XH4D

In October, I covered Eve Holding (NYSE:EVEX) with a buy rating. Since then, the stock price has performed horribly with a share price decline of over 60%. To me that continues to show the risks on the commercialization path of urban air mobility solutions. In this report, I will be discussing the most recent results with a focus on the risks and liquidity.

The Risks And Opportunities Of Urban Air Mobility

One risk I’m seeing with coverage of UAM or eVTOL names is that the disruptive technology is often equated to value creation. This is not necessarily the case.

In a previous report, one of the article bullet points was the following:

The eVTOL development is in its early phase and it’s likely that many of the eVTOL designs won’t enter the market or create sustained success.

That remark will apply for the foreseeable future. In some ways, urban air mobility at the current stage is not much different from biotech or disruptive technology applied in commercializing space. There’s a disruptive technology which needs to be tested thoroughly, and UAM solution providers need to develop their product, test, and then scale up production. With the many UAM players active, there’s no doubt that some will not be able to deliver on their prospects and might run out of liquidity runway even before the product is launched.

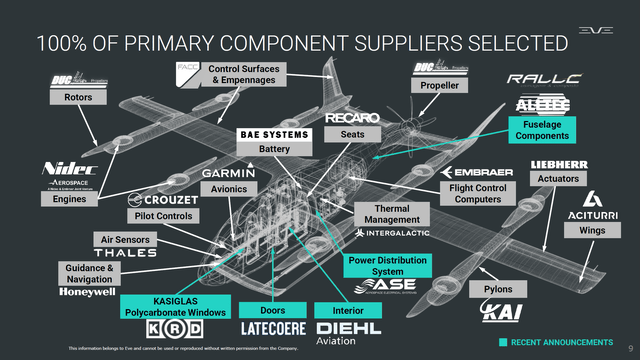

As more and more urban air mobility solutions are heading towards a path of commercialization, I believe the risk of shareholder dilution is also increasing. eVTOLs likely need to be produced at high quantities to make the production profitable and that requires the selection of the right suppliers as well as having the infrastructure to scale up production significantly. Eve has an advantage compared to many other urban air mobility developers, since it can tap into the knowledge and resources of Embraer.

However, even before that commercialization phase fully kicks in the risk of elongated development and certification timelines remains which could add financial pressure to the business.

Eve Rolls Out Its eVTOL

In July, Eve rolled out its first prototype which marked the completion of its prototype airframe assembly. The company also continued to select additional suppliers for the fuselage, power distribution systems, doors, interior and windows. With that, the selection of the primary component suppliers has been completed. So there is definitely progress on the development.

The prototype does not include a cockpit and after ground tests, the company will perform hover and flight tests later this year with the prototype being remotely controlled.

Eve Raises Additional Capital

What we have been hearing for a very long time is that the company believes it has sufficient available liquidity to fund its operations through 2025. So, perhaps it might have come as a surprise that the company raised $94 million in capital which diluted shareholders by approximately 7% and another $1.6 million was raised through an additional equity raise issuing 0.4 million shares. The private placements were dilutive in nature, but as part of the agreement there was a cancellation of warrants that would have allowed the purchase of 8.3 million common shares. That has now been replaced by the issuance of 3.3 million common shares.

The Q2 2024 pro forma liquidity stood at $340 million and to me that raises some questions. For 2024, a cash burn of around $130 million to $170 million is expected with the expectation that it will be closer to the lower end of the range. If we would assume $140 million in cash burn for 2024 and keep in mind the free cash flow of $67.3 million in the first half of the year, then we get to a year-end balance of $267.3 million. In 2025, the cash consumption is expected to intensify as five prototypes will be built and investments in manufacturing will pick up pace. So, I would expect the free cash flow burn to be materially higher. If we would assume that it is 50% higher than the expected lower end of the 2024 cash flow burn, we would see free cash flow use of around $195 million in 2025 which would bring the year-end balance of 2025 to $72.3 million. What this basically would indicate is that the $95.6 million capital raise was a necessity and not so much adding liquidity on a safe buffer. Furthermore, looking into 2026 I don’t believe that that is going to be the inflection point for Eve’s cash burn.

Looking at the liquidity, I don’t believe the buffer is as big as one would think when we look at management comment and I also believe that additionally liquidity raises are likely in the future and the only offset would be either raising capital through issuing debt or milestone payments starting to flow. Eve expects that conversion of part $14.5 billion pipeline will start converting into firm orders over the next 12 months and that should provide some incremental cash inflows. However, I do believe that the dilution risk remains. There also are 11.5 million warrants which expire in May 2027. Those warrants can be redeemed in the case the share price of Eve is above $18 for a prolonged period, which currently is not the case. The public warrants can be exercised at a price of $11.50. So, the only tangible way for this to be truly dilutive is if the share price snaps back to at least $11.50 in which case it makes sense for warrant holders to exercise and at that point I also do believe that higher stock prices are reflective of a successful commercialization. Furthermore, the company has new warrant outstanding that would convert to 37.4 million common shares if exercised and 14.3 million private placement warrants.

In theory, the exercise of all warrants would raise around $530 million while diluting existing shareholders by 18%, which is a better equity raise than the one the company agreed on in the second quarter but exercising those warrants only makes sense if there is some indication that Eve is on the right track and timeline for commercialization.

Is Eve Holding Stock A Good Buy?

If you are considering to purchase stock of Eve Holding, I believe you should be very aware of the capital requirements and dilution risk. The tangible value per share currently is $0.39. The median price-to-book value for Eve is 10.33x which would provide a $4.03 price target, which provides 43.3% upside from current prices which is in excess of the possible dilution. So, I would mark the stock a speculative buy.

Conclusion: Eve Holding Is A High Risk Speculative Buy

My view on Eve has been unchanged, and that view is that there is a highly speculative buying opportunity with significant risk of dilution. That shouldn’t necessarily scare investors off, but Eve is a company that you would want to incrementally invest in for a speculative bet on its urban air mobility success. The big question is how much shareholder will be diluted before the company starts profitable production on its urban air mobility vehicles. That is an answer nobody knows, but that commercialization timeline is going to be dictating whether eventually a speculative buy will pay off or not. I continue to mark the stock a buy, a very speculative one, with the note that the company’s liquidity has been less strong than initially expected and I find a service entry by 2026 highly optimistic. Perhaps the only reasons I am marking this a buy rather than a hold is the discount to the price-to-book and the partnership with Embraer (ERJ), which should benefit the commercialization path for Eve.