Dragon Claws

Fed Funds Rates And Treasury Rates Are Different

It’s been 11 months since I last reviewed the iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG). My Buy call turned out to be a good one, with a total return of 11.38% since publication.

I take very little credit for that call, as it happened to come right before a peak in interest rates. The 10-year Treasury yield (US10Y) touched 5% intraday about 2 weeks after publication. The opening section of that article discussed how interest rates are hard to predict. That’s still true, and it’s especially useful to remember now that we know a Fed Funds rate cut in September 2024 is highly likely.

Just because we know the Fed Funds rate is coming down, we can’t say for sure what will happen to other interest rates, like those of the longer-term Treasuries, agencies, and investment grade corporate bonds that make up AGG. After all, the Fed Funds rate has been constant in the 5.25-5.5% range since August 2023, but longer-term Treasury yields are lower.

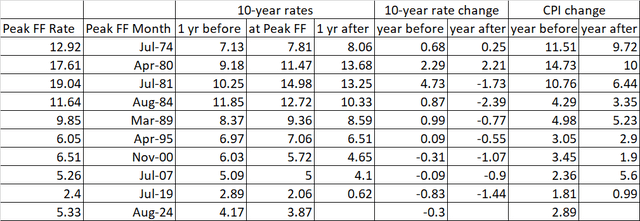

History gives us no simple rule of thumb to follow on how Treasury rates respond to Fed Funds rate cuts, as we can see from the last 50 years of data around Fed Funds rate peaks.

In the inflationary 1970s, the bond market apparently had little faith in the Federal Reserve to keep inflation under control, as the 10-year Treasury yield kept on rising in the 12 months following the peak Fed Funds rate. After the record high Fed Funds rate in 1981, however, the markets learned that the Fed was serious about inflation, and 10-year yields dropped around 2% following the peak Fed Funds rates in 1981 and 1984.

The next couple of Fed Funds cycles, peaking in 1989 and 1995 caused mild or no recession, and the 10-year yields declined modestly, less than 1 percentage point. In the new millennium, Fed Funds hiking cycles ended ahead of big negative events (the dotcom bubble burst, the housing crisis, and the covid pandemic). In these cases, 10-year yields dropped even in the year before the Fed Funds peak and went on to drop another percentage point or so in the year after.

The current situation is not exactly like any of the past 50 years. There appears to be greater confidence that inflation is at least heading in the right direction than there was in the 1970s, making a big increase in 10-year yields from here less likely. On the other hand, there is less confidence of big drops in inflation like those that preceded the rate cuts in 1981 and 1984. There is also no sign of a big crisis like those that precipitated the last three Fed Funds rate cutting cycles, although such crises are hard to predict and sometimes seem to come out of nowhere.

That leaves us with the 1989 and 1995 cycles, where Treasury yields declined modestly after the first Fed Funds cut. Even those periods are different from today, which lacks the positive geopolitical developments like the fall of communism and the positive fiscal developments like the balanced budgets of the Bill Clinton era.

If I have to make a forecast of where yields go from here, I would peg them as roughly unchanged over the next year. Long-term inflation expectations are near the Fed’s target of 2%. While the Fed is scaling back its balance sheet runoff (quantitative tightening), there does not appear to be any appetite to reduce Treasury rates through outright quantitative easing as there was in the 2010s when inflation was persistently below 2%.

The upside risk to this rate forecast would be a resumption of higher inflation or loss of confidence in the US government to get its deficit spending under control. The downside risk to rates would be a recession or geopolitical event triggering a flight to safety, faster Fed Funds cuts, and a possible return of QE. I see these risks as roughly balanced at this time, hence my flat forecast for Treasury yields.

Given this expectation, I expect minimal capital gains or losses for AGG over the next year. Monthly dividends should be up slightly over the next year as older low-rate bonds mature and roll out of the portfolio. This effect should peak in 2025 with flat to slightly declining distributions after that. Let’s look at how the fund and my price and dividend model have changed in the past year.

AGG Fund Characteristics

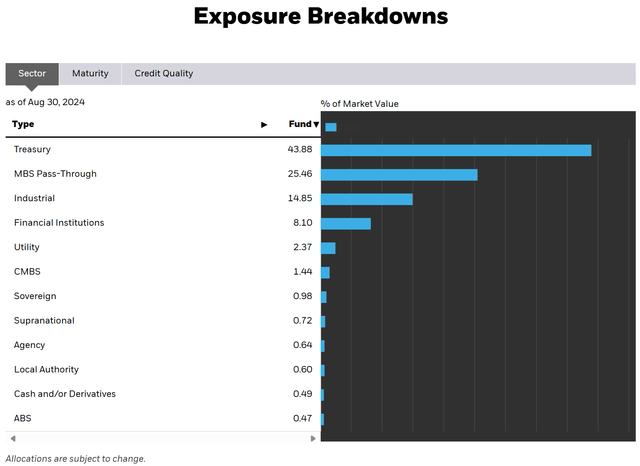

As stated on the iShares website, “The iShares Core US Aggregate Bond ETF seeks to track the investment results of an index composed of the total U.S. investment-grade bond market.” AGG has now been in existence for 21 years. It is one of the largest fixed income ETFs and had added more assets under management in the past year. Net asset value is now $116.9 billion, up from $89.2 billion at the time of my last article. The fund now holds 11,839 individual bonds with average maturity around 8.3 years and a duration of 5.99 years. This duration has not changed much in the past year.

The fund’s portfolio shows that the US government continues to grow its debt. Treasuries now make up over 43.88% of AGG’s portfolio, compared to 42% last year. Mortgage and other asset backed securities (largely US government agencies) declined about 2 percentage points to 28%. The remainder is largely investment grade corporate bonds. The credit quality of the AGG portfolio is little changed, with 72.3% of its portfolio rated AA+. 2.7% is rated AAA, 11.9% is A, and 12.7% is BBB.

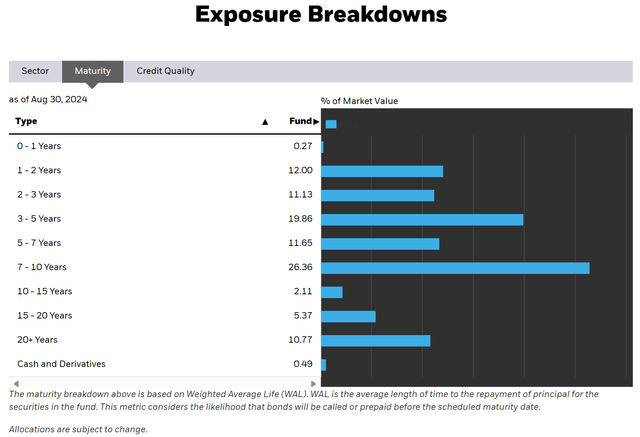

Since last year, average maturity has come down slightly, with the 10-15 year bucket dropping the most in concentration and the 3-5 year bucket growing the most.

AGG continues to have an almost negligible expense ratio of 0.03%. Since last year, the increase in fund NAV has brought the average yield to maturity down to 4.4%. The average coupon has improved to 3.4% from 3% as more low-coupon debt has rolled off the portfolio. The estimated forward yield is now about 3.7% based on the September dividend of $0.311936 per share. Even if interest rates are flat to down, I expect steady to slightly higher monthly dividends over the next year as lower coupon bonds continue to mature and roll out of the portfolio.

Updated Rate And Pricing Model

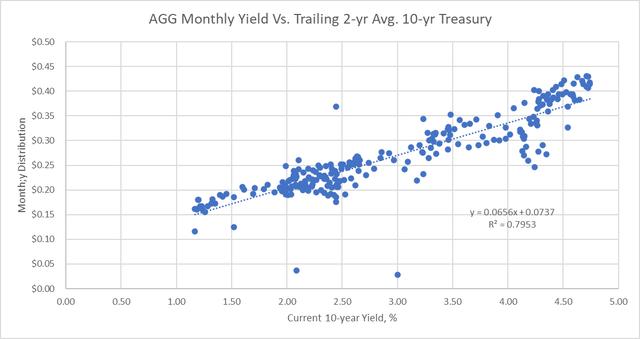

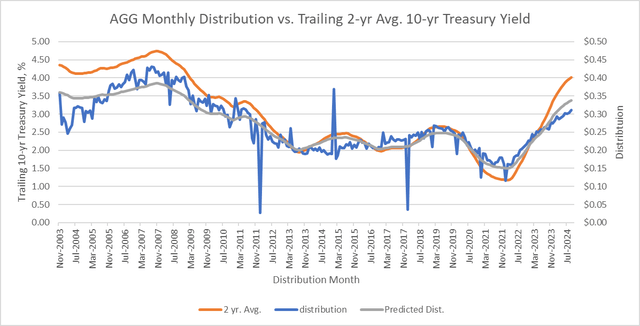

AGG’s monthly dividends continue to correlate well with a 2-year trailing average of the 10-year Treasury yield.

Applying this correlation to historical 2-year trailing 10-year Treasury yields, we see that the predicted distributions still match the actuals fairly well.

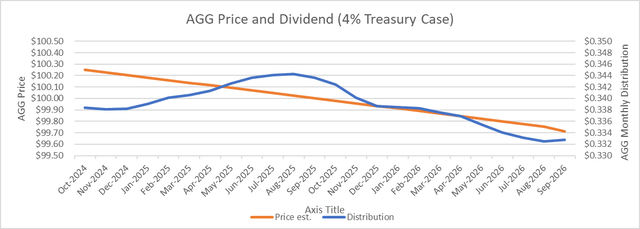

Applying this correlation to the next two years, my base case has the 10-year Treasury yield at 4%, close to the 3.91% actual at the end of August 2024. Distributions continue increasing slightly over the next year (about $0.005 per month higher by August 2025) then go slightly lower over the subsequent year. Fund price is estimated to drop just $0.54 over this period based on the 0.09 decrease in rates and the 6-year duration of the portfolio. Predicted total return in this case would be 7.58% for the 2-year period, or 3.72% annualized.

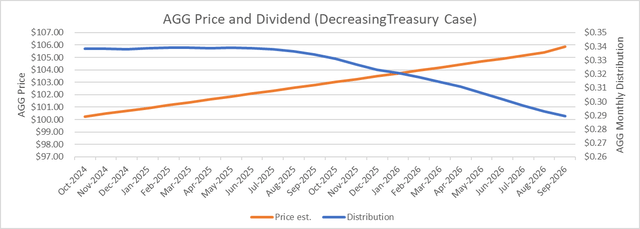

In the next most likely case with Treasury rates declining (3.0% by September 2026), distributions still stay pretty flat in the first year due to lower coupon debt maturing, but then distributions start to drop off in the second year. Fund price increases 5.6%, however. The predicted total return for this case is 13.36% over 2 years, or 6.47% annualized.

Investment Implications

With the decrease in Treasury rates over the past year and the corresponding increase in AGG share price, I am downgrading AGG to Hold from Buy. With most of the decline in Treasury rates likely having taken place, I see little capital appreciation for AGG even as Fed Funds rates come down. I also see monthly dividends peaking in the next year just slightly above where they are now, following 3 years of healthy increases.

AGG remains true to its name, a relatively safe “core” part of the fixed income allocation within a portfolio. However, for investors with the time and inclination to do so, I prefer building a bond ladder of investment grade corporate bonds for greater predictability of interest income and principal repayment timing. It is also a good time to take advantage of declining Fed Funds rates, a more certain prospect than anyone’s forecast of longer-term Treasury yields. This means that the cost of leverage will start to drop for the funds that use it. Levered muni bond funds are one way to take advantage of declining leverage costs while maintaining high-quality portfolio holdings. These include closed end funds like (NEA) and (NAD) from Nuveen, which I wrote about in June. Another plus for these funds is they still trade at a discount to net asset value, although it has been narrowing. A drawback of these funds is they now over distribute income so that some of the monthly dividend contains a return of capital. As leverage costs come down, the percentage that is ROC will decline, however. In the taxable space, a mutual fund like PIMCO Income Fund (PIMIX) (PONAX) has high-quality holdings like AGG but also employs leverage. This is safer than any of PIMCO’s taxable closed end funds, most of which trade at a premium to NAV. My favorite of these, for its relatively better dividend coverage and low premium to NAV, is the PIMCO Dynamic Income Opportunities Fund (PDO), which I also wrote about in June.

Please keep in mind that most of these levered funds have lower-quality holdings than AGG, so if there is an economic downturn, these funds could lose more due to widening credit spreads than they gain from falling cost of leverage. AGG, Treasury ETFs, and individual Treasuries and investment grade corporates should still be the core of a conservative investor’s fixed income portfolio. Levered funds are a good way to take advantage of declining short-term rates but be aware of the risk and limit your allocation.

Conclusion

AGG has benefitted from falling longer-term Treasury rates over the past year even though Fed Funds rate cuts have not started yet. Looking forward, it is possible that other interest rates will stay flat as Fed Fund rates start coming down. This implies less capital gain potential for a fund like AGG that holds Treasuries, agencies, and investment grade corporate bonds. The monthly dividend has been growing but is now likely to peak in the next year then start coming down if my interest rate outlook holds.

AGG is now a Hold because of these dynamics. Laddered individual investment grade corporate bonds or Treasuries look more attractive at this point. Investors can also consider leveraged funds to take advantage of falling short-term rates but must be aware of the other risks involved.