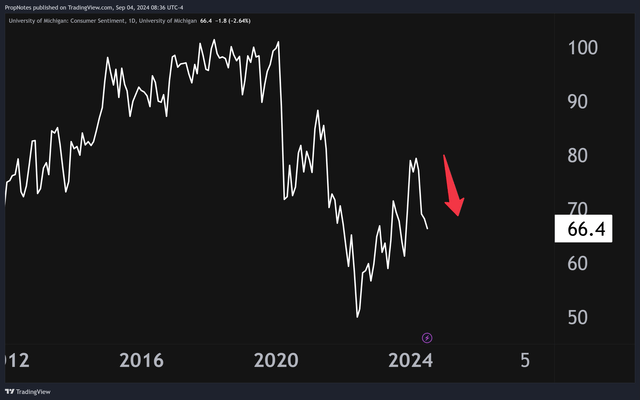

On the Consumer Sentiment side, numbers have been falling lately as recession fears begin to creep in:

TradingView

While one might expect that worsening consumer sentiment would be bad for a consumer staples company, it’s actually not too much of an issue. Sure, people have less money to spend, but typically, they’re not cutting back on soap, diapers, and hygiene products.

As a result, slightly weaker numbers here may impact results over the interim, but PG’s small losses will likely pale in comparison to those experienced by companies that sell products with more elastic demand profiles.

What about Economic Health?

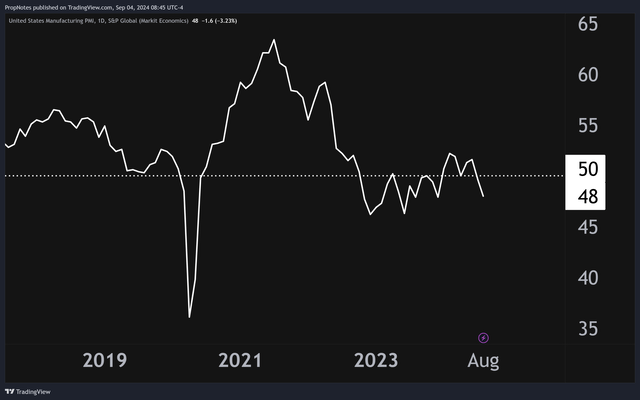

In short, the economy isn’t looking too hot right now. Aside from weakening consumer sentiment, business sentiment has also been sliding this year:

TradingView

This is the PMI, which is a powerful leading economic indicator. It predicts S&P returns 6 months to 1-year out with a relatively high level of accuracy, and recent moves have sent investors ducking for cover. Add it together with a weakening consumer, and we’re looking at some choppy waters over the next twelve months.

Again, one may think that this would be a negative for PG, but the key here is relative performance.

Sure, there may be rough seas ahead, but what really matters is where investors choose to hide.

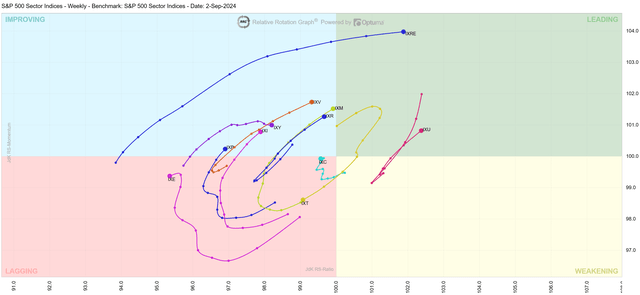

As you can see from the RRG below, consumer staples stocks are improving substantially vs. the market, and especially vs. tech:

RRG Online

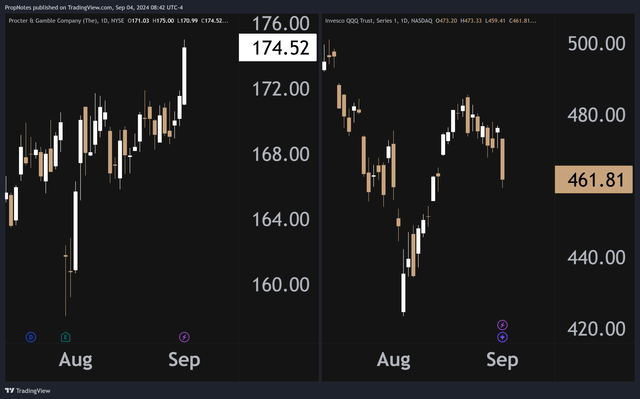

You can see this dynamic playing out live in the markets as well. Tuesday, the market largely sold off as investors dumped high growth tech exposure.

What did they buy? Consumer Staples:

PG vs. QQQ (TradingView)

With these dynamics, along with PG’s scope, size, and inelastic customer demand profile, we think investors will choose the company as a hiding place as the economic picture worsens, even if financial results dip a bit.

Thus, the downside picture appears muted, even with things where they are.

At the same time, as a consumer staples company in a downturn, we don’t think the upside appears too exciting, either.

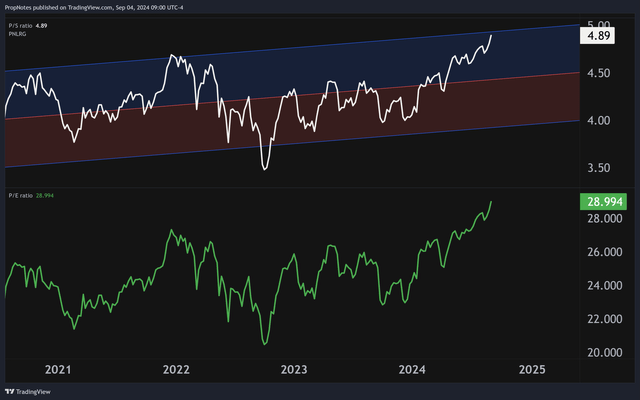

Tack on a relatively stretched valuation – at around 4.89x sales and 29x EPS – and it’s hard to see meaningful multiple appreciation in PG over the next twelve months:

TradingView

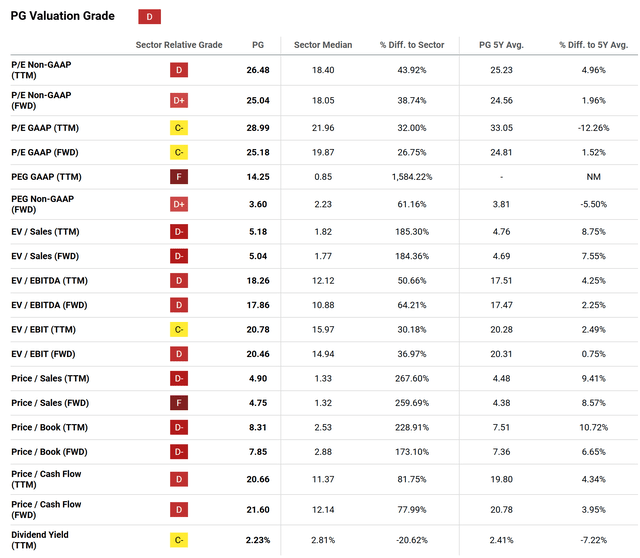

For its part, the SA Quant Rating system also gives PG a ‘D’ on the valuation scorecard, which seems about right to us:

Seeking Alpha

PG’s P/E and PEG are considerably stretched as a result of the company’s weak growth trajectory, and so we don’t think that there’s a ton of room on the upside here.

Add up the financial results, valuation, and relative rotation, and we think Fair Value is optimistically somewhere between $165 and $175 per share, which is right around where shares are currently trading.

The Trade

Thus, we’re in a situation where we don’t see much upside or downside potential in PG over the coming months.

What to do?

Sure, you could buy the stock for a 2.5% yield and a tepid outlook – but in our view, this is a great opportunity to sell put options.

What does this entail?

It’s simple: When you sell a put option, you are agreeing to purchase the underlying stock at an agreed-upon price up until some point in the future. In return for committing to being a willing buyer, you receive a cash payout.

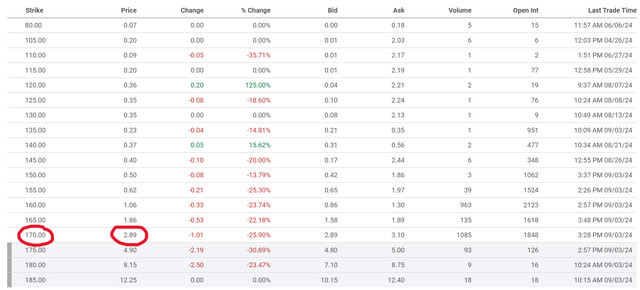

In this case, we like the $170 strike, November 15th put options:

Seeking Alpha

These options pay out $2.89 per share, or $289 per contract. This results in a payout of 1.73% over the next 73 days, which annualizes to an 8.7% return on capital.

After you sell the option, one of two things can happen – the stock can finish on the expiration date above the strike price, or below the strike price.

- If the stock closes on November 15th above $170 per share, you get to keep the cash free and clear.

- If the stock closes below $170 per share, then you’ll need to purchase shares at $170 – but you still get to keep the cash.

In this way, you’re essentially getting paid 8.7% annualized to bid for PG at a discount to the current market price, and deeper into our ‘Fair Value’ range for the stock.

On balance, this seems like a win-win, and a better choice than buying the stock outright.

Risks

There are some additional risks to be aware of if you’re planning on taking this trade, though.

First off, the economy could get worse – a lot worse. As we mentioned, this is the strongest input to PG’s financial results in our view, and if indicators continue to sour, then it’s hard to see how PG won’t be impacted. We think that the company is insulated from this in terms of the share price, but over time, it could catch up.

Secondly, when selling put options, if something drastic happens, you’re still on the hook for buying shares at $170 between now and November. This isn’t a ‘risk’ per se, as it’s the same risk profile as buying shares outright, but it’s something to be aware of for those who haven’t sold puts before.

Finally, PG will report earnings between now and mid-November, which is likely to cause some volatility with the stock price. If the market reacts poorly to this announcement, it could send shares below $170, where you then may be assigned on your position.

Summary

All in all, though, we like the risk/reward profile of this trade.

Upside is improved vs. buying and holding the stock, and risks are mitigated through the discounted acquisition price (if shares do drop), strong company margins, and potentially strong relative performance if the macro situation worsens.

While the multiple seems a bit inflated, we’re happy earning yield through options and ‘bidding’ for the stock at a lower level.

Thus, our ‘Hold’ rating.

Good luck out there!