Just_Super

Investment Thesis

Zscaler (NASDAQ:ZS) delivers investors with a startling outlook for fiscal 2025. The company’s next quarter will mark its tenth consecutive quarter of revenue growth deceleration and the market didn’t take well to this outlook, with its stock sliding 15% after hours.

Consequently, this means that including the sell-off in its market cap, the stock is still priced at 46x forward non-GAAP operating profits.

This is not the most shocking valuation, but investors who pay this sort of multiple demand a stream of positive updates every quarter. There’s minimal room for a slowdown in execution, and that’s precisely what Zscaler delivered.

To be clear, it’s not all negative, after all, Zscaler carries a rock-solid balance sheet that will support its growth prospects, but that element isn’t enough to offset this lackluster outlook.

Therefore, I now revise my rating to a hold.

Rapid Recap

Back in May, I said,

[Zscaler] is priced at 38x next year’s EPS. Given that some of its peers are priced at significantly higher premiums than this, for largely the same growth rates, I believe this reinforces that this stock is reasonably priced.

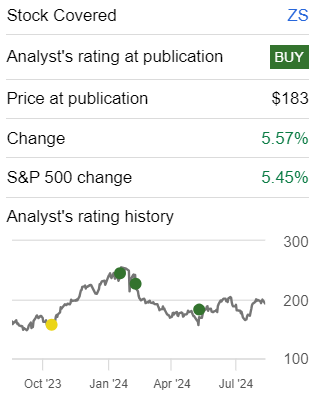

Author’s work on ZS

As you’ll see from this analysis, I was caught off-guard with my expectations for ZS. Therefore, I now rectify my analysis and am neutral on this stock.

Zscaler’s Near-Term Prospects

Zscaler provides a cloud-based security platform that protects businesses by ensuring that their employees, applications, and data are safe when they connect to the internet. Instead of relying on traditional security tools like firewalls, Zscaler uses a modern approach called “Zero Trust,” which assumes that no one, whether inside or outside the network, can be trusted by default. This means Zscaler continuously verifies the identity and integrity of every user and device trying to access a company’s resources, ensuring they are safe from cyber threats.

Zscaler is in a strong position to grow in the medium term. The company has seen significant increases in customer adoption, driven by the demand for its Zero Trust platform. As organizations increasingly recognize the limitations of traditional security methods, they are turning to Zscaler’s solutions.

Zscaler expects to reach $3 billion in annual recurring revenue by fiscal 2025, showing confidence in its continued expansion and leadership in the cybersecurity market.

Still, despite its successes, Zscaler’s growth is beginning to slow down due to the highly competitive environment in which it operates. The company faces significant competition from other cybersecurity providers, especially in the emerging Secure Access Service Edge (”SASE”) market. One of its main competitors is Palo Alto Networks (PANW), which appears to be more focused on a value offering than being the highest technological SASE offering appears to be a strategy that is working well in the current environment.

Given this overall context, let’s now discuss its valuation.

Projected 10th Consecutive Quarter of Revenue Growth Deceleration

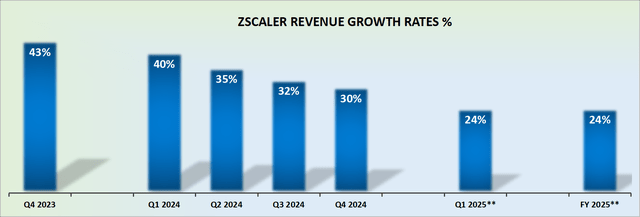

ZS revenue growth rates

Back in May, I said,

Here’s the setup. Zscaler’s revenue growth rates should be up against easier comparables in fiscal 2025 than it was in fiscal 2024.

Consequently, I’m inclined to believe that Zscaler’s growth rates could come out at around 25% CAGR next fiscal year (starting August 2024).

As it stands right now, this is basically the same as what analysts are expecting for fiscal 2025, which further validates my contention that Zscaler could deliver around a 25% y/y increase in revenues.

I was convinced that Zscaler would deliver at least 25% CAGR in fiscal 2025. Now, even if I take the high end of its guidance and add some further upside to allow for management’s conservative outlook, the facts are in, and Zscaler is highly likely to deliver even less than 25% topline growth.

This stands in contrast with the other 2 top cybersecurity companies. More specifically, both SentinelOne (S) and Palo Alto Networks (PANW) appear to have been beneficiaries of CrowdStrike’s (CRWD) IT outage. As it transpires, contrary to popular belief, Zscaler doesn’t appear to have benefitted.

What’s more, despite the easier guidance against the prior year, it appears that Zscaler’s fiscal Q1 2025 will mark the 10th consecutive quarter of revenue growth rate deceleration. That’s not the sort of setup that is commensurate with a high-growth stock, that can command a high premium on its stock.

ZS Stock Valuation – 46x Forward Non-GAAP Operating Profits

Before we discuss its valuation, it’s important to note Zscaler’s financial footing. As an inflection investor, I believe that without understanding a company’s financial position, you’ll have limited ability to gain firm conviction over your holding.

Along these lines, Zscaler holds just over $1.2 billion of net cash, including marketable securities. This undoubtedly allows Zscaler to operate from a position of strength.

Next, Zscaler finished fiscal Q4 2024 with 22% non-GAAP operating margins, an improvement of 300 basis points relative to the same period a year ago.

Meanwhile, looking ahead to fiscal Q1 2025, taking the high end of Zscaler’s non-GAAP operating margin, it appears to show a slight dip of approximately 200 basis points, or slightly more to approximately 19.5% non-GAAP operating margins.

Similarly, if we look towards Zscaler’s full-year fiscal 2025, its non-GAAP operating margin presently points to approximately 21% operating margins. For a business that just delivered 22% non-GAAP operating margins in the last quarter, for the business to now charge that as it continues to gain more scale, it’s actually going to be less profitable, this is something that the market is unforgiving towards.

Growth software businesses get awarded massive premiums on the idea that as they scale up, they’ll become more profitable not less. And yet, lower profit margins is exactly what Zscaler’s guidance implies.

Now, you could say that Zscaler is just being conservative with its guidance. But I would then yet again reiterate that investors are not paying 46x forward non-GAAP operating profits for Zscaler to be conservative. Investors are paying a high premium to be blown away, with a steady stream of positive surprises. And that’s evidently not what is being offered here.

As such, I now stand firmly neutral on Zscaler as I don’t view its near-term prospects as overly enticing.

The Bottom Line

Given Zscaler’s current valuation at 46x next year’s non-GAAP operating margins, I find it challenging to see significant upside potential for investors. While the company has a solid balance sheet and strong growth prospects, its slowing revenue growth and slightly declining profit margins raise concerns.

Investors paying a premium for Zscaler expect consistent positive surprises, but with the company likely delivering less than 25% topline growth and facing its 10th consecutive quarter of deceleration, I believe the risks outweigh the rewards. As such, despite its solid foundation, the stock’s potential upside seems to be scaling back.