AlizadaStudios

In my previous piece on Energy Transfer LP (NYSE:ET), I articulated a continued buy thesis after digesting the Q1, 2024 earnings report. The case was based on an attractive dividend yield of close to 8% that was underpinned by strong cash flows from which a sizeable chunk could be directed towards M&A, organic CapEx and/or share buyback activity. In other words, it was not only about the dividend, but also about the growth potential.

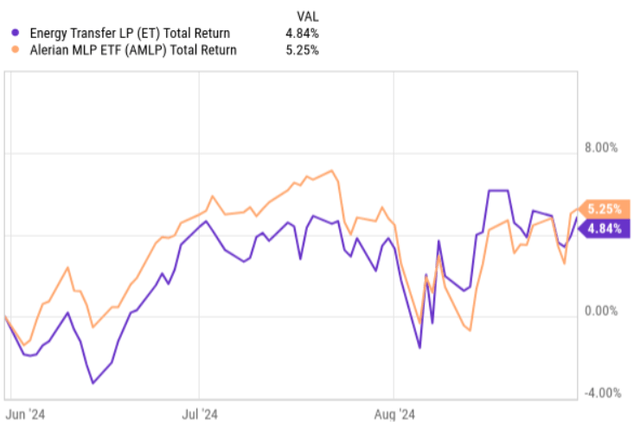

Since then, ET has performed largely in line with the relevant index, registering a decent total return result. Half of this return was explained by the dividend (or rather distribution), which implies that the share (or unit) price has moved up only by ~ 2.5%.

Knowing that from the share price perspective, there have not been any material changes, let’s see what the Q2, 2024 earnings have brought to the table and how these new data points impact the investment case.

Thesis review

The Q2, 2024 earnings package included some very encouraging signals, which, in my opinion, should have sent ET’s stock price materially higher than just by ~ 2.5% over this period (since I published my last piece back in June).

For example, the Q2 adjusted EBITDA came in at $3.76 billion compared to $3.12 billion in the same period last year. If we adjusted for the one-offs like M&A or transaction service expense, the adjusted EBITDA would increase to $3.8 billion. On a DCF (distributable cash flow) basis, which reflects a more pure form of cash generation, the rate of change was even better – i.e., $2 billion this quarter relative to $1.6 billion in Q2, 2023.

Now, if we look at the key segments in terms of how EBITDA is achieved, we will observe robust dynamics across the board.

The NGL and refined products segment generated $1.07 billion in EBITDA compared to circa $840 million for the second quarter of 2023. As opposed to other segments, the primary reason behind the increase here is related to the organic growth across transportation, fractionation and terminal operations. Part of the increase was achieved through favorable hedging activity.

In the midstream segment the adjusted EBITDA was $693 million, which also translates to a meaningful uptick compared to Q2 last year when the relevant figure landed at $579 million. Here, however, the key driver behind the increase was the acquisition of Crestwood asset base.

It was also a similar case for the crude oil segment, where the adjusted EBITDA increased by 18% (on a year-over-year basis) mostly due to the acquisitions of the Lotus and Crestwood assets that were not directly included in the previous year’s comp measure. Excluding the effects of the M&A activity, the adjusted EBITDA for the crude oil segment would be up by 4%.

Speaking of the further growth potential, we have to keep in mind that there are multiple projects that ET has initiated of which some will be put online this year, but the majority of them will start their operations in 2025 or even 2026.

If we focus on the near-term adjusted EBITDA growth, there will be obviously the effects from the previous acquisitions and organic growth project that would drive up the results in Q3 and Q4, 2024. On top of this, the recent (July) acquisition of WTG should start contributing this year as well. The Red Lake 3 processing plant is also slowly increasing the production volumes with a fuller ramp-up estimated over Q3 and Q4 periods.

In terms of longer-term growth prospects, I would like to distinguish ET’s opportunity that lies in its gas-fired power generation business. As of now, ET has ~ 185 plants operational across 15 states and just recently it signed several deals that are set to provide gas loads of over 500,000 MMBtus per day. Currently, it has approved eight 10 MW units for construction, where for some the estimated date of commercial operations is already in 2025.

This particular segment is a clear and attractive opportunity to create value. The comment in the recent earnings call by Mackie McCrea – Co-Chief Executive Officer – provides a great color on it:

Once again, we are very well positioned and then you add on to that, I mean, we’ve got population growth in Florida, in Texas, Bahamas all these gas utilities that will be feeding. And we want our business you’ve got Blue Mont just what we’re working with Long with a handful of folks. If it comes to fruition, the majority of that, we’re looking at between one and two BCF of natural gas deliveries at our terminals close to our terminals for blue ammonia, and then you throw in crypto and on and on, So yeah, we’re very bullish.

Given the strong momentum in the adjusted EBITDA generation, the Management also raised the guidance to between $15.3 billion to $15.5 billion, compared to the previous range of $15 billion to $15.3 billion.

At the same time, the commentary by Tom Long – Co-Chief Executive Officer – indicated a continued focus on preserving the high quality of the capital structure as the projected CapEx spend for 2025 seems to remain in the conservative range:

With our growth and our scale our size and with everything we’re doing, let us scrub that a little bit more. So we won’t just do give you the 2025 number. We will also kind of give you that ongoing run rate. But as of right now, we’ve always had that $2 billion to $3 billion. If anything it’ll be it’ll be probably at that $3 billion. But let us let us do some more work on that before you give any official long-term run rate.

This is largely in line with the 2024 organic growth CapEx, which is estimated to land at $3.1 billion. Now, compared to the full year EBITDA of circa $15 billion, the conclusion is very clear – i.e., ET retains huge amounts of cash each year that could be put to work across different value-creating activities.

Given ET’s ability to access so huge amounts of internal cash generation from which part is directed towards optimization of the capital structure, in June Moody’s ET’s senior unsecured credit rating to Baa2 (mid-range of investment grade credit rating).

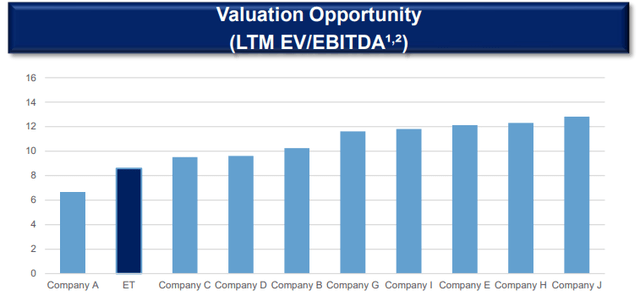

Finally, if we look at the valuations, the picture gets even more interesting.

In ET’s investor presentation deck, we can see how favorable the current multiple is compared to many other peers. On an FWD basis, the EV/EBITDA looks even more attractive standing at 8.25x.

Key risks

If we speak about risks, then we could focus on two specific areas.

One is related to the inherent commodity risk exposure, which means that in case the oil and natural gas markets turn south, ET’s business would be impacted in a negative fashion. Given that we are currently in a time when the overall production volumes are high, it would be only logical to expect some downward trend in the foreseeable future (usually driven by reduced oil and natural gas prices). However, this particular risk is well-mitigated as roughly 90% of ET’s cash flows are linked to fee-based contracts that include a pre-set pricing mechanism that ultimately decreases the exposure to commodity cycles. Plus, the fact that ET continues to deploy CapEx and venture into M&A transactions, the corresponding growth should also act as a safety buffer to at least shield the already achieved EBITDA generation levels.

The second risk lies on the balance sheet, where the current leverage ratio stands at ~ 4.2x. This is quite high in relation to what we can see in the MLP space among truly well-capitalized partnerships. However, I would consider this risk rather immaterial as ET is clearly in a position to gradually reduce the debt load from its strong internal cash generation, which is also confirmed by the recent upgrade by Moody’s to Baa2 (a level that is reflective of robust capital structure).

The bottom line

All in all, Energy Transfer continues to demonstrate solid performance across the board and each quarter it is getting stronger since it can retain notable amounts of internal liquidity to further boost the balance sheet, invest in M&A/CapEx projects or even put a heavier emphasis on the share buybacks.

In my opinion, the current multiple of ET provides a clear opportunity for investors to not only capture juicy distributions, but also benefit from potential price appreciation that could be driven by multiple convergence processes. Plus, the presence of the valuation discount, growing cash flows and surplus capital being put to work in incremental cash-generating projects all introduce a notable layer of safety for the protection of the current dividend in case the natural gas and crude oil markets turn really south.

As a result of this, I remain very bullish on Energy Transfer.