Adam Gault

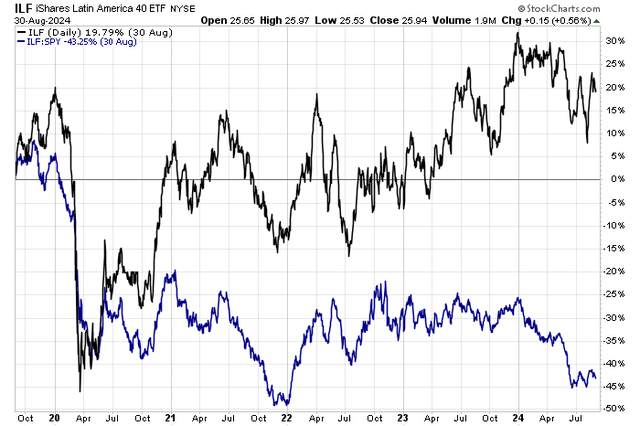

The iShares Latin America 40 ETF (NYSEARCA:ILF) continues to be an underperforming regional equity fund. I have been neutral on the fund since April 2023, waiting for a bullish technical move as the ETF keeps on trading at a favorable valuation. Despite a rebound in the Financials and Materials sectors, the two largest weights in ILF, the fund hasn’t captured much of any upside price action.

Indeed, ILF is down significantly against the S&P 500 so far in 2024 after a period of keeping up with the SPX from early 2022 through the end of last year. But Latin American equities have not been an outright bad investment on their own – on a total return basis, they are up notably from their July 2022 low.

I reiterate a hold rating, however. I last reviewed the fund in Q4 2023, and the valuation remains compelling, but I want to see both an absolute and relative price thrust before upgrading it to a buy.

ILF: Severe Underperformance to the S&P 500

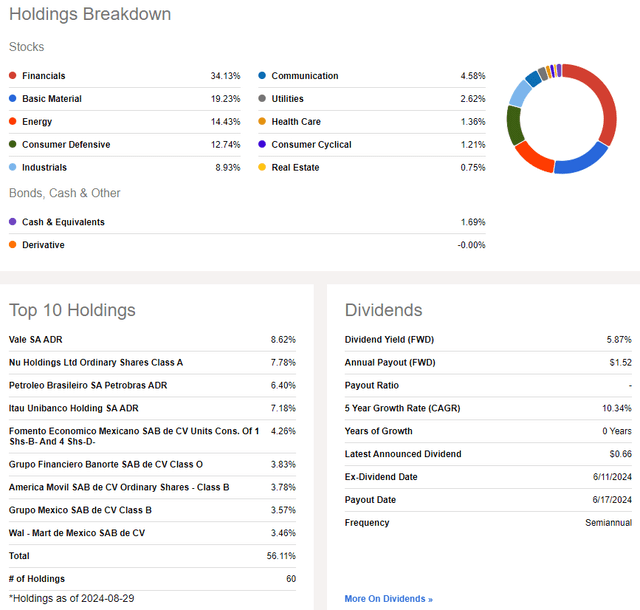

According to the issuer, ILF focuses on investing in the public equity markets of Latin America and the Caribbean. The fund targets growth and value stocks of large-cap companies across various sectors, and it aims to track the performance of the S&P Latin America 40 index, which consists of the 40 largest Latin American stocks.

ILF has seen assets flee since Q4 last year. Total assets under management are now just $1.4 billion, down from $1.6 billion 10 months ago. The ETF features a moderate 0.48% annual expense ratio, and it pays a high 5.9% forward dividend yield, earning it an A Dividends ETF Grade by Seeking Alpha’s quant system.

But share price momentum continues to run soft, and I will highlight key price levels to monitor on the chart later in the article. ILF is also a risky product given its concentration level and high volatility metrics. The good news is that the fund sports strong liquidity figures – average daily volume is north of 1.5 million shares while its 30-day median bid/ask spread is tight at four basis points, per iShares.

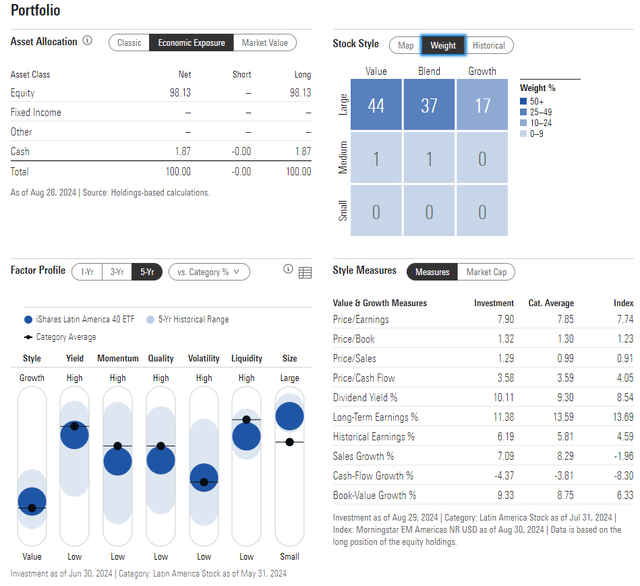

Looking closer at the portfolio, the four-start, Gold-rated ETF by Morningstar has undergone some shifts since late 2023. It now has more growth exposure but remains primarily a large-cap value allocation. Its price-to-earnings ratio is very low, under 8, while the long-term earnings growth rate is high at 11.4%. The resulting PEG ratio is extremely depressed at less than 0.7. So the valuation case is absolutely there, but in this situation, after many years of negative alpha, I want to see price action turn bullish too.

ILF: Portfolio & Factor Profiles

What’s different this go-around is that despite strength from Financials in 2024 (it’s the top-performing S&P 500 sector so far this year), ILF has not benefitted. Materials have also notched all-time highs in the large-cap US space in 2024, but that has not been the case for resource-rich firms in Central and South America.

I’d like to see an upside move in copper prices and crude oil to support ILF’s Energy- and Materials-sector holdings. Political stability and broader economic growth would help the region’s Financials-sector companies.

ILF: High Financials, Materials, Energy Cyclical Exposure, Big Yield

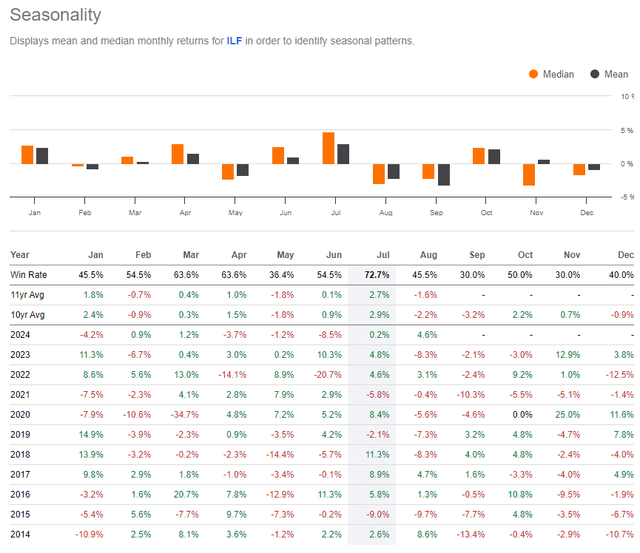

And seasonality is another headwind in the short run. September has been a weak month for ILF over the past 10 years, particularly in the trailing four instances. So, we could see a pullback in ILF’s modest uptrend over the ensuing weeks.

ILF: Bearish September Seasonality

The Technical Take

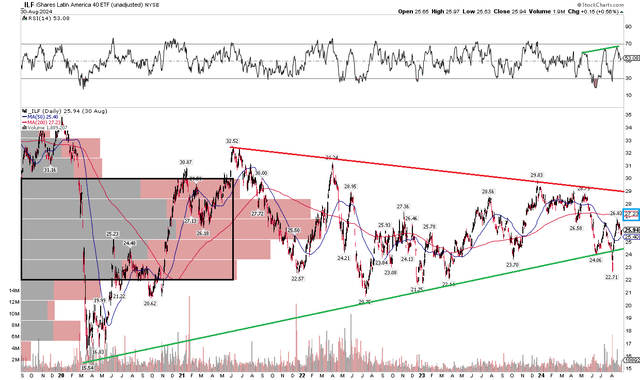

ILF is indeed trending ever so slightly higher, but the upside move is not impressive. Notice in the chart below that shares put in a series of higher lows but lower highs since the middle of 2021, but price trends over the past two years have been more favorable. But with a down move about a month ago, below an uptrend support line, the technical situation has turned more vulnerable.

Also, take a look at the long-term 200-day moving average, it is flat in its slope suggesting that there is now a battle between the bulls and the bears. What’s encouraging, though, is that the RSI momentum oscillator at the top of the graph has actually notched a fresh 2024 high before pulling back into the close of August. That’s intriguing considering that price could follow. Still, resistance is seen in the $29 to $30 range while support is near $22.

Overall, ILF’s momentum continues to run soft.

ILF: Ongoing Consolidation, Improved RSI, Congestion Zone Persists

The Bottom Line

I have a hold rating on ILF. The valuation is compelling, but the technical situation is weak, particularly compared to big gains in the S&P 500 since the start of last year.